Table of Contents

Sahara Life Insurance

Launched in 2004, Sahara Life Insurance is one of the notable life Insurance companies in India. Sahara Life insurance Company Ltd is India’s first completely owned private life insurance company. Sahara Insurance was launched with the initial paid up Capital of 157 crores. The company offers comprehensive Term Insurance plans for long-term savings and life cover.

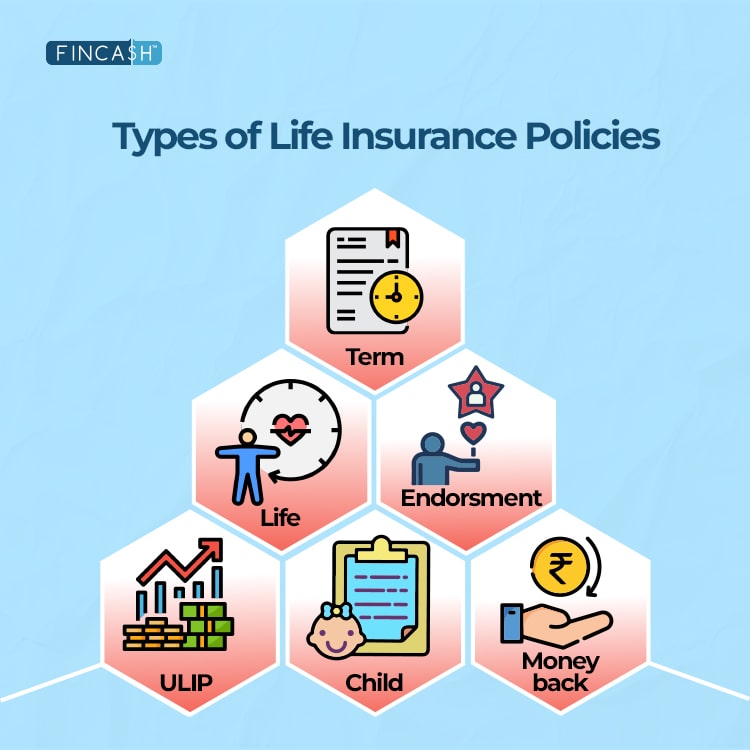

Sahara Life term plans offer good insurance services and investment option as well such as ULIP plans, money back plans, endowment plans, term insurance and Group Insurance plans. The company has a healthy claim settlement ratio of 90.19%. Sahara Life has the credibility of Sahara Group making it a trustworthy name in the insurance Market. It has grown very quickly to be recognised among the top insurance companies in India.

Sahara Life Insurance Plans

Sahara Life Unit Linked Plans

1. Sahara Sanchit – Jeevan Bima

This unit linked plan provides you to protect gains made through your funds invested in the equity markets from its Volatility and risk coverage.

| Factors | Plan Details |

|---|---|

| Minimum Issue Age | 18 Years (Nearest birthday) |

| Maximum Issue Age | 65 Years (Nearest birthday) |

| Policy Term | 5 Years to 10 Years |

| premium Paying Term | Single Premium Plan |

| Maximum Age at Maturity | 75 Years (Nearest birthday) |

| Minimum Premium | Rs.30,000 Top ups are not allowed |

| Maximum Premium | No limit subject to underwriting |

| Sum Assured | Age at entry (Nearest birthday) Sum Assured. Up to 45 Years - 125% of single premium. 46 Years & above - 110% of single premium |

Talk to our investment specialist

2. Sahara Utkarsh- Jeevan Bima

The plan enhances the value of the savings over a period of time and offers the choices to choose the Investment plan according to your risk profile and investment horizon at various points during the life of the policy.

| Factors | Plan Details |

|---|---|

| Minimum Issue Age | 12 Years(Nearest birthday) |

| Maximum Issue Age | 55 Years (Nearest birthday) |

| Policy Term | 8-20 Years |

| Premium Paying Term | Same as policy term except Single Premium Plan |

| Maximum Age at Maturity | 70 Years (Nearest birthday) |

| Factors | Single Premium | Regular Premium |

|---|---|---|

| Minimum Premium | Rs.50,000 Rs.20, 000 under yearly mode | Rs.15, 000 under half-yearly mode. (Premium once chosen will remain unaltered throughout the premium paying term. Top ups are not allowed.) |

| Maximum Premiun | No limit subject to underwriting | No limit subject to underwriting |

| Sum Assured | Age at entry Sum Assured (Nearest birthday. Upto 45 Years - 125% of single premium and 46 Years & above - 110% of single premium | Age at entry Sum Assure (Nearest birthday). Upto 45 Years - 10 times of annualized premium and 46 Years & above - 7 times of annualized premium |

3. Sahara Sugam Jeevan Bima

The Unit linked plan being offered is a unique blend of risk coverage and market linked returns.

| Factors | Plan Details |

|---|---|

| Minimum Issue Age | 10 Years(Nearest birthday) |

| Maximum Issue Age | 55 Years (Nearest birthday) |

| Policy Term | 10 Years or 15 Years or 20 Years |

| Premium Paying Term | Same as policy term |

| Maximum Age at Maturity | 70 Years (Nearest birthday) |

| Minimum Premium | Rs.12,000 Premium once chosen will remain unaltered throughout the premium paying term. Top ups are not allowed. |

| Maximum Premium | No limit subject to underwriting |

| Minimum/Maximum Sum Assured | Sum Assured = 10 times of Annualised Premium |

Sahara Life Money Back Plan

1. Sahara Pay Back – Jeevan Bima

Sahara Pay Back Jeevan Bima is a money-back participating Endowment Plan that helps in planning for future expenses by making lump-sum funds available at specific intervals. In case of any unfortunate event, this plan also helps to protect the family from financial hardships.

