Investor Protection Fund

investor protection Fund (IPF) is set up by Inter-connected Stock Exchange (ISE) in accordance with the guidelines issued by the Ministry of Finance for investor protection, in order to compensate the claims of investors against the members of exchanges (brokers) who have defaulted or failed to pay.

The investor can ask for the compensation if a member (broker) of the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE) or any other stock exchange fails to pay the due money for the investments made. The Stock Exchanges have put certain limits on the level of compensation paid to the investors. This limitation has been put according to the discussions and guidance with the IPF Trust. The limit allows that the money to paid as a compensation for a single claim shall not be less than INR 1 lakh - for the case major Stock Exchanges like BSE and NSE - and it should not be less INR 50,000 in case of other Stock Exchanges.

Establishment

The Exchange shall establish and maintain an Investors' Protection Fund to protect the interests of the clients of the trading members of the Exchange, who may have been declared defaulters or who may have been expelled, under theprovisions of the Rules, Bye-laws and Regulations of the Exchange.

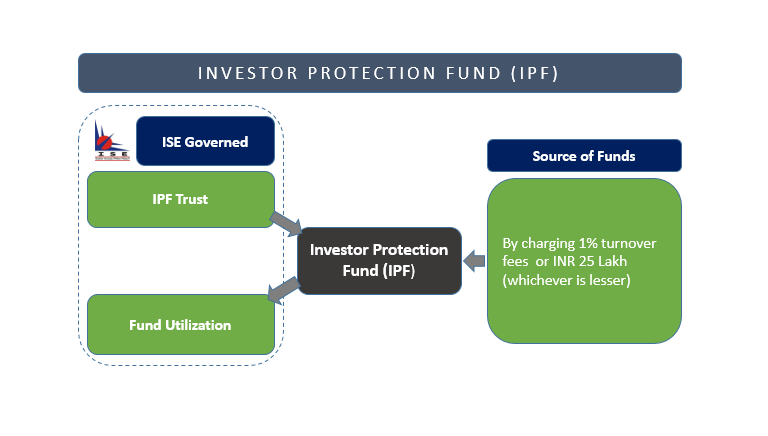

Structure of Investor Protection Fund (IPF)

Money in Investor Protection Fund (IPF) is collected by charging one percent turnover fee by the stock exchanges from the brokers or INR 25 lakh, whichever is less in the Fiscal Year. The stock exchanges follow the norms by SEBI to ensure that the funds in the IPF are well separated and are immune from any other liabilities. Apart from the settlement related penalties such as deliver Default fine, all the other fines charged and collected by the exchanges will be a part of the Investor Protection Fund (IPF).

A Trust is created for the administration of the Investor Protection Fund (IPF). Stock Exchange's MD and CEO along with a name suggested by the other Exchanges and approved by SEBI would be part of the administration panel.

The Trust of Investor Protection Fund (IPF) may opt for arbitration mechanism to decide the legitimacy of the claims received. The Trust might also ask the members of the Stock Exchange's default committee for advice to grant the payments to be made to the claimants. SEBI has allowed the exchanges the freedom to fix suitable compensation limits with proper consultation with the IPF trust.

Investor Guide to IPF

Here is the investor guide to IPF

- Only retail investor claims will be eligible for compensation from the Investor Protection Fund

- Claims against the default member (broker) in the given period of time will be eligible for compensation from the IPF

- IPF Trust will process claims that might arise within three years from the date of expiry of the given period of time at their discretion.

- Any claim registered after the three-year gap from the date of expiry and if not processed by the Investor Protection Fund Trust, then it will be dealt with as a civil dispute.

- The compensation given to the investors from the IPF should not exceed the maximum amount that is fixed for a single claim made by an investor.

- Only the interest earned on the IPF can be utilised by the board of exchanges and that too is subject to the approval of the IPF Trust.

Talk to our investment specialist

Compensation

The Investors’ Protection Fund may provide compensation against a genuine and bonafide claim made by any client, who has either not received the securities bought from a trading member for which the payment has been made by such client to the trading member thereagainst or has not received the payment for the securities sold and delivered to the trading member or has not received any amount or securities which is/are legitimately due to such client from the trading member, who is either declared a defaulter or expelled by the Exchange or where the trading member, through whom such client has dealt, is unable to get the securities rectified or replaced for the reason that the introducing trading member at the Exchange is either declared a defaulter or expelled by the Exchange, under the relevant Rules, Bye-laws and Regulations of the Exchange.

