Table of Contents

- Understanding Form 26QB

- Important Characteristics of Form 26QB Under Section 194-IA

- Points to Bear in Mind: Property Seller

- Points to Bear in Mind: Property Buyer

- Information Needed to Submit Form 26QB Online

- How to Fill out Form 26QB Online?

- Form 26QB Payment

- Form 26QB Download

- Penalties Associated with Form 26QB under Section 194-IA

- Conclusion

- Frequently Asked Questions (FAQs)

- 1. Is it necessary to submit the seller's PAN information?

- 2. My TAN Number is absent. How can I deduct TDS?

- 3. I bought a home and but have not deposited TDS. Now, what should I do?

- 4. Should I take TDS into account if I'm buying agricultural land?

- 5. Should I deduct TDS from the full purchase price or just the portion that exceeds the property's Rs 50 lakh value?

- 6. Is it possible to make corrections to Form 26 QB?

Understand the Basics of Form 26QB

A person must deduct TDS (Tax Deducted at Source) while paying the seller when purchasing an immovable property valued more than Rs. 50 lakhs following the rules of Section 194-IA of the income tax Act of 1961. By submitting Form 26QB, the TDS amount has to be paid within 30 days of the month's end for which TDS was deducted.

For instance, if a transaction was started on June 15, 2020, the TDS sum must be paid to the government by July 31 2020. But it's important to remember that this TDS payment and Deduction only apply if an immovable property was purchased after June 1, 2013. According to the Income Tax Act rules, filing TDS is not necessary if the formalities about the property were finished before the date. Let’s find out more about Form 26QB in this post.

Understanding Form 26QB

The Finance Bill of 2013 stipulates that TDS applies to Real Estate sales if the purchase price is Rs. 50,000 or above. According to Section 194 IA of the Income Tax Act of 1961, starting on June 1, 2013, the buyer must deduct tax at a rate of 1% when making a property payment. The buyer must get Form 26QB, whereas the seller must obtain Form 16B to pay TDS.

Important Characteristics of Form 26QB Under Section 194-IA

A few important guidelines for the sale and purchase of immovable property are outlined in the IT Act of 1961. The buyer, also called the deductor, must deduct TDS in such transactions, as covered by Section 194-IA if the transaction value is exceeding Rs. 50 lakhs. The deductor then has to provide Form 16B to the deductee.

Section 194-IA refers to a complete list of the requirements for Form 26QB. As follows:

- Following Section 194-IA, the buyer must deduct TDS when consummating the transaction at 1% of the wholesale value

- Transactions that involve agricultural Land are not subject to TDS under Section 194-IA

- For selling real estate valued at less than Rs. 50 lakhs, TDS is not applied. Beyond this threshold, TDS is applied to the overall value of the transaction. Suppose the property's cost is Rs. 52 lakhs; you have to pay TDS on Rs. 52 lakhs instead of Rs. 2 lakhs (Rs. 52 lakhs – Rs. 50 lakhs)

- TDS is proportionately subtracted from every instalment if the payment is made through instalments

- For the deduction and Deposition of TDS, the buyer does not require a Tax Deduction Account Number (TAN). However, if a TDS deduction is made via Form 26QB, the buyer and the seller must have a PAN

- The buyer has 30 days, beginning from the month's end, in which TDS was deducted for depositing TDS and submitting form 26QB

- If there are numerous purchasers and sellers, the deductor will need to submit multiple Form 26QB

- The buyer has to provide a TDS certificate to the seller before the completion 15 days after the transaction

- The buyer has to acquire Form 16B and give it to the seller

Talk to our investment specialist

Points to Bear in Mind: Property Seller

Here are some points that the property seller should bear in mind before initiating:

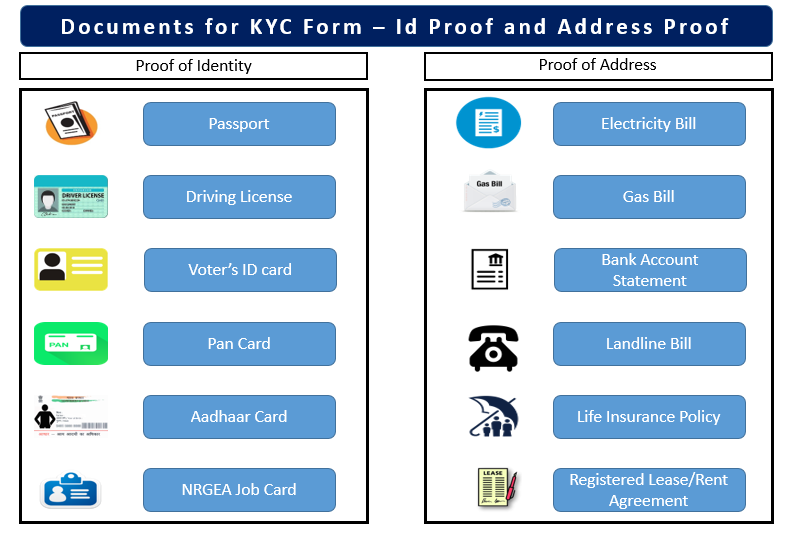

- The purchaser must have access to your PAN to give the Income Tax Department information regarding the TDS

