Table of Contents

- Kotak Life Insurance Products

- Kotak Life Insurance Calculator

- Kotak Life Insurance Customer Care

- Kotak Life Insurance FAQs

- 1. Does Kotak e-Term Plan cover deaths due to COVID-19?

- 2. How to pay premiums?

- 3. What happens if you miss paying the premiums?

- 4. When is the refunded paid from the full amount invested?

- 5. How to file an individual claim?

- 6. Can I change or update the policy online?

- 7. What should be the steps taken when you’ve lost or misplaced a policy docket?

- 8. What is the percentage of loan I can get on a policy?

- 9. What is the rate of interest of the loan applicable for traditional plans?

- 10. Are loans available in a unit-linked plan?

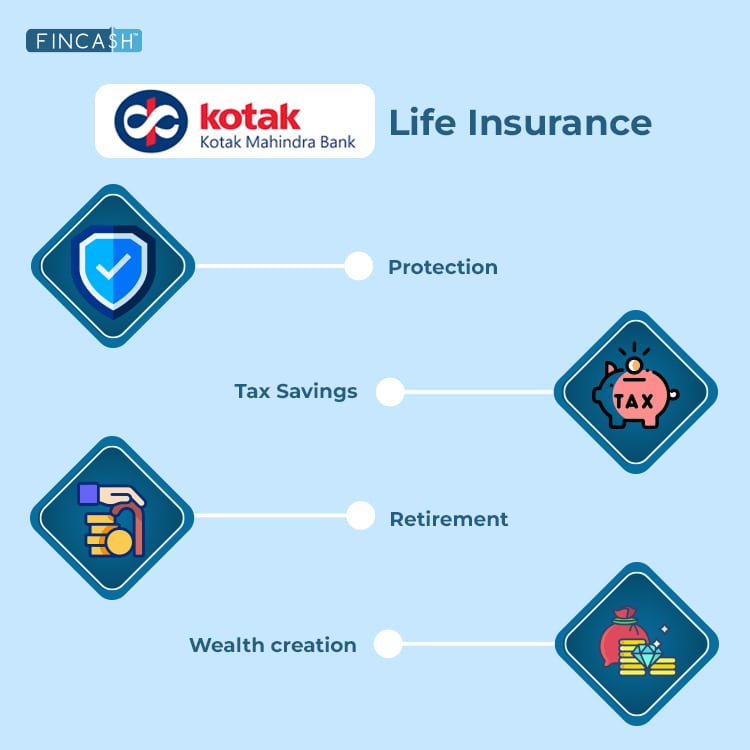

Kotak Life Insurance

Kotak Life Insurance is one of the most popular Insurance companies in India. It is a joint venture between Kotak Mahindra Bank and Old Mutual. The division of shares is in the ratio 74:26 between Kotak Mahindra Bank and Old Mutual respectively. Kotak Mahindra insurance has developed into one of the most trusted names in the Market with the company providing its customers with a wide Range of insurance products and services. Kotak Life plans are designed in a user-friendly manner so that customers find it easy to understand and buy products. Kotak Life Insurance plans, especially Kotak Term Plans are more popular among the policyholders compared to other Kotak Life Insurance products.

Kotak Insurance aims to give its customers an experience of dealing with a global Indian brand which has an understanding of their requirements and delivers customised financial solutions across different platforms. The company uses latest the technology and benchmarks its practices to satisfy the policyholders.

