+91-22-48913909

+91-22-48913909

Table of Contents

- भारतातील आंतरराष्ट्रीय म्युच्युअल फंडांची पार्श्वभूमी

- आंतरराष्ट्रीय म्युच्युअल फंड कसा निवडायचा?

- आर्थिक वर्ष 22 - 23 मध्ये गुंतवणूक करण्यासाठी सर्वोत्तम आंतरराष्ट्रीय म्युच्युअल फंड

- आंतरराष्ट्रीय म्युच्युअल फंडाचे प्रकार

- आंतरराष्ट्रीय म्युच्युअल फंडात गुंतवणूक का करावी?

- आंतरराष्ट्रीय म्युच्युअल फंडांची कर आकारणी

- इंटरनॅशनल म्युच्युअल फंडात ऑनलाइन गुंतवणूक कशी करावी?

- वारंवार विचारले जाणारे प्रश्न

- 1. आंतरराष्ट्रीय म्युच्युअल फंडामध्ये गुंतवणूक करण्याचे काय फायदे आहेत?

- 2. भारतापेक्षा कमी वाढ करणाऱ्या कंपन्यांमध्ये मी गुंतवणूक करू शकतो का?

- 3. फ्रँकलिन इंडिया फीडर म्हणजे काय?

- 4. ब्लॅकरॉक वर्ल्ड मायनिंग फंड म्हणजे काय?

- 5. आंतरराष्ट्रीय म्युच्युअल फंडांच्या कमाईवर कर आकारला जातो का?

- 6. आंतरराष्ट्रीय म्युच्युअल फंडाचा मुख्य धोका काय आहे?

- 7. परदेशी म्युच्युअल फंडात कोणी गुंतवणूक करावी?

Top 8 Equity - Global Funds

- DSP BlackRock World Gold Fund

- Principal Global Opportunities Fund

- Edelweiss Europe Dynamic Equity Off-shore Fund

- Aditya Birla Sun Life International Equity Fund - Plan B

- Aditya Birla Sun Life International Equity Fund - Plan A

- DSP BlackRock Global Allocation Fund

- Invesco India Feeder- Invesco Global Equity Income Fund

- Edelweiss ASEAN Equity Off-shore Fund

8 सर्वोत्तम आंतरराष्ट्रीय म्युच्युअल फंड 2022

आंतरराष्ट्रीयम्युच्युअल फंड शिवाय परदेशी बाजारात गुंतवणूक करणारे फंड आहेतगुंतवणूकदारच्या राहण्याचा देश. दुसरीकडे,जागतिक निधी परदेशी बाजारपेठांमध्ये तसेच गुंतवणूकदाराच्या राहत्या देशात गुंतवणूक करा. आंतरराष्ट्रीय म्युच्युअल फंडांना "परदेशी निधी" म्हणून देखील ओळखले जाते आणि ते 'निधीचा निधी' रणनीती.

आंतरराष्ट्रीय म्युच्युअल फंड हे गेल्या काही वर्षांत स्थानिक बाजारातील अस्थिरतेमुळे गुंतवणूकदारांसाठी आकर्षक गुंतवणूक पर्याय बनले आहेत.अर्थव्यवस्था त्याच्या चढ-उतारांमधून जात आहे.

भारतातील आंतरराष्ट्रीय म्युच्युअल फंडांची पार्श्वभूमी

रिझर्व्हच्या परवानगीनेबँक भारताचे (RBI), आंतरराष्ट्रीय म्युच्युअल फंड 2007 मध्ये भारतात उघडले गेले. प्रत्येक फंडाला USD 500 दशलक्ष निधी मिळण्याची परवानगी आहे.

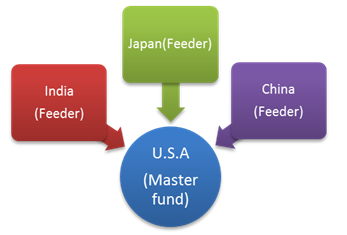

आंतरराष्ट्रीय म्युच्युअल फंडांची मास्टर-फीडर संरचना

इंटरनॅशनल म्युच्युअल फंड मास्टर-फीडर स्ट्रक्चर फॉलो करतात. मास्टर-फीडर स्ट्रक्चर ही तीन-स्तरीय रचना असते जिथे गुंतवणूकदार त्यांचे पैसे फीडर फंडमध्ये ठेवतात जे नंतर मास्टर फंडमध्ये गुंतवणूक करतात. मास्टर फंड नंतर पैसे गुंतवतोबाजार. फीडर फंड ऑन-शोअरवर आधारित आहे, म्हणजे भारतात, तर, मास्टर फंड ऑफ-शोअर (लक्समबर्ग इत्यादीसारख्या परदेशी भूगोलात) आधारित आहे.

मास्टर फंडामध्ये अनेक फीडर फंड असू शकतात. उदाहरणार्थ,

आंतरराष्ट्रीय म्युच्युअल फंड कसा निवडायचा?

योग्य फंडाची निवड करताना काही गोष्टी लक्षात ठेवल्या पाहिजेत.

