Table of Contents

ICICI Net Banking - Managing Money was Never this Simple & Quick Before!

ICICI net banking brings to you a wide Range of options for online banking transactions along with a plethora of exciting and convenient features. With ICICI internet banking solutions, long queues and inappreciable delays can be now averted.

It is a safe and user-friendly platform for carrying out banking transactions online. ICICI Bank login is quite easy on its portal.

Steps for ICICI Internet Banking Registration

- You need to log in to the official website of ICICI Bank (www[dot]icicibank[dot]com) and click on “New User” under “Personal Banking”.

- Click on the option “I want my User ID” and hit the “Click here to proceed” link.

- Then enter the account number along with the Debit Card/credit card number or registered mobile number.

- Post that, you will need to enter the OTP, sent to your registered mobile number. After that, the user ID will be generated.

- Now, you will have to again go to the home page of ICICI bank and click on “New User” under “Personal Banking”.

- Press the button “I want my password” and then the “Click here to proceed” link.

- Now, you just have to enter the registered mobile number and the generated user ID.

- Again you will get an OTP, that you have to enter and set the password.

- After that, your registration process will be finished and you can enter your credentials for ICICI Bank Login.

Benefits of ICICI Net Banking

- Get a whole host of banking services at your fingertips. You can effortlessly and promptly carry out banking transactions, check balances and track your transactions, sitting anywhere in the world.

- Paying bills, opening fixed and recurring deposits are just a touch away. You can choose to pay bills, manage your billers and use the “Quick Pay” function to make payments quicker. Also, those who can’t remember payment dates can set reminders for the same.

- ICICI Net Banking is completely safe and therefore you don’t need to worry about the security of the information and data you are providing. It is backed by a multi-level security system that keeps your crucial data safe.

- The banking portal is quite easy to use and can be accessed on smartphones, through which you can make payments, check account information and access a whole range of services. You can visit m[dot]icicibank[dot]com, if using a mobile browser.

Talk to our investment specialist

ICICI Corporate Net Banking or Corporate Internet Banking (CIB)

Corporate Internet Banking (CIB) is an award-winning feature of ICICI Bank. With this, one can carry out numerous financial transactions, merely sitting at the office. Immensely reducing paperwork, it offers an efficient and economical option for corporate banking transactions. Today, banking operations are substantially faster and safer with the availability of features like this. Also, ICICI CIB accelerates the Efficiency of the associated organizations. Therefore, corporates can now pay more attention to the growth graph than mere banking matters.

Advantages of ICICI Corporate Net Banking

- Shows account balance on a real-time Basis.

- Provides six formats of account statements for downloading purposes. Allows you to subscribe to the account statement by email.

- Allows you to request a cheque book and stop payment of cheque online.

