Table of Contents

ELSS कॅल्क्युलेटर

परिचय

ELSS एक ओपन-एंडेड इक्विटी आहेम्युच्युअल फंड ते केवळ कर बचतीच्या उद्देशांसाठीच उत्तम नाही तर तुमच्या गुंतवणुकीसाठी वाढीची संधी देखील निर्माण करते. लोकांमध्ये दीर्घकालीन गुंतवणुकीची सवय लावण्यासाठी भारत सरकारद्वारे या योजनांचा प्रचार केला जातो. नावावरून स्पष्ट आहे की, इक्विटी लिंक्ड सेव्हिंग्ज स्कीममधील फंडाचा मोठा भाग यामध्ये गुंतवला जातोइक्विटी किंवा इक्विटी-संबंधित उत्पादने. जेव्हा तुम्ही इक्विटी गुंतवणुकीची योजना आखता तेव्हा गुंतवणुकीच्या आधीच्या कामगिरीचे निर्धारण करणे हा एक शहाणपणाचा निर्णय आहेगुंतवणूक. हे ELSS कॅल्क्युलेटर म्हणून संदर्भित साधनाद्वारे केले जाऊ शकते.

ELSS कॅल्क्युलेटर म्हणजे काय?

ELSS कॅल्क्युलेटर हे अत्यंत उपयुक्त साधन आहे जे तुम्हाला ELSS योजनेतील सर्वोत्तम गुंतवणूक निवडण्याच्या संदर्भात योग्य निर्णय घेण्यास मदत करण्यात महत्त्वाची भूमिका बजावते. T=गुंतवणूक कितपत प्रभावी आहे किंवा नाही याचे मूल्यमापन तुम्ही करू शकाल. तुम्ही निवडलेल्या योजनेच्या प्रकारानुसार, तुम्ही वापरू शकता असे अनेक ELSS कॅल्क्युलेटर आहेत.

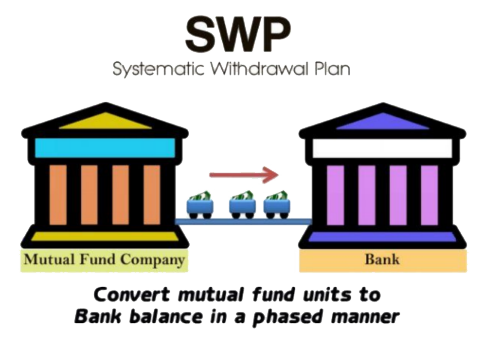

ELSS कॅल्क्युलेटर: SIP कामाची मागील कामगिरी?

मागील कामगिरीसिप कॅल्क्युलेटर आपल्या ऐतिहासिक कामगिरीवर अंतर्दृष्टी प्रदान करण्यासाठी हे एक महत्त्वपूर्ण साधन आहेSIP. कॅल्क्युलेटर काही तपशील विचारात घेते जसे की:

- एसआयपी गुंतवणूक रक्कम

- SIP च्या सुरुवातीचा महिना आणि वर्ष

- SIP चा मॅच्युरिटी महिना आणि वर्ष

- मूल्यांकन तारीख

- चे नावमालमत्ता व्यवस्थापन कंपनी

वरील तपशीलांसह, एक ELSS SIP मागील कामगिरी कॅल्क्युलेटर परिपक्वतेच्या वेळी तुमची SIP गुंतवणूक किती मूल्यवान असेल याचा अंदाज तयार करेल. वेगवेगळ्या कालावधीत फंडाची कामगिरी कशी आहे हे ठरवण्यासाठी असे मूल्यमापन हे एक चांगले माध्यम आहेबाजार सायकल दीर्घकालीन कामगिरी ही भविष्यातील संभाव्यतेच्या दृष्टीने फंड कोठे जात आहे हे मोजण्यासाठी देखील एक चांगली माहिती आहे. जरी हे स्पष्ट केले पाहिजे की भूतकाळातील कामगिरी भविष्यात परताव्याची हमी देत नाही, तरीही बाजाराच्या प्रतिकूल परिस्थितीत निधी कसा टिकून राहिला हे दर्शवून ते मदत करतात.