| Factors | Plan Details |

|---|---|

| Minimum Issue Age | 16 years nearer birthday. Further the risk commences immediately. |

| Maximum Issue Age | 50 Years (Nearer birthday) |

| Minimum Sum Assured | Rs 75000/- and thereafter in multiples of Rs 5000/- |

| Maximum Sum Assured | 1 crore, subject to underwriting |

| Minimum Policy Term | Policy term is fixed for 12 years, 16 years and 20 years. |

| Maximum Policy Term | Policy term is fixed for 12 years, 16 years and 20 years. |

| Premium Paying Term | The premium paying term is 5 years for 12 years policy term, 5 years or 10 years for 16 years policy term and 5 years or 10 years or 15 years for 20 years policy term. |

| Maximum Coverage Age | 70 Years |

Sahara Life Endowment Plan

1. Sahara Shrestha Nivesh-Jeevan Bima

This plan is designed to meet the real investment and protection needs and help you to maintain your family's financial independence. Sahara Shrestha Nivesh-Jeevan Bima plan suits the requirements of those with an unpredictable, seasonal or uneven Income stream.

| Factors | Plan Details |

|---|---|

| Minimum Entry Age | 9 Years (Nearer birthday) where the risk commences immediately |

| Maximum Entry Age | 60 Years (Nearer birthday) |

| Minimum Sum Assured | Rs. 30,000 |

| Maximum Sum Assured | Rs. 1 Crore subject to underwriting |

| Minimum Single Premium | Rs. 16,992 for age at entry 9, policy term 10 years and Sum Assured 30000 |

| Policy Term | 5 Years to 10 Years subject to minimum maturity age of 19 years nearer birthday |

| Premium Paying Term | Single Premium |

| Maximum Maturity Age | 70 Years |

| Premium Payment Mode | Single Premium |

2. Sahara Shubh Nivesh-Jeevan Bima

The plan offers more liquidity and is ideal for customers who are investment savvy. It offers you a life cover for the policy term and that too without burdening you to pay premium for the entire term i.e. invest today and reap the benefit at maturity.

| Factors | Plan Details |

|---|---|

| Minimum Entry Age | 9 Years (Nearer birthday) where the risk commences immediately |

| Maximum Entry Age | 60 Years (Nearer birthday) |

| Minimum Sum Assured | Rs. 50,000. (There after in multiple of Rs 5000) |

| Maximum Sum Assured | No Limit subject to underwriting |

| Policy Term under the plan is | 10 years (fixed) |

| Premium Paying Term | Single Premium |

| Maximum Maturity Age | 70 Years |

| Available premium Payment Mode | Single Premium |

3. Sahara Dhan Sanchay Jeevan Bima

Sahara Dhan Sanchay Jeevan Bima plan offers a perfect blend of income and financial protection for you and your family. It is suitable for investors who want safety, returns, tax benefits and guaranteed cash inflow to meet the desired financial Obligation.

| Factors | Plan Details |

|---|---|

| Minimum Issue Age | 14 Years (Nearer birthday) |

| Maximum Issue Age | 50 Years (Nearer birthday) |

| Minimum Sum Assured | Rs 50000/- and thereafter in multiples of Rs 5000/- where sum assured will not be less than 10 times of annualized premium for age at entry less than 45 years and 7 times of annualized premium for age at entry more than or equal to 45 years. |

| Maximum Sum Assured | No limit, subject to underwriting |

| Minimum Policy Term | 15 Years |

| Maximum Policy Term | 40 Years subject to maximum maturity age of 70 years |

| Premium Paying Term | Same as policy term |

| Maximum Coverage Age | 70 Years |

| Available premium Payment Modes | Yearly, Half-yearly, Quarterly and Monthly |

Sahara Life Group Insurance Plans

1. Sahara Samooh Suraksha

This plan is for Establishments/Groups. The product provides the advantage of market appreciation on the savings portion of premium.

| Factors | Plan Details |

|---|---|

| Minimum group size | 50 members |

| Minimum entry age | 18 years (Last Birthday) |

| Minimum total monthly contribution for the Group | Rs. 5000 |

| Maximum entry age | 64 years nearest birthday |

| Minimum sum assured per member | Rs. 50000 |

| Maximum sum assured per member | Rs. 500000 |

| Maximum maturity age for the member | 65 years (Last Birth Day) |

Sahara Insurance Online Payment

Sahara Life online payment can be made on its website portal. Sahara Life Insurance term plans and ULIP are considered to be its flagship insurance products. The company also offers micro insurance and rider benefits to its customers. Interested customers need to fill up an online form so that the company can send their personal financial advisor to them. It also offers an online premium calculator on its website portal.

Corporate Office Address

Sahara India Life Insurance Company Limited, Corporate Office, Sahara India Centre, 2, Kapoorthala Complex, Lucknow - 226024.

Sahara Customer Care Service

Toll Free Number:

1800-180-9000

Tel.: 0522-2337777 Fax: 0522-2332683

Email: sahara.life@sahara.in

FAQs

1. What are the terms & modes available for payment of premium?

A: You can pay the premium on Yearly, Half-Yearly, Quarterly, Monthly Basis. The modes to pay it are direct debit and group billing only. In case you choose to pay your premiums through cheques, please draw them in favour of Sahara India Life Insurance Company Ltd., payable at any of the company's branch cities. Cash payments can be made at any of the Sahara Insurance branch offices.

2. What are the rebates available?

A: For yearly & half-yearly mode of premium payments rebate of 3% and 1.5% respectively.

3. How to check policy status?

A: To check the policy status, go to the official website of Sahara Insurance, login on the home page with your user name and password.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.