How to Get More from Savings Account?

A Savings Account is a type of Bank account which is used to deposit money. Interest is earned on the account over a period of time. It is an account where one deposits money for saving and thus, the name savings account. It is one of the simplest types of bank accounts which allows you to store your extra cash and also earn interest on it. These days one can open an online savings account with a bank, start saving and earning interest.

Customers usually prefer high-interest saving accounts. Different banks provide different savings account interest rates. With your saving account, you can transfer funds and withdraw money any time you want.

Savings Account Interest Rates 2025

As said above, savings account interest rates are different for different banks. The usual Range of savings account interest rates varies from 2.07% - 7% per annum.

| Bank | Interest Rate |

|---|---|

| Andhra Bank | 3.00% |

| Axis Bank | 3.00% - 4.00% |

| Bank of Baroda | 2.75% |

| Bank of India | 2.90% |

| Bandhan Bank | 3.00% - 7.15% |

| Bank of Maharashtra | 2.75% |

| Canara Bank | 2.90% - 3.20% |

| Central Bank of India | 2.75% - 3.00% |

| Citibank | 2.75% |

| Corporation Bank | 3.00% |

| Dena Bank | 2.75% |

| Dhanlaxmi Bank | 3.00% - 4.00% |

| DBS Bank (Digibank) | 3.50% - 5.00% |

| Federal Bank | 2.50% - 3.80% |

| HDFC Bank | 3.00% - 3.50% |

| HSBC Bank | 2.50% |

| ICICI Bank | 3.00% - 3.50% |

| IDBI Bank | 3.00% - 3.50% |

| IDFC Bank | 3.50% - 7.00% |

| Indian Bank | 3.00% - 3.15% |

| Indian Overseas Bank | 3.05% |

| IndusInd Bank | 4.00% - 6.00% |

| Karnataka Bank | 2.75% - 4.50% |

| Kotak Bank | 3.50% - 4.00% |

| Punjab National Bank (PNB) | 3.00% |

| RBL Bank | 4.75% - 6.75% |

| South Indian Bank | 2.35% - 4.50% |

| State Bank of India (SBI) | 2.75% |

| UCO Bank | 2.50% |

| YES Bank | 4.00% - 6.00% |

As per the latest RBI mandate, interest on your saving account is calculated on a daily Basis. The calculation is based on your closing amount. The interest earned will be credited half-yearly or quarterly depending upon the account type and bank's policy.

Formula for Calculating Interest on Savings Account

Monthly Interest = Daily Balance x (No. of days) x Interest Rate/ Days in the year

For example, if we assume that the daily closing balance is daily 1 lakh for a month and the interest rate on the savings account is 4% p.a., then as per the formula

Interest for the month = 1 lakh x (30) x (4/100)/365 = INR 329

So with so much of idle cash lying around and low savings account interest rates, how can you get more from your bank account? Naturally, the answer is to invest your money. But if you don't want to take high risks and prefer playing safe, let's look how you can get more from your savings account.

Talk to our investment specialist

Liquid Funds - Better Option to Earn Money?

Most of us park a significant chunk of our spare money in the bank with lower savings account interest rates and thus earn less from the idle cash. On the other hand, Liquid Funds offer much better interest rates than the savings account interest rates with almost similar risk level and a better option to earn money.

What is a Liquid Fund?

Liquid funds or liquid Mutual Funds is a type of Mutual Fund that primarily invests in money market instruments. It involves Investing in financial instruments like treasury bills, term deposits, certificates of deposits, etc. These instruments have a lower maturity period(less than 91 days) which ensures that the risk level in these Types of Mutual Funds is minimal.

