Table of Contents

Investor Education and Protection Fund - IEPF

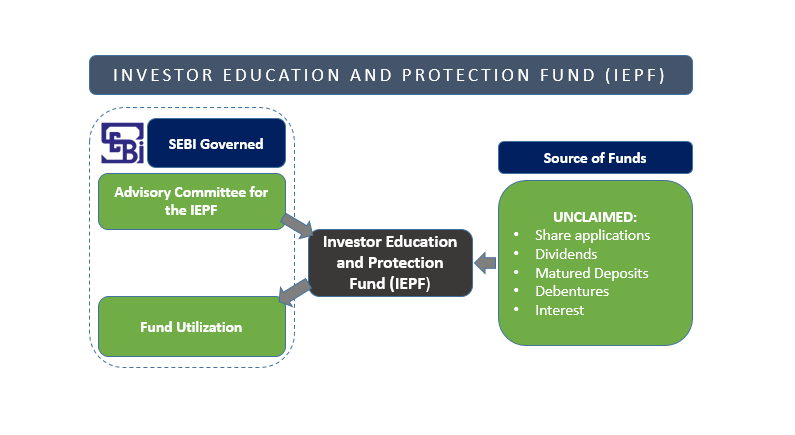

investor education and protection fund or IEPF is a fund set up under the Section 205C of the Companies Act, 1956 to pool all the dividends of the Asset Management Companies, matured deposits, share application interests or money, Debentures, interests, etc. that are unclaimed for seven years. All the money collected from the mentioned sources has to be transferred to IEPF. Investors, who are trying to seek a refund for their unclaimed rewards can now do so from the Investor Protection and Education Fund (IEPF). The fund has been set up under the guidance of SEBI and Ministry of Corporate Affairs India.

Role of Ministry of Corporate Affairs

As mentioned above, the Ministry of Corporate Affairs was responsible for setting up of IEPF. But, in 2016, the Ministry of Corporate Affairs notified IEPF to allow investors to seek a refund on their unclaimed rewards. For claiming such amount, they have to fill the IEPF-5 along with the required documents of the website of the IEPF.

The dividends or corporate benefits that are unclaimed for seven years are pooled into the fund. But previously, there was no provision for the claims of genuine investors. This issue was brought up and legally fought for over a decade and a half. This has finally resulted in a decision in favour of genuine investors.

Objectives of Investor Education and Protection Fund (IEPF)

- Educating investors about how the Market operates.

- Making investors educated enough so that they can analyse and take informed decisions.

- Educating investors about the Volatility of the markets.

- Making investors realise their rights and various laws about Investing.

- Promoting research and surveys to spread knowledge among the investors

Talk to our investment specialist

Administration

The Central Government has specified a committee with such members for administration of the fund. Pursuant to Section 205C (4) read with Rule 7 of the IEPF Rules 2001, the Central Government has constituted a Committee vide Notification No. S.O. 539(E) dated 25.02.2009. The Secretary, Ministry of Corporate Affairs is the Chairman of the Committee. The members are representatives of Reserve Bank of India, Securities Exchange Board of India and experts from the field of investors’ education and protection. The non-official members of the Committee hold office for a period of two years. The official members hold office for a period of two years or until they occupy their position, whichever is earlier. The committee has an authority under sub section 4 to spend money out of the fund for carrying the object which the fund has been established. The Registrar of Companies have an duty to furnish as abstract of receipts and shall reconcile them the amount so remitted and collected with concern pay and account officer. MCA maintain a consolidated abstract of Receipt and shall reconcile with principal pay and account officer of MCA. The following amounts shall be part of IEPF, if they remain unpaid for a period of seven years from the date of declaration except point (f) and (g)

- amounts in the unpaid dividend accounts of companies;

- the application moneys received by companies for allotment of any securities and due for refund;

- matured deposits with companies;

- matured debentures with companies

- the interest accrued on the amounts referred to in clauses (a) to (d);

- grants and donations given to the Fund by the Central Government, State Governments, companies or any other institutions for the purposes of the Fund; and

- the interest or other Income received out of the investments made from the Fund

As per secretarial standard 3 of ICSI, the company should give individual intimation to the members in respect of whose unclaimed amount being transfer at least six month before due date amount. Also, the Company should be mentioned amount unpaid and proposed date of transfer to IEPF in Annual Report of the Company.

Function of the committee

- To recommend the Investor Education and Protection activities like seminars, symposium, proposal for registration of voluntary association or institution engaged in Investor Education and Protection projects.

- Proposals for registration of Voluntary Associations or Institution or other Organizations engaged in Investor Education and Protection activities;

- Proposals for projects for Investors’ Education and Protection including research activities and proposals for financing such projects;

- Co-ordination with institution engaged in Investor Education and awareness and profession activities.

- To appoint one or more sub committee for functioning of fund in good manner

- To furnish report to central government at end of each six months

Registration

The committee may register from time to time various association or organization engaged in activities relating to Investor Education, Protection and proposing for investor programme, seminars, undertaking projects for investors interactions including research.

- Any voluntary organization or association engaged in the activities relating to investors awareness, education and protection and proposing investors programmes, organizing seminars; symposium and undertaking projects for investor protection including research activities can register itself under IEPF through form 3

- The committee finance upto five of total budget of Investor Education and Protection Fund subject to maximum 80%

- The entity may register in Society Registration Act, Trust Act or Companies Act 1956.

- For proposal, it is required two years experienced organization have a minimum 20 member and a proven record of at least two years.

- No profit making entity shall eligible for registration for the purpose of financial assistance.

- The committee considered audited account, annual report for last three years of entity seeking assistance.

Guidelines for funding of research proposals

Application for funding of research projects.

- A 2000-word outline of the research program that is being proposed indicating therein also a rationale of why the same fits in with the goals of IEPF

- Detailed resume of all the researchers who shall be associated with the project.

- Three best recent published/unpublished papers of the researchers.

- Letters of commitment by researchers promising that they will put in at least 50% of their time for the proposed project from the stated starting date to the stated ending date.

Procedure for financial assistance

- Entities that fulfill the criteria/guidelines for the purpose of financial assistance from IEPF may apply to the IEPF for such assistance in Form 4.

- The feasibility of the project, quantum of financial assistance, genuineness of the organization, etc. is then evaluated by the Sub Committee of IEPF in its meetings held in regular intervals

- After the Sub -Committee approves the proposal, IEPF issues the financial sanction with the approval of Internal Finance Wing of the Ministry of Corporate Affairs.

- The amount is then released to the organization, but only after it submits a pre-defined bond and a pre-receipt to IEPF. After the project is completed, the organization is required to submit the funds utilization certificate and copies of the bills etc. to IEPF for scrutiny.

Refund from IEPF

Here's how you can claim a refund for your unclaimed investment returns from the Investor Education and Protection Fund -

- Fill the IEPF 5 form online on the website along with the fees as per the decided by the Authority and send it to the company along required documents. This is done for the verification of the claim

- The company is obliged to send the verification report of the claim received to the fund authority in the pre-decided format along with all the documents submitted. This process should be completed within 15 days of receiving the claim.

- For a monetary refund, IEPF initiates e-payment as per the rules.

- If shares are reclaimed, the shares will be credited to the claimant's Demat account by the Investor Education and Protection Fund

Investor Protection In India

SEBI has given out Investor protection measures in order to safeguard interests of the investors. These measures are to be followed by the investors in order to save themselves from any misconduct and other investment frauds. Investor Education and Protection Fund (IEPF) is a part of the investor protection measures by SEBI.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.