FD കാൽക്കുലേറ്റർ - ഫിക്സഡ് ഡെപ്പോസിറ്റ് കാൽക്കുലേറ്റർ

നിക്ഷേപകരെ സഹായിക്കുന്ന ദീർഘകാല നിക്ഷേപ ഉപകരണമാണ് ഫിക്സഡ് ഡിപ്പോസിറ്റുകൾപണം ലാഭിക്കുക ദീർഘകാലത്തേക്ക്. നിക്ഷേപകർക്ക് ഒരു നിശ്ചിത കാലാവധി തിരഞ്ഞെടുക്കാം, അതിനായി നിക്ഷേപം സൂക്ഷിക്കുംബാങ്ക്. പൊതുവായി,FD സേവിംഗ്സ് അക്കൗണ്ടുകളെ അപേക്ഷിച്ച് ഉയർന്ന പലിശനിരക്ക് വാഗ്ദാനം ചെയ്യുന്നതിനാൽ ദീർഘകാല സമ്പത്ത് സൃഷ്ടിക്കാൻ ആഗ്രഹിക്കുന്നവർക്ക് നിക്ഷേപം നല്ലതാണ്.

എങ്ങനെയാണ് FD പലിശ കണക്കാക്കുന്നത്?

മിക്ക ബാങ്കുകളിലും FD യുടെ പലിശ ത്രൈമാസികമായി കൂട്ടുന്നു. ഇതിനുള്ള ഫോർമുല ഇതാണ്:

A = P * (1+ r/n) ^ n*t , എവിടെ

- ഐ = എ - പി

- എ = മെച്യൂരിറ്റി മൂല്യം

- പി = പ്രധാന തുക

- ആർ = പലിശ നിരക്ക്

- ടി = വർഷങ്ങളുടെ എണ്ണം

- എൻ = സംയുക്ത പലിശ ആവൃത്തി

- ഐ = പലിശ സമ്പാദിച്ച തുക

FD യുടെ പ്രയോജനങ്ങൾ

- FD ആയി ഉപയോഗിക്കാംകൊളാറ്ററൽ വായ്പ എടുക്കുന്നതിന്. നിങ്ങളുടെ FD തുകയിൽ നിങ്ങൾക്ക് 80-90% വരെ ലോണുകൾ എടുക്കാം

- കൂടുതൽ സ്ഥിര നിക്ഷേപത്തിനായി കാലാവധി പൂർത്തിയാകുമ്പോൾ തുക കൈമാറാൻ നിക്ഷേപകന് തിരഞ്ഞെടുക്കാം.

- ഒരു തവണ മാത്രമേ പണം നിക്ഷേപിക്കാൻ കഴിയൂ. നിക്ഷേപിച്ചുകഴിഞ്ഞാൽ, അക്കൗണ്ടിൽ നിന്ന് പണം പിൻവലിച്ചാൽ പിഴ ഈടാക്കും.

- FD സ്കീമുകൾ മിച്ച ഫണ്ടുള്ളവർക്കും അതിൽ നിന്ന് പണം സമ്പാദിക്കാൻ ആഗ്രഹിക്കുന്നവർക്കും നല്ലൊരു നിക്ഷേപ ടൂളാണ്.

Investment Amount:₹100,000 Interest Earned:₹28,930.22 Maturity Amount: ₹128,930.22ഫിക്സഡ് ഡിപ്പോസിറ്റ് (എഫ്ഡി) കാൽക്കുലേറ്റർ

Talk to our investment specialist

FD-യിലെ നികുതി ആനുകൂല്യങ്ങൾ

മറ്റ് വ്യക്തിഗത നികുതി ലാഭിക്കൽ, നിക്ഷേപ ഉപകരണങ്ങൾ എന്നിവയ്ക്ക് സമാനമായി, സ്ഥിര നിക്ഷേപ പദ്ധതികളും ആകർഷിക്കുന്നുനികുതികൾ. മൊത്തം പലിശ 1000 രൂപയിൽ കൂടുതലാണെങ്കിൽ, FD-യിൽ നിന്ന് ലഭിക്കുന്ന റിട്ടേണുകളിൽ 10% TDS കുറയ്ക്കും. 10,000 ഒരു സാമ്പത്തിക വർഷത്തിൽ.

