Fincash » Demat Account » Eligibility Criteria for Demat Account

Table of Contents

Eligibility Criteria for Demat Account

Embarking on your investment journey in India necessitates opening a Demat account—a digital repository for your securities like stocks and Bonds.

Understanding the eligibility criteria and required documentation is crucial for a seamless account opening process.

Who Can Open a Demat Account?

A diverse Range of entities are eligible to open a Demat account in India:

Individual Investors: Any individual aged 18 or above can open a Demat account.

Minors: Minors can have a Demat account under the supervision of a guardian until they reach the age of majority.

Non-Resident Indians (NRIs): NRIs can open Demat accounts, subject to specific regulations.

Hindu Undivided Families (HUFs): HUFs are eligible to open Demat accounts.

Corporate Entities: Partnership firms, Limited Liability Partnerships (LLPs), Public and Private Limited Companies, Trusts, and Societies can also open Demat accounts.

Partnership Firms & LLPs: A Demat account cannot be opened in a partnership firm’s name. However, it can be opened in the name of a partner on behalf of the firm, supported by a partnership Deed and authorization letter.

Trusts, Societies & Charitable Organisations: Registered trusts and societies can hold a Demat account. A copy of the trust deed, registration certificate, and authorized signatory details must be submitted.

Talk to our investment specialist

Essential Documents for Opening a Demat Account

As per the Securities and Exchange Board of India (SEBI) guidelines, the following documents are typically required:

Proof of Identity (POI):

- Permanent Account Number (PAN) card (mandatory)

- aadhaar card

- Passport

- Voter ID

- Driving license

Proof of Address (POA):

- Utility bills (electricity, water, gas, or telephone), not older than three months

- Bank account statement or passbook

- Ration card

- Passport

- Driving license

- Voter ID card

Proof of Income (required for trading in derivatives):

- Latest salary slips

- Income Tax Return (ITR) acknowledgment

- Net worth certificate

- Demat holdings statement

Bank Account Proof:

- Cancelled cheque leaf

- Bank passbook

Additional Requirements for Specific Entities:

- NRIs: Portfolio Investment Scheme (PIS) permission letter from the Reserve Bank of India and linking the Demat account to an NRE/NRO bank account.

- Companies: Certificate of Incorporation, Memorandum of Association (MoA), and Articles of Association (AoA).

Additional Factors That Affect Demat Account Eligibility

Credit Score & Financial History

While there’s no credit check for opening a Demat account, brokers may verify financial history for margin trading and derivatives trading accounts.

Taxation & KYC Compliance

- Investors must comply with SEBI's Know Your Customer (KYC) norms.

- Taxation rules vary for resident Indians and NRIs, affecting Capital gains tax and dividends.

Multiple Demat Accounts Eligibility

- Individuals can open multiple Demat accounts, but they must be with different Depository Participants (DPs).

- Holding multiple accounts can be beneficial for diversification but may lead to higher maintenance costs.

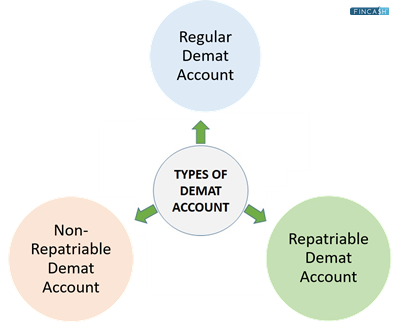

Types of Demat Accounts Based on Investor Eligibility

There are different types of Demat accounts based on the investor’s residency and purpose:

| Demat Account Type | Who is Eligible? | Purpose |

|---|---|---|

| Regular Demat Account | Indian residents (individuals) | Holding securities like stocks, bonds, Mutual Funds |

| Repatriable Demat Account (NRE) | NRIs with NRE accounts | Allows international investments with full repatriation benefits |

| Non-Repatriable Demat Account (NRO) | NRIs with NRO accounts | Investment with limited repatriation |

| Corporate Demat Account | Companies, LLPs, Partnership firms | Holding company shares and securities |

| Minor Demat Account | Individuals below 18 (with guardian) | Investments for a minor’s future |

Common Queries About Demat Account Eligibility

1. How can I open a Demat account?

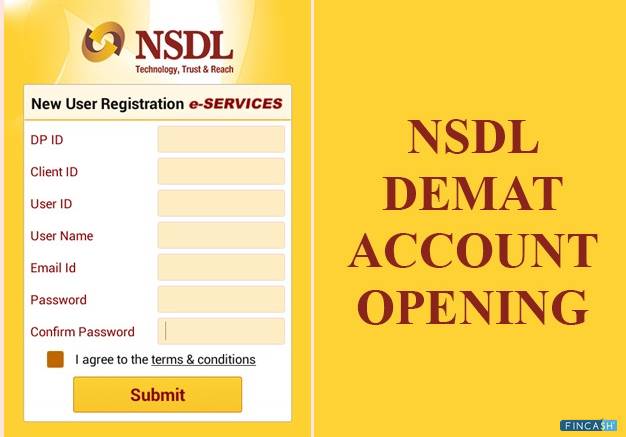

A: You can open a Demat account online through SEBI-registered depository participants (DPs), stockbrokers, or financial institutions like banks.

2. Is there a minimum age requirement for opening a Demat account?

A: No, there is no minimum age requirement. However, accounts for minors must be operated by a guardian until the minor turns 18.

3. Can I open a joint Demat account?

A: Yes, a Demat account can have joint holders. However, a minor cannot be a joint holder.

4. What happens if I do not provide nominee details?

A: If nominee details are not provided, transferring securities in the event of the account holder's demise can become complex and time-consuming. By ensuring you meet the eligibility criteria and have the necessary documentation, you can open a Demat account seamlessly and embark on your investment journey with confidence.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.