What are NRI Bonds?

The Indian debt Market is one of Asia's largest debt markets, Offering guaranteed returns. No doubt, Non-Resident Indians (NRIs) from all over the world are always looking for good investment opportunities in the country.

They invest for a variety of reasons, including to provide financial security to their families. Some people want to make a lot of money, while others seek to diversify their financial portfolios.

While the majority of them invest in Mutual Funds, direct equities, and real estate, many of them are also interested in debt markets, especially government Bonds. However, NRI bonds are always the perfect choice for NRIs. This article goes through all the aspects that one needs to know about NRI bonds.

What are NRI Bonds?

NRI bonds are government securities in the form of bonds issued by the Reserve Bank of India (RBI) to NRIs who want to invest their money in the country. These securities are available to users through a separate route known as the 'Fully Accessible Route.'

As these bonds offer better yields than other similar investments, they can be utilised to attract money when other local assets Fail to pique international investors' interest. As of April 1, 2020, NRIs would be able to invest in government bonds in India without a maximum limit. The procedures and requirements for Investing in bonds are the same for both NRIs and OCIs (overseas citizens of India).

Types of Bonds

From FY 20-21, NRIs are able to invest in bonds with maturities of 5, 10, and 30 years. However, the RBI has the authority to issue new guidelines at any time. Having said that, NRIs can consider investing in the following categories of bonds:

Debt Mutual Funds

Through debt mutual fund, NRIs ensure obtaining fixed interest. After submitting the Foreign Account Tax Compliance Act (FATCA) declaration, NRIs are eligible to invest these funds. An investment is made through funds from a Non-Resident External Account (NRE) or Non-Resident Ordinary Account (NRO) account.

Talk to our investment specialist

Non-Convertible Debentures

The NCDs are tradable and redeemable corporate bonds. They are long-term investment options and debt securities. The mature phase might be anywhere between 1-20 years

Capital Bonds and Public Sector Units

The investors do not receive any tax benefits from these bonds, but the interest they earn is tax-free under section 10 (15) (IV) (h). NRIs can deduct their investment in REC and NHAI Capital Gain Bonds under Section 54 EC. The duration of these bonds is three years

Bharat Bond Exchange-Traded Fund (ETF) & Funds of Funds (FOF)

The Bharat Bond ETF & FOF invest in AAA-rated bonds issued by public sector companies and other government agencies. NRIs are highly interested in Bharat Bond ETF & FOF since they are safe, low-cost, and give better returns. Bharat Bond ETF blends maturity with the advantages of an ETF

RBI NRI Bonds

Through the Reserve Bank of India, NRIs can now invest in Government of India securities (G-sec). These are long-term investments. The time Range of this bond is 5 to 40 years. Depending upon the tenure, NRI bonds' interest rates range from 6.18%-7.72%.

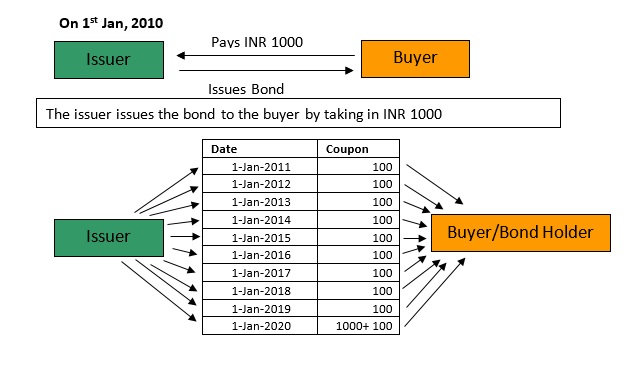

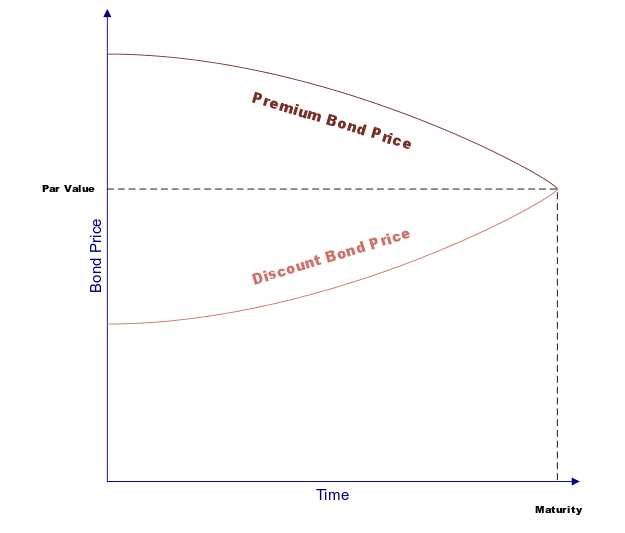

The trading of bonds yields a set return, known as the 'coupon rate' or 'interest rate.' The interest rate might be either fixed or variable. However, NRIs are not allowed to invest in Floating Rate Bonds.

