Table of Contents

Management Fee

What is a Management Fee?

The management fee definition refers to the amount charged by the money manager for managing the investment account of an individual or institutional investor. This fee is used to compensate the fund manager for spending their time and efforts on handling the investment accounts, providing the investor with financial advice, selecting the most suitable stocks, researching the companies, and completing the investment deal on behalf of the investor.

The manager could charge a fixed price annually or add the administration and other management expenses to the total price. Either way, the investor is supposed to pay the annual fee to the fund manager for handling the investment accounts.

What Management Fee do the Money managers Charge?

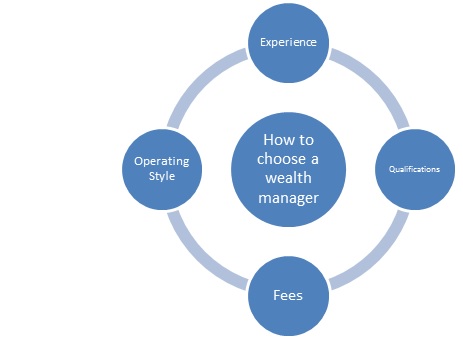

Nowadays, many high Net worth investors hire a professional money manager. Note that the manager has the right to make investment decisions on behalf of the investor. As long as their decision is in line with the investor’s objectives, the money manager can trade stocks without having to get the investor’s approval. The fee charged to the investor could vary from manager to manager. However, it is mostly calculated based on the assets under management. Managers charge a Flat fee of 1-2 percent on the AUM.

Some managers accept a 0.5% fee on AUM, while others charge a fee up to 2 percent. The difference between the fees is mainly due to the investment method the money manager uses. The more active the money manager is, the higher the fee they will charge. If you are looking for a money manager who will actively manage your account by using the lucrative investment opportunities, then they will charge a higher management fee. The index and Mutual Fund managers, on the other hand, do not have to do a lot of trading. So, they charge a reasonable fee.

Talk to our investment specialist

Active and Passive Fund Managers

Active fund managers research the company and track the past performances of the stock to figure out its potential. They make an investment in the stocks that are highly likely to outperform the stock and equity Market. While there are many ways you can predict stock movements, there is a slim chance your prediction will be accurate. With that being said, even the active fund managers cannot guarantee a successful investment Portfolio. However, they have the experience to diversify your portfolio and mitigate the risks from a single investment. Note that no investor or money manager can outperform the stock market for longer periods unless it happens by chance.

If research is to be believed, then active money managers tend to Underperform passive managers. That’s not because there is a flaw in their investment strategies, but it is the law of arithmetic that makes it a bit challenging for the active fund manager to beat the stock market. hedge fund managers charge a high fee. Their rates are fixed, i.e. 2% on the assets under management and 20% fee on the profits earned. The fee can cost thousands of dollars to investors annually.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.