Fincash » Mutual Funds India » Inflation-Proof Your Finances

Table of Contents

- What is Inflation and How Does It Affect Your Money?

- Strategy 1: Invest in Inflation-Protected Assets

- Strategy 2: Diversify Your Investment Portfolio

- Strategy 3: Rebalance Your Portfolio Regularly

- Strategy 4: Increase Your Income Streams

- Strategy 5: Manage Debt Wisely

- Strategy 6: Invest in Mutual Funds with Inflation-Resistant Focus

- Conclusion: Stay Ahead of Inflation

Inflation-Proofing Your Finances: Strategies for Long-Term Wealth Protection

Inflation is the silent wealth eroder. Over time, the rising cost of goods and services eats away at the purchasing power of your hard-earned money.

If you’re not prepared, inflation can significantly impact your financial well-being. So, how can you protect your wealth and ensure that your money continues to grow, even during times of inflation?

In this article, we will explore inflation-proofing strategies that you can adopt to secure your long-term Financial goals. Whether you’re planning for retirement, saving for future expenses, or simply looking to preserve the value of your assets, these actionable tips will help you stay ahead.

What is Inflation and How Does It Affect Your Money?

Before diving into strategies, let’s first understand what inflation actually means. Inflation refers to the increase in the price of goods and services over time. This results in a decrease in the purchasing power of money. For example, if the inflation rate is 5%, something that costs ₹100 today will cost ₹105 next year.

Here’s the problem:

If your investments or savings don’t grow at the same rate (or higher) as inflation, you’re effectively losing money. This is why it’s important to focus on inflation-proofing your finances.

Strategy 1: Invest in Inflation-Protected Assets

One of the most effective ways to combat inflation is by Investing in inflation-protected assets. These are investments designed specifically to keep pace with or outperform inflation. Let’s look at a few options:

1. Gold

Historically, gold has been considered a reliable hedge against inflation. When inflation rises, the value of gold often increases, making it a safe bet for long-term protection. In India, gold is deeply tied to cultural practices, so Investing in Gold—whether through physical gold, gold ETFs, or Sovereign Gold Bonds—can be an effective inflation-protection strategy.

Example: If inflation increases by 5% annually, the price of gold tends to increase as well, maintaining its value over time. This is why many Indian households prefer to invest in gold to preserve wealth.

Talk to our investment specialist

2. Real Estate

Real Estate is another solid investment to shield your money from inflation. Property values and rent prices typically rise with inflation, making real estate a potential source of both Capital appreciation and passive Income.

Example: Buying a property today for ₹50 lakhs can potentially be worth ₹60 lakhs or more in a few years due to rising property values. Meanwhile, if you rent out the property, your rental income will also likely increase over time.

3. Inflation-Linked Bonds

Governments often issue inflation-indexed Bonds that adjust their payouts based on inflation. In India, for instance, Inflation-Indexed Bonds (IIBs) offer a guaranteed real return by adjusting their principal value to inflation rates.

Solution: Consider allocating a portion of your investment Portfolio to such bonds to ensure your returns outpace inflation.

Strategy 2: Diversify Your Investment Portfolio

Diversification is key to mitigating inflation risks. When you spread your investments across different asset classes, you reduce the overall risk to your portfolio. If inflation affects one type of investment negatively, another type may balance the loss.

1. Stocks/Equities

Over the long term, equities tend to outperform inflation, making them an essential part of an inflation-proof strategy. Companies increase prices in response to inflation, which can lead to higher revenues and Earnings, ultimately driving up stock prices.

Example: Investing in large-cap companies or sectors that perform well during inflationary periods (like consumer staples and energy) can help grow your wealth.

2. Commodities

Commodities like oil, metals, and agricultural products often increase in value when inflation rises. Investing in commodities, whether through ETFs or Mutual Funds, can provide additional protection for your portfolio.

Solution: Include commodity-linked investments in your portfolio to hedge against rising inflation.

