+91-22-48913909

+91-22-48913909

Table of Contents

- What is a Systematic Withdrawal Plan (SWP)?

- How does a Systematic Withdrawal Plan work?

- How SWP Works: General Overview

- Example of a Systematic Withdrawal Plan

- SWP Calculator

- How Practical is SWP?

- Benefits of SWP

- Disadvantages of SWP

- Taxation of Systematic Withdrawal Plans (SWP) in India

- Retirement Planning Using SWP

- Best Money Market Funds for Systematic Withdrawal Plan

Systematic Withdrawal Plan (SWP): A Detailed Overview

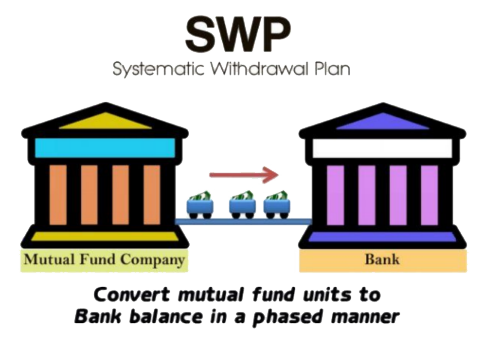

Systematic Withdrawal Plan or SWP is a process of redeeming money from Mutual Funds. SWP is the opposite of SIP. In SIP, individuals invest their money earned through regular Income in Mutual Fund schemes.

This investment is done in small amounts at regular intervals. On the contrary, in SWP individuals redeem their Mutual Fund holdings and get back the money credited to their Bank account. Individuals can exercise the option of Systematic Withdrawal Plan to augment their income. This scheme is more suitable for retired people. So, let us understand the concept of the Systematic Withdrawal Plan, how individuals can do Retirement planning through Systematic Withdrawal Plan, benefits of SWP, and other related parameters.

What is a Systematic Withdrawal Plan (SWP)?

A Systematic Withdrawal Plan (SWP) is a strategic method of redeeming mutual fund units in a structured manner. It can be viewed as an automated Redemption process for mutual fund investments. Investors have the flexibility to customize the frequency of their withdrawals, which can be set to weekly, monthly, or quarterly intervals, depending on their needs.

To start an SWP, individuals first invest a lump sum amount in a mutual fund, such as a Liquid Fund, ultra-short-term fund, or any other scheme that suits their goals. Once the investment is made, the investor can withdraw a fixed sum of money at regular intervals, providing them with a steady income stream.

Example:

Let’s consider an example to understand how SWP works. Imagine Mr. Sharma, who has taken a sabbatical for a year to pursue a personal hobby. He has set aside ₹5,00,000 to cover his expenses during this period. However, he is concerned that he might spend all the money quickly and run out of funds. To address this, Mr. Sharma decides to invest his ₹5,00,000 in a liquid fund, which carries minimal risk. He chooses the SWP option to withdraw ₹40,000 per month. This ensures that he will receive a Fixed Income every month, while also allowing his investment to continue growing, providing both security and potential returns.

How does a Systematic Withdrawal Plan work?

In an SWP, the investor invests a lump sum amount in a mutual fund. After that, the investor sets a regular withdrawal frequency (monthly, quarterly, etc.), and the mutual fund company processes the withdrawals as per the agreed schedule.

Fixed Withdrawal Amount: The investor decides on the amount to be withdrawn, say ₹10,000 per month.

SWP Payout Options: The payout can be made in two ways:

- Capital Appreciation: If the investment earns a return, the withdrawal is made from the gains of the investment.

- Principal: If the returns aren't sufficient, the withdrawal is made from the principal amount.

Types of SWP

Fixed SWP: In this plan, you choose a fixed amount to withdraw regularly. For instance, ₹5,000 every month. The amount remains the same throughout the withdrawal period.

Variable SWP: In this plan, the withdrawal amount may change depending on the performance of the mutual fund. If the mutual fund grows in value, the withdrawal amount can be higher, and vice versa.

Talk to our investment specialist

How SWP Works: General Overview

| Event | Action/Process | Example |

|---|---|---|

| Initial Investment | Investor invests ₹5,00,000 in mutual fund. | ₹5,00,000 invested in an equity mutual fund. |

| SWP Setup | Investor decides to withdraw ₹10,000 every month. | Set to withdraw ₹10,000 monthly. |

| First Withdrawal | Fund value at withdrawal time determines the amount of units sold. | If NAV is ₹105, withdraw ₹10,000 by selling 95.24 units. |

| Subsequent Withdrawals | Each withdrawal will sell the required number of units based on the NAV. | If NAV changes, the number of units sold will change to meet ₹10,000 withdrawal. |

| Ongoing | Process continues monthly until the investor stops the SWP or the investment is exhausted. | If Market value grows, the fund balance may increase. If market falls, the balance may decrease. |

| Taxation | Withdrawal might incur capital gains tax depending on holding period. | After 2 years, the withdrawal is subject to LTCG tax. |

Example of a Systematic Withdrawal Plan

Let’s consider an example to understand how SWP works in real life:

Example 1:

- You invest ₹10,00,000 in an equity mutual fund.

