Table of Contents

What is Two Wheeler Insurance?

Two Wheeler insurance, as the name suggests, is an insurance policy that provides a shield against any loss or damage that may occur to a motorcycle (or any two wheeler) or to its rider due to any unforeseen events like an accident, theft or man-made/natural disaster. Two wheeler insurance, also known as bike insurance provides coverage against liabilities arising from injuries caused to one or more individuals due to an accident.

In this article, we will study two wheeler insurance in detail, the advanced options available for two wheeler insurance renewal and how to buy Two Wheeler Insurance Online or bike insurance online.

Types of Two Wheeler Insurance Plans

Third Party Liability Insurance

Third Party liability insurance covers the third person who has been injured in an accident. Third Party Insurance covers your legal liability arising due to the damage caused by you resulting in personal injury, property damage or death to a third party. Carrying Third party insurance is compulsory by the law of India.

Comprehensive Insurance

Comprehensive Insurance is a type of insurance that provides cover against the third party plus loss/damage occurred to the owner or to the insured vehicle. This scheme also covers damages caused to the vehicle due to thefts, legal liabilities, personal accidents, man-made/natural calamities, etc. Since this policy offers a wide coverage, even though the premium cost is higher, consumers tend to opt this policy.

Talk to our investment specialist

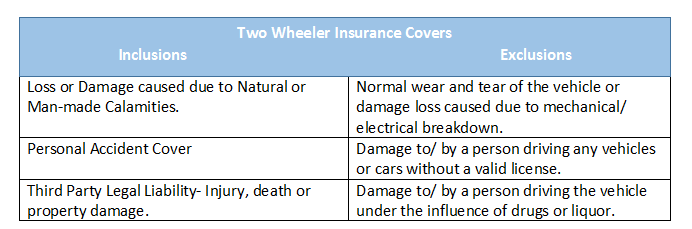

Two Wheeler Insurance Coverage: Inclusions and Exclusions

Some of the typical inclusions and exclusions are as follows (refer the image)-

Bike Insurance Online

Many Insurance companies offer online purchase of a plan or policy renewal through their web portal and sometimes even through mobile apps. Customers can avail this advance option to renew or buy a policy, at their comfort!When it comes to buying two wheeler insurance or bike insurance online, customers may need to visit a few insurers websites, scan through each policy’s features, submit details, get quotes, compare the premiums and then finally opt for the one that meets your objectives.

While buying a policy, customers may need to submit all the relevant information such as two wheeler’s registration number, license number, date of Manufacturing, model number, insured personal details, etc.

Best Two Wheeler Insurance 2025

- Bajaj Allianz Two Wheeler Insurance

- Bharti AXA Two Wheeler Insurance

- Edelweiss Two Wheeler Insurance

- Future Generali Two Wheeler Insurance

- HDFC ERGO Two Wheeler Insurance

- IFFCO TOKIO Two Wheeler Insurance

- Kotak Mahindra Two Wheeler Insurance

- National Insurance Two Wheeler

- New India Assurance Two-Wheeler Insurance

- Oriental Two-Wheeler Insurance

- Reliance Two Wheeler Insurance

- SBI Two Wheeler Insurance

- Shriram Two Wheeler Insurance

- TATA AIG Two Wheeler Insurance

- United India Two-Wheeler Insurance

- Universal Sompo Two-Wheeler Insurance

| Two Wheeler Insurer | Minimum Policy Term | Personal Accident Cover | No Claim Bonus | Online Purchase & Renewal |

|---|---|---|---|---|

| Bajaj Allianz Two Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| Bharti AXA Two Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| Edelweiss Two Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| Future Generali Two Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| HDFC ERGO Two Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| IFFCO TOKIO Two Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| Kotak Mahindra Two Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| National Insurance Two Wheeler | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| New India Assurance Two-Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| Oriental Two-Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| Reliance Two Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| SBI Two Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| Shriram Two Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| TATA AIG Two Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| United India Two-Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

| Universal Sompo Two-Wheeler Insurance | 1 Year | Rs. 15 lakh | Avaliable | Yes |

Two Wheeler Insurance Renewal

Two wheeler insurance renewal can be done via both online and offline mode. With the advent of technology, insurers are providing a quick and hassle-free way to their consumer for policy renewal. Some insurance companies even have their own apps, wherein customers can download the app on their smartphones and renew their plans. If not online, customers can renew their policy offline as well.

Conclusion

A two wheeler is a prized asset to many, while third party liability is mandatory, one should always buy the best two wheeler insurance policy. A bike insurance policy will not only secure you from any liability, but it will also give you peace of mind while riding! Investing in this policy will ensure adept safety for your bike! So, buy a quality plan today and secure your two wheeler!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.