Corpus and Composition of the Fund

Every trading member of the Exchange shall contribute such amount, as may be determined by the Relevant Authority from time to time, to constitute the corpus of the Investors’ Protection Fund. The Relevant Authority shall have the power to Call for such additional contributions, as may be required from time to time to make up for any shortfall in the corpus of the Investors’ Protection Fund. The Exchange shall also credit to the Investors’ Protection Fund such amount out of the listing fees collected by it in each financial year, as may be prescribed by SEBI or as may be specified in the relevant Regulations from time to time. The Exchange may also augment the Investors' Protection Fund from such other sources, as it may deem fit.

Ceiling for Corpus

The Exchange or SEBI may from time to time determine the ceiling amount upto which the contribution from the trading members and contribution from the listing fees shall be collected and credited to the Investors’ Protection Fund. While determining the ceiling amount, the Relevant Authority may be guided by factors, which may, inter alia, include highest amount of compensation disbursed from the Investors’ Protection Fund in a financial year during the preceding five financial years, amount of interest accrued to the Fund in the previous financial year and the number of times the size of the corpus is a multiple of the highest aggregate amount of compensation disbursed from the Investors’ Protection Fund in any particular financial year. The Relevant Authority may, subject to taking prior approval of SEBI with proper justification, decide to reduce, and/or not to call for, any further contribution from the trading members and/or from listing fees.

Insurance Cover

The Relevant Authority may, at its absolute discretion, decide to have an insurance cover to protect the corpus of the Investors’ Protection Fund.

Management of the Fund

The Investors’ Protection Fund as above shall be held in trust and shall vest in the Exchange or any other entity or authority, as may be specified by the Relevant Authority from time to time. The Investors’ Protection Fund shall be managed by the Trustees appointed under the Trust Deed created and executed and in accordance with the provisions contained in the Trust Deed and the Rules, Bye-laws and Regulations of the Exchange.

Utilisation of the Fund

The Trustees of the Fund shall be guided by the recommendations of the Committee for Settlement of Claims Against Defaulters, who may scrutinize and vet each of the claims placed before them for consideration after due screening by the officials of the Exchange and also by an Independent Chartered Accountant, if need be, for satisfying that each claim meets the requirements, may be stipulated by the Committee for Settlement of Claims against Defaulters from time to time. The amount of compensation that may be disbursed out of the Investors Protection Fund to a client shall be limited to the balance amount of the admitted claim of the client as may be remaining after adjustment of the amount paid out of distribution of the assets vesting in the Committee for Settlement of Claims Against Defaulters on account of the concerned defaulter or expelled trading member. All claims received shall be processed and paid out of Fund as provided herein:

1. Genuine and Bonafide Claims

All genuine and bonafide claims, for which an order or trade is recorded on the ATS of the Exchange, may be eligible for consideration irrespective of whether the claimant produces a copy of contract note as proof or otherwise.

2. Proof of Payment or Delivery

No claim shall be entertained unless such a claim is supported with necessary and sufficient proof of payment or delivery of securities to the trading member who is declared a defaulter or expelled, either directly or through a sub-broker.

3. Eligible Claims

All claims, which meet the requirements of Bye-laws as mentioned above, will be eligible for consideration by the Exchange.

4. Claims on Merits Without Precedent

Any claim which does not meet both the requirements of Bye-laws above above shall be placed before the Committee for Settlement of Claims Against Defaulters for scrutiny and the said Committee may consider each case on its merit, and a decision on any case made on the Basis of the merits of the case shall not constitute or be quoted as a precedent in any other case.

5. Claims Entertained Only If Executed on the ATS

While considering a claim referred to under Bye-law above above, the Committee for Settlement of Claims Against Defaulters may direct payment of such claim, which, in the opinion of the Committee, is made by an investor and the claim has direct relevance to such transactions executed on the ATS of the Exchange.