- You choose to withdraw ₹10,000 every month (this is a fixed SWP).

- The fund generates an annual return of 8%.

Year 1:

- ₹10,000 is withdrawn monthly, which adds up to ₹1,20,000 annually.

- The remaining ₹8,80,000 continues to grow at 8% annual returns.

Year 2:

- Even after withdrawing ₹1,20,000 for the year, the remaining principal continues to earn returns. The next year’s returns will be based on the remaining balance after withdrawals.

In this case, your capital will continue to grow even as you withdraw money, provided the returns on the fund exceed the amount withdrawn.

Example 2:

If the mutual fund is performing poorly and yields only 4% return annually, your principal will start to deplete as the withdrawals exceed the returns. In such cases, you may need to adjust the amount withdrawn or switch to a safer, more stable fund.

SWP Calculator

Want to see how SWP can work for you? Use our SWP Calculator now to plan your withdrawals and estimate your returns. Start making informed investment decisions today!

VALUE AT END OF TENOR:₹4,597SWP Calculator

How Practical is SWP?

SWP is an extremely practical option for those looking for regular income with minimal hassle. For retirees or individuals in need of monthly income, SWP can act as a reliable solution without having to sell assets or convert investments into cash.

Is it Practical for Everyone?

- SWP is ideal for individuals who are looking for stable income over a longer period.

- If you need money urgently or are aiming for short-term goals, SWP may not be the best option, as it depends on the growth of the mutual fund.

- It's best to use SWP in conjunction with other investment strategies, especially if you're using it to fund retirement or ongoing expenses.

Benefits of SWP

Systematic Withdrawal Plan has its own benefits. Some of the major ones are as follows.

Regular income flow

SWP can be used for creating a regular source of income flow for individuals, especially for retirees. Moreover, individuals also earn returns on their Mutual Fund investment depending on its performance and the type of scheme in which the investment is done.

Redeem required money

Through SWP, individuals can only redeem the required money and can keep the excess amount invested. Thereby, it creates a disciplined withdrawal habit among individuals. This will help individuals retain their investments as required thereby preventing capital erosion.

Discontinue whenever required

Individuals can discontinue the SWP process whenever required and redeem the entire money in case of urgency. However, if the money is invested in case of fixed deposits or other investment avenues that have a lock-in period, it is difficult to redeem money in such cases.

Substitute for pension

SWP acts as a substitute for pension for individuals wherein; they can use it as a pension amount once they stop working. As a consequence, pensioners can get a sigh of relief as their investment generates returns and also they are able to earn a regular source of income.

Disadvantages of SWP

Depleting Capital

One of the biggest risks of SWP is that if you are withdrawing more than the returns generated by the fund, you may eventually deplete your capital. It’s essential to ensure that the withdrawal rate is sustainable based on the fund’s performance.

Market Risk

SWP is linked to the performance of the mutual fund. If the market falls, your withdrawals will come from the capital, reducing the overall value of your investment.

Not Suitable for Short-Term Goals

SWP is more suitable for long-term goals, like retirement planning. For short-term goals, it might not be the best option as the withdrawals may result in a smaller amount than initially invested.

Taxation of Systematic Withdrawal Plans (SWP) in India

The taxation of SWPs depends on the type of mutual fund from which you are withdrawing and the duration for which the investment has been held. Here's a detailed breakdown of how SWPs are taxed in India:

1. Tax on Capital Gains

When you withdraw from your mutual fund through an SWP, the amount withdrawn is treated as a sale of units of the mutual fund. The taxation is based on the capital gains (the difference between the purchase price and the sale price) earned on these units.

There are two types of capital gains:

Short-Term Capital Gains (STCG): If you withdraw within three years of Investing in an equity mutual fund or within three years for Debt fund, the gains are considered short-term.

Long-Term Capital Gains (LTCG): If you withdraw after three years of investing, the gains are considered long-term.

2. Tax Rates on SWP

The tax treatment for SWP withdrawals differs for Equity Funds and debt funds.

Equity Mutual Funds:

Short-Term Capital Gains (STCG): If the units are sold within 1 year of investment, the gains are taxed at 15%.

Long-Term Capital Gains (LTCG): If the units are held for more than 1 year, the long-term capital gains are taxed at 10% without the benefit of indexation. If the gains exceed ₹1 lakh in a financial year, only the excess amount is taxed at 10%.

Debt Mutual Funds:

- Short-Term Capital Gains (STCG): If units are sold within 3 years of investment, the gains are added to your total income and taxed at your applicable income tax slab rate.

- Long-Term Capital Gains (LTCG): If the units are held for more than 3 years, the long-term capital gains are taxed at 20% with the benefit of indexation.

