Fincash » Credit Score Ranges » Credit Score Vs Credit Remarks

Table of Contents

- What is a credit score in India?

- What is a good credit score in India?

- How to check your credit score in India?

- What is a credit remark?

- How are credit remarks added to your credit report?

- What does "remark removed from account'' mean on a credit report?

- How to improve your credit score in India?

- Conclusion

- Frequently Asked Questions (FAQs)

Difference Between Credit Score and Credit Remarks

Your Credit Score and credit remarks are two important factors that impact your financial health.

While a credit score is a numerical representation of your creditworthiness,credit remarks provide additional information about your credit history. In this article, we will explore the meaning of credit scores and credit remarks, how they are calculated, and their impact on your financial health in India. You will also know how you can dispute credit remarks and Improve your Credit Score in India.

What is a credit score in India?

In India, a credit score is a three-digit number representing your creditworthiness. It is calculated based on your credit history, which includes your:

- Payment history

- Credit utilisation

- Length of credit history

- Types of credit

- Recent credit inquiries

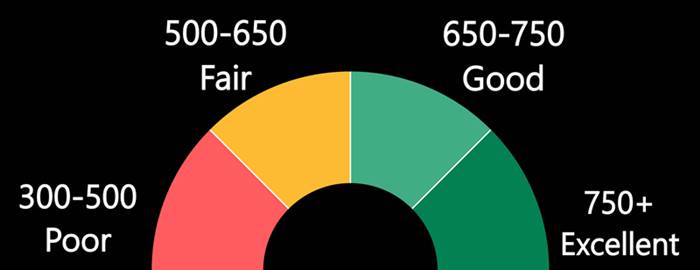

The CIBIL Score, which can vary from 300 to 900, is the most widely used credit scoring model. In India, a higher credit score denotes a lesser credit risk, which increases your chances of being authorised for credit and receiving preferential terms and interest rates.

What is a good credit score in India?

A credit score of 750 or higher in India is generally regarded as excellent. Those with credit scores under 750 may find it difficult to obtain credit or may be charged higher interest rates. Credit score requirements in India may vary from one lender to the next depending on the lender's risk tolerance and strategic goals.

How to check your credit score in India?

You can check your credit score for free through various online platforms like CIBIL, Experian, or Equifax. These platforms provide your credit score and Credit Report, which shows your credit history, outstanding debts, and credit inquiries. Reviewing your credit report regularly to ensure its accuracy and identify any errors or fraudulent activities is important. You can also request a free credit report from each credit bureau once a year in India.

Talk to our investment specialist

What is a credit remark?

A credit remark in India is a notation on your credit report that provides additional information about your credit history. Depending on the context, it can be positive, negative, or neutral. For example, a positive credit remark may indicate that you have paid off a loan or have a long credit history. A negative credit remark may indicate that you have missed a payment, defaulted on a loan, or have a high debt-to-Income ratio. A neutral credit remark may indicate that you have applied for credit, but there is no significant impact on your creditworthiness in India.

How are credit remarks added to your credit report?

Credit remarks can be added to your credit report by lenders, creditors, or collection agencies in India. They may report your payment history, delinquencies, charge-offs, collections, or other activities that affect your creditworthiness. The credit remarks are then compiled by the Credit Bureaus and included in your credit report. It is important to note that credit remarks can stay on your credit report for up to seven years, depending on the type of remark.

What does "remark removed from account'' mean on a credit report?

"Remark removed from account" on a credit report means a previously reported remark or comment regarding the user's credit account has been removed. If a remark has been removed from an account, it could indicate that the information was incorrect or outdated and has been corrected or updated. It could also mean the user has successfully disputed the remark with the credit bureau or the creditor who reported it.

Removing a negative remark from a credit report can have a positive impact on the user's credit score and creditworthiness, as it eliminates any negative information that may have been affecting their credit. It is essential to regularly check credit reports for any inaccuracies or incorrect information and take steps to correct them to maintain a Good Credit history.

How to improve your credit score in India?

Here are some steps you can take to improve your credit score in India:

Pay your bills on time: Your payment history is the most crucial Factor in your credit score. To improve your credit score, you should pay all your bills on time, including credit card bills, loan payments, and utility bills

Reduce your debt-to-income ratio: Your debt-to-income ratio is the amount of debt you have compared to your income. To improve your credit score, you should try to reduce your debt-to-income ratio by paying off your debts or increasing your income

Use credit wisely: You should use credit responsibly and avoid maxing out your credit cards or taking on too much debt. It is a good idea to have a mix of credit types, such as credit cards, personal loans, and secured loans

Monitor your credit report: You should monitor your credit report regularly to ensure its accuracy and identify any errors or fraudulent activities. You can also set up alerts to get notified of any changes to your credit report

Limit credit inquiries: Too many credit inquiries can lower your credit score. To improve your credit score, you should limit the number of credit inquiries and only apply for credit when necessary

Conclusion

In the end, a good credit score can help you get credit and get better terms and interest rates. Credit remarks add to your credit history and can have an effect on how creditworthy you are. Pay your bills on time, reduce your debt-to-income ratio, use credit wisely, keep an eye on your credit report, and limit the number of credit inquiries you make. If you find mistakes or wrong information on your credit report, you can ask the credit bureaus in India to change or remove it. By doing these things, you can get better credit and reach your Financial goals.

Frequently Asked Questions (FAQs)

1. How is credit score calculated in India?

A: The factors that are used to calculate a credit score in India include:

Payment history: This includes the user's track record of paying bills and loans on time. Late payments or defaults can negatively impact the credit score.

Credit utilisation: This is the amount of credit that the user has used compared to the total credit available. High credit utilisation can indicate a higher risk of Default, which can lower the credit score

Length of credit history: This includes the user's credit accounts and their duration. A longer credit history can indicate greater creditworthiness and stability

Credit mix: This includes the types of credit accounts the user has, such as credit cards, loans, and mortgages. A mix of credit types can demonstrate responsible credit behaviour and can positively impact the credit score

Recent credit inquiries: This includes the number of times the user has applied for credit recently. Multiple inquiries can indicate a higher risk of default, which can lower the credit score

Credit bureaus use complex algorithms to analyse these factors and generate a credit score for each user. The credit score is updated periodically based on the user's credit behaviour and history.

2. How often should I check my credit score?

A: It is recommended to check your credit score at least once a year or before applying for a major loan or credit card. However, you can also check your credit score more frequently, as some credit monitoring services provide free access to credit scores and reports on a regular Basis.

3. What is the difference between credit score and CIBIL score?

A: CIBIL score is a type of credit score specifically provided by the credit bureau CIBIL. A credit score is a more general term used to refer to any numerical representation of an individual's creditworthiness.

4. How to calculate the credit scores for loans?

A: Credit scores are not explicitly calculated for loans. Instead, credit scores are calculated by credit bureaus based on a user's credit history and financial behaviour, which is then used by lenders to evaluate creditworthiness for various types of loans. The factors that impact a user's credit score for a Home Loan are the same as those for any other kind of loan, such as payment history, credit utilisation, length of credit history, credit mix, and recent credit inquiries.

5. Will credit remarks impact my loan?

A: Yes, credit remarks can potentially impact your ability to get approved for a loan, as they indicate negative financial behaviour or risks to the lender. Lenders may view credit remarks as red flags and may be more hesitant to approve a loan or may offer less favourable terms and higher interest rates. It is essential to monitor your credit report regularly and address any credit remarks or inaccuracies to maintain a good credit history and increase your chances of loan approval.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.