Know Your SIP Returns

Talk to our investment specialist

शीर्ष ELSS फंड

To provide medium to long term capital gains along with income tax relief to its Unitholders, while at all times emphasising the importance of capital appreciation.. Tata India Tax Savings Fund is a Equity - ELSS fund was launched on 13 Oct 14. It is a fund with Moderately High risk and has given a Below is the key information for Tata India Tax Savings Fund Returns up to 1 year are on To generate long-term capital growth from a diversified portfolio of predominantly equity and equity-related securities. L&T Tax Advantage Fund is a Equity - ELSS fund was launched on 27 Feb 06. It is a fund with Moderately High risk and has given a Below is the key information for L&T Tax Advantage Fund Returns up to 1 year are on To build a high quality growth-oriented portfolio to provide long-term capital gains to the investors, the scheme aims at providing returns through capital appreciation. Principal Tax Savings Fund is a Equity - ELSS fund was launched on 31 Mar 96. It is a fund with Moderately High risk and has given a Below is the key information for Principal Tax Savings Fund Returns up to 1 year are on To generate long term capital appreciation from a portfolio that is predominantly in equity and equity related instruments HDFC Long Term Advantage Fund is a Equity - ELSS fund was launched on 2 Jan 01. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Long Term Advantage Fund Returns up to 1 year are on 1. Tata India Tax Savings Fund

CAGR/Annualized return of 14.6% since its launch. Ranked 1 in ELSS category. Return for 2024 was 19.5% , 2023 was 24% and 2022 was 5.9% . Tata India Tax Savings Fund

Growth Launch Date 13 Oct 14 NAV (21 Apr 25) ₹42.0215 ↑ 0.47 (1.13 %) Net Assets (Cr) ₹4,335 on 31 Mar 25 Category Equity - ELSS AMC Tata Asset Management Limited Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 0 Sharpe Ratio 0.22 Information Ratio -0.15 Alpha Ratio 3.19 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,724 31 Mar 22 ₹20,336 31 Mar 23 ₹20,326 31 Mar 24 ₹27,013 31 Mar 25 ₹29,622 Returns for Tata India Tax Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Apr 25 Duration Returns 1 Month 2.7% 3 Month 0.2% 6 Month -6.8% 1 Year 10.3% 3 Year 14.4% 5 Year 23.6% 10 Year 15 Year Since launch 14.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 19.5% 2022 24% 2021 5.9% 2020 30.4% 2019 11.9% 2018 13.6% 2017 -8.4% 2016 46% 2015 2.1% 2014 13.3% Fund Manager information for Tata India Tax Savings Fund

Name Since Tenure Sailesh Jain 16 Dec 21 3.21 Yr. Tejas Gutka 9 Mar 21 3.98 Yr. Data below for Tata India Tax Savings Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 32.98% Consumer Cyclical 15.28% Industrials 12.78% Technology 7.77% Basic Materials 7.15% Energy 5.32% Communication Services 3.91% Health Care 3.49% Utility 2.65% Real Estate 2.39% Consumer Defensive 1.48% Asset Allocation

Asset Class Value Cash 4.81% Equity 95.19% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 10 | HDFCBANK7% ₹299 Cr 1,725,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 16 | ICICIBANK6% ₹256 Cr 2,125,000 Infosys Ltd (Technology)

Equity, Since 30 Sep 18 | INFY5% ₹196 Cr 1,160,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 18 | RELIANCE4% ₹162 Cr 1,350,000 State Bank of India (Financial Services)

Equity, Since 30 Nov 18 | SBIN4% ₹150 Cr 2,175,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 19 | BHARTIARTL4% ₹148 Cr 940,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Aug 18 | 5322153% ₹132 Cr 1,300,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 16 | LT3% ₹111 Cr 352,147 NTPC Ltd (Utilities)

Equity, Since 30 Jun 21 | 5325553% ₹107 Cr 3,451,000 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Mar 22 | 5000342% ₹91 Cr 107,000 2. L&T Tax Advantage Fund

CAGR/Annualized return of 14.2% since its launch. Ranked 7 in ELSS category. Return for 2024 was 33% , 2023 was 28.4% and 2022 was -3% . L&T Tax Advantage Fund

Growth Launch Date 27 Feb 06 NAV (21 Apr 25) ₹126.191 ↑ 2.14 (1.73 %) Net Assets (Cr) ₹3,871 on 31 Mar 25 Category Equity - ELSS AMC L&T Investment Management Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.89 Sharpe Ratio 0.38 Information Ratio 0.34 Alpha Ratio 6.76 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,157 31 Mar 22 ₹20,223 31 Mar 23 ₹19,900 31 Mar 24 ₹27,682 31 Mar 25 ₹31,345 Returns for L&T Tax Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Apr 25 Duration Returns 1 Month 2.6% 3 Month 0.2% 6 Month -7% 1 Year 13.1% 3 Year 17.1% 5 Year 24.5% 10 Year 15 Year Since launch 14.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 33% 2022 28.4% 2021 -3% 2020 30.3% 2019 13.5% 2018 4.6% 2017 -8.1% 2016 42.3% 2015 8.1% 2014 2.9% Fund Manager information for L&T Tax Advantage Fund

