Table of Contents

- Components of EPF Passbook

- EPFO E-Passbook Benefits for Members

- Creating UAN e-Passbook Account

- Downloading EPFO Member Passbook

- Updates to the Passbook

- Points to Consider When Downloading the EPF Passbook

- UAN Member Passbook Check via Umang App

- EPF Passbook Balance Check via EPFO

- UAN Passbook Login and Balance Check by SMS

- EPF Passbook Balance Check by Missed Call

- Conclusion

EPF Passbook

The Employees' Provident Fund (EPF) passbook contains details and information on all transactions performed in the EPF and Employees' Pension Scheme (EPS) accounts by both the employer and the employee.

All of the monthly payments, including the accrued interest, are listed in the passbook related to each of your EPF accounts. This EPF passbook can be viewed online and downloaded in PDF format. However, you must register your Universal account number (UAN) on the Employees' Provident Fund Organisation's official website (EPFO).

In this article, you can find a detailed guide to understand the components of the EPF passbook and how to download it.

Components of EPF Passbook

The following are the parts of an EPF Passbook for UAN members:

1. Basic Information

The EPF passbook includes basic information, such as the establishment's name, ID, address, the member's name, date of birth, and the organization's membership date.

2. Opening Balance

The opening balance is shown in the employee and employer columns in the passbook. The whole contribution and interest earned in the preceding financial year are also included in this section.

3. Monthly Contribution

This column shows the employee's and the employer's monthly contributions. Contribution to EPS, on the other hand, is shown differently.

4. Interest

At the end of the year, the interest rate on PF is credited for both employee and employer contributions, but it is computed on the running balance of each month. In addition, the passbook specifies the interest rate at which the interest will be credited.

5. Withdrawal

If you have made a withdrawal throughout the year for any reason, it will be shown in this section in your EPF passbook.

6. Balance at the End

It is the sum of the employee's contribution plus the interest earned and the total employer's contribution plus interest. In addition, the EPF balance is carried forward to the following year as an opening balance.

7. Voluntary PF

Employees have the option of contributing more than the mandatory EPF contribution of 12% to the Voluntary Provident Fund. The excess contributions are shown in this section.

EPFO E-Passbook Benefits for Members

EPFO e-passbook is highly beneficial for the members as it comes with a lot of essential details handy to be referred to whenever the need arrives. Here are the key benefits associated with it:

- For all EPF account holders, it is a time-saving and dependable function

- It keeps track of your EPS account balance and assists with Retirement planning

- It lets you calculate the amount you will withdraw in advance in the event of a financial emergency

- EPF passbook records every transaction made by your company, allowing you to determine whether or not your employer makes a monthly payment

- You can print and download your e-passbook at any time, even if you leave your current job and start a new one

- It also aids in detecting faults (if any) so that they can be corrected as soon as possible

Talk to our investment specialist

Creating UAN e-Passbook Account

To register for the services of the e-passbook, you must first activate your UAN. It can be done by visiting the official website of the Employees’ Provident Fund Organisation. Once activated, it will take up to three working days from the authentication for you to get access to download the EPF member passbook.

Downloading EPFO Member Passbook

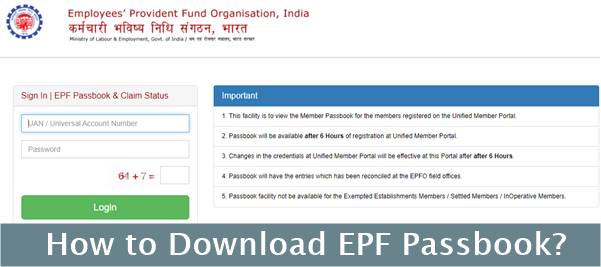

Here is how you, being an employee, can download the e-passbook by the EPF passbook login:

- Go to the EPFO website's Member Passbook page

- Enter your Universal Account Number (UAN) in the first column and password

- Complete the mathematical captcha

- Click Login

All EPF accounts linked to your UAN will have their member IDs shown on the screen. Under Select Member ID to View Passbook, click on the EPF Member ID.

When an employee clicks on the Member ID, all information about the PF account is displayed, including the employer's and the employee's name, the office location, the employer's and employee's shares, and the contribution made to the EPS account.

The employee can also download the PF statement in PDF format and print it.

Updates to the Passbook

EPFO updates the employee's EPF passbook as soon as a contribution is made to the account. Even though the date is not specified in the passbook, it includes the month and year the contribution was made.

If your EPF passbook has not been updated, it is recommended that you wait a few days and then connect to the portal again to obtain the new passbook.

Points to Consider When Downloading the EPF Passbook

The PF Passbook check and downloading it is a straightforward process that can be done on the EPFO website. However, if you want to access and download the passbook online, you must keep the following points in mind:

- Only those members who have completed the UAN Registration on the EPFO portal are eligible for the PF passbook

- The passbook Facility will be available within 6 hours after finishing the registration or activation

- The entries in the passbook must match the EPFO field offices' entries

- The EPF Passbook facility will not be available to inoperative, settled, or exempted establishment members

UAN Member Passbook Check via Umang App

The EPFO account is also accessible via the Umang App. To check your account balance on your passbook through this app, follow these steps:

- Install the Umang app on your smartphone and log in to the app

- Choose EPFO from the app's menu

- Select Employee Centric Service from the drop-down menu

- Enter your UAN

- You will receive an OTP on your registered mobile number; enter the same to continue

- Under the EPFO option, select see passbook

You can check all the details regarding your EPF account, including the member details, from here.

EPF Passbook Balance Check via EPFO

EPF members can use the EPFO portal balance check option by visiting the EPFO's official website. Here is how to do so:

- As you open the site, the login section will appear; enter the UAN, password, and captcha to log in to your account

- Visit the EPF site and click on 'Our Services' on the dashboard to check your EPFO balance

- Click the For Employees tab to check your PF balance online

- To proceed, click the Member Passbook option and enter your username and password.

- After successfully logging in to the member portal using your EPF passbook, select the Download e-passbook option

UAN Passbook Login and Balance Check by SMS

You can check your PF balance by sending a text message to the EPFO if your UAN and mobile number are registered.

To do so, send - EPFOHO UAN ENG - to the number 7738299899 if you have a PF account.

The abbreviation ENG denotes the user's preference for information in English. If you'd want the information to come to you in a different language, such as Hindi, substitute ENG with HIN.

You must also seed your UAN with a Bank account, your Aadhaar number, and your PAN to use the SMS feature to check your PF balance.

EPF Passbook Balance Check by Missed Call

Through your registered mobile number, simply dial the toll-free numbers, 7738299899 and 011-22901406 for checking your balance.

The Call will connect and then disconnect on its own after one ring. Just after the disconnection, you will receive an SMS regarding your PF account, along with the account balance.

In this situation, the UAN must also be seeded with your bank account number, Aadhaar number, and PAN.

Conclusion

The EPFO's entire Range of services is available online. This means you can access your UAN passbook from anywhere in the world. Using your 12-digit UAN, you can check your UAN member passbook online. You must first register your UAN on the EPFO official website before you can do so.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.