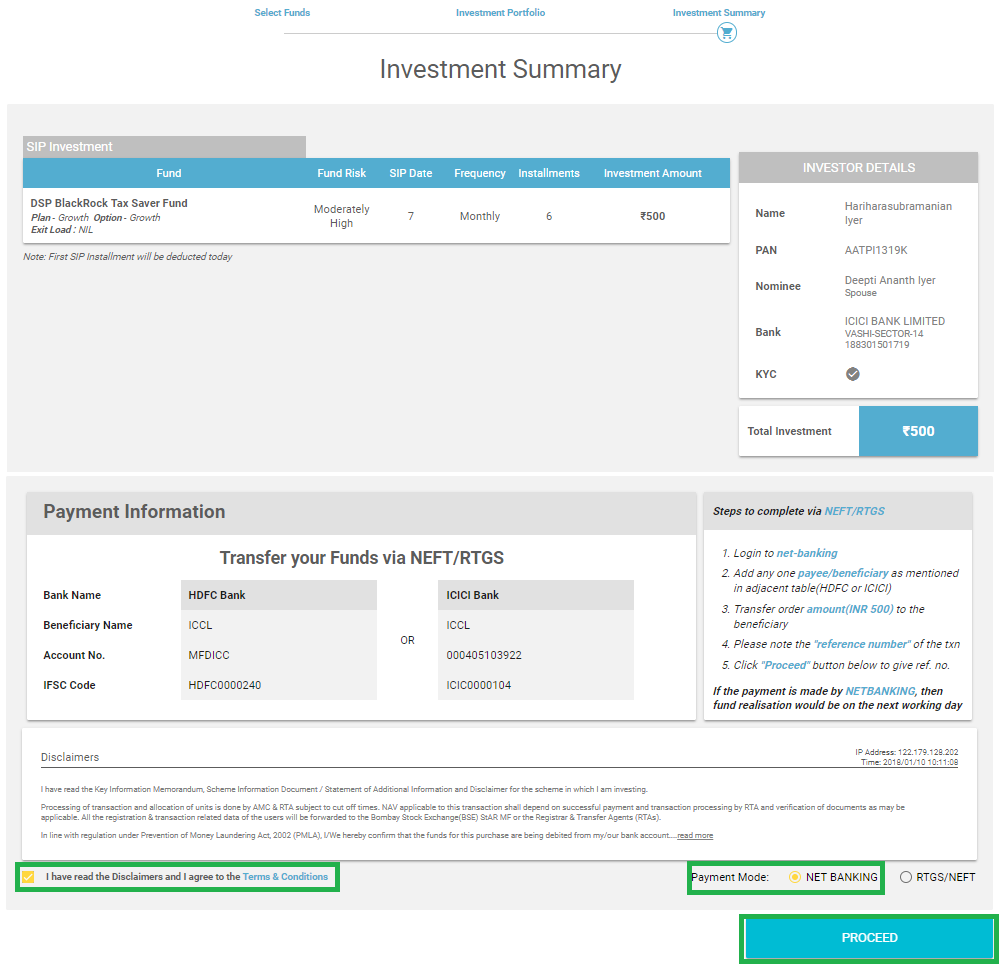

- Permits you to open Fixed Deposits(FD) and Trade MIS online. Also, allows you to pay tax, transfer funds to your other accounts and channel partners online. NEFT and RTGS transfers can also be done using ICICI net banking.

- Utility bill payments can be done to more than 302 registered billers.

- ICICI net banking offers current account management, Cash Management and global trade services.

- It offers separate login and transaction passwords for double security. With a secured socket layer comprising 128-bit encryption, it grants access only after authorization.

- One-to-one fund transfer can be done to the ICICI Bank account and other bank accounts.

- To effortlessly transfer funds to multiple beneficiaries, you can use the “Bulk File Upload” feature through CIB of ICICI Bank.

- It supports multi level approvals, with the help of which, you can create layers of approvals as per the company’s requirements. The transaction will be processed only after the final approver gives a green signal.

- The IMPS Facility, under ICICI CIB, can be used to transfer funds 24x7. For a higher amount,

NEFT (8 AM - 6.30 PM)andRTGS (8.15 AM - 4.15 PM)can be used fromMonday to Saturday (except the 2nd and 4th Saturday).

Process to Avail ICICI CIB

- Firstly, you need to have a current account with ICICI Bank.

- You have to register by filling up the registration form for corporate internet banking with the ICICI Bank branch.

- The bank will issue the corporate ID, user ID and sign-in password after thoroughly authenticating.

- With the user ID and password, you can log in to the net banking website icicibank.com.

ICICI Infinity-Internet Banking

Launched by the Industrial Credit and Investment Corporation of India's ICICI Bank, the 'Infinity-Internet Banking' service allows the bank to provide the 'Internet' as a banking channel for retail and corporate customers. To establish the 'Infinity-Internet Banking', Infosys Technologies Limited has provided ICICI with the software-Bankaway.

As of January 1997, 1240 retail banking sites were on the internet, out of which, approximately 151 are in the Asia-Pacific-Japan region. The banking site of ICICI will be now added to the select group. Infinity-Internet Banking is expected to be implemented in three phases.

The first phase will show a demo version of the software on the website of the bank. The demo will guide the users through the main features of Infinity-Internet Banking. Also, it will allow users to share improvement ideas, which will be considered while developing the later versions.

The second phase will offer services like account statements, information and balances. Also, transactions can be tracked and a cheque book can be issued in the second phase. The third phase will offer services like fund transfers, standing instructions, DD issue, opening FD, intimation of loss of ATM cards etc.

Benefits of ICICI Infinity-Internet Banking

- Through Infinity, one can access their accounts 24 hours a day, throughout the year, irrespective of the location he/she is currently in.

- It denies unauthorized access through the multi-layered security system that comprises firewalls, encryption, filtering routers and digital certifications.

- The software ‘Bankaway’ is extremely user-friendly and offers extensive online help to those who are not technologically sound. Therefore, the software can be easily used by a layman.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.