Table of Contents

CAGR कॅल्क्युलेटर

CAGR म्हणजे काय?

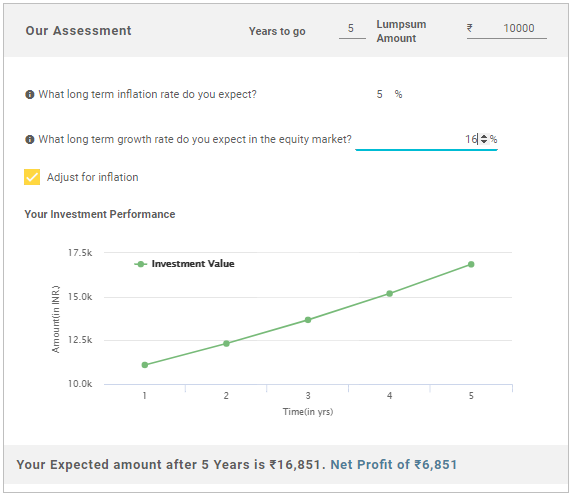

CAGR विशिष्ट कालावधीत गुंतवणुकीच्या सरासरी वार्षिक वाढीचा संदर्भ देते. असे गृहीत धरले जाते की गुंतवणुकीचे मूल्य कालावधीत चक्रवाढ होते. विपरीतनिरपेक्ष परतावा, CAGR घेतेपैशाचे वेळेचे मूल्य खात्यात परिणामी, ते एका वर्षात व्युत्पन्न केलेल्या गुंतवणुकीचे खरे उत्पन्न प्रतिबिंबित करण्यास सक्षम आहे.

CAGR (Compound Annual Growth Rate) 20.11% CAGR Calculator

सीएजीआर कॅल्क्युलेटर कसे वापरावे

तुम्ही सीएजीआर कॅल्क्युलेटर कुठे वापरू शकता सीएजीआर हे तुमच्या गुंतवणुकीच्या निर्णयांचे विश्लेषण करण्यासाठी वापरण्यास सोपे साधन आहे. हे खालील परिस्थितींमध्ये अनुप्रयोग शोधते:

- मध्ये तुम्ही काही विशिष्ट युनिट्स खरेदी केल्या आहेतइक्विटी फंड या वर्षी आणि तुमचे फंड मूल्य वाढले. सीएजीआर कॅल्क्युलेटरच्या मदतीने तुम्ही तुमच्या गुंतवणुकीवरील परताव्याचा दर जाणून घेऊ शकता

- तुम्हाला सुरुवात करायची आहेगुंतवणूक आणि काही विशिष्ट ध्येये आहेत. सीएजीआर कॅल्क्युलेटरद्वारे, तुम्हाला कालमर्यादेत तुमचे पैसे किती दराने वाढवायचे आहेत हे कळेल.

- तुम्ही एका इक्विटी फंडात गुंतवणूक केली आहे याचा विचार करा ज्याचे 3,5 आणि 10 वर्षांचे परतावे अनुक्रमे 25%, 15% आणि 10% आहेत. तुमचा फंड दरवर्षी कोणत्या सरासरी दराने वाढला हे तुम्हाला जाणून घ्यायचे आहे

- गुंतवणुकीच्या CAGR ची तुमच्या अपेक्षित दराशी तुलना करण्यासाठी आणि योग्यता तपासा. सीएजीआर तुमच्या अपेक्षित परताव्याच्या दरापेक्षा जास्त किंवा त्यापेक्षा जास्त असेल तरच गुंतवणूक करा

- च्या CAGRम्युच्युअल फंड बेंचमार्क रिटर्नशी तुलना केली जाऊ शकते

CAGR सूत्र

CAGR गणितीय सूत्र वापरून काढता येतो

CAGR = [ (अंतिम मूल्य/प्रारंभिक मूल्य)^(1/N)] -1

वरील सूत्र तीन चलांवर अवलंबून आहे. म्हणजे, सुरुवातीचे मूल्य, शेवटचे मूल्य आणि वर्षांची संख्या (N)

जेव्हा तुम्ही वरील तीन व्हेरिएबल्स इनपुट करता, तेव्हा CAGR कॅल्क्युलेटर तुम्हाला दर देईलगुंतवणुकीवर परतावा.

