Table of Contents

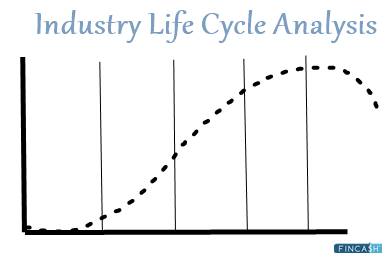

What is an Industry Life Cycle Analysis?

Industry life cycle analysis is a component of the basic analysis of a company that involves the examination of the stage in which the industry is at any given time. An industry's life cycle relates to its growth, consolidation, and ultimate downfall.

It is similar to an Economic Cycle which has four major stages: expansion, peak, contraction, and trough, all of which occur at different times. It is used to evaluate a firm's stock based on where it is in its life cycle at the time of evaluation.

The size of the Market and the length of time are two aspects that can be considered for the life cycle analysis of an industry.

Industry Life Cycle Stages

The life cycle of a given industry may not always match the general economic process. In addition, an industry's life cycle can differ from the phases of an economic cycle in terms of growth, contraction percentages or duration of peak and trough stages, and it can lead or lag an economic cycle.

Every industry goes through development stages which are discussed in detail below.

1. Expansion Stage

An industry will enjoy revenue and profit growth during an expansion phase in open and competitive markets, attracting more competitors to match the increasing demand for the industry's goods or services.

2. Peak Stage

It's at this point in the cycle when growth stops. Demand has been met, and the current Economic Conditions don't encourage more purchases—profits in the industry level off.

3. Contraction Stage

During the contraction phase of the life cycle, Earnings begin to decline as current period sales fall short of preceding period sales. The contraction phase could be associated with an economic downturn or just reflect the industry's depleted short-term demand. Production capacity adjustments occur during this phase, in which marginal players are weeded out, and more vital enterprises reduce their output.

4. Trough Stage

The trough phase of the industry's life cycle was brought on by this adjustment process, which was accompanied by a firming of the Economy in employment and personal Income levels and the consumer confidence index. At this phase, the output capacity meets the industry's lower demand levels.

As the economy gains momentum, the industrial life cycle begins with the expansion phase, which lasts for a time. As stated earlier, an industry's life cycle is usually linked to the economy. An example is the recreational and entertainment sector. On the other hand, the technology industry comprises demonstrated life cycle movements that diverge from the economic cycle. This industry's earnings have increased even when there has been little Economic Growth.

Talk to our investment specialist

Use of Industry Life Cycle Analysis

Analysts and traders typically use industry life cycle analysis to determine the relative strength and weakness of a given company's stock. The future growth prospects may be favourable or unfavourable depending on where it is in the industry's life cycle.

As the industry evolves, the economic forces that drive it to alter. For example, during the growth stage of the industry, the level of competition between enterprises is at its highest. Price reductions and accelerated shipping are common practices among startups to attract as many clients as possible.

New competitors may threaten an existing firm's market share during this period. The situation shifts as the mature stage progresses. Startups with low competition and substandard products are weeded out or purchased.

The risk of newcomers is low, and the industry's product is old enough to be accepted by most people. During this stage, startups become established businesses, but their future growth prospects are limited in terms of expanding into new areas. They must seek out new business opportunities and markets, or else they risk extinction.

Conclusion

The life cycle analysis is an important and well-known way for managers to understand better how sales grow and change over time. The rise of an industry's revenues over time is used to chart the industry's life cycle. Industrial Life Analysis helps the business manage risks to get more work

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.