आर्थिक वर्ष 22 - 23 मध्ये गुंतवणूक करण्यासाठी सर्वोत्तम आंतरराष्ट्रीय म्युच्युअल फंड

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." DSP BlackRock World Gold Fund is a Equity - Global fund was launched on 14 Sep 07. It is a fund with High risk and has given a Below is the key information for DSP BlackRock World Gold Fund Returns up to 1 year are on The investment objective of the Scheme is to provide long term capital appreciation by predominantly investing in overseas mutual fund schemes, and a certain portion of its corpus in Money Market Securities and/or units of Money Market / Liquid Schemes of Principal Mutual Fund. Principal Global Opportunities Fund is a Equity - Global fund was launched on 29 Mar 04. It is a fund with High risk and has given a Below is the key information for Principal Global Opportunities Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek to provide long term capital growth by investing predominantly in the JPMorgan Funds - Europe Dynamic Fund, an equity fund which invests primarily in an aggressively managed portfolio of European companies. Edelweiss Europe Dynamic Equity Off-shore Fund is a Equity - Global fund was launched on 7 Feb 14. It is a fund with High risk and has given a Below is the key information for Edelweiss Europe Dynamic Equity Off-shore Fund Returns up to 1 year are on An Open-ended diversified equity scheme with an objective to generate long-term growth of capital, by investing predominantly in a diversified portfolio of equity and equity related securities in the domestic and international markets. Aditya Birla Sun Life International Equity Fund - Plan B is a Equity - Global fund was launched on 31 Oct 07. It is a fund with High risk and has given a Below is the key information for Aditya Birla Sun Life International Equity Fund - Plan B Returns up to 1 year are on An Open-ended diversified equity scheme with an objective to generate long-term growth of capital, by investing predominantly in a diversified portfolio of equity and equity related securities in the international markets Aditya Birla Sun Life International Equity Fund - Plan A is a Equity - Global fund was launched on 31 Oct 07. It is a fund with High risk and has given a Below is the key information for Aditya Birla Sun Life International Equity Fund - Plan A Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of BlackRock Global Funds - Global Allocation Fund (BGF - GAF). The Scheme may also invest in the units of other similar overseas mutual fund schemes which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/ or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized. It shall be noted ‘similar overseas mutual fund schemes’shall have investment objective, investment strategy and risk profile/consideration similar to those of BGF – GAF DSP BlackRock Global Allocation Fund is a Equity - Global fund was launched on 21 Aug 14. It is a fund with High risk and has given a Below is the key information for DSP BlackRock Global Allocation Fund Returns up to 1 year are on (Erstwhile Invesco India Global Equity Income Fund) To provide capital appreciation and/or income by investing predominantly

in units of Invesco Global Equity Income Fund, an overseas equity fund which invests primarily in equities of companies worldwide. The Scheme may, at the discretion of Fund Manager, also invest in units of other similar Overseas Mutual Funds with similar objectives, strategy and attributes which may constitute a significant portion of its net assets. Invesco India Feeder- Invesco Global Equity Income Fund is a Equity - Global fund was launched on 5 May 14. It is a fund with High risk and has given a Below is the key information for Invesco India Feeder- Invesco Global Equity Income Fund Returns up to 1 year are on The primary investment objective of the Scheme is to provide long term capital growth by investing predominantly in JPMorgan Funds – JF ASEAN Equity Fund, an equity fund which invests primarily in companies of countries which are members of the Association of South East Asian Nations (ASEAN). However, there can be no assurance that the investment objective of the Scheme will be realized. Edelweiss ASEAN Equity Off-shore Fund is a Equity - Global fund was launched on 1 Jul 11. It is a fund with High risk and has given a Below is the key information for Edelweiss ASEAN Equity Off-shore Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) DSP BlackRock World Gold Fund Growth ₹29.5719

↓ -0.16 ₹1,146 500 33.8 20.6 61.8 16.3 11.9 15.9 Principal Global Opportunities Fund Growth ₹47.4362

↓ -0.04 ₹38 2,000 2.9 3.1 25.8 24.8 16.5 Edelweiss Europe Dynamic Equity Off-shore Fund Growth ₹21.549

↑ 0.13 ₹108 1,000 11.9 9.7 16.7 14.5 17 5.4 Aditya Birla Sun Life International Equity Fund - Plan B Growth ₹28.8036

↑ 0.07 ₹93 1,000 10.3 10 13.8 18.9 9 Aditya Birla Sun Life International Equity Fund - Plan A Growth ₹35.8761

↑ 0.38 ₹193 1,000 -0.8 0.9 13.5 6.6 11.1 7.4 DSP BlackRock Global Allocation Fund Growth ₹21.1152

↑ 0.03 ₹115 500 -0.6 3.8 13.4 9.2 9.7 11.6 Invesco India Feeder- Invesco Global Equity Income Fund Growth ₹26.1764

↑ 0.70 ₹32 500 -3.6 -0.4 13.3 14.9 18.4 13.7 Edelweiss ASEAN Equity Off-shore Fund Growth ₹26.519

↑ 0.02 ₹102 1,000 -6.2 -6.9 11.6 3.7 9.3 14.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 25 10 कोटी अधिकचे आणि मागील एका वर्षाच्या रिटर्नवर क्रमवारी लावलेले.1. DSP BlackRock World Gold Fund

