Table of Contents

A Guide to Travel Insurance

Travelling is an important and regular event in everyone’s life. Making trips to new destinations always bring joy, excitement and adventure. However, while exploring new places you may need a support system that protects you from unexpected emergencies like loss of baggage, trip delay or even a medical emergency, etc.

Hence an essential back up like 'travel insurance' matters a lot! While talking about travel insurance, let's have an in-depth look at its types such as Travel health insurance, Student Travel Insurance, the covers offered, comparison across policies and Travel Insurance Companies in India.

Travel Insurance

Travel Insurance is often bought to compensate the cost of any unexpected loss or damage that may arise while travelling. Most travel insurance policies usually cover the cost that may accrue due to trip cancellation, loss of baggage, theft, a medical issue or even plane hijack. Though this policy does not guarantee safety, but it acts as a safeguard against the unexpected losses due to any uncertain incidents. It gives a sense of security when away from home. Nowadays, many countries have made travel insurance mandatory for visitors.

Travel insurance is generally based on the frequency of travel. A person can buy it for a single trip or for multiple trips. During your travel, especially to overseas, most policies offer 24-hour emergency assistance.

Types of Travel Insurance

Travel Health Insurance

Travel health insurance provides benefits of medical cover. For example, if you have met through an accident or fallen sick in a foreign Land then the medical expenses can be covered by travel health insurance. This policy provides for both pre and post hospitalisation expenses. Covers like surgery, dental charges, emergency medical care, expenses for prescribed drugs, etc., are included in this policy.

Talk to our investment specialist

Single and Multi Trip Insurance

A single trip insurance policy is designed for a single trip and it usually covers health insurance and offers reimbursement in case of trip cancellation. Multi-trip insurance is specially designed for frequent visitors/travellers such as businessmen or professionals who travel overseas multiple times in a year.

Student Travel Insurance

It is a Comprehensive Insurance policy that provides cover for loss of baggage, accident, etc., incurred during a student’s tenure overseas.

Senior citizen insurance, long stays insurance, group travel policy, flight insurance, cruise travel insurance are other types of travel insurance. Each of these types is further classified into Silver, Gold and Platinum, depending on the insurance provider. Also, these classifications are based on the premium rates and coverage offered.

Travel Insurance Policy Coverage

Some of the common covers are as follows:

- Loss of passport

- Loss of baggage, travel papers, etc.

- Delay or missed in trip

- Flight related accidents, etc.

- Loss of driving license

- Medical emergencies such as accidents or sickness.

- Relief benefits in case of hijack

- Emergency dental assistance

- Costs of funeral outside the country.

- Cashless hospitalisation for senior citizens

These are some of the common exclusions to a travel policy-

- Baggage delay for less than 24 hours

- Loss of keys

- Flight or train missed in case of local protest or civil war

- No cover on pre-existing diseases

- Self-inflicted injury

- Addiction to alcohol or drugs

- Loss of passport in public place

Online Travel Insurance

Those who are planning to travel abroad need to pay a fixed amount of premium to avail a good online travel insurance cover. Since this premium is determined by many factors, travellers should be aware of the factors involved in the calculation of online insurance premium for travel. Some factors may increase the premium, while others may help to reduce the premium.

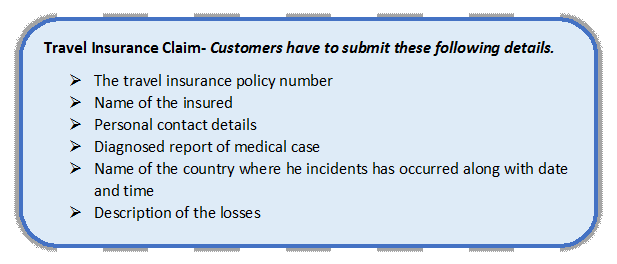

If a person is looking to buy a new travel policy or wants to renew the existing one, they can avail the option of online service. While purchasing a travel policy online, customers need to enter their trip details such as duration of trip and destination, their personal details, covers that they would like to opt, and then make a payment online. Later, the customers would get the issued policy from the insurer.

Travel Insurance Comparison

From various options available in the Market, it may be a very difficult task to choose the right policy. To avoid glitches in choosing, always compare and buy. Make a comparative analysis of companies, their covers on policies and their overall Offering. One needs to look at their claim process, payment options and networks of hospitals overseas to make a good decision.

