Investor Protection Measures by SEBI

Investors are the pillar of the financial and securities Market. They determine the level of activity in the market. They put the money in funds, stocks, etc. to help grow the market and thus, the Economy. It thus very important to protect the interests of the investors. investor protection involves various measures established to protect the interests of investors from malpractices. Securities and Exchange Board of India (SEBI) is responsible for regulations of the Mutual Funds and safeguard the interests of the investors. Investor protection measures by SEBI are in place to safeguard the investors from the malpractices in shares, the stock market, Mutual Fund, etc.

What is Investor Protection?

The investor insurance money is a symbol of assurance. In simpler words investor protection implies that up to a specific breaking point, you get your cash back if the dealer goes into Bankruptcy or submits extortion. It is a significant Factor to consider when you open a Trading Account or a record with an online dealer. At the point when you open an exchanging account at a brokerage, you normally get financial backer security.

What is SEBI?

The Securities and Exchange Board of India is a legal administrative body set up on the 12th of April, 1992. The main purpose of SEBI is to manage and regulate the securities and commodity market of India while forming guidelines and rules. The administrative center of SEBI is in Bandra Kurla Complex, Mumbai.

SEBI has a corporate structure involving different divisions, each oversaw by an office head. There are about 20+ divisions. A portion of these offices are company account, financial and strategy investigation, Obligation and mixture protections, authorization, HR, speculation about the executives, product subsidiaries market guideline, legitimate issues, etc.

What are the functions of SEBI?

SEBI is basically set up to ensure the interests of financial backers in the protections market.

- It advances the improvement of the protections market and controls the business.

- SEBI gives a stage to stockbrokers, sub-dealers, Portfolio chiefs, speculation consultants, share market specialists, brokers, trader financiers, trustees of trust deeds, recorders, guarantors, and other related individuals to enlist and manage work.

- It controls the activities of safes, members, caretakers of protections, unfamiliar portfolio financial backers, and FICO assessment organizations.

- It blocks internal trade securities, for instance fake and preposterous trade practices related to the insurance market. It prevents inward exchanges protections like Fake and unreasonable exchange transactions identified within the market.

- It guarantees that financial backers are instructed on the mediators of protections markets.

- It screens considerable acquisitions and take-over of organizations.

- SEBI deals with innovative work to guarantee the protections market is proficient consistently

The Role of SEBI in Investor Protection

SEBI has given out various methods and measures to ensure the investor protection from time to time. It has published various directives, driven many investor awareness programmes, set up investor protection Fund (IPF) to compensate the investors. We will look into the investor protection measures by SEBI in detail:

To begin with, SEBI constructs the limit of financial backers through instruction and attention to empower a financial backer to take educated choices. SEBI tries to guarantee that the financial backer gets the hang of contributing. In simpler words, SEBI ensures that the investor gets and utilizes data needed for contributing and assesses different speculation alternatives to suit his particular objectives.

It helps the investor find out his privileges and commitments in a specific venture, bargains through enlisted mediators, plays it safe, looks for help if there should be an occurrence of any complaint, and so on.

SEBI has been putting together financial backer schooling and mindfulness workshops through financial backer affiliations and market members, and has been urging market members to sort out comparable projects.

It keeps a refreshed, far reaching site for training of financial backers. It distributes different sorts of alerts through media. It reacts to the questions of financial backers through phone, messages, letters, and face to face for the individuals who visit SEBI office.

Talk to our investment specialist

Secondly, SEBI makes everything of interest accessible in public domain. SEBI has received revelation based administrative system. Under this structure, backers and go-betweens unveil applicable insights concerning themselves, the items, the market and the guidelines so the financial backer can take educated venture choices dependent on such divulgences. SEBI has endorsed and screens different introductory and persistent exposures.

Thirdly, SEBI guarantees that the market has frameworks and practices which make exchanges safe. SEBI has taken different estimates, for example, screen based exchanging framework, dematerialization of protections and outlined different guidelines to direct delegates. It has also issued an exchange of protections, corporate rebuilding, etc. to ensure the interests of financial backers in protections. It additionally guarantees that only legitimate people are permitted to work on the lookout, each member has motivation to agree with the recommended principles, and the defaulters are granted praiseworthy discipline.