Talk to our investment specialist

CAGR च्या मर्यादा

जरी CAGR ही एक उपयुक्त संकल्पना असली तरी तिला खूप मर्यादा आहेत. या मर्यादांची जाणीव नसल्यामुळे गुंतवणुकीचे चुकीचे निर्णय होतात. काही मर्यादा आहेत:

सीएजीआरशी संबंधित गणनेमध्ये, ही फक्त सुरुवात आणि शेवटची मूल्ये आहेत. हे असे गृहीत धरते की वाढ कालावधी कालावधीत स्थिर आहे आणि अस्थिरता पैलू विचारात घेण्यात अयशस्वी आहे

हे फक्त एकरकमी गुंतवणुकीसाठी योग्य आहे. जसे की अएसआयपी गुंतवणूक, CAGR ची गणना करताना फक्त सुरुवातीचे मूल्य विचारात घेतल्याने विविध अंतराने पद्धतशीर गुंतवणूक विचारात घेतली जाणार नाही.

सीएजीआर गुंतवणुकीत अंतर्निहित जोखीम घेत नाही. जेव्हा इक्विटी गुंतवणुकीचा विचार केला जातो तेव्हा जोखीम-समायोजित परतावा CAGR पेक्षा अधिक महत्त्वाचा असतो. या हेतूंसाठी, आपल्याला जसे चांगले गुणोत्तर विचारात घेणे आवश्यक आहेतीव्र प्रमाण

सर्वोत्तम 3 वर्षांच्या CAGR सह शीर्ष निधी

The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. SBI PSU Fund is a Equity - Sectoral fund was launched on 7 Jul 10. It is a fund with High risk and has given a Below is the key information for SBI PSU Fund Returns up to 1 year are on The investment objective of Franklin India Opportunities Fund (FIOF) is to generate capital appreciation by capitalizing on the long-term growth opportunities in the Indian economy. Franklin India Opportunities Fund is a Equity - Sectoral fund was launched on 21 Feb 00. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Opportunities Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Invesco India PSU Equity Fund is a Equity - Sectoral fund was launched on 18 Nov 09. It is a fund with High risk and has given a Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on 1. SBI PSU Fund

CAGR/Annualized return of 8% since its launch. Ranked 31 in Sectoral category. Return for 2024 was 23.5% , 2023 was 54% and 2022 was 29% . SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (23 Apr 25) ₹31.2562 ↑ 0.01 (0.02 %) Net Assets (Cr) ₹4,789 on 31 Mar 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 2.3 Sharpe Ratio 0.07 Information Ratio -0.23 Alpha Ratio 3.14 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,883 31 Mar 22 ₹17,382 31 Mar 23 ₹19,831 31 Mar 24 ₹37,078 31 Mar 25 ₹39,285 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 5.8% 3 Month 6.1% 6 Month -0.8% 1 Year 4.3% 3 Year 30.6% 5 Year 31.3% 10 Year 15 Year Since launch 8% Historical performance (Yearly) on absolute basis

Year Returns 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% 2014 -11.1% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 0.75 Yr. Data below for SBI PSU Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 35.9% Utility 24.13% Energy 17.02% Industrials 10.67% Basic Materials 6.34% Asset Allocation

Asset Class Value Cash 5.81% Equity 94.07% Debt 0.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN14% ₹591 Cr 8,577,500 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | 5321559% ₹380 Cr 24,350,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | 5328989% ₹380 Cr 15,135,554

↑ 950,000 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL8% ₹334 Cr 13,575,000

↑ 800,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | 5005476% ₹230 Cr 9,700,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | 5263714% ₹174 Cr 27,900,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | 5325554% ₹170 Cr 5,443,244 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | 5321344% ₹154 Cr 7,800,000 General Insurance Corp of India (Financial Services)

Equity, Since 31 May 24 | GICRE4% ₹153 Cr 4,150,000

↑ 550,000 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 24 | SBICARD3% ₹138 Cr 1,650,000 2. Franklin India Opportunities Fund

CAGR/Annualized return of 13.4% since its launch. Ranked 47 in Sectoral category. Return for 2024 was 37.3% , 2023 was 53.6% and 2022 was -1.9% . Franklin India Opportunities Fund

