Table of Contents

A Quick Guide on Loan Against Insurance Policy

A financial emergency can come anytime, during such a situation taking a loan against an insurance policy is one of the preferred ways to avail assistance. Taking a loan against an insurance policy is also quickly available as many people opt for this option.

The loans are offered as a percentage of the surrender value, but the processing of the loan is easier and faster as compared to other loans. The rate of interest on a loan against an insurance policy is between 10-14%, which also relies on the type of insurance and tenure of the loan. Loan against LIC policy currently charges an interest rate of 9%, which needs to be paid half-yearly. They charge with a minimum tenure of 6 months and if you want to repay the loan before 6 months, you have to pay the interest for 6 months.

What is Loan against Policies?

Taking personal loan during an emergency might be an easy option, but instead of going for an expensive option like a personal loan, you can take a loan against a Life Insurance policy.

It suits well for loan seekers as you don’t have to render any other assets as Collateral. Also, the interest rate charged depends on the insurance company, but it is usually lower than personal loans.

Policies Available for Loan

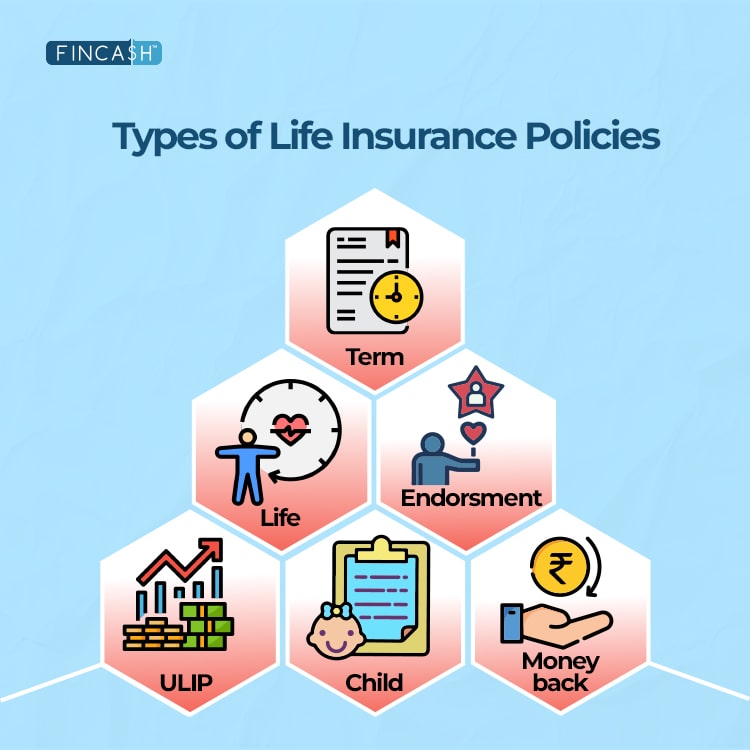

You cannot avail a loan for every type of life insurance policy. Before buying any insurance, you should check with your insurer. whole life policy, money-back policy and Endowment Plan renders with a loan against the insurance policy. The loan can also be taken against Unit-Linked Insurance Plan (ULIP) relying on the insurance company.

Talk to our investment specialist

Benefits of Loan Against Insurance Policy

Lower Interest Rates

The interest rate on this type of loan is less as compared to other interest rates imposed on the personal loan.

Quick Disbursement

The documentation is minimal and the disbursement of the loan is quick with the limited application and processing fees is required.

Fewer Chances of Rejection

Unlike unsecured loans, there are fewer chances of your loan application getting rejected as you hold an insurance policy with the company.

Less Scrutiny

The insurance company has your life insurance policy as security against the loan because there is less scrutiny. So, mostly your Credit Score is not examined unlike other types of loan where score plays an important role in a loan approval.

4 Things to Consider before taking a Loan against Policy

1. Eligibility

People who hold a life insurance plan or unit-linked insurance plans can apply for this loan. Other than the traditional insurance policies, ULIPs offer life insurance risk that provides an option to invest in areas like shares, stocks and Bonds. If you are planning to apply for a loan in the future, you must buy life insurance first.

2. Rate of Interest

The interest rate charged on this type of loan relies on the interest rate applicable while taking the insurance policy. The applicant has to pay interest for a minimum of 6 months.

3. Repayment

Usually, the repayment period is of 6 months and the terms and conditions of repaying the loan may vary from your lender. For example, some insurance providers do not require the borrower to pay the principal amount. But at the time of maturity or claim, they directly credit it from the policy value.

4. Loan Amount

The eligible loan amount which you borrow has to be checked with the insurer. The loan amount is a percentage of the amount payable to a person who surrenders a life insurance policy with the loan up to 85-90% against the traditional life insurance plans.

What Happens if you Fail to Repay?

In case you Fail to repay the loan against the taken life insurance policy, then the interest keeps adding into the balance amount. If the loan amount surpasses the insurance policy value, then this can cause the end of the policy. The insurer will have a complete right to recover the amount and the interest from the surrender value of the policy and can stop the insurance.

How to Apply for Loan Against Life Insurance Policy?

The process for applying the loan may differ from one company to another. You can contact your insurer to know about the surrender value of the policy, loan amount, terms and conditions, etc..

Documents for Loan Against Life Insurance Policy

To avail loan against a life insurance policy, you need to fill the application form, which needs to be accompanied with the original insurance policy document. Also, attach a copy of a cancelled cheque and a payment Receipt of the loan amount.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.