CAGR/Annualized return of 6.4% since its launch. Ranked 11 in Global category. Return for 2024 was 15.9% , 2023 was 7% and 2022 was -7.7% . DSP BlackRock World Gold Fund

Growth Launch Date 14 Sep 07 NAV (22 Apr 25) ₹29.5719 ↓ -0.16 (-0.54 %) Net Assets (Cr) ₹1,146 on 31 Mar 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.35 Sharpe Ratio 1.49 Information Ratio -0.12 Alpha Ratio 0.84 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,604 31 Mar 22 ₹15,152 31 Mar 23 ₹14,266 31 Mar 24 ₹13,920 31 Mar 25 ₹20,792 Returns for DSP BlackRock World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 14% 3 Month 33.8% 6 Month 20.6% 1 Year 61.8% 3 Year 16.3% 5 Year 11.9% 10 Year 15 Year Since launch 6.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% 2014 -18.5% Fund Manager information for DSP BlackRock World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.01 Yr. Data below for DSP BlackRock World Gold Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Basic Materials 92.86% Asset Allocation

Asset Class Value Cash 3.12% Equity 93.16% Debt 0.02% Other 3.7% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -80% ₹844 Cr 1,880,211

↓ -73,489 VanEck Gold Miners ETF

- | GDX19% ₹199 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹19 Cr Net Receivables/Payables

CBLO | -0% -₹4 Cr 2. Principal Global Opportunities Fund

CAGR/Annualized return of 9.2% since its launch. Ranked 8 in Global category. . Principal Global Opportunities Fund

Growth Launch Date 29 Mar 04 NAV (31 Dec 21) ₹47.4362 ↓ -0.04 (-0.09 %) Net Assets (Cr) ₹38 on 30 Nov 21 Category Equity - Global AMC Principal Pnb Asset Mgmt. Co. Priv. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.1 Sharpe Ratio 2.31 Information Ratio 0 Alpha Ratio 0 Min Investment 10,000 Min SIP Investment 2,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,944 Returns for Principal Global Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 0% 3 Month 2.9% 6 Month 3.1% 1 Year 25.8% 3 Year 24.8% 5 Year 16.5% 10 Year 15 Year Since launch 9.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Principal Global Opportunities Fund

Name Since Tenure Data below for Principal Global Opportunities Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. Edelweiss Europe Dynamic Equity Off-shore Fund

CAGR/Annualized return of 7.1% since its launch. Ranked 22 in Global category. Return for 2024 was 5.4% , 2023 was 17.3% and 2022 was -6% . Edelweiss Europe Dynamic Equity Off-shore Fund

Growth Launch Date 7 Feb 14 NAV (22 Apr 25) ₹21.549 ↑ 0.13 (0.59 %) Net Assets (Cr) ₹108 on 31 Mar 25 Category Equity - Global AMC Edelweiss Asset Management Limited Rating ☆☆☆ Risk High Expense Ratio 1.38 Sharpe Ratio 0.18 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,539 31 Mar 22 ₹16,056 31 Mar 23 ₹17,672 31 Mar 24 ₹20,799 31 Mar 25 ₹22,599 Returns for Edelweiss Europe Dynamic Equity Off-shore Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 0.4% 3 Month 11.9% 6 Month 9.7% 1 Year 16.7% 3 Year 14.5% 5 Year 17% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 5.4% 2022 17.3% 2021 -6% 2020 17% 2019 13.5% 2018 22.9% 2017 -12.2% 2016 12.5% 2015 -3.9% 2014 5.4% Fund Manager information for Edelweiss Europe Dynamic Equity Off-shore Fund

Name Since Tenure Bhavesh Jain 9 Apr 18 6.98 Yr. Bharat Lahoti 1 Oct 21 3.5 Yr. Data below for Edelweiss Europe Dynamic Equity Off-shore Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 23.28% Industrials 13.75% Consumer Cyclical 10.7% Health Care 9.56% Consumer Defensive 8.22% Communication Services 7.93% Technology 6.73% Energy 6.21% Basic Materials 5.53% Utility 2.89% Real Estate 2.37% Asset Allocation

Asset Class Value Cash 1.18% Equity 97.18% Debt 0.02% Other 1.62% Top Securities Holdings / Portfolio

Name Holding Value Quantity JPM Europe Dynamic I (acc) EUR

Investment Fund | -99% ₹106 Cr 226,283

↑ 51,426 Clearing Corporation Of India Ltd.