Growth Launch Date 21 Feb 00 NAV (23 Apr 25) ₹239.2 ↑ 1.24 (0.52 %) Net Assets (Cr) ₹6,047 on 31 Mar 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.12 Sharpe Ratio 0.46 Information Ratio 1.68 Alpha Ratio 8.45 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,903 31 Mar 22 ₹21,132 31 Mar 23 ₹23,026 31 Mar 24 ₹37,539 31 Mar 25 ₹43,201 Returns for Franklin India Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 5% 3 Month 0.8% 6 Month -2.4% 1 Year 13.3% 3 Year 29.4% 5 Year 32.5% 10 Year 15 Year Since launch 13.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 37.3% 2022 53.6% 2021 -1.9% 2020 29.7% 2019 27.3% 2018 5.4% 2017 -10.1% 2016 35.6% 2015 4.2% 2014 2.3% Fund Manager information for Franklin India Opportunities Fund

Name Since Tenure Kiran Sebastian 7 Feb 22 3.06 Yr. R. Janakiraman 1 Apr 13 11.92 Yr. Sandeep Manam 18 Oct 21 3.37 Yr. Data below for Franklin India Opportunities Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Consumer Cyclical 19.47% Financial Services 13.37% Health Care 11.56% Communication Services 9.09% Basic Materials 8.49% Technology 7.97% Industrials 6.9% Energy 4.32% Consumer Defensive 3.74% Real Estate 2.22% Utility 1.37% Asset Allocation

Asset Class Value Cash 8.98% Equity 91.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 May 24 | HDFCBANK5% ₹301 Cr 1,735,296

↑ 676,365 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 22 | RELIANCE4% ₹238 Cr 1,987,098 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 24 | BHARTIARTL4% ₹211 Cr 1,342,233 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 May 24 | M&M3% ₹165 Cr 637,966 Mphasis Ltd (Technology)

Equity, Since 30 Nov 24 | 5262993% ₹160 Cr 710,533 Lemon Tree Hotels Ltd (Consumer Cyclical)

Equity, Since 31 Aug 24 | LEMONTREE3% ₹156 Cr 12,833,401 Info Edge (India) Ltd (Communication Services)

Equity, Since 31 Jul 24 | NAUKRI3% ₹151 Cr 216,138 APL Apollo Tubes Ltd (Basic Materials)

Equity, Since 31 Oct 24 | APLAPOLLO3% ₹144 Cr 998,385 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Aug 23 | 5433203% ₹142 Cr 6,398,413 CE Info Systems Ltd (Technology)

Equity, Since 31 Mar 24 | 5434253% ₹139 Cr 835,883

↑ 76,164 3. Invesco India PSU Equity Fund

CAGR/Annualized return of 12.3% since its launch. Ranked 33 in Sectoral category. Return for 2024 was 25.6% , 2023 was 54.5% and 2022 was 20.5% . Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (23 Apr 25) ₹60.05 ↑ 0.03 (0.05 %) Net Assets (Cr) ₹1,217 on 31 Mar 25 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.39 Sharpe Ratio 0.06 Information Ratio -0.47 Alpha Ratio 3.27 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,149 31 Mar 22 ₹17,370 31 Mar 23 ₹19,711 31 Mar 24 ₹36,141 31 Mar 25 ₹37,811 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 6.1% 3 Month 5% 6 Month -3.8% 1 Year 5% 3 Year 28.8% 5 Year 29.1% 10 Year 15 Year Since launch 12.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% 2014 2.5% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Dhimant Kothari 19 May 20 4.79 Yr. Data below for Invesco India PSU Equity Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 27.81% Utility 24.59% Financial Services 21.69% Energy 18.38% Basic Materials 6.48% Asset Allocation

Asset Class Value Cash 1.06% Equity 98.94% Top Securities Holdings / Portfolio

Name Holding Value Quantity Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹96 Cr 3,894,619 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 28 Feb 22 | 5328989% ₹90 Cr 3,599,413 State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN8% ₹86 Cr 1,251,543 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | 5005478% ₹82 Cr 3,445,961 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Aug 24 | 5003126% ₹65 Cr 2,868,783 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL5% ₹54 Cr 175,355

↑ 22,180 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN5% ₹52 Cr 5,911,723 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | 5325555% ₹49 Cr 1,570,631 National Aluminium Co Ltd (Basic Materials)

Equity, Since 31 Aug 24 | 5322344% ₹46 Cr 2,604,332 Hindustan Petroleum Corp Ltd (Energy)

Equity, Since 30 Nov 23 | HINDPETRO4% ₹46 Cr 1,564,169

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.