Make a decision, according to your duration of stay, cover requirements and the purpose of travelling. If you are a frequent traveller opt for a multi-trip insurance policy, this will save you money. Likewise, if you are going abroad for studies, opt for student insurance as it provides all the necessary covers that are required.

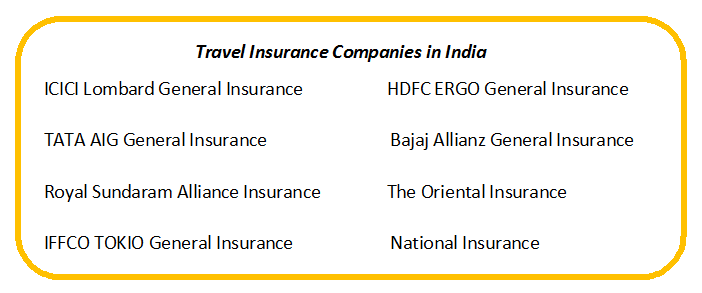

Travel Insurance Companies 2025

Most travel insurance policies usually cover the cost that may accrue due to trip cancellation, loss of baggage, theft, medical issue or even hijack of a plane. These are a few travel Insurance companies in India that offers tailored plan:

1. ICICI Lombard Travel Insurance

- Overseas hospitalisation coverage. If you face a medical emergency abroad, the insurer gives you an immediate help with cashless Facility, along with emergency hotel extension

- Trip cancellation and interruption cover

- Assurance for your frequent trips

- No medical test required to secure your travel plans

- If you lose luggage, the insurance plan covers the compensation loss

- Get pre-approved cover when you travel to Schengen countries

2. HDFC Travel Insurance

- Cashless treatment on emergency medical expenses

- Emergency dental expenses when traveling abroad

- In case of a death, the insurer will bear the cost to transfer the mortal remains to the home country

- Lump-sum compensation to your family upon accidental death

3. TATA Travel Insurance

- With a global presence spanning 190+ countries, the insurer offers safe trip anywhere

- 24x7 assistance on any emergency during the trip

- The insurer offers comprehensive plans that are designed to suit your travel requirements and budget

- Local assistance in a foreign land

- If you fall sick or get injured on your trip, a two-way ticket will be provided to a member of your family to visit you and stay at your bedside

- You will be compensated for any bounced flight and hotel bookings if they have been made in advance

4. Bajaj Allianz Travel Insurance

- Overseas medical emergencies covered

- Delayed flights covered

- Country/Visa requirements

- Loss or delay of luggage

- Cover for natural calamities or human-made disasters

- Cover on missed flights or trip cancellation

5. Royal Sundaram Travel Insurance

- The plan offers a customized annual plan for frequent business travelers

- A very useful annual plan for all students going abroad for studies

- Exclusive tailor made plan for members aged 71 and above

6. Oriental Travel Insurance

- Host of options to choose the most suited plan, wherein you have the freedom to choose the premium you want to pay

- Instant digitally signed plan document with hassle-free processing and simple documentation

- 24x7 worldwide assistance in partnership with Coris International

- A complete protection for accidental, emergency medical or third party liable when the beneficiary is outside the Republic of India

7. IFFCO TOKIO Travel Insurance

- The plan covers expenses incurred due to loss of passport

- Loss of checked-in baggage, including delays is taken care

- Cover on emergency medical expenses or dental treatments while traveling

- The insurer provides hospital daily allowance in case of hospitalization. Along with the cost of transportation to the hospital

- Personal liability and Personal Accident coverage

8. National Travel Insurance

- The plan is designed to protect you against any unforeseen circumstance that you could face while travelling abroad

- In case of emergency, the travel policy covers all the medical expenses in a foreign country

- With the comprehensive travel insurance, you can be stress-free from any financial loss due to a medical emergency while travelling abroad

- 24x7 assistance for full support

Conclusion

There are many companies in India that offer travel insurance. The main mistake that people often tend to do is that they choose the cheapest policy blindly. To avoid such mistakes, make sure that you understand each policy carefully and buy the one that suits the best for you. So, if you have a plan to travel in the near future, buy travel insurance and make your trip risk free!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.