Table of Contents

All About NPS Vatsalya Scheme

Union Finance Minister Nirmala Sitharaman introduced the National Pension System (NPS) Vatsalya scheme, a pension plan for minors featuring an online subscription platform. She distributed Permanent retirement Account Number (PRAN) cards to newly registered minors at the launch.

The NPS Vatsalya scheme aims to assist parents in securing their children's financial futures by leveraging the benefits of long-term compounding. Managed by the Pension Fund Regulatory and Development Authority (PFRDA), this scheme allows families to start Investing for their children from a young age with contributions as low as ₹1,000 annually. With its flexible contribution options and investment choices, NPS Vatsalya provides a pathway to build substantial savings over time, ensuring financial security as the child matures.

Applicability of the NPS Vatsalya Scheme

The NPS Vatsalya Scheme is available to all parents and guardians of minor children. Once the child turns 18, the NPS Vatsalya account will automatically convert into a standard NPS Account. This scheme extends the NPS framework to include minor children, Offering families a valuable investment option for their children's financial security and future retirement.

Features of NPS Vatsalya Scheme

Here are the main features of the NPS Vatsalya scheme:

- Open to any minor citizen (up to 18 years old).

- The pension account is opened in the minor's name and managed by the guardian.

- The minor is the sole beneficiary of the account.

NPS Vatsalya Scheme Interest Rate and Returns

Nirmala Sitharaman highlighted that the NPS has generated returns of 14% in equity, 9.1% in corporate debt, and 8.8% in government securities.

If parents contribute ₹10,000 annually for 18 years, the investment is expected to grow to approximately ₹5 lakhs by the end of this period, assuming a Return on Investment (RoR) of 10%. If the investment is maintained until the investor turns 60, the expected corpus can vary widely with different rates of return.

At a 10% RoR, the corpus could reach around ₹2.75 crores. If the Average Return increases to 11.59%—based on a typical NPS allocation of 50% in equity, 30% in corporate debt, and 20% in government securities—the expected corpus could rise to about ₹5.97 crores.

Additionally, with a higher average return of 12.86% (from a Portfolio of 75% in equity and 25% in government securities), the corpus could reach ₹11.05 crores.

Please note that these figures are illustrative, based on historical data, and actual returns may differ.

Talk to our investment specialist

Rules for Withdrawal, Exit, and Death

Based on information from the Central Bank of India’s website, the NPS Vatsalya scheme has specific guidelines for withdrawals, exits, and provisions in the event of the minor's death. Here are the key points:

Withdrawals: After a three-year lock-in period, up to 25% can be withdrawn for designated purposes such as education, medical expenses, or disability. This is limited to a maximum of three withdrawals.

Exit: When the minor turns 18, the NPS Vatsalya account automatically converts to an NPS Tier-I account under the 'All Citizen' category. In such a situation:

- If the total savings (corpus) exceed ₹2.5 lakhs, 80% must be used to purchase an annuity, while 20% can be withdrawn as a lump sum.

- If the corpus is ₹2.5 lakhs or less, the entire amount may be withdrawn as a lump sum.

Minor's Death: The entire corpus will be returned to the guardian.

How to Open an NPS Vatsalya Account?

You can open an NPS Vatsalya account either offline or online. Here’s how:

Offline Method

Parents or guardians can visit designated Points of Presence (POPs) to open the NPS Vatsalya account. These POPs include:

- Major Banks

- India Post offices

- Pension funds

NPS Vatsalya Scheme Apply Online

The account can also be opened conveniently through the e-NPS platform.

Recently, Computer Age Management Services (CAMS), a leading service provider for NPS, informed investors via SMS about the launch of the NPS Vatsalya Scheme for minors. This initiative allows you to secure your child’s future with various investment options and benefits regulated by the PFRDA.

Documents Required to Open an NPS Vatsalya Account

To open an NPS Vatsalya account, you will need the following documents:

- For the Guardian

- Proof of identity

- Proof of address

- For the Minor

- Proof of date of birth

- If the Guardian is an NRI

An NRE/NRO bank account (solo or joint) in the minor's name is required.

Investment Choices in NPS Vatsalya

Guardians have the option to choose a PFRDA-registered pension fund for the minor’s NPS Vatsalya account, with several investment options available, such as:

Default Choice

50% of investments are allocated to equities.