Kotak Life Insurance Products

Kotak Life Insurance Term Plans

- Kotak Saral Suraksha

- Kotak Preferred e-Term Plan

- Kotak Preferred Term Plan

- Kotak Term Plan

- Kotak Income Protection Plan

Kotak Protection Plans

- Kotak Term Plan

- Kotak e-Term Insurance Plan

Kotak Mahindra Savings and Investment Plans

- Kotak Assured Income Accelerator

- Kotak Gramin Bima Yojana

- Kotak Premier Moneyback Plan

- Kotak Classic Endowment Plan

- Kotak Assured Savings Plan

- Kotak Assured Income Plan

- Kotak Platinum

- Kotak Single Invest Advantage

- Kotak Ace Investment

- Kotak Wealth Insurance

- Kotak Invest Maxima

- Kotak Premier Endowment Plan

- Kotak Single Invest Plus

- Kotak Sampoorn Bima Micro-Insurance Plan

- Kotak POS Bachat Bima Plan

Kotak Mahindra Child Plans

- Kotak Headstart Child Assure

Kotak Mahindra Retirement Plans

- Kotak Lifetime Income Plan

- Kotak e-Lifetime Income Plan

- Kotak Premier Pension Plus

Kotak Mahindra Group Plans

- Kotak Gratuity Plus Group Plan

- Kotak Leave Encashment Group Plan

- Kotak Secure Return Superannuation Plan

- Kotak Secure Return Employee Benefit Plan

- Kotak Superannuation Group Plan – II

- Kotak Term Group Plan

- Kotak Credit Term Group Plan

- Kotak Gratuity Group Plan

- Kotak Complete Cover Group Plan

- Kotak Group Assure

- Kotak Group Shield

- Kotak Group Secure

- Kotak Group Secure One

Kotak Life Insurance Calculator

Kotak Mahindra offers its customers a life insurance premium calculator to estimate policy premiums. Policyholders can calculate the premium they will have to pay for their term life insurance plans via the calculator.

Talk to our investment specialist

Kotak Life has over 200 branches across the country in over 160 cities. The company serves over 15 million customers with more that 90,000 insurance agents. It boasts of a healthy claim settlement ratio of 90.69%

Kotak Life Insurance Customer Care

If you need any help with the life insurance, you can contact Kotak's customer service unit:

Toll free number

1800 209 8800(8:00 am to 10:00pm)

Also,

Get details of your policy on WhatsApp

Send a "Hi" to 93210 03007, from your registered mobile number.

Kotak Life Insurance FAQs

1. Does Kotak e-Term Plan cover deaths due to COVID-19?

A: Yes. Kotak e-Term plan covers all claims arising out of the death of the insured due to COVID-19.

2. How to pay premiums?

A: Kotak Life Insurance offers the most convenient payment options for you:

- NEFT

- ECS

- Credit Card

- Debit Card

- IMPS

- Internet Banking

- Payment through Bill desk

- Electronic Bill Payment

- Kotak Mahindra Bank ATM Drop Box

- Payment at Branch Office

- Postal Money Order

- bank guarantee

- Auto debit from bank account (Available to all Kotak & HDFC bank customers). You can pay the renewal premiums through auto debit mode, if you have a valid banking account with any of the following banks:

- Allahabad Bank

- Axis Bank

- Bank of Baroda

- Bank of India

- CITI Bank

- Federal Bank

- ICICI Bank

- IDBI Bank

- Karnataka Bank

- Kotak Mahindra Bank

- State Bank of India

- Union Bank of India

- United Bank of India

3. What happens if you miss paying the premiums?

A: It is mandatory to pay all your premiums within the premium due date. When the premium is not paid within the days of grace provided after the due date, the policy will move into Lapse/ ACM / ANM/ Paid Up / Notice Period Mode. The grace period in case of yearly, half-yearly and quarterly modes of payment is 30 days and in case of the monthly mode of payment, it is 15 days.

4. When is the refunded paid from the full amount invested?

A: The company would refund the premium paid by you after deducting stamp duty, medical expenses and proportionate risk premium for the period of cover.

5. How to file an individual claim?

A: You can file/ update/ track the claim by calling: 022-66057280 (10am to 6pm - Mon to Fri). You can also email - kli.claimsmitra@kotak.com.

6. Can I change or update the policy online?

A: Only minor changes can be made online such as:

- Fund switches

- Payment frequency change

- Name change

- Address change

- Contact details update

- Nominee change

7. What should be the steps taken when you’ve lost or misplaced a policy docket?

A: You must immediately intimate the nearest Kotak Life Insurance branches through a letter along with an indemnity on Rs. 200 stamp paper and Rs. 500 (plus ST and Edu cess) towards administrative charges (stamp duty paid for registration).

In case the stamp duty for a particular policy amounts to more than the administrative charges collected, you will need to pay an amount based on the actual stamp duty.

8. What is the percentage of loan I can get on a policy?

A: Availability of the loan would differ for different plans subject to product-wise eligibility.

9. What is the rate of interest of the loan applicable for traditional plans?

A: Interest rate is charged at 12.5% p.a. compounded half yearly.

10. Are loans available in a unit-linked plan?

A: For products launched under new guidelines from October 2013 onwards loans are not allowed. Please refer to your policy document for further information.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.