Lastly, SEBI encourages a redressal of financial backer complaints. SEBI has a far-reaching system to encourage redressal of financial backer complaints against middle people and recorded organizations. It circles back to the organizations and middle people who don't change financial backers' complaints, by sending suggestions to them and having gatherings with them. It makes proper implementation moves as given under the law (counting dispatch of settling, indictment procedures, bearings) where progress in redressal of financial backer complaints isn't good. It has set up a complete mediation instrument in stock trades and vaults for goal debates of the financial backers. The stock trades have financial backer security assets to remunerate financial backers when a dealer is pronounced a defaulter. Store repays financial backers for misfortune because of carelessness of storehouse or safe member.

Investor Protection Measures by SEBI

Investor protection legislation is implemented under the Section 11(2) of the SEBI Act. The measures are as follows:

- Stock Exchange and other securities market business regulation.

- Registering and regulating the intermediaries of the business like brokers, transfer agents, bankers, trustees, registrars, portfolio managers, investment consultants, merchant bankers, etc.

- Recording and monitoring the work of custodians, depositors, participants, foreign investors, credit rating agencies, etc.

- Registering investment schemes like Mutual fund & venture Capital funds, and regulating their functioning.

- Promotion and controlling of self-regulatory companies.

- Keeping a check on frauds and unfair trading methods related to the securities market.

- Observing and regulating major transactions and take-over of the companies.

- Carry out investor awareness and education programme.

- Train the intermediaries of the business.

- Inspecting and auditing the security exchanges (SEs) and intermediaries.

- Assessment of fees and other charges.

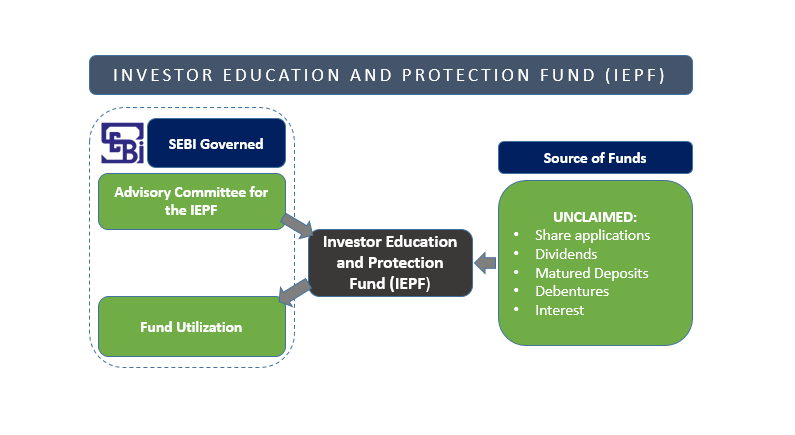

Investor Education and Protection Fund(IEPF)

Investor protection measures by SEBI also includes the Government of India established a fund called, Investor Education and Protection Fund(IEPF) under the 1956 Company Act. According to the act, the company which has completed seven years in the business should hand over all the unclaimed fund dividends, matured deposits, and Debentures, share application money etc. to the Government through IEPF.