Benefits for NRIs on Investing in NRI Bonds

Here is the list of benefits NRIs enjoy while investing in government securities apart from high returns:

Secure Option

These bonds are safe and risk-free with a cautious and secure transaction, which is a significant benefit.

Flexible Tenure

They provide NRIs with a wide range of tenure options, ranging from 91 days (3 months) to 41 years.

Diverse Portfolio

Investing in NRI bonds will diversify an NRI's Portfolio, lowering overall risk.

Repatriable

NRIs typically seek to invest in plans that allow them to repatriate their gains. Bonds are a good way to repatriate all of your profits.

High Liquidity

These bonds can be sold on the secondary market in the event of a cash shortage. It can also be used as security to borrow money on the Open Market

Can NRIs Invest in Bonds in India?

Government-issued bonds were not completely available for NRIs until April 2020. However, this changed after the Reserve Bank of India established a distinct route known as the 'Fully Accessible Route' (FAR), via which NRIs can invest in specific government securities without any restrictions.

The Indian government provides marketable securities with an interest or coupon rate. Treasury bills and bonds have maturities ranging from 90 days to several years. Government Securities (G-Secs) are considered safe investments since the interest and principal amounts are guaranteed by the government.

Procedure to Invest in NRI Bonds

When the issuer makes the bonds available for purchase, the subscription period is restricted. Some of the most popular bonds may be oversubscribed in a matter of days, forcing the offer to close to new subscribers. As a result, NRI investors have a very short window to purchase these bonds. NRIs can subscribe to it either through an online brokerage platform or by giving a Power of Attorney (PoA) to a trusted person who can apply on their behalf in person.

Both repatriable and non-repatriable bonds are available in the Indian debt market for NRIs. Bonds can be purchased by NRIs using both NRE and NRO accounts.

Repatriable Basis

If applying online, applications must be made from a Demat account that is connected to an NRE account. Physical applications should be submitted with rupee-denominated cheques or bank drafts drawn on an NRE account.

Non-Repatriable Basis

If applying online, you must use a DEMAT account that is linked to an NRO account. Physical applications should be submitted with rupee-denominated cheques or bank drafts drawn on an NRO account.

Key Conditions to be Noted while Buying NRI Bonds

The following are the terms and conditions for buying with repatriation or without repatriation:

- NRI/OCB investments in any listed Indian company's equity or preference shares, as well as convertible Debentures, should not exceed 5% of the company's total paid-up equity or preference Capital

- It also shouldn't be more than 5% of the total paid-up value of any convertible Debenture series it issues. The shares or convertible debentures acquired and sold under this plan are delivered to NRIs/OCBs

- The RBI's general authorisation to invest in non-repatriable funds will be valid for five years. After this, approved dealers can renew their authorisation for another five years

- NRIs/OCBs will be able to invest in shares/debentures if they do so through the Stock Exchange or a Reserve Bank-approved designated branch

Taxation Policy

Unless the bonds are designated as "tax-free," Earnings from the sale of the bonds or interest received on them are taxable under the income tax Act of 1961. Since NRIs are permitted to invest in government securities, debentures, and listed non-convertible debentures, the Tax Rate varies depending on the kind of investment and the holding term.

Long-Term Capital Gains Tax on the Sale of Equity Shares

Equities shares or equity-oriented Mutual Funds are held for more than one year. When these instruments are sold, the gain on sale will be taxed at a rate of 10% if the gain is higher than Rs. 1 lakh.

If Securities Transaction Tax (STT) is paid to purchase and sell equity shares, the gain on sale is excluded from tax if it is less than Rs. 1 lakh. On the selling of units of equity-oriented mutual funds, STT is needed to be paid.

Short-Term Capital Gains Tax on the Sale of Equity Shares

When equities shares and equity-oriented mutual funds are sold before the end of the 12-month period, a short-term capital gain is realised. If STT is paid, the short-term capital gain is 15% taxed.

Note: NRIs can also avoid Taxes by investing in a variety of tax-free bonds in India.

Wrapping Up

India is a thriving country with a fast-expanding Economy that offers its residents several investment prospects. NRIs are also entitled to participate in a variety of government-sponsored schemes that are both beneficial and simple to implement. The Indian debt market, which is one of Asia's largest, offers guaranteed profits. Investing in NRI Bonds is one of the finest solutions for NRIs when evaluating other possibilities.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.