CBLO/Reverse Repo | -1% ₹1 Cr Net Receivables/(Payables)

CBLO | -0% ₹0 Cr Accrued Interest

CBLO | -0% ₹0 Cr 4. Aditya Birla Sun Life International Equity Fund - Plan B

CAGR/Annualized return of 7% since its launch. Ranked 39 in Global category. . Aditya Birla Sun Life International Equity Fund - Plan B

Growth Launch Date 31 Oct 07 NAV (28 Jul 23) ₹28.8036 ↑ 0.07 (0.23 %) Net Assets (Cr) ₹93 on 30 Jun 23 Category Equity - Global AMC Birla Sun Life Asset Management Co Ltd Rating ☆ Risk High Expense Ratio 2.6 Sharpe Ratio 0.85 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,053 31 Mar 22 ₹19,412 31 Mar 23 ₹18,541 Returns for Aditya Birla Sun Life International Equity Fund - Plan B

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 4.2% 3 Month 10.3% 6 Month 10% 1 Year 13.8% 3 Year 18.9% 5 Year 9% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Aditya Birla Sun Life International Equity Fund - Plan B

Name Since Tenure Data below for Aditya Birla Sun Life International Equity Fund - Plan B as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 5. Aditya Birla Sun Life International Equity Fund - Plan A

CAGR/Annualized return of 7.6% since its launch. Ranked 36 in Global category. Return for 2024 was 7.4% , 2023 was 8.6% and 2022 was -2.1% . Aditya Birla Sun Life International Equity Fund - Plan A

Growth Launch Date 31 Oct 07 NAV (22 Apr 25) ₹35.8761 ↑ 0.38 (1.08 %) Net Assets (Cr) ₹193 on 31 Mar 25 Category Equity - Global AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆ Risk High Expense Ratio 2.5 Sharpe Ratio 0.26 Information Ratio -0.9 Alpha Ratio -0.05 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,889 31 Mar 22 ₹14,931 31 Mar 23 ₹14,889 31 Mar 24 ₹16,481 31 Mar 25 ₹18,096 Returns for Aditya Birla Sun Life International Equity Fund - Plan A

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month -4.4% 3 Month -0.8% 6 Month 0.9% 1 Year 13.5% 3 Year 6.6% 5 Year 11.1% 10 Year 15 Year Since launch 7.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 7.4% 2022 8.6% 2021 -2.1% 2020 13.5% 2019 13.2% 2018 24.7% 2017 4.1% 2016 13.5% 2015 -2.1% 2014 0% Fund Manager information for Aditya Birla Sun Life International Equity Fund - Plan A

Name Since Tenure Dhaval Joshi 21 Nov 22 2.36 Yr. Data below for Aditya Birla Sun Life International Equity Fund - Plan A as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 28.49% Financial Services 16.48% Technology 12.94% Consumer Defensive 11.36% Health Care 10.97% Consumer Cyclical 7.37% Communication Services 6.74% Basic Materials 4.41% Asset Allocation

Asset Class Value Cash 1.23% Equity 98.77% Top Securities Holdings / Portfolio

Name Holding Value Quantity Rheinmetall AG (Industrials)

Equity, Since 31 Aug 24 | RHM3% ₹6 Cr 700 Allegro.EU SA Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Aug 24 | ALE2% ₹5 Cr 80,700 Compagnie Financiere Richemont SA Class A (Consumer Cyclical)

Equity, Since 29 Feb 24 | CFR2% ₹5 Cr 2,700 Imperial Brands PLC (Consumer Defensive)

Equity, Since 31 Oct 21 | IMB2% ₹4 Cr 14,600 Singapore Exchange Ltd (Financial Services)

Equity, Since 31 Jul 23 | S682% ₹4 Cr 51,000 Brambles Ltd (Industrials)

Equity, Since 31 Aug 24 | BXB2% ₹4 Cr 38,800 British American Tobacco PLC (Consumer Defensive)

Equity, Since 31 Jul 24 | BATS2% ₹4 Cr 12,900 Tencent Holdings Ltd (Communication Services)

Equity, Since 30 Sep 22 | 007002% ₹4 Cr 7,800 Corteva Inc (Basic Materials)

Equity, Since 31 Aug 24 | CTVA2% ₹4 Cr 7,300 Melrose Industries PLC (Industrials)

Equity, Since 31 Aug 24 | MRO2% ₹4 Cr 56,800 6. DSP BlackRock Global Allocation Fund

CAGR/Annualized return of 7.3% since its launch. Ranked 26 in Global category. Return for 2024 was 11.6% , 2023 was 12.8% and 2022 was -6.6% . DSP BlackRock Global Allocation Fund

Growth Launch Date 21 Aug 14 NAV (22 Apr 25) ₹21.1152 ↑ 0.03 (0.14 %) Net Assets (Cr) ₹115 on 31 Mar 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆ Risk High Expense Ratio 1.22 Sharpe Ratio 0.16 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,295 31 Mar 22 ₹13,389 31 Mar 23 ₹13,440 31 Mar 24 ₹15,520 31 Mar 25 ₹16,747 Returns for DSP BlackRock Global Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month 1.6% 3 Month -0.6% 6 Month 3.8% 1 Year 13.4% 3 Year 9.2% 5 Year 9.7% 10 Year 15 Year Since launch 7.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 11.6% 2022 12.8% 2021 -6.6% 2020 7.3% 2019 21.2% 2018 18.3% 2017 -1.3% 2016 4.9% 2015 4.4% 2014 1.7% Fund Manager information for DSP BlackRock Global Allocation Fund

Name Since Tenure Shantanu Godambe 11 Mar 25 0.06 Yr. Kaivalya Nadkarni 11 Mar 25 0.06 Yr. Data below for DSP BlackRock Global Allocation Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 8.28% Basic Materials 2.53% Industrials 2.48% Consumer Cyclical 2.17% Energy 2.14% Technology 1.59% Health Care 1.2% Utility 0.89% Communication Services 0.88% Consumer Defensive 0.83% Real Estate 0.26% Asset Allocation

