Table of Contents

ULIP: Unit Linked Insurance Plan

ULIP 2021 Budget Update

Budget 2021 has rolled back exemption to ULIPs if annual premiums exceed Rs 2.5 lakh. This will be applicable to Unit Linked insurance Plan bought on/or after February 1, 2021. Such ULIPs will now be treated as Capital assets. Profits from such ULIPs will now be taxable as Capital Gains.

What is a ULIP?

ULIP stands for Unit Linked Insurance Plan. A ULIP is a Market linked product that is a combination of both investment and insurance. It is linked to Capital Markets and offers a flexible investment option in equity or Debt fund as per the one's risk appetite. Thus, a ULIP becomes an attractive option for investment because of this dual benefit. The first unit-linked insurance plan was the UTI ULIP launched in 2001. It was then the Government of India opened up the insurance sector to foreign investment. Insurance Regulatory and Development Authority of India (IRDA) issued guidelines for ULIPs in 2005. Many Insurance companies jumped into the business Offering a variety of schemes to serve the needs of the customers looking to invest in a product offering both insurance and investment.

Types of ULIP Plans

ULIPs are mainly classified on the Basis of the purpose they serve:

ULIPs for Retirement

In this plan, you need to pay the premium during the time of your employment, which is directly collected as the surplus amount. This lump sum amount is then paid in the form of annuities to the plan holder after their retirement.

ULIPs for Wealth Creation

In this plan, your money is gradually saved to build up to a considerable amount. These plans generally recommended to people who are in their late twenties or early thirties. It also allows them to accumulate wealth and fund their future Financial goals.

ULIPs for Children’s Education

No parent would want to hinder their child’s education in any sort of way. There are many ULIPs in the market that provides money in chunks at regular intervals and key stages of your child’s life.

ULIPs for Health Benefits

Along with the common benefits, ULIPs efficiently provide financial help to meet medical or health emergencies.

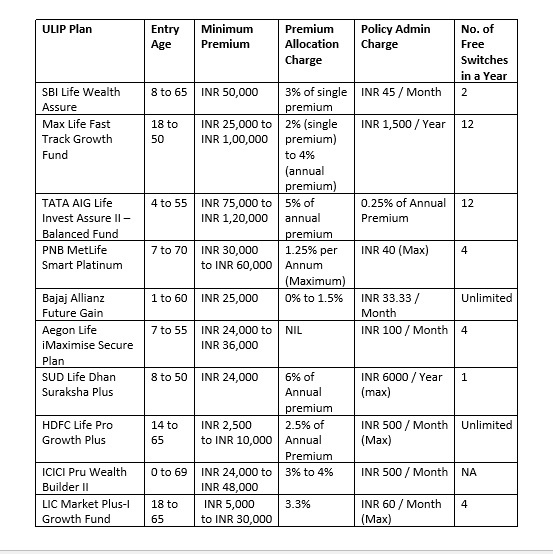

Best ULIPs in 2016

Why ULIPs are A Good Choice?

Here are some reasons why Unit Linked Insurance Plans are a good choice:

- Transparent and crystal clear structure, features and charges

- There is a flexibility to switch between funds

- Insurance cover

- Variable premium paying frequencies

- A wide Range of funds suiting for both risk averters and risk takers

- With additional charges, rider option is available

- There is a tax benefit under Section 80C and 10(10D)

ULIP Charges

Unit Linked Insurance Plans have certain fees attached with them which can be further divided into multiple sub-categories. They are as follows:

Premium Allocation Charges

This charge is imposed beforehand on the premium paid by the client. These are the initial costs drawn by the company in issuing the plan.

Policy Administrative Charges

These are regularly deducted charges for the recovery of costs bore by the insurance company and the Life Insurance policy maintenance.

Surrender Charges

Surrender charges are imposed during the Deduction for full or partial encashing of premature ULIP units subject to the plan documents. Charges can be levied as the percentage of fund value or of the premium.

Mortality Charges

These charges are bored by the insuring company to provide the life cover to the client. It varies with age and sum assured of the policy and are deducted on monthly basis.

Fund Management Charges

The sum collected through ULIP funds is invested in equity and debt instruments. The insuring company bears these charges for the fund management which differ according to both the fund and plan. The amount deducted is calculated according to the net asset value(NAV) of the fund.

Fund Switching Charges

ULIP provides you with an option to switch between different funds during your investment period. The insurance company will charge you for switching between the funds.

Discontinuance Charges

On premature discontinuation of the ULIP scheme, the insurer deducts a small amount. These charges are set by IRDA and are same for all policies.

ULIP Calculator

Many insurance companies provide an online platform for ULIP calculator. It helps you understand the amount of cover and the money you need. The ULIP calculator calculates the future value of the investment. You need to put in details of the investment amount, frequency, a number of years for investment, etc. in the ULIP calculator to know which unit-linked investment best suits you.

Talk to our investment specialist

Conclusion

To add up, ULIP is a great combination of traditional and modern investment options. It is generally seen that people keep the insurance and capital appreciation different, unit linked plan tries to bring the best of both. With the emergence of online unit-linked plans with extra features and flexibility, ULIP has become a great choice of investment for the new generation.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.