Table of Contents

Critical Illness Insurance– Get One Before It’s Too Late

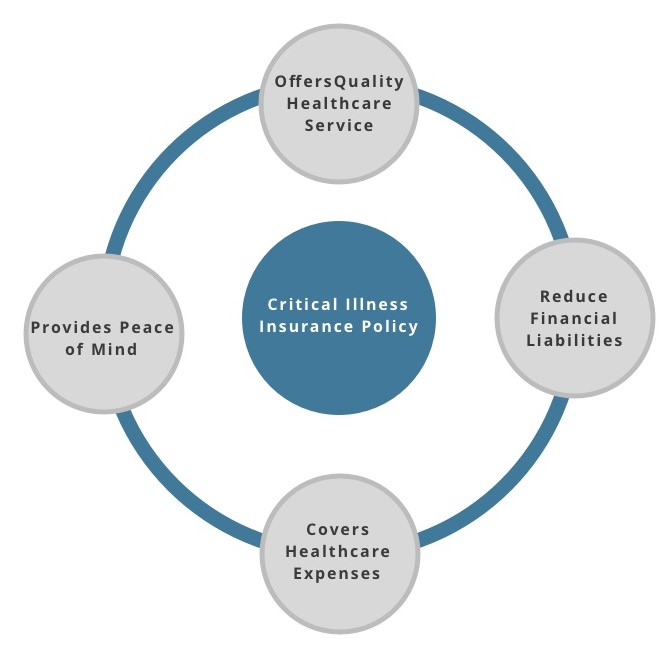

In today’s times, with the changing lifestyle of people and increasing risk of lifestyle diseases, buying a critical illness insurance is a must. As per estimates, one out of every four Indians is at a risk of suffering from critical illnesses such as cardiovascular diseases, cancer etc. before the age of 70. The treatment cost of such illnesses is much more than that of minor ailments and can even lead to a financial drain. This is where a critical insurance policy (also known as a critical illness plan) helps. To keep yourself and your family members protected during severe healthcare emergencies, one needs to get one of the best critical insurance covers. It is suggested to get critical insurance quotes from various Life Insurance, general insurance or health insurance companies and choose the Best Critical Illness Policy among them.

What is Critical Illness Insurance?

Critical Illness health insurance is a health insurance plan specially formulated to provide safety against critical illnesses that are very costly to treat and generally take a longer time for recovery. Such illnesses include heart attack, paralysis, organ transplant, kidney failure, bypass surgery, cancer, stroke, coma etc. Often, it is advised to get a critical illness insurance at around the age of 40. However, buying early is helpful as well, as at an early age the risk of disease is low and so is the premium. Let’s have a look at some of the features of critical illness insurance policy.

Features of Critical Illness Policy

Workflow of Critical Illness Plan

The workflow of a critical illness policy is quite different from a mediclaim policy. Basically, it is a health insurance policy that reimburses a lumpsum of sum assured amount to the insurer as soon as they are diagnosed with any serious ailment. Whatsoever be your hospital and treatment expenses, the insurance company pays the full sum assured amount. The benefit of this plan is that you can use the reimbursed sum assured amount as and how you like. You can use it to pay for the treatment, recuperation expenses, and to pay your debt as well.

Diseases Covered Under Best Critical Illness Insurance

There are numerous critical diseases covered under a critical illness policy. Some of the major illnesses covered by some of the best critical illness insurance policies include-

- Cancer

- Stroke resulting in permanent symptoms

- First heart attack

- Major organ or bone marrow transplant

- Kidney failure

- Permanent paralysis of limbs

- Primary Pulmonary Arterial Hypertension

- Multiple sclerosis with persisting symptoms

- Open heart replacement or repair of heart valves

How Much Does a Critical Insurance Cover?

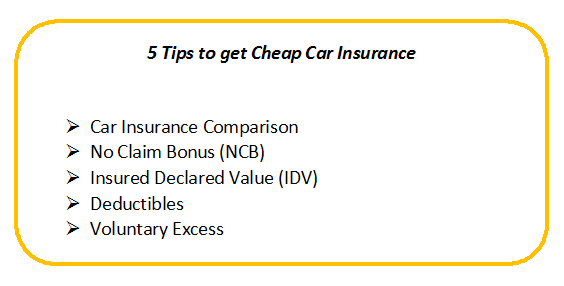

Different Insurance companies offer different critical insurance covers. The critical illness insurance cover can be anywhere above INR 1,00,000. However, it is suggested to get a policy with a cover above INR 15,00,000, assuming the fact that the entire sum assured amount is given after detection for the treatment and rehabilitation.

Waiting Period of Critical Illness Insurance Plans

This is a distinctive feature of the critical illness insurance policy. According to it, the insurer has to survive for 30 continuous days after the detection of a critical illness in order to make a claim. Moreover, the policy has a waiting period(or cooling period) of 90 days, which means any severe disease diagnosed within the first 90 days will not be covered under the critical illness policy.

Tax Benefits Of Critical Illness Insurance

Lastly, the critical insurance health insurance offers tax benefits as well. Under Section 80D of the income tax Act, one can avail tax benefits on the premiums paid towards the critical illness policy.

Talk to our investment specialist

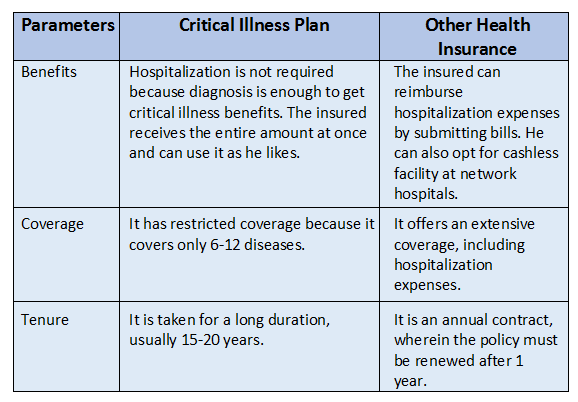

Critical Illness Vs Health Insurance

Before you buy, know how a Critical Illness Insurance is different from other Health Insurance plans. Take a look!

Now that you know the importance of a critical illness insurance policy and all its features, buy one before it’s too late. In popular opinion, one must buy a critical insurance policy that provides the privilege of adding critical illness plans. Otherwise, buy a separate plan for your spouse and yourself. Buy early, buy better!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.