Asset Class Value Cash 43.25% Equity 0.16% Debt 56.42% Other 0.17% Top Securities Holdings / Portfolio

Name Holding Value Quantity DSP Banking & PSU Debt Dir Gr

Investment Fund | -63% ₹34 Cr 14,205,721

↑ 14,205,721 DSP Arbitrage Dir Gr

Investment Fund | -35% ₹19 Cr 12,401,469

↑ 12,401,469 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹1 Cr Net Receivables/Payables

CBLO | -0% ₹0 Cr iShares $ Treasury Bd 7-10y ETF USD Acc

- | -₹0 Cr 00

↓ -503 BGF Global Allocation I2

Investment Fund | -₹0 Cr 00

↓ -67,470 7. Invesco India Feeder- Invesco Global Equity Income Fund

CAGR/Annualized return of 9.2% since its launch. Ranked 12 in Global category. Return for 2024 was 13.7% , 2023 was 27% and 2022 was -2.1% . Invesco India Feeder- Invesco Global Equity Income Fund

Growth Launch Date 5 May 14 NAV (23 Apr 25) ₹26.1764 ↑ 0.70 (2.73 %) Net Assets (Cr) ₹32 on 31 Mar 25 Category Equity - Global AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 1.4 Sharpe Ratio 0.4 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,948 31 Mar 22 ₹16,252 31 Mar 23 ₹17,927 31 Mar 24 ₹21,881 31 Mar 25 ₹24,276 Returns for Invesco India Feeder- Invesco Global Equity Income Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month -3.5% 3 Month -3.6% 6 Month -0.4% 1 Year 13.3% 3 Year 14.9% 5 Year 18.4% 10 Year 15 Year Since launch 9.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 13.7% 2022 27% 2021 -2.1% 2020 21% 2019 7.3% 2018 24.7% 2017 -7.5% 2016 13.2% 2015 2.6% 2014 4% Fund Manager information for Invesco India Feeder- Invesco Global Equity Income Fund

Name Since Tenure Sagar Gandhi 1 Mar 25 0 Yr. Data below for Invesco India Feeder- Invesco Global Equity Income Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 19.21% Financial Services 17.76% Technology 15.32% Health Care 12.74% Consumer Defensive 7.91% Consumer Cyclical 7.41% Real Estate 4.31% Basic Materials 2.96% Communication Services 2.6% Energy 1.85% Asset Allocation

Asset Class Value Cash 2.74% Equity 92.06% Other 5.2% Top Securities Holdings / Portfolio

Name Holding Value Quantity Invesco Global Equity Income C USD Acc

Investment Fund | -97% ₹30 Cr 22,652

↑ 1,625 Triparty Repo

CBLO/Reverse Repo | -3% ₹1 Cr Net Receivables / (Payables)

Net Current Assets | -1% ₹0 Cr 8. Edelweiss ASEAN Equity Off-shore Fund

CAGR/Annualized return of 7.3% since its launch. Ranked 18 in Global category. Return for 2024 was 14.5% , 2023 was -1.4% and 2022 was 4.8% . Edelweiss ASEAN Equity Off-shore Fund

Growth Launch Date 1 Jul 11 NAV (22 Apr 25) ₹26.519 ↑ 0.02 (0.07 %) Net Assets (Cr) ₹102 on 31 Mar 25 Category Equity - Global AMC Edelweiss Asset Management Limited Rating ☆☆☆ Risk High Expense Ratio 1.42 Sharpe Ratio 0.39 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,277 31 Mar 22 ₹15,371 31 Mar 23 ₹15,896 31 Mar 24 ₹15,540 31 Mar 25 ₹17,276 Returns for Edelweiss ASEAN Equity Off-shore Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 22 Apr 25 Duration Returns 1 Month -2% 3 Month -6.2% 6 Month -6.9% 1 Year 11.6% 3 Year 3.7% 5 Year 9.3% 10 Year 15 Year Since launch 7.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 14.5% 2022 -1.4% 2021 4.8% 2020 6.3% 2019 2.3% 2018 12% 2017 -2.1% 2016 21.9% 2015 9.6% 2014 -11.1% Fund Manager information for Edelweiss ASEAN Equity Off-shore Fund

Name Since Tenure Bhavesh Jain 27 Sep 19 5.51 Yr. Bharat Lahoti 1 Oct 21 3.5 Yr. Data below for Edelweiss ASEAN Equity Off-shore Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 49.18% Consumer Cyclical 10.41% Communication Services 9.24% Industrials 8.13% Real Estate 5.66% Consumer Defensive 3.33% Technology 3.25% Health Care 2.38% Utility 2.12% Energy 1.9% Basic Materials 1.88% Asset Allocation

Asset Class Value Cash 2.52% Equity 97.48% Top Securities Holdings / Portfolio

Name Holding Value Quantity JPM ASEAN Equity I (acc) USD

Investment Fund | -100% ₹102 Cr 63,262

↑ 4,488 Clearing Corporation Of India Ltd.