3. Mutual Funds and ETFs

investing in Mutual Funds or exchange-traded funds (ETFs) that focus on inflation-proof sectors (like energy, utilities, or infrastructure) can provide diversified exposure to inflation-resistant assets. Look for funds that include a mix of stocks, bonds, and commodities.

Example: A mutual fund that invests in a broad mix of sectors, including technology, healthcare, and real estate, can help spread out the inflation risk across different industries.

Strategy 3: Rebalance Your Portfolio Regularly

Markets are dynamic, and inflation can fluctuate. That’s why it’s essential to rebalance your portfolio regularly to ensure it stays aligned with your financial goals and inflation risks.

1. Monitor Asset Performance

Keep track of how each Asset Class in your portfolio is performing relative to inflation. If certain assets are underperforming, consider shifting more of your money to those that are holding up better against inflation, such as gold, real estate, or inflation-linked bonds.

Solution: Set a schedule to review your portfolio quarterly or bi-annually, and make adjustments based on Market conditions.

2. Adopt a Defensive Strategy

When inflation is on the rise, adopting a defensive investment strategy—focusing on stable, income-generating investments—can protect your wealth. Assets like dividend-paying stocks, blue-chip companies, and defensive sectors (like healthcare and utilities) can perform well during inflationary times.

Example: If inflation rises to 6%, but your stock portfolio is yielding a 10% return annually, you’re effectively staying ahead.

Strategy 4: Increase Your Income Streams

One of the best ways to stay ahead of inflation is by increasing your income. Instead of solely relying on investments to keep pace with inflation, look for ways to generate additional income streams.

1. Invest in Skills

Investing in your own skills and education can lead to better job opportunities, promotions, or the ability to switch to a higher-paying career. This helps you stay ahead of rising costs.

Example: Upskilling through courses in technology, management, or other high-demand areas can increase your earning potential and provide you with the ability to adjust your salary expectations to meet inflation.

2. Side Income

Start a side hustle or passive income stream, such as freelance work, investing in dividend-paying stocks, or renting out property. This extra income can supplement your regular earnings, helping you save and invest more for inflation-proofing.

Solution: Use your extra income to invest in inflation-resistant assets or grow your savings faster.

Strategy 5: Manage Debt Wisely

Inflation can impact your debt, both positively and negatively. If you have fixed-rate loans, inflation can actually work in your favor by eroding the real value of your debt over time. However, if your debt has variable interest rates, rising inflation can increase your repayment burden.

1. Prioritize Fixed-Rate Loans

If possible, choose fixed-rate loans over variable-rate ones. This way, even if inflation rises, your loan repayments will remain the same, protecting you from paying more interest.

Example: A fixed-rate Home Loan with a 6% interest rate will remain constant even if inflation causes general interest rates to rise, allowing you to pay off your loan with "cheaper" money over time.

2. Avoid High-Interest Debt

High-interest debt, such as Credit Card Debt, can become a significant burden during inflationary times. Focus on paying off this debt as quickly as possible.

Solution: Use a debt repayment strategy like the debt avalanche (paying off the highest interest debts first) to reduce your overall debt faster.

Strategy 6: Invest in Mutual Funds with Inflation-Resistant Focus

Mutual funds are a great way to diversify your portfolio and shield yourself from inflation. However, the type of mutual fund you choose can make a significant difference when inflation rises. Let’s explore how certain mutual funds can help you tackle inflation:

1. Equity Mutual Funds

Equity Mutual Funds, particularly those that invest in blue-chip stocks or sectors that benefit during inflationary periods (like consumer goods or utilities), can provide long-term growth that outpaces inflation.

Example: An equity mutual fund focused on large-cap companies that consistently grow their earnings can help generate returns higher than inflation over time. This makes them a solid choice for wealth preservation during inflation.