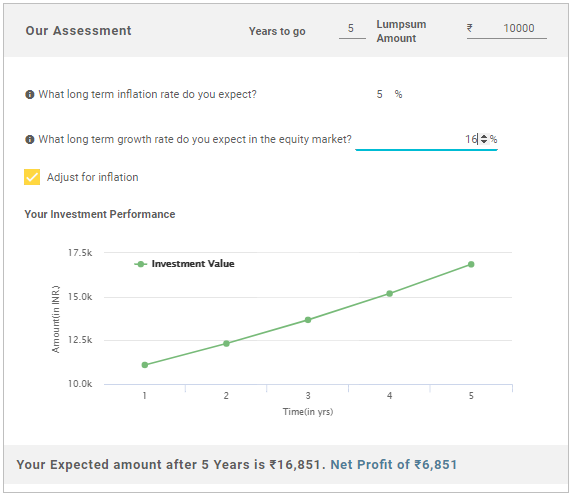

ഇതുമായി താരതമ്യം ചെയ്യാംഎസ്.ഐ.പി സ്കീമും SIP-കൾ ദീർഘകാലത്തേക്ക് കൂടുതൽ പ്രയോജനകരമാണെന്ന് നിങ്ങൾക്ക് കാണാൻ കഴിയും. ഇക്വിറ്റിയിൽ നിന്നുള്ള ദീർഘകാല നേട്ടങ്ങൾ നികുതി രഹിതമായതിനാൽ, നിക്ഷേപിക്കുന്ന ഏതൊരു എസ്ഐപിയുംELSS (ഇക്വിറ്റി ലിങ്ക്ഡ്മ്യൂച്വൽ ഫണ്ടുകൾ) ഒരു വർഷത്തിനു ശേഷം നികുതി രഹിതവുമാണ്.

*കഴിഞ്ഞ 1 വർഷത്തെ പ്രകടനത്തെയും ഫണ്ടിന്റെ പ്രായം > 1 വർഷത്തെയും അടിസ്ഥാനമാക്കിയുള്ള ഫണ്ടിന്റെ ലിസ്റ്റ് ചുവടെയുണ്ട്.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹51.4804

↑ 1.81 ₹1,498 500 27.4 70 132.4 47.2 22.4 15.9 DSP World Mining Fund Growth ₹25.6059

↑ 0.68 ₹169 500 22.4 49.7 56.1 15.1 16.3 -8.1 Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Growth ₹20.9126

↑ 0.07 ₹164 1,000 10 24 36.7 15.4 4.4 5.9 Invesco India Feeder- Invesco Pan European Equity Fund Growth ₹22.1111

↑ 0.23 ₹103 500 9 14.1 36.1 17.1 14.5 -5.1 DSP World Energy Fund Growth ₹23.6259

↑ 0.25 ₹109 500 13 26.8 33.7 12.3 11.4 -6.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Dec 25 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund DSP World Mining Fund Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Invesco India Feeder- Invesco Pan European Equity Fund DSP World Energy Fund Point 1 Highest AUM (₹1,498 Cr). Upper mid AUM (₹169 Cr). Lower mid AUM (₹164 Cr). Bottom quartile AUM (₹103 Cr). Bottom quartile AUM (₹109 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (15+ yrs). Established history (11+ yrs). Established history (11+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 2★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 22.41% (top quartile). 5Y return: 16.35% (upper mid). 5Y return: 4.36% (bottom quartile). 5Y return: 14.53% (lower mid). 5Y return: 11.37% (bottom quartile). Point 6 3Y return: 47.19% (top quartile). 3Y return: 15.06% (bottom quartile). 3Y return: 15.40% (lower mid). 3Y return: 17.06% (upper mid). 3Y return: 12.30% (bottom quartile). Point 7 1Y return: 132.38% (top quartile). 1Y return: 56.12% (upper mid). 1Y return: 36.69% (lower mid). 1Y return: 36.10% (bottom quartile). 1Y return: 33.68% (bottom quartile). Point 8 Alpha: -4.16 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 1.28 (top quartile). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 1.83 (upper mid). Sharpe: 1.28 (bottom quartile). Sharpe: 2.24 (top quartile). Sharpe: 1.57 (lower mid). Sharpe: 1.17 (bottom quartile). Point 10 Information ratio: -1.04 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.93 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). DSP World Gold Fund