CBLO/Reverse Repo | -1% ₹1 Cr Net Receivables/(Payables)

CBLO | -0% ₹0 Cr Accrued Interest

CBLO | -0% ₹0 Cr

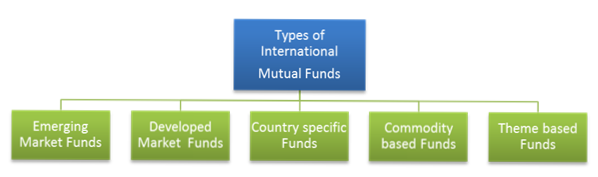

आंतरराष्ट्रीय म्युच्युअल फंडाचे प्रकार

1. इमर्जिंग मार्केट फंड

या प्रकारचा म्युच्युअल फंड भारत, चीन, रशिया, ब्राझील इत्यादी उदयोन्मुख बाजारपेठांमध्ये गुंतवणूक करतो. चीन यूएसएला मागे टाकून जगातील सर्वात मोठा कार उत्पादक बनला आहे. नैसर्गिक वायूमध्ये रशिया हा मोठा खेळाडू आहे. भारतामध्ये वेगाने वाढणारी सेवा अर्थव्यवस्था आधार आहे. येत्या काही वर्षांत या देशांची प्रचंड वाढ होण्याची अपेक्षा आहे ज्यामुळे ते गुंतवणूकदारांसाठी एक लोकप्रिय पर्याय बनतील.

बिर्ला सन लाइफ इंटरनॅशनल इक्विटी प्लॅन ए, कोटक ग्लोबल इमर्जिंग मार्केट फंड आणि प्रिन्सिपल ग्लोबल अपॉर्च्युनिटीज फंड या उदयोन्मुख बाजारपेठांमध्ये गुंतवणूक करणाऱ्या काही सर्वोत्तम आंतरराष्ट्रीय म्युच्युअल फंड योजना आहेत.

Talk to our investment specialist

2. विकसित बाजार निधी

विकसित मार्केट फंड हा एक आकर्षक पर्याय आहे कारण सर्वसाधारणपणे परिपक्व बाजार अधिक स्थिर असतात. तसेच, त्यांच्याकडे अर्थव्यवस्था किंवा अर्थव्यवस्थेतील चलन जोखीम, राजकीय अस्थिरता इत्यादीसारख्या उदयोन्मुख बाजारपेठांशी संबंधित समस्या नाहीत ज्यामुळे त्यांना कमी धोका निर्माण होतो. विकसित बाजारपेठांमध्ये गुंतवणूक करणाऱ्या काही योजना DWS ग्लोबल थीमॅटिक आहेतसुमारे निधी इ.

3. देश विशिष्ट निधी

नावाप्रमाणेच, हा प्रकार केवळ विशिष्ट देशात किंवा जगाच्या भागामध्ये गुंतवणूक करतो. परंतु, देश-विशिष्ट फंड पोर्टफोलिओमध्ये विविधता आणण्याच्या संपूर्ण उद्देशाला अपयशी ठरतात कारण ते सर्व अंडी एकाच टोपलीत घालतात. तथापि, जेव्हा विविध कारणांमुळे विशिष्ट देशांमध्ये संधी उपलब्ध होतात, तेव्हा हे फंड एक चांगला पर्याय बनतात.

रिलायन्स जपानइक्विटी फंड, कोटक यूएस इक्विटीज फंड आणिमिरे मालमत्ता चायना अॅडव्हांटेज फंड काही देश-विशिष्ट योजना आहेत.

4. कमोडिटी बेस्ड फंड

हे फंड सोने, मौल्यवान धातू, कच्चे तेल, गहू इत्यादी वस्तूंमध्ये गुंतवणूक करतात.महागाई हेज, अशा प्रकारे गुंतवणूकदारांचे संरक्षण करते. तसेच, हे फंड बहु-कमोडिटी असू शकतात किंवा एकाच कमोडिटीवर केंद्रित असू शकतात.

सर्वोत्तम कमोडिटी आधारित आंतरराष्ट्रीय म्युच्युअल फंड म्हणजे डीएसपी ब्लॅक रॉक वर्ल्ड गोल्ड फंड, आयएनजी ऑप्टिमिक्स ग्लोबल कमोडिटीज, मिरे अॅसेट ग्लोबल कमोडिटी स्टॉक्स, बिर्ला सन लाइफ कमोडिटी इक्विटीज - ग्लोबल अॅग्री फंड इ.

5. थीम आधारित निधी

थीम आधारित फंड किंवा थीमॅटिक फंड एखाद्या विशिष्ट थीममध्ये गुंतवणूक करतात. उदाहरणार्थ, जर थीम पायाभूत सुविधा असेल, तर ती पायाभूत सुविधा बांधकाम कंपन्यांमध्ये तसेच सिमेंट, स्टील इ. सारख्या पायाभूत सुविधा व्यवसायाशी संबंधित कंपन्यांमध्ये गुंतवणूक करेल.

