Fincash » Investment Plan » Investing Philosophy from David Tepper

Table of Contents

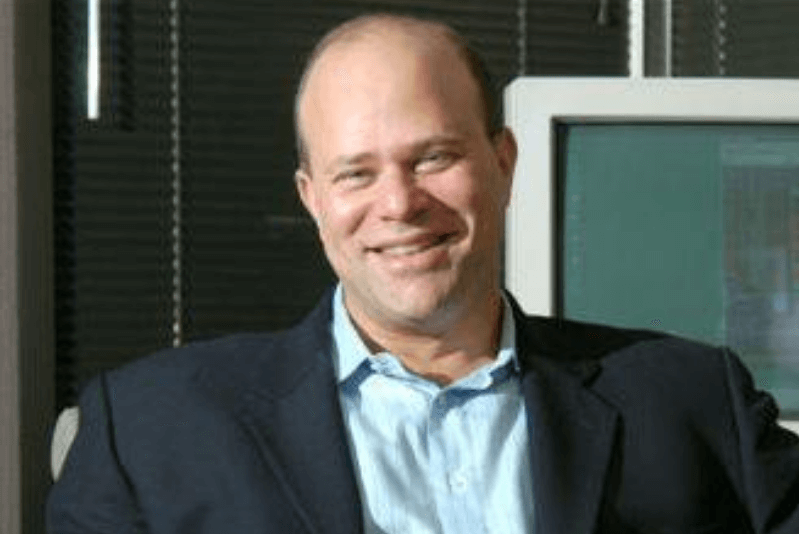

Top Investing Philosophy from Hedge Fund Manager David Tepper

David Alan Tepper is an American businessman, hedge fund manager and philanthropist with a successful investment journey. He is the founder and the president of Appaloosa Management, a global hedge fund in Miami Beach, Florida. He is the owner of the Carolina Panthers of National Football League (NFL) along with Charlotte FC in Major League Soccer (MLS).

In 2018, Forbes listed as #3 on the Highest Earning hedge Fund Managers. In 2012, Institution investor’s Alpha ranked Tepper’ $2.2 billion paycheck as the world’s highest contribution for a hedge fund manager. He has also been called ‘golden god’ by an investor in the New York magazine in 2010. Tepper looks forward to converting his hedge fund into a family office.

| Particulars | Description |

|---|---|

| Name | David Alan Tepper |

| Birth Date | September 11, 1957 |

| Age | 62 years |

| Birth place | Pittsburgh, Pennsylvania, U.S. |

| Nationality | American |

| Alma mater | University of Pittsburgh (BA), Carnegie Mellon University (MSIA) |

| Occupation | Hedge fund manager |

| Employer | Appaloosa Management |

| Known for | Principal owner of the Carolina Panthers, Owner of Charlotte FC, President of Appaloosa Management |

| Net worth | US$13.0 billion (July 2020) |

About David Tepper

David Tepper, is one of the most renowned and legendary investors in the hedge fund business with a profile of impressive gains spanning across decades.

In 1985, Tepper worked at Goldman Sachs as a credit analyst. Within 6 months at the workplace, he became the Head Trader with his focus on bankruptcies and special situations. He remained at Goldman for eight years. He is also known as someone who has played a major role at Goldman after the Market crash in 1987.

He opened his own company Appaloosa Management in early 1993. He started the business with $57 million as working Capital. Within the first 6 months, Appaloosa delivered 57% returns and the asset value and fund grew to $300 million in 1994.

Talk to our investment specialist

In 1995, it grew to $450 million and in 1996 it was $800 million. In 2014, its assets under management exceeded $20 billion.

In 2009, New York Times named him as the top-earning hedge fund manager and in 2011, he was awarded the Institutional Hedge Fund Firm of the year. According to Forbes, in July 2020, David Tepper’s net worth stood at $13 billion.

David Tepper’s Top Investing Philosophy

1. Spot Opportunities

David Tepper once said that very few people have gotten rich on their seventh best idea, but a lot of people have gotten rich with their best idea. He encourages you to realise that the best idea can take you places. You only need to spot the right opportunity which is always around the corner.

Do your best to be updated with the market and do your research well to understand the best opportunity available for you. To become rich it is important to spot the opportunity and make the best use of your idea for investment.

2. Separate Emotions from Investment

David Tepper says that fearful environments affect the market. This tends to devalue the stock value. He encourages separating emotions from investments. When the price of the stock is low, the sale is high. When the sale increases, the stock is bound to go back up to its game in the market.

It is important to not mix emotions when it comes to investment and do refrain from making emotional decisions about investments.

3. Diversify Investments

He believes that only Investing in stocks is not enough. It is important to invest in various other Bonds, assets, etc. Tepper is well-known for investing in distressed debt and converting it into equity ownership. With equity ownership, which can help you gain certain rights with the investment and get the returns you desire.

4. Patience is the Key

David Tepper once said the key is to wait. Sometimes the hardest thing to do is to do nothing. When it comes to investing, people usually think that doing more than required will help in getting favourable returns. It is important to be an active investor but to be patient when it comes to investing in the market.

Conclusion

David Tepper is one of the most successful hedge fund managers and has given out some winning strategies for investing. If one thing you should take back from his tips, it would be to have patience when it comes to investment in the market. Don’t make emotional decisions and stay conscious regarding opportunities in the market.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.