Table of Contents

Experian Credit Score- An Overview

A credit information report plays an important role when you apply for credits like a loan, credit card, etc. Lenders rely on this report to check how responsible you are as a borrower. Experian is one among the SEBI and RBI approved credit bureau in India.

The Experian Credit Information Report is a collection of information like credit history, credit lines, payments, identity information, etc.

Experian Credit Report

The Credit Report includes all the records for any consumer, such as payment history, type of borrowing, outstanding balance, Default payments (if any), etc. The report also covers the lender enquiry information. Furthermore, it also shows how many times you have made inquiries about credit.

What does Experian Credit Score Mean?

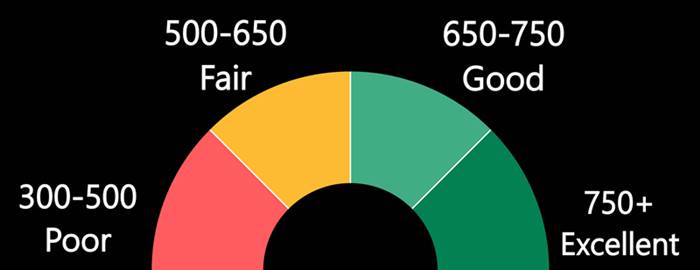

The Credit Score is a three-digit score that represents the entire Experian credit report. Here's what the scores represent-

| Score Range | Score meaning |

|---|---|

| 300-579 | Very poor score |

| 580-669 | Fair score |

| 670-739 | Good score |

| 740-799 | Very good score |

| 800-850 | Exceptional score |

Ideally, the higher the score, the better new credit Facility you’ll get. Lower scores may not offer you the most favourable offers. In fact, with a poor score, you may not even get a loan or credit card approval.

How to get your Free Experian Credit Report?

You can get your credit report from Credit Bureaus like Experian. You are entitled to one free credit report from other three RBI-registered credit bureaus- CRIF, CIBIL Score & Equifax every 12 months.

Check credit score

What is Experian Report Number (ERN)?

ERN is a unique 15 digit number recorded on every credit information report by Experian. This is used as a Reference Number to validate your information.

Whenever you have a communication with Experian, you will need to provide your ERN. In case, if you have lost your credit report, you’ll have to apply for a new credit report with a fresh ERN.

How is the Experian Credit Score Beneficial?

Your credit score will tell you how likely you’ll get loan and credit card approval. Experian compiles all your credit-related information and prepares credit report that helps lenders understand your creditworthiness.

If you are planning to apply for a loan or want to increase the limit of your credit card then you should first check your scores. If they are low, then first work on building your score up and postpone your borrowing plans until the score gets better.

How to Improve the Experian Credit Score?

Pay on time

Always pay on time. Delayed payments have a huge effect on your scores. Set reminders for your monthly payment or opt for auto-debit option.

Monitor your credit report

Check for errors in your credit report. Your score might not be improving because of some wrong information in the report.

Stick to 30-40% of credit utilization

If you exceed this limit, lenders would consider this as ‘credit hungry’ behaviour and may not lend you money in the future.

Avoid unnecessary credit inquiry

Every time you enquire about a loan or credit card, lenders pull out your credit report and this lowers your score on a temporary Basis. Too many hard inquiries can hamper credit score. Also, these inquiries remain on your credit report for two years. Therefore, apply only when it is needed.

Don't close your old accounts

Ensure you keep your old credit cards active. It is a smart strategy, because closing old accounts may increase your credit utilization ratio. Also, when you close an old card, you wipe off that particular credit history, which again may hamper your score.

Conclusion

The credit score is one of the important parameters of your financial life. The higher it is, the better your purchasing power. Get your free credit score check, and start building it strong.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.