Name Since Tenure Gautam Bhupal 26 Nov 22 2.26 Yr. Sonal Gupta 21 Jul 21 3.61 Yr. Abhishek Gupta 1 Mar 24 1 Yr. Data below for L&T Tax Advantage Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 24.8% Consumer Cyclical 19.28% Industrials 16.35% Technology 11.48% Basic Materials 6.73% Health Care 5.79% Energy 4.26% Consumer Defensive 3.25% Utility 3.16% Communication Services 2.03% Real Estate 1.44% Asset Allocation

Asset Class Value Cash 1.39% Equity 98.61% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 06 | HDFCBANK6% ₹201 Cr 1,162,500 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 09 | ICICIBANK4% ₹139 Cr 1,155,500 Infosys Ltd (Technology)

Equity, Since 31 Mar 06 | INFY4% ₹131 Cr 774,900 Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 21 | RELIANCE3% ₹114 Cr 951,812 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Jul 22 | LT3% ₹95 Cr 301,450 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Jun 23 | SHRIRAMFIN2% ₹80 Cr 1,291,500 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 24 | BHARTIARTL2% ₹73 Cr 467,000 Persistent Systems Ltd (Technology)

Equity, Since 31 Jul 21 | PERSISTENT2% ₹71 Cr 133,000

↓ -27,000 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | 5433202% ₹70 Cr 3,150,000 State Bank of India (Financial Services)

Equity, Since 31 Jan 19 | SBIN2% ₹68 Cr 984,432 3. Principal Tax Savings Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 8 in ELSS category. Return for 2024 was 15.8% , 2023 was 24.5% and 2022 was 4.3% . Principal Tax Savings Fund

Growth Launch Date 31 Mar 96 NAV (21 Apr 25) ₹486.78 ↑ 6.19 (1.29 %) Net Assets (Cr) ₹1,288 on 31 Mar 25 Category Equity - ELSS AMC Principal Pnb Asset Mgmt. Co. Priv. Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 2.26 Sharpe Ratio 0.02 Information Ratio -0.26 Alpha Ratio -0.34 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,162 31 Mar 22 ₹21,396 31 Mar 23 ₹21,311 31 Mar 24 ₹29,041 31 Mar 25 ₹30,850 Returns for Principal Tax Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Apr 25 Duration Returns 1 Month 3.9% 3 Month 3.9% 6 Month -3.1% 1 Year 9.4% 3 Year 13.9% 5 Year 24.8% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 15.8% 2022 24.5% 2021 4.3% 2020 32.1% 2019 18.9% 2018 2.5% 2017 -9.2% 2016 48.8% 2015 6.2% 2014 2.7% Fund Manager information for Principal Tax Savings Fund

Name Since Tenure Sudhir Kedia 29 Oct 19 5.42 Yr. Rohit Seksaria 1 Jan 22 3.25 Yr. Data below for Principal Tax Savings Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 32.55% Industrials 11.74% Consumer Cyclical 10.61% Technology 8.27% Health Care 6.81% Consumer Defensive 5.77% Energy 5.37% Basic Materials 5.31% Communication Services 4.95% Utility 1.37% Asset Allocation

Asset Class Value Cash 6.71% Equity 93.29% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 09 | HDFCBANK9% ₹112 Cr 644,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK7% ₹89 Cr 737,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 21 | RELIANCE4% ₹52 Cr 434,000 Infosys Ltd (Technology)

Equity, Since 31 Jan 09 | INFY4% ₹52 Cr 306,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 13 | LT3% ₹42 Cr 134,000

↑ 19,000 State Bank of India (Financial Services)

Equity, Since 30 Apr 05 | SBIN3% ₹37 Cr 532,000

↑ 88,000 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 17 | 5322153% ₹32 Cr 311,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Oct 22 | INDIGO2% ₹28 Cr 63,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Jan 14 | 5325382% ₹27 Cr 27,000 Bharti Airtel Ltd (Partly Paid Rs.1.25) (Communication Services)

Equity, Since 30 Nov 21 | 8901572% ₹25 Cr 221,000

↓ -62,000 4. HDFC Long Term Advantage Fund

CAGR/Annualized return of 21.4% since its launch. Ranked 23 in ELSS category. . HDFC Long Term Advantage Fund

Growth Launch Date 2 Jan 01 NAV (14 Jan 22) ₹595.168 ↑ 0.28 (0.05 %) Net Assets (Cr) ₹1,318 on 30 Nov 21 Category Equity - ELSS AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.25 Sharpe Ratio 2.27 Information Ratio -0.15 Alpha Ratio 1.75 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,787

Purchase not allowed Returns for HDFC Long Term Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Apr 25 Duration Returns 1 Month 4.4% 3 Month 1.2% 6 Month 15.4% 1 Year 35.5% 3 Year 20.6% 5 Year 17.4% 10 Year 15 Year Since launch 21.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for HDFC Long Term Advantage Fund

Name Since Tenure Data below for HDFC Long Term Advantage Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.