2. Debt Mutual Funds

Though Debt fund might seem less attractive during inflation, certain types, like short-term debt funds, can be beneficial. These funds invest in short-duration bonds, which are less sensitive to interest rate fluctuations, and can offer steady returns even when inflation is rising.

Example: Short-term debt funds that focus on high-quality government or corporate bonds may offer safer returns without getting hit hard by interest rate hikes associated with inflation.

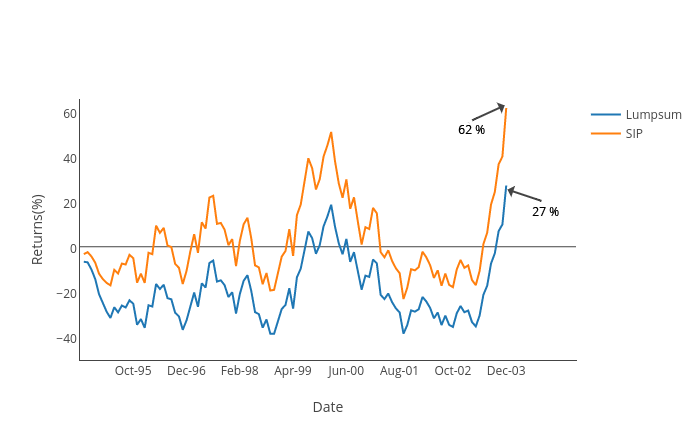

3. Inflation-Linked Bond Funds

Some mutual funds focus on inflation-protected securities such as inflation-linked bonds (in India, IIBs or Government Inflation-Indexed Bonds). These funds ensure that your investments stay aligned with rising inflation, Offering a cushion against decreasing purchasing power.

Solution: Consider allocating a portion of your portfolio to mutual funds that invest in inflation-linked bonds to safeguard your returns.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Infrastructure Fund Growth ₹178.42

↓ -0.23 ₹6,886 100 -4.3 -12 8.1 29.5 40.9 27.4 Nippon India Small Cap Fund Growth ₹149.859

↓ -0.12 ₹50,826 100 -14.2 -17.9 6.1 21.7 40.9 26.1 IDFC Infrastructure Fund Growth ₹45.942

↓ -0.12 ₹1,400 100 -11.2 -18 6.3 27.2 38 39.3 Nippon India Power and Infra Fund Growth ₹318.077

↓ -0.65 ₹6,125 100 -8.5 -17 2.8 29.4 37.8 26.9 L&T Emerging Businesses Fund Growth ₹72.5753

↓ -0.24 ₹13,334 500 -18.1 -19 4.3 17.8 37.3 28.5 SBI Contra Fund Growth ₹359.819

↑ 1.65 ₹39,590 500 -4.3 -11.4 8 22.3 37.3 18.8 HDFC Infrastructure Fund Growth ₹43.275

↓ -0.11 ₹2,105 300 -7.4 -13.9 4.9 29.9 36.8 23 Motilal Oswal Midcap 30 Fund Growth ₹92.6273

↓ -0.65 ₹23,704 500 -16.7 -13.9 16.9 28.3 36.7 57.1 Franklin Build India Fund Growth ₹129.008

↓ -0.27 ₹2,406 500 -7.1 -13.1 6.8 28 36.5 27.8 DSP BlackRock India T.I.G.E.R Fund Growth ₹285.339

↑ 0.59 ₹4,465 500 -11.8 -18.2 7.5 26.9 36.5 32.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25 Assets >= 200 Crore & Sorted on 5 Year Return.

Conclusion: Stay Ahead of Inflation

Inflation is an inevitable part of any Economy, but it doesn’t have to erode your wealth. By adopting smart strategies—like investing in inflation-protected assets, diversifying your portfolio, increasing your income, and managing debt—you can inflation-proof your finances and secure long-term wealth protection.

Stay proactive, keep learning, and regularly review your Financial plan. With the right approach, you can not only survive inflation but thrive through it.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.