5 Mutual Fund Tricks You Should Know

*"People Make Investing Seem More Difficult Than it Should" - Warren Buffett*

People who make investments could relate to this quote!

Simply put, many people don't consider investing in Mutual Funds thinking that it's not their cup of tea. But, Mutual Funds are a no rocket science; if followed some parameters during the investment. Mutual funds carries certain process that helps in successful investments such as - to analyse scheme, understand investment options, build a Portfolio and select the funds.

Whether you are new to mutual fund investments or a seasoned investor, here are some of the mutual fund tricks that will help you make the most of your investments.

1. Redeem Partially

Instead of redeeming the entire amount at once, you can partially redeem whenever required. For instance, if you need INR 1 lakh for a medical emergency, and your total investment in a mutual fund is worth INR 5 lakhs, so you can withdraw only INR 1 lakh and leave the rest in the mutual fund to grow.

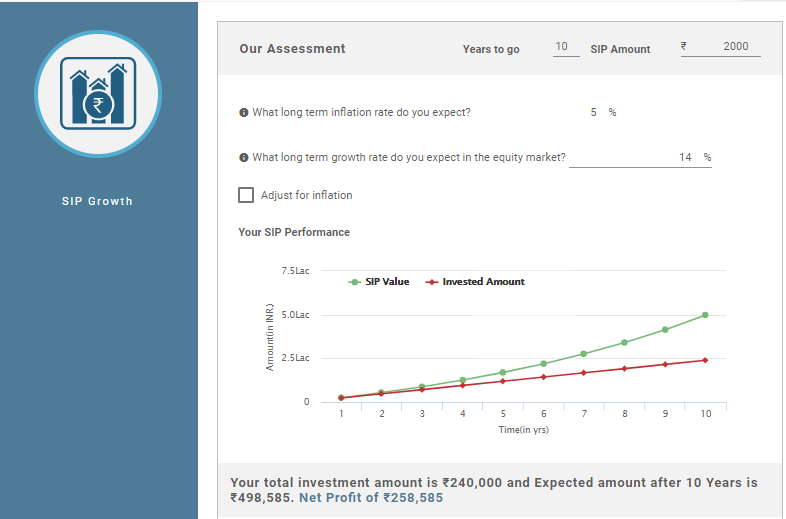

2. Increase SIP Amount

Suppose you got an appraisal or you have started another Income where you can save more money. You can increase your SIP amount, by simply starting another SIP in the same mutual fund with an increased amount.

For example, let's say that you already have an on-going SIP of INR 10,000 in a mutual fund scheme and now you want to start a SIP of INR 5000. You can start an additional SIP in the same fund of INR 5,000.

3. Make Lump Sum in Less Risky Funds

Many investors prefer making a one-time investment payment, which is known as a Lump Sum Investment in Mutual Funds. Lump sums are usually large corpus that investors want to invest to earn good returns.

So, instead of investing via a lump sum in high risky funds like equities, investors can prefer investing in less risky or no risky funds like Liquid Funds. Liquid funds are a type of Debt fund where you can earn better returns than a Bank Savings Account over a short period of time. Also, these funds are highly liquid, which means that you can redeem the funds whenever required.

Talk to our investment specialist

4. Opt for Monthly Income

Investors can earn a monthly income from mutual funds too. It is called the Systematic Withdrawal Plan or SWP. SWP is the reverse of SIP. In SWP, individuals first invest a considerable amount in a mutual fund scheme that generally carries a low level of risk. Then, they start to redeem a fixed sum of money at regular intervals as per their requirements. This way, you get a fixed monthly income while your money is still growing.

SWP is suitable for individuals who are looking for a regular source of income. In SWP, the withdrawal amount is fixed and the various intervals include monthly, quarterly, or weekly based on the individuals.

5. ELSS Can be the Best Way to Save Tax

ELSS or Equity Linked Saving Scheme is one of the best Tax Saving Scheme in the mutual fund. Investors can get up to INR 1.5 lakhs of tax deductions from their Taxable Income under Section 80C.

ELSS comes with the lowest lock-in period of three years among all other options. Since ELSS is an Equity Fund, a portion is also invested in equities, so investors can save tax and also earn returns over the period of time.

You have the tricks now! All you need to do is start investing in mutual funds and apply these tricks for a healthy portfolio.

How to Invest in Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.