Auto Choice

Guardians can select from various life cycle funds:

- Aggressive LC-75: 75% in equities

- Moderate LC-50: 50% in equities

- Conservative LC-25: 25% in equities

Active Choice

Guardians can actively manage fund allocation across different categories:

- Equity: Up to 75%

- Corporate Debt: Up to 100%

- Government Securities: Up to 100%

- Alternate Assets: Up to 5%

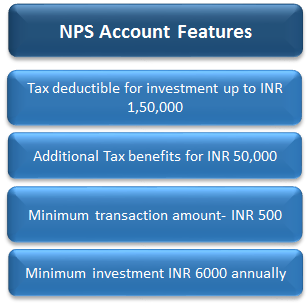

NPS Vatsalya Scheme Tax Benefit

Clarity on tax benefits for the NPS Vatsalya scheme is still pending. The information provided by the PFRDA and the finance ministry does not indicate any additional tax breaks specifically for this scheme.

Limitations of the NPS Vatsalya Scheme

Parents interested in this scheme should know the restrictions on premature and partial withdrawals. The need to access this corpus for children's education or other essential expenses can arise unexpectedly.

This aspect of the scheme could be a drawback. If the same withdrawal rules as the regular NPS apply to Vatsalya, subscribers can only withdraw up to 25% of their contributions before vesting (60 years) for significant needs like education, critical illness treatment, or purchasing a home. Withdrawals can occur three years after account opening and are limited to three times throughout the account's duration.

Benefits of the NPS Vatsalya Scheme

The NPS Vatsalya Scheme offers several advantages that encourage Financial Literacy and security for children, such as:

- The scheme helps instill savings habits in children. When they turn 18, the account can be converted into a standard NPS account, allowing them to manage it and contribute independently.

- The NPS scheme offers portability, enabling individuals to change jobs without affecting their NPS account. The NPS Vatsalya account can transition into a standard NPS account when the child reaches adulthood, continuing to grow throughout their lifetime and building a substantial retirement corpus.

- Since contributions begin while the child is still a minor, the NPS Vatsalya account accumulates significantly by retirement. Individuals can withdraw up to 60% of the accumulated amount at retirement.

- Upon reaching adulthood, the NPS Vatsalya account converts to a standard NPS account, allowing the child to benefit from potentially high returns that support a comfortable retirement. They must allocate 40% of the corpus to an annuity plan, ensuring a steady Income during retirement.

- Opening the NPS Vatsalya account when the child is a minor emphasises the importance of early savings, motivating them to invest early to maximise returns.

- The scheme promotes responsible financial management from a young age. Children learn to contribute and manage their finances effectively as the NPS Vatsalya account transitions to a standard account at 18.

- The NPS Vatsalya Scheme provides families a structured way to secure their children's financial future, making it a valuable tool for building a retirement corpus and ensuring long-term stability.

10-Year Return Calculation: NPS Vatsalya vs Mutual Funds

| Parameter | NPS Vatsalya Scheme (9%) | Mutual Funds (Equity) (14%) |

|---|---|---|

| Initial Investment | ₹50,000 | ₹50,000 |

| Annual Contribution | ₹10,000 per year | ₹10,000 per year |

| Total Investment | ₹1,50,000 | ₹1,50,000 |

| Estimated Returns (p.a.) | 9% | 14% |

| Corpus after 10 years | ₹2,48,849 | ₹3,13,711 |

This table simplifies the comparison of investment growth over 10 years, showing how higher equity exposure in mutual funds leads to a larger corpus compared to the moderate return in the NPS Vatsalya Scheme.

Conclusion

The NPS Vatsalya Scheme presents a valuable opportunity for parents and guardians to secure their children's financial future from an early age. By promoting savings habits and financial literacy, this scheme helps accumulate a substantial retirement corpus and encourages responsible money management as children transition into adulthood. With the flexibility of converting the account to a standard NPS account upon reaching 18, families can ensure that their children benefit from long-term investments and potentially significant returns. Overall, the NPS Vatsalya Scheme is an effective tool for fostering financial security and stability, laying the foundation for a comfortable retirement for the next generation.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.