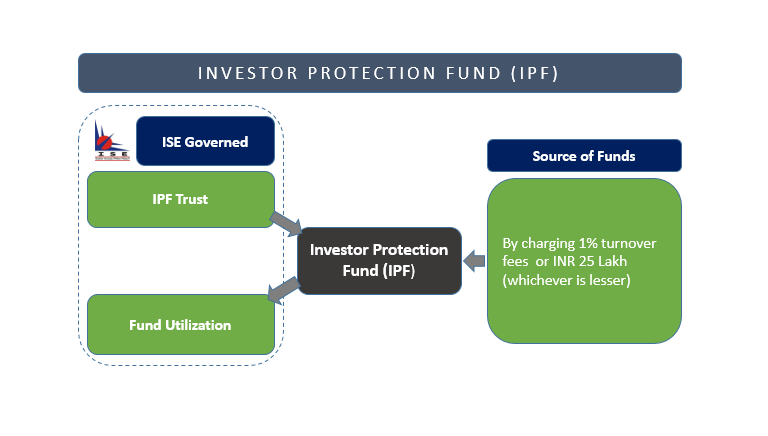

Investor Protection Fund

investor protection Fund (IPF) is set up by Inter-connected Stock Exchange (ISE) in accordance with the guidelines issued by the Ministry of Finance for investor protection, in order to compensate the claims of investors against the members of exchanges (brokers) who have defaulted or failed to pay. The investor can ask for the compensation if a member (broker) of the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE) or any other stock exchange fails to pay the due money for the investments made. The Stock Exchanges have put certain limits on the level of compensation paid to the investors. This limitation has been put according to the discussions and guidance with the IPF Trust. The limit allows that the money to paid as a compensation for a single claim shall not be less than INR 1 lakh - for the case major Stock Exchanges like BSE and NSE - and it should not be less INR 50,000 in case of other Stock Exchanges.

Investor Awareness Programme

Investor protection measures by SEBI follows the slogan ‘An informed investor is a safe investor’. SEBI has thus launched the Securities Market Awareness Campaign in January 2003. Such programmes are now regularly organised by SEBI to educate and create awareness among the investors. The programme covers major subjects like portfolio management, Mutual Funds, tax provisions, Investor Protection Fund, Investors’ Grievance Redressal system of SEBI. It also conducts workshops on derivatives, stock exchange trade, Sensex, etc. SEBI has now conducted over 2000 workshops in more than 500 cities across the country. SEBI has marketed the Investor Awareness Programme across all formats like print media, radio, television, and the internet.

Simplification of Share Transfer and Allotment Procedure

SEBI named a board under the chairmanship of Shri R Chandrasekaran, Managing Director of the Stock Holding Corporation of India Limited, to propose a methodology for speeding up and working on share move and allocation. The board of trustees has presented its draft report which has been flowed to different market go-betweens for their remarks. In view of the criticism, the report will be concluded and vital move will be made to carry out the suggestions. It is normal that execution of the proposals of this panel would impressively facilitate the troubles looked by financial backers by virtue of unreasonable deferrals in share moves and awful conveyances.

Unique Order Code Number

All stock trades have been needed to guarantee that a framework is set up whereby every exchange is allotted a remarkable request code number which is hinted by the merchant to his customer. When the request is executed, this number is to be imprinted on the agreement note, which ensure accuracy and confidentiality.

Time Stamping of Contracts

Stock specialists have been asked to keep a record of time when the customer has submitted the request and mirror something similar in the agreement note alongside the hour of the execution of the request. This is to ensure that the merchant gives due inclination in execution of customer's structure and charges the right cost to his customer without exploiting any intra-day value vacillation for himself.

The Role of AMFI

Association of Mutual Funds in India (AMFI) was set up on August 22, 1995, is the association of SEBI registered Mutual Funds in India. It was set up to regulate all those who sell Mutual Fund in India. AMFI registration is required to solicit the Mutual Funds and it regulates the members of the association in order to protect the investor from any kind of misselling or unfair investment practices.

Conclusion

Investor protection is among the most talked topics in the securities market. Safeguarding investor interests is one of the top priorities of the regulatory bodies. It is evident that SEBI has put out some hard measures to ensure investor protection. The guidelines and measures are formed to make sure that every aspect of the investor interest in secured. But there is a lot of work to be done yet. The investor awareness programme has certainly helped and will continue to do so. These measures are just the direction for a clean and transparent transaction. It is for issuers and investors to follow the guidelines to really secure the securities market.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

MUTUAL FUND takes public money in different name ,but, it seems they work out almost 90% of the funds paying less than 6% ROI. There should be a minimum norm fixed ,like whaqtever is the performance ,to pay min. interest and / or otherwise the fund

Okay. It was helpful up to some extent.