ते बर्याचदा क्षेत्रीय निधीमध्ये गोंधळलेले असतात जे केवळ विशिष्ट उद्योगावर केंद्रित असतात. उदाहरणार्थ, फार्मास्युटिकल सेक्टोरल फंड फक्त फार्मा कंपन्यांमध्ये गुंतवणूक करतात. च्या तुलनेतक्षेत्र निधी, थीमॅटिक फंड ही एक व्यापक संकल्पना आहे. हे अधिक वैविध्य आणि कमी जोखीम देते कारण गुंतवणूक विविध उद्योगांमध्ये पसरलेली आहे.

काही थीम आधारित फंड म्हणजे DSPBR वर्ल्ड एनर्जी फंड, L&T ग्लोबल रिअल अॅसेट्स फंड इ.

आंतरराष्ट्रीय म्युच्युअल फंडात गुंतवणूक का करावी?

1. विविधीकरण

चा मुख्य हेतूगुंतवणूक आंतरराष्ट्रीय म्युच्युअल फंडामध्ये विविधता आहे. वैविध्यपूर्ण रिटर्न्स ऑप्टिमाइझ करण्यात आणि पोर्टफोलिओची एकूण जोखीम कमी करण्यात मदत करते. गुंतवणुकीमधील कमी किंवा नकारात्मक सहसंबंध हे सुनिश्चित करतात की परतावा केवळ एका क्षेत्रावर किंवा अर्थव्यवस्थेवर अवलंबून नाही. अशा प्रकारे, पोर्टफोलिओ संतुलित करणे आणि गुंतवणूकदाराचे संरक्षण करणे.

2. गुंतवणुकीत सुलभता

तुम्ही इक्विटी, कमोडिटीज, रिअल इस्टेट आणि एक्सचेंज ट्रेडेड फंड (ईटीएफ) सुद्धा. आंतरराष्ट्रीय म्युच्युअल फंडाची युनिट्स खरेदी करणे खूप सोपे आहे आणि ते फंड व्यवस्थापकाचे कौशल्य देखील प्रदान करतात जे इतर गुंतवणूकीच्या मार्गांमध्ये उपलब्ध नाही.

3. आंतरराष्ट्रीय प्रदर्शन

आंतरराष्ट्रीय म्युच्युअल फंड देशांतर्गत सीमांच्या पलीकडे गुंतवणूकदारांचे क्षितिज विस्तारण्यास मदत करतात. तसेच, आंतरराष्ट्रीय गुंतवणुकीमुळे देशांतर्गत बाजारात गुंतवणूकदाराचे होणारे नुकसान भरून काढण्यास मदत होते.

4. चलन चढउतार

आंतरराष्ट्रीय म्युच्युअल फंड योजना ठरवतातनाही (निव्वळ मालमत्ता मूल्य) प्रचलित विनिमय दर वापरून. विनिमय दर दररोज, किंवा त्याहूनही अधिक, प्रत्येक मिनिटाला चढ-उतार होतात.

याचा अर्थ यूएस डॉलर्समध्ये गुंतवणूक करणाऱ्या योजनेसाठी, डॉलर-रुपयाच्या हालचालीनुसार योजनेच्या NAV वर परिणाम होईल. रुपया जितका घसरतो तितका नफा जास्त असतो, असे निरीक्षण आहे. हे आंतरराष्ट्रीय म्युच्युअल फंड अधिक आकर्षक बनवते कारण रुपया आता खाली जात आहे.

5. देश विशिष्ट एक्सपोजर

जर गुंतवणूकदाराला दुसऱ्या देशाच्या वाढीचा संपूर्ण फायदा घ्यायचा असेल, तर आंतरराष्ट्रीय म्युच्युअल फंड हे जाण्याचा मार्ग आहे. पणफ्लिप पोर्टफोलिओ ही केवळ एका अर्थव्यवस्थेवर अवलंबून आहे. त्यामुळे धोका वाढतोघटक.

आंतरराष्ट्रीय म्युच्युअल फंडांची कर आकारणी

भारतातील आंतरराष्ट्रीय म्युच्युअल फंडांची कर उपचार पद्धती सारखीच आहेकर्ज निधी. जर गुंतवणुकदाराने अल्प मुदतीची म्हणजेच पेक्षा कमी गुंतवणूक केली असेल36 महिने, ते त्याच्या एकूण मध्ये समाविष्ट केले जातीलउत्पन्न आणि लागू स्लॅब दरानुसार कर आकारला जाईल.

जर गुंतवणूक 36 महिन्यांपेक्षा जास्त काळ ठेवली असेल, तर गुंतवणूकदार इंडेक्सेशन लाभांसाठी पात्र आहे. योजनांमधून होणारा कोणताही फायदा कर आकारला जाईल@ 10% इंडेक्सेशनशिवाय किंवा20% अनुक्रमणिका सह.

इंटरनॅशनल म्युच्युअल फंडात ऑनलाइन गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा.

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

तज्ञांच्या मते, गुंतवणूकदाराने पोर्टफोलिओपैकी सुमारे 10-12% गुंतवणूक आंतरराष्ट्रीय म्युच्युअल फंडांमध्ये केली पाहिजे. त्यामुळे आत्ताच मूलभूत गोष्टींचा अंतर्भाव करून, आजच आंतरराष्ट्रीय म्युच्युअल फंडांसह तो पोर्टफोलिओ तयार करण्यास सुरुवात करा.

