Table of Contents

Whole Life Insurance: A Complete Lifetime Protection

What is Whole Life Insurance?

Whole Life Insurance, as the name suggests is a type of life insurance which provides cover for the entire life of an individual. Whole life plans are also called as straight life plans or ordinary life plans. Whole life insurance policy does not expire and remains intact throughout the insured’s life. Most whole life plans come loaded with a feature called as ‘cash value’ or ‘Cash Surrender Value’. Cash value is the money offered to the policyholder by the insurance company upon the cancellation of the insurance contract. Generally, this feature is not available with most Term Insurance plans. One of the key advantages of whole life insurance is the policy amasses a cash value against which you can apply for loans. The maturity age of such policies is usually 100 years. If the insured goes past the maturity period, the policy becomes matured endowment. Also, the death benefit under whole life policy is tax-free.

How does Whole Life Insurance Plan Work?

A whole life policy is a bit different from the other Types of life insurance policies. Knowing how the whole life plan works will also give you an idea if such plan is suitable for you or not. A whole life plan can be purchased against a payment that can be paid as a one-time sum, on a monthly or yearly Basis. In the case of a unit-linked whole life policy, some of the funds will be directed towards the premium of your Life Insurance and the remaining money will be invested in an investment fund. Moreover, certain whole life plans give customers the option of having a cover against a specific illness or disability.

Types of Whole Life Policy

The two main of Whole Life Insurance plans are given below:

Non-Participating Whole Life Insurance

In this type of whole life plan, the premium and sum assured during the entire policy course is same. The main advantage of such policy is that inbuilt costs are fixed and there are comparatively low premiums. And since the policy is non-participating it does not give you any dividends.

Participating Whole Life Insurance

The key feature of this whole life policy is that it gives you dividends. Dividends are the extra Income which company has amassed via investments, savings from expenses and beneficial mortality rates. There is no guarantee that the policyholders will certainly get dividends. But, if they are paid, it will be done in form of cash which will be utilised in bringing down the premium amount. It can also be allowed to accumulate and will have interest at a specified rate.

Under the above mentioned broad categories, there are different types of whole life plans which you can choose from:

1. Level Premium Whole Life Insurance

As the name suggests, the insurance policy features level premiums which must be paid till the insured is alive.

2. Limited Payment Whole Life Insurance

Under this plan, the premiums are to be paid for a limited amount but the insurance cover is for the lifetime. Naturally, the premiums are costlier since the premiums are front-ended and concentrated over a shorter period.

3. Single Premium Whole Life Insurance

Under this whole life policy, a single lump sum premium has to be paid. The payment is to be made at the time of policy issue and no further premium payments are required after that.

4. Indeterminate Premium Whole Life Insurance

The special feature of this policy is that it allows the insured to adjust their premiums. The ‘current’ premium will be charged according to insured’s current salary, the cost of expenses etc. And in future, if there is some change in the future estimates, the insurer will adjust the amount accordingly.

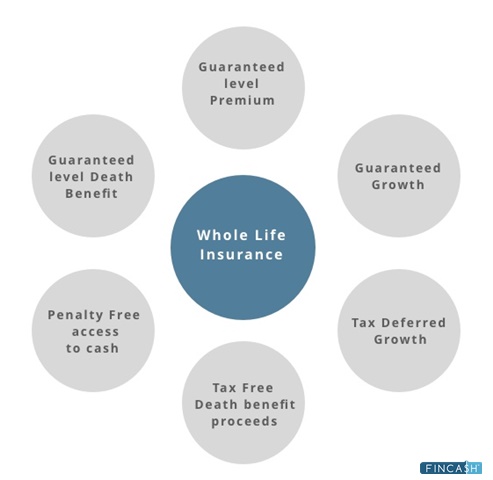

Benefits of Whole Life Policy

Cover for Life

The policyholder gets a cover for life, unlike term insurance where the cover is for a limited period.

Assured Cover and Tax Benefits

The survival benefits of the whole life policy keep on building over time. You get a lifetime cover with level premiums for a limited period. Insured gets a tax benefit on both the premium and the sum assured under the Section 80C and Section 10(10D) of the income tax Act, 1961

A Source of Income

With a whole life insurance policy, you can have a source of income after your premium payment term ends.

Loan Approval

You can approve a Bank loan against the surrender value of your whole life policy which increases over the period.

Family Cover

Your family gets a financial cover from your whole life insurance policy.

Talk to our investment specialist

Popular Whole Life Insurance Policies

We have listed here some of the most popular whole life plans in the insurance Market:

- ICICI Pru Whole Life

- Max Whole Life Super

- IDBI Federal Life Insurance Whole Life Savings Insurance Plan

- SBI Life Shubh Nivesh

- LIC Whole Life Policy

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.