6. Actual Loss, Damages, Interest, Notional Loss Excluded

A claim will be eligible for payment to the extent of the actual loss suffered by an investor and the actual loss would include any difference receivable by the claimant arising out of the transactions. No claim shall include any claim for damages or interest or notional loss.

7. Other Documentary Evidence

In case of a claim which does not fall under Bye-laws above, the Relevant Authority may require the claimant/s to produce necessary documentary or other evidence in regard to the following issues, to be placed before the Committee for Settlement of Claims Against Defaulters, substantiating that

- the actual amount paid and/or securities delivered was/ were towards a trade on the Exchange and not towards a deposit, loan or otherwise;

- the claimant had regular transactions through the defaulter or expelled member, in the ordinary course of business, for a reasonable period of time and that the claimant is in a position to substantiate this by a copy of the accounts, proof of payment of money or delivery of securities, contract notes, order execution details, or such other relevant material available, and

- the claimant had initiated actions, including lodging of a complaint with the Exchange, if the claim related to an act or omission in the execution of the instructions or orders of the claimant by a trading member who is declared a defaulter or expelled.

8. Certain Claims not to be Entertained

The Committee for Settlement of Claims Against Defaulters shall not entertain any claim against a defaulter / expelled trading member, where the trading membership ceases to exist attributable to the action taken by the Exchange i.e. other than surrender of trading membership

- which arises out of a contract in securities, dealings in which are not permitted or which are not made subject to, and/or under the Rules, Bye-laws and Regulations of the Exchange, or the claimant has either not paid the amount due or delivered the securities in respect of obligations or colluded with the defaulter / expelled trading member in the evasion of margin payable on the transactions in any security;

- which arises from the transactions not settled by delivery and payment within the time prescribed by these Bye-laws and Regulations;

- which arises from any arrangement for settlement of claims in lieu of bonafide money payment in full on the day when such claims become due;

- which arises from any outstanding balance or any outstanding difference in respect of previous transactions which have not been claimed at the proper time and in the manner prescribed in these Bye-laws and Regulations;

- which is in respect of a loan with or without security;

- which is not filed with the Exchange/Committee for Settlement of Claims Against Defaulters within such time, as may be prescribed by the Governing Board or in the relevant Regulations from time to time

- which arises out of an arbitration award as provided in Bye-law

- which arises out of an arbitration award as provided in Bye-law

more details can be found here Chapter 16 Investor Protection Fund By SEBI

Undertaking by a Client Making a Claim

Any client desirous of making a claim under these Bye-laws shall be required to sign and submit an undertaking to the Exchange while submitting a claim to the effect that the decision of the Relevant Authority shall be final and binding on him.

Investor Education and Protection Fund (IEPF)

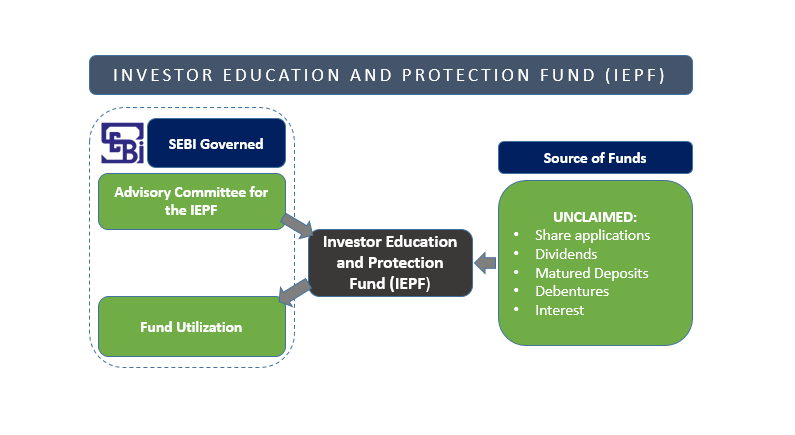

The Government of India has established a fund called Investor Education and Protection Fund (IEPF) for investors. Under this fund, all the share applications money, dividends, matured deposits, interest, Debentures, etc. that are unclaimed for over seven years are pooled together. Investors who failed to collect their dividends or interests etc. can now seek a refund from IEPF.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Satisfactoru

Well explained, keep it up