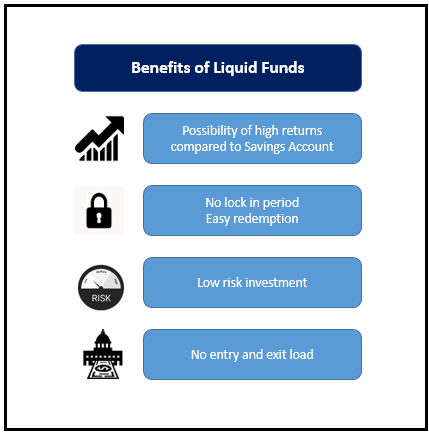

Benefits of Liquid Mutual Funds

These Mutual Funds have no lock-in period and withdrawals are generally processed within 24 hours on a working day (or lesser in some cases). There is no entry load or exit load attached to these funds and interest rate risk is negligible due to the type of instruments in the fund.

Liquid Fund Returns

Liquid funds offer better returns for short-term investment during a high Inflation Market environment. During such periods, interest rates are high and this, in turn, ensures better returns for liquid funds. Liquid funds are available in the market in form of various options such as daily/weekly/monthly dividend (payout or reinvestment) and growth option.

Liquid funds, on an average offer interest rate of around 7% to 8% per annum. This is considerably higher than the savings account interest rates. For investors wanting steady cash flows, they can opt for dividends which will be credited to their account as per their choice. Some of the best performing liquid funds that have delivered constant returns are as follows:

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Indiabulls Liquid Fund Growth ₹2,589.85

↑ 0.29 ₹155 0.5 1.4 2.9 6.6 7.4 6.03% 1M 9D 1M 9D PGIM India Insta Cash Fund Growth ₹348.604

↑ 0.03 ₹573 0.5 1.4 2.9 6.6 7.3 5.95% 1M 2D 1M 2D JM Liquid Fund Growth ₹73.0424

↑ 0.01 ₹1,374 0.5 1.4 2.8 6.5 7.2 6.04% 1M 6D 1M 8D Axis Liquid Fund Growth ₹2,981.98

↑ 0.30 ₹35,360 0.5 1.4 2.9 6.6 7.4 6% 1M 6D 1M 8D Tata Liquid Fund Growth ₹4,217.66

↑ 0.38 ₹22,366 0.5 1.4 2.9 6.6 7.3 6.09% 2M 2D 2M 2D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Dec 25 Research Highlights & Commentary of 5 Funds showcased

Commentary Indiabulls Liquid Fund PGIM India Insta Cash Fund JM Liquid Fund Axis Liquid Fund Tata Liquid Fund Point 1 Bottom quartile AUM (₹155 Cr). Bottom quartile AUM (₹573 Cr). Lower mid AUM (₹1,374 Cr). Highest AUM (₹35,360 Cr). Upper mid AUM (₹22,366 Cr). Point 2 Established history (14+ yrs). Established history (18+ yrs). Oldest track record among peers (27 yrs). Established history (16+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Point 5 1Y return: 6.60% (upper mid). 1Y return: 6.57% (lower mid). 1Y return: 6.46% (bottom quartile). 1Y return: 6.61% (top quartile). 1Y return: 6.57% (bottom quartile). Point 6 1M return: 0.46% (lower mid). 1M return: 0.46% (bottom quartile). 1M return: 0.46% (bottom quartile). 1M return: 0.47% (top quartile). 1M return: 0.46% (upper mid). Point 7 Sharpe: 2.76 (bottom quartile). Sharpe: 2.91 (upper mid). Sharpe: 2.30 (bottom quartile). Sharpe: 3.13 (top quartile). Sharpe: 2.83 (lower mid). Point 8 Information ratio: -1.01 (bottom quartile). Information ratio: -0.36 (lower mid). Information ratio: -2.00 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Point 9 Yield to maturity (debt): 6.03% (lower mid). Yield to maturity (debt): 5.95% (bottom quartile). Yield to maturity (debt): 6.04% (upper mid). Yield to maturity (debt): 6.00% (bottom quartile). Yield to maturity (debt): 6.09% (top quartile). Point 10 Modified duration: 0.11 yrs (bottom quartile). Modified duration: 0.09 yrs (top quartile). Modified duration: 0.10 yrs (lower mid). Modified duration: 0.10 yrs (upper mid). Modified duration: 0.17 yrs (bottom quartile). Indiabulls Liquid Fund