DSP World Mining Fund

Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Invesco India Feeder- Invesco Pan European Equity Fund

DSP World Energy Fund

2022-ലെ മികച്ച ഫണ്ടുകൾ

*1 വർഷത്തെ പ്രകടനത്തെ അടിസ്ഥാനമാക്കിയുള്ള മികച്ച ഫണ്ടുകൾ.

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may

constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. Research Highlights for DSP World Mining Fund Below is the key information for DSP World Mining Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (11 Dec 25) ₹51.4804 ↑ 1.81 (3.64 %) Net Assets (Cr) ₹1,498 on 31 Oct 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 1.83 Information Ratio -1.04 Alpha Ratio -4.16 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹9,903 30 Nov 22 ₹8,659 30 Nov 23 ₹9,599 30 Nov 24 ₹12,026 30 Nov 25 ₹27,573 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Dec 25 Duration Returns 1 Month 14% 3 Month 27.4% 6 Month 70% 1 Year 132.4% 3 Year 47.2% 5 Year 22.4% 10 Year 15 Year Since launch 9.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 15.9% 2023 7% 2022 -7.7% 2021 -9% 2020 31.4% 2019 35.1% 2018 -10.7% 2017 -4% 2016 52.7% 2015 -18.5% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.68 Yr. Data below for DSP World Gold Fund as on 31 Oct 25

Equity Sector Allocation

Sector Value Basic Materials 95.15% Asset Allocation

Asset Class Value Cash 2.29% Equity 95.15% Debt 0.02% Other 2.54% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -75% ₹1,127 Cr 1,347,933

↓ -108,097 VanEck Gold Miners ETF

- | GDX24% ₹367 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹23 Cr Net Receivables/Payables

Net Current Assets | -1% -₹20 Cr 2. DSP World Mining Fund

DSP World Mining Fund

Growth Launch Date 29 Dec 09 NAV (11 Dec 25) ₹25.6059 ↑ 0.68 (2.73 %) Net Assets (Cr) ₹169 on 31 Oct 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.14 Sharpe Ratio 1.28 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Nov 20 ₹10,000 30 Nov 21 ₹12,339 30 Nov 22 ₹14,572 30 Nov 23 ₹13,637 30 Nov 24 ₹14,706 30 Nov 25 ₹21,988 Returns for DSP World Mining Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Dec 25 Duration Returns 1 Month 10% 3 Month 22.4% 6 Month 49.7% 1 Year 56.1% 3 Year 15.1% 5 Year 16.3% 10 Year 15 Year Since launch 6.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 -8.1% 2023 0% 2022 12.2% 2021 18% 2020 34.9% 2019 21.5% 2018 -9.4% 2017 21.1% 2016 49.7% 2015 -36% Fund Manager information for DSP World Mining Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.68 Yr. Data below for DSP World Mining Fund as on 31 Oct 25

Equity Sector Allocation

Sector Value Basic Materials 96.18% Energy 1.1% Asset Allocation

Asset Class Value Cash 2.35% Equity 97.28% Debt 0.01% Other 0.36% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Mining I2

Investment Fund | -99% ₹167 Cr 193,620

↓ -1,404 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -1% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr

ഇവിടെ നൽകിയിരിക്കുന്ന വിവരങ്ങൾ കൃത്യമാണെന്ന് ഉറപ്പാക്കാൻ എല്ലാ ശ്രമങ്ങളും നടത്തിയിട്ടുണ്ട്. എന്നിരുന്നാലും, ഡാറ്റയുടെ കൃത്യത സംബന്ധിച്ച് യാതൊരു ഉറപ്പും നൽകുന്നില്ല. എന്തെങ്കിലും നിക്ഷേപം നടത്തുന്നതിന് മുമ്പ് സ്കീം വിവര രേഖ ഉപയോഗിച്ച് പരിശോധിക്കുക.

Research Highlights for DSP World Gold Fund