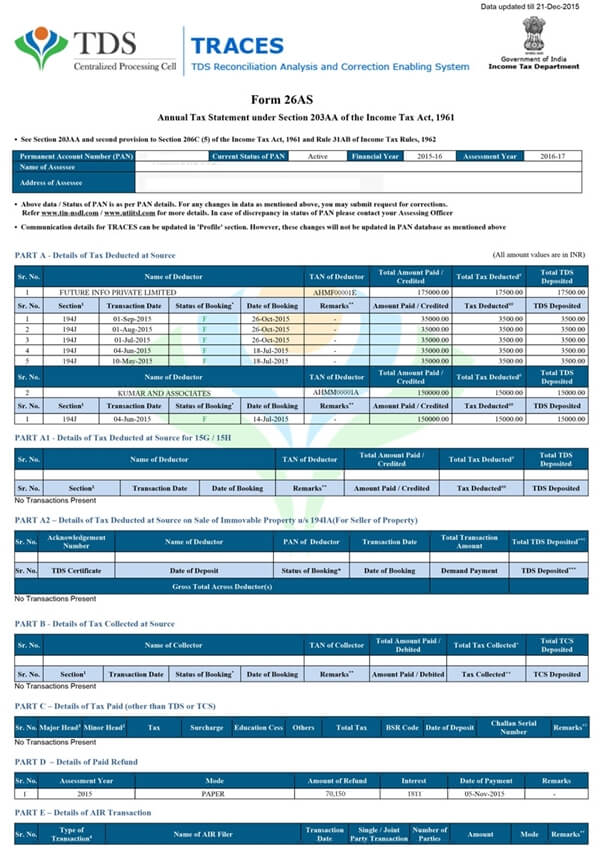

- The buyer must confirm the Taxes that have been subtracted on Form 26AS

Points to Bear in Mind: Property Buyer

Here are some points that the property buyer should bear in mind before initiating:

- The sale consideration must be reduced by tax at 1%

- It is necessary to verify and get the seller's PAN

- The online form needs the PANs for both the buyer and the vendor

- When quoting PAN information, there must be no mistakes. You must get in touch with the Income Tax Department if anything changes

Information Needed to Submit Form 26QB Online

The following details must be provided:

- The buyer and seller's PAN

- Buyer and seller's complete addresses

- Details of the buyer and seller's contacts

- Property Information

- The amount credited or paid

- Tax deposit information

How to Fill out Form 26QB Online?

Here are the steps to follow:

- Visit https://www.tin-nsdl.com/

- From the menu, hover your cursor on "Services" and click on “epayment: Pay Taxes Online"

- A new tab will open with several options

- Scroll down a bit and under "TDS on Property (Form 26QB)," select "Proceed"

- Fill out the form with the required information and submit it

- There will be a confirmation message on the screen. Following completion, you will have the options to "Print Form 26QB" and "Submit to the Bank"

- A specific acknowledgement number will be shown, which you must note down

- Then select "Print Form 26QB"

- Then, select "Submit to the bank"

- The payment must then be made through internet banking. You will be taken to the bank's payment page

- A challan with the bank name, payment information, and CIN will be displayed once the payment has been made

Form 26QB Payment

Here are some authorised banks where TDS payments can be made:

- Central Bank of India

- Bank of Maharashtra

- Bank of India

- United Bank of India

- Union Bank of India

- Bank of Baroda

- ICICI Bank

- HDFC Bank

- Corporation Bank

- UCO Bank

- Canara Bank

- State Bank of India

- Indian Overseas Bank

- Indian Bank

- IDBI Bank

- Punjab National Bank

- Punjab and Sind Bank

- Jammu and Kashmir Bank

Form 26QB Download

You can download the form here - Form 26QB

Penalties Associated with Form 26QB under Section 194-IA

It is crucial to note that failure to deduct TDS, submit Form 16B or file Form 26QB results in interest and penalties. The following are the applicable penalties:

- TDS is not deducted: 1% interest is charged as a penalty on any money not subject to TDS

- TDS not being remitted to the government: 1.5% of the amount is deducted as a penalty per month

- TDS return filing is late: There is a daily fine of Rs. 200 for Default

Conclusion

The TDS rule was implemented to maintain track of selling and purchasing real estate transactions. This was carried out because the Market in question is highly speculative, and transactions are mostly made in cash and through banking channels. Furthermore, this modification helps make it easy for the government to identify scenarios where a property is bought for less than its stamp value.

Frequently Asked Questions (FAQs)

1. Is it necessary to submit the seller's PAN information?

A: Yes, it is necessary to supply the seller's PAN information.

2. My TAN Number is absent. How can I deduct TDS?

A: To deduct TDS, the buyer does not require a Tax Collection and Deduction Account Number (TAN). The buyer and the seller must, however, provide their PAN for the transaction, which includes the deduction of TDS.

3. I bought a home and but have not deposited TDS. Now, what should I do?

A: A penalty interest of 1% is applied to the outstanding TDS amount for non-deduction of TDS. To rectify the account, you must act and pay the penalty as soon as possible. To prevent further fines, pay the TDS to the government and submit your TDS return within the allotted period.

4. Should I take TDS into account if I'm buying agricultural land?

A: No. Purchasing agricultural land exempts you from the requirement to deduct TDS under Section 194-IA.

5. Should I deduct TDS from the full purchase price or just the portion that exceeds the property's Rs 50 lakh value?

A: If the property value is greater than Rs. 50 lakhs, TDS will be applied to the total consideration amount or the stamp duty value, whichever is larger.

6. Is it possible to make corrections to Form 26 QB?

A: Corrections under 26QB are indeed feasible.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.