PGIM India Insta Cash Fund

JM Liquid Fund

Axis Liquid Fund

Tata Liquid Fund

Taxation

Liquid funds offer significant tax advantage over savings account. The taxation of liquid funds for Capital gains is 30% for less than 3 years and 20% with indexation for more than or equal to 3 years as per current tax laws. Due to this lower tax incidence, the net yield on the liquid funds is higher for most cases than a savings account. For short tenures, one can get taxed on dividend on liquid funds at 25%. This leads us to the conclusion that in most cases the yield on liquid funds is higher than the savings account. Moreover, this is also dependent on the customer's ability to take the risk involved in the products.

Naturally, to get more out of your savings account, you need to invest money. Savings account interest rates offer lower returns compared to what liquid funds offer. Thus, liquid funds offer a substantially better option to make the most out of the idle cash with similar risk, but almost double the returns. It's time you tried something new and better that will significantly get more out of your normal savings bank account.

FAQs

1. Is a Savings Account (SA) different from a Fixed Deposit (FD)?

A: Yes, it is different. With fixed deposits, the money you have invested is locked in for the given period, and you cannot withdraw it before maturity. With a savings account, you have the freedom to deposit and to withdraw at your will. Moreover, banks' interest on the money deposited is higher for fixed deposits compared to savings accounts.

2. Is the same formula followed by all banks?

A: Most banks follow the same formula while calculating the rate of interest for a savings account. Daily balance is multiplied by the number of days for which the money is deposited, multiplied by the constant ongoing interest rate. The whole thing is then divided by 365. This gives you the interest you will earn on the money that you have in your savings account.

3. Are savings accounts and liquid accounts the same?

A: Although the funds in your savings account behaves like liquid funds, savings account and liquid assets are not the same. Liquid accounts are usually in the form of mutual funds or investments made for a short duration, with the expectation that these will bring higher returns than a savings account.

4. Can I withdraw money from the savings account?

A: Yes, you can withdraw money anytime from a savings account. However, for most banks, there is a minimum amount of money that you must keep in your savings account, which you can withdraw when you close the account.

5. Are there any tax benefits in SA?

A: Yes, you can claim tax Deduction under Section 80C on the interest earned from your savings account.

6. Is there any upper limit I can keep?

A: No, there is no upper limit on the amount of money you can keep in your savings account.

7. What is the minimum amount required to open a savings account?

A: The minimum amount differs from bank to bank. Some banks allow clients to open accounts with zero balance, whereas some require clients to deposit a minimum amount of Rs. 2500. You will have to get in touch with your bank to know the minimum balance to open the account.

8. Is there any exit load I have to bear if I close SA?

A: Usually, there is no exit load in case you close a savings account. But you must ask about the exact nature of the savings account that you have opened with your bank before closing it, to understand if you have to pay any forfeiture.

9. Why is it that sometimes it is beneficial to invest in FD than SA?

A: Fixed deposits have a higher rate of interest compared to a savings account. Hence, instead of keeping money in a savings account, it is advisable to keep this money in fixed deposits as you can earn interest incomes. This is a form of passive Income that can also be an investment.

10. Does inflation affect savings accounts?

A: Inflation affects your overall savings, and hence, it will impact your savings accounts as well. The rate of interest on your SA can decrease due to inflation. Thus, inflation can adversely affect your savings account.

11. Can I have multiple savings accounts?

A: Yes, you can open multiple savings accounts. You can open the accounts in the same banks or even in different banks.

12. What are the documents I need to open a savings account?

A: Some of the documents that you require to open a savings account are as follows:

- Aadhar card

- Voter card

- Address proof (electricity bill, telephone bill, etc.)

- Passport

- Ration card

13. Do I need a KYC to open a savings account?

A: KYC is Know Your Customer, which is a necessary document that clients have to provide the bank to open a savings account. Currently, it has become mandatory to have necessary KYC documents to open a savings account.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.