Table of Contents

Registering to Kotak Mahindra Mobile Banking App

The Kotak mobile banking app is a new way to manage all your banking needs at the tip of your fingers. While managing your transactions, you can access a Range of services through the app.

How to Download Kotak Mahindra Bank App?

Kotak Mahindra mobile banking app called ‘Kotak-811 and Mobile Banking’ is available both on Google Play Store and Apple Store.

Step 1: Go to Google Play Store or Apple Store to download ‘Kotak-811 & Mobile Banking’ app. You can also download the app from app[dot]kotak[dot]com. Or, SMS 'Mobile' to 9971056767/5676788 to receive the link on your registered mobile number.

Step 2: Open the app on the phone and enter your CRN (Customer Relationship Number). Then click the ‘submit’ tab.

Step 3: CRN is found on the lower section of your debut or credit card. Enter the details on the app to confirm identity.

Step 4: Put in a 6-digit MPIN and then re-type and confirm.

Step 5: Enter the activation code you have received on your registered mobile number. Click Submit.

Features of Kotak Mobile Banking App

1. Kotak 811

You can open a zero balance Kotak 811 Savings Account within 5 minutes and access your virtual Debit Card as an 811 customer. Also, one can add money to the 811 accounts and also book a KYC appointment.

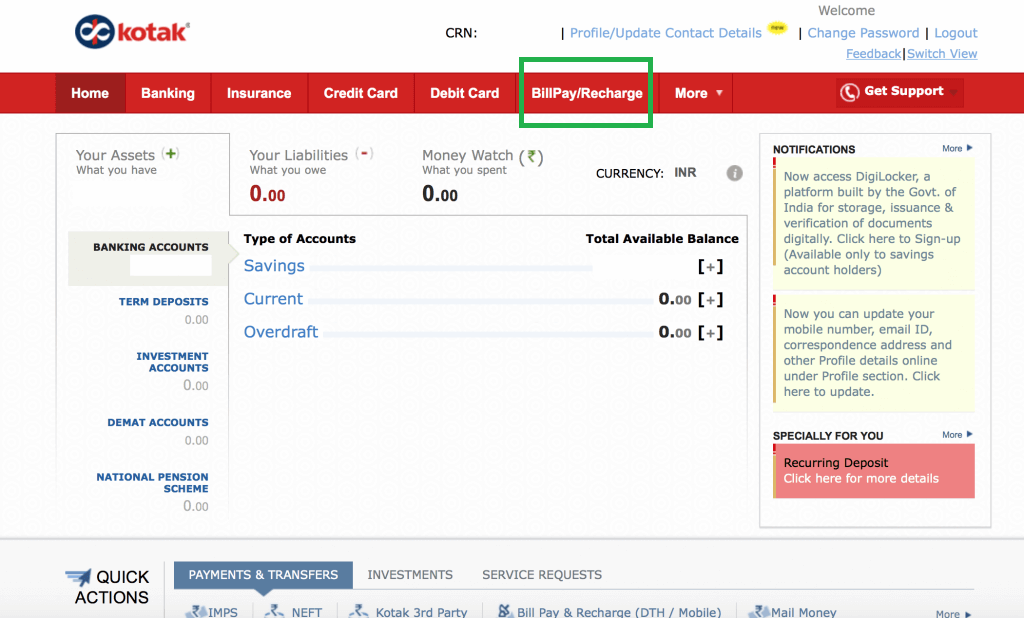

2. Banking Features

If you are a customer with the Bank, you can check your savings and current accounts along with viewing past transactions. You can review your account and request for an account statement. The app also gives an option to open a Term Deposit account and Recurring deposit account. You can conduct a premature withdrawal of both FD and RD.

Furthermore, you can view and modify MMID and check account balance through virtual assistants like SIRI and Google assistants.

3. Transactions

The app allows you to pay and transfer money with ease. Account holder can add a beneficiary for fund transfer and modify registered beneficiary. The app allows you to search a registered beneficiary and also select favourites while editing transaction limits for the beneficiary. You can also activate or deactivate a beneficiary.

Another option available is - One Time Transfer Facility, which allows you to transfer funds without registering beneficiary. You can repeat past debit transactions through a special ‘repeat’ feature available in the app.

Customers of Kotak can send money to the concerned person through the Pay feature. There is a special option available with people transferring money from Kotak to Kotak account. You can also opt for NEFT and RTGS fund transfer.

The app features to view and manage scheduled payments and send the Receipt along with scan and pay feature. It offers a UPI feature where you can send and receive money without entering bank information. You can modify UPI ID and create, accept, revoke and modify UPI mandate.

Talk to our investment specialist

4. Payment and Recharges

Account holders can pay all their bills with just one tap through the app. Make regular payments to all your registered billers, recharge your mobile phones, DTH recharges and pay electricity bills. You can also pay your credit card due and landline bill, insurance payments, Mutual Funds payment, property tax payment, water bill, gas bill, magazine subscription and rent through the app.

5. Credit Card Features

The app offers features through which you can pay your credit card bills and also view your past billed and unbilled statements. You can make a Balance Transfer on EMIs and pay your outstanding EMIs. Check your Redemption history and also get various coupons and rewards on your credit card.

6. Mutual Fund Investments

The app brings great ease in managing your mutual fund investments. You invest, redeem and also keep a track of your investments - all in one place through the Kotak Mahindra banking app.

You can get the latest NAV report, check your transaction requests and also cancel the request.

7. KayMall

The Kotak mobile banking app offers KayMall features, wherein you can book domestic and international flight tickets and also view flight booking history all in one place. You can make hotel reservations or even view and cancel the reservations. Book bus travel, do online shopping and subscribe to the magazine, book railway tickets and cab all in one place.

8. Request for Services

You can request various services through the app.

Debit Card Services: You can activate or deactivate debit card on the app and also regenerate PIN for the same. The app also allows you to report the loss of card and set or remove international usage facility for the card.

Credit Card Services: You can generate PIN instantly and request for Add-on card. Auto debit, report lost and damaged card issues. Register for E-statements via the app. You can also upgrade the card and increase the card limit.

Demat Services: You can request Client Master List (CML), pledge form, nomination form and statement of the transaction along with a statement of holding and billing.

Bank Account Services: You can activate or deactivate a passbook or deregister printed statement. This feature also allows you to upgrade the account variant.

9. Loan Features

Get quick loan details for a Home Loan, personal loan, business loan, loan against property, etc., through the app. The app also gives quick disbursement details and instalment details. You can also download the form and request statement on email and download PDF for the same.

10. Insurance Features

You can check your policies, get two-wheeler insurance, health insurance, Motor Insurance all in one app.

Kotak Mobile Banking Customer Care Number

Call 1860 266 2666 with any queries or in case your mobile or debit/credit card is lost.

Conclusion

Download the Kotak Mahindra Mobile banking app and enjoy various benefits. invest in a SIP (SIP) and various other mutual funds as a Kotak Mahindra customer through the mobile banking app.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.