वारंवार विचारले जाणारे प्रश्न

1. आंतरराष्ट्रीय म्युच्युअल फंडामध्ये गुंतवणूक करण्याचे काय फायदे आहेत?

अ: हे तुमच्या गुंतवणुकीच्या पोर्टफोलिओमध्ये वैविध्य आणते, ज्यामुळे तुम्हाला अधिक चांगले आणि वैविध्यपूर्ण परतावा मिळतो. यामुळे तुमचा पोर्टफोलिओही संतुलित राहतो. या कंपन्यांकडे परदेशी निधी असल्याने, तुम्ही तुमच्या गुंतवणुकीवर चांगला परतावा मिळण्याची अपेक्षा करू शकता.

2. भारतापेक्षा कमी वाढ करणाऱ्या कंपन्यांमध्ये मी गुंतवणूक करू शकतो का?

अ: होय, तुम्ही करू शकता, परंतु ते तुम्ही ज्या वित्तीय संस्थेमध्ये गुंतवणूक करत आहात त्यावर अवलंबून असेल. तुम्ही परदेशी कंपनीच्या रोख्यांमध्ये थेट गुंतवणूक करू शकत नाही. विशिष्ट सुरक्षिततेमध्ये गुंतवणूक करण्यात मदत करण्यासाठी तुम्हाला ब्रोकर किंवा वित्तीय संस्थेची आवश्यकता असेल.

3. फ्रँकलिन इंडिया फीडर काय आहे?

अ: फ्रँकलिन इंडिया फीडर किंवा फ्रँकलिन यूएस अपॉर्च्युनिटीज फंड हा सर्वात यशस्वी आंतरराष्ट्रीय म्युच्युअल फंडांपैकी एक आहे. हा फंड तुम्हाला युनायटेड स्टेट्समधील तंत्रज्ञान, आरोग्यसेवा, ग्राहक चक्रीय, वित्तीय सेवा आणि अशा अनेक औद्योगिक क्षेत्रांमध्ये गुंतलेल्या कंपन्यांच्या एकाधिक सिक्युरिटीजमध्ये गुंतवणूक करण्याची परवानगी देतो. हे म्युच्युअल फंड तुम्हाला तुमच्या गुंतवणुकीच्या पोर्टफोलिओमध्ये विविधता आणण्याची परवानगी देतात, ज्यामुळे एकाच गुंतवणुकीद्वारे एकाधिक सिक्युरिटीजमध्ये गुंतवणूक करणे सोपे होते. लॉन्च झाल्यापासून, फ्रँकलिन इंडिया फीडरने परतावा दिला आहे19.9%.

4. ब्लॅकरॉक वर्ल्ड मायनिंग फंड म्हणजे काय?

अ: हे फ्रँकलिनपेक्षा वेगळे आहे कारण त्यात फक्त आवश्यक साहित्य आणि आर्थिक सेवांमध्ये इक्विटी क्षेत्र आहे. हा उच्च-जोखीम असलेला म्युच्युअल फंड मानला जातो, परंतु उत्कृष्ट परतावा देण्यासाठी ओळखला जातो. दडीएसपी ब्लॅकरॉक जागतिक खाणकामाने जवळपास परतावा दिला आहे34.9% 3 वर्षांच्या गुंतवणूक कालावधीसाठी.

5. आंतरराष्ट्रीय म्युच्युअल फंडांच्या कमाईवर कर आकारला जातो का?

अ: होय,कमाई आंतरराष्ट्रीय म्युच्युअल फंडांवर कर आकारला जातो. या निधीतून तुम्ही कमावलेला लाभांश स्रोतावर कर कपात किंवा येथे TDS साठी जबाबदार आहे७.५% 31 मार्च 2021 पर्यंत, आणि म्युच्युअल फंड हाऊस ते कापतात. जर तुम्ही 3 वर्षांसाठी गुंतवणूक केली असेल, तर ती अल्प-मुदतीच्या गुंतवणुकीत येईल, आणि जर जास्त असेल, तर तुम्हाला ती दीर्घकालीन गुंतवणुकीत वर्गीकृत करावी लागेल. कर आकारणी स्लॅब देखील गुंतवणूक कोणत्या वेळेसाठी केली आहे यावर अवलंबून असेल.

6. आंतरराष्ट्रीय म्युच्युअल फंडाचा मुख्य धोका काय आहे?

अ: आंतरराष्ट्रीय म्युच्युअल फंडाची प्राथमिक जोखीम म्हणजे परकीय चलन दराचे चढउतार. रुपयाच्या तुलनेत परकीय चलन दरात चढ-उतार झाल्यास त्याचा तुमच्या गुंतवणुकीवर विपरीत परिणाम होऊ शकतो.

7. परदेशी म्युच्युअल फंडात कोणी गुंतवणूक करावी?

अ: तुम्ही तुमच्या गुंतवणुकीच्या पोर्टफोलिओमध्ये विविधता आणू इच्छित असाल आणि भौगोलिक वैविध्य जोडू इच्छित असाल, तर तुम्ही परदेशी म्युच्युअल फंडात गुंतवणूक करण्याचा विचार करू शकता.

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

Very good article I got all the required information.