3. Indexation Benefit (For Debt Funds)

For long-term capital gains in debt mutual funds, the investor can benefit from indexation. Indexation adjusts the purchase price of the investment based on Inflation, reducing the taxable capital gains and lowering the Tax Liability.

4. Dividend Option SWP

In case of an SWP from a dividend-paying mutual fund, the withdrawal is treated as income. The mutual fund will deduct a dividend distribution tax (DDT) before distributing the dividends. However, this method is less common for SWPs, as most investors prefer capital gains.

Example of Taxation

Let’s consider two examples of SWP taxation for both equity and debt mutual funds.

Equity Mutual Fund Example:

- Investment: ₹1,00,000

- Holding Period: 2 years

- SWP Withdrawal: ₹5,000 monthly

- Capital Gain (on sale of units): ₹2,000

Since the units are held for more than 1 year but less than 3 years, the capital gains are considered long-term, and they are taxed at 10% beyond ₹1 lakh of total capital gains in a year. For smaller amounts, they would be tax-free until they cross the ₹1 lakh limit.

Debt Mutual Fund Example:

- Investment: ₹1,00,000

- Holding Period: 4 years

- SWP Withdrawal: ₹5,000 monthly

- Capital Gain: ₹15,000

Since the holding period is greater than 3 years, the withdrawal is considered long-term capital gain. The gains are taxed at 20% with indexation.

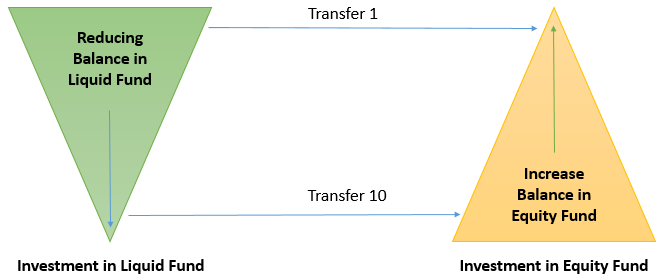

Retirement Planning Using SWP

Individuals can plan for their retirement through Systematic Withdrawal Plan. Here, individuals can deposit their retirement benefits (such as gratuity or provident fund) in a Mutual Fund that carries low-risk such as Money market funds. Post investing, they need to opt for SWP option through which individuals can start getting monthly income.

One of the advantages of SWP is the money does not get blocked as compared to other avenues such as Senior Citizen Savings Scheme (SCSS) or Post Office Monthly Income Scheme (POIMS). Individuals can stop the SWP option whenever they want and can redeem the entire funds back to their bank account. In addition, their investment also earns returns that can be used by the individuals. However, one of the disadvantages of SWP is it leads to capital erosion as the withdrawal is done from the exisiting money which is not the case in SCSS or POIMS.

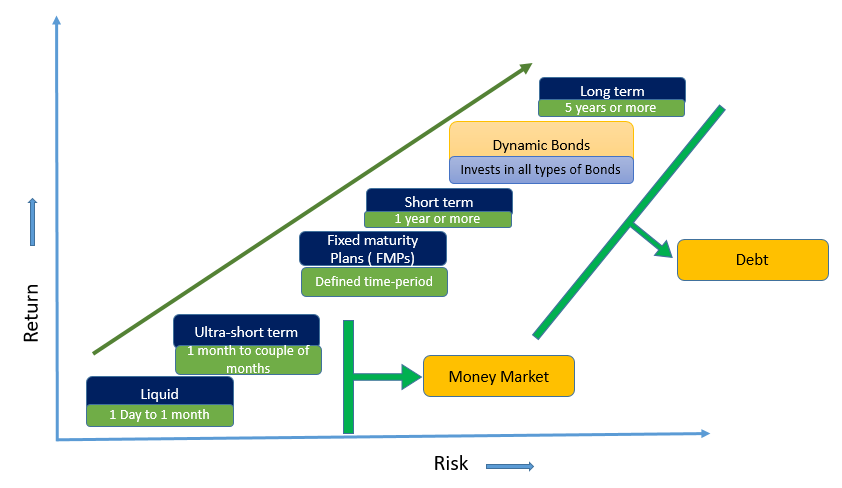

Best Money Market Funds for Systematic Withdrawal Plan

In case of SWP, individuals can opt for money market funds which have the lowest level of risk, therefore, some of the top funds under money market category are listed below as follows.

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Money Manager Fund Growth ₹366.629

↑ 0.06 ₹25,581 0.7 2.2 4.1 8 7.8 7.35% 9M 9M 4D UTI Money Market Fund Growth ₹3,055.85

↑ 0.49 ₹16,265 0.7 2.3 4.1 8.1 7.7 7.24% 9M 16D 9M 17D ICICI Prudential Money Market Fund Growth ₹376.083

↑ 0.06 ₹24,184 0.7 2.3 4.1 8 7.7 7.23% 10M 2D 10M 25D Kotak Money Market Scheme Growth ₹4,450.66

↑ 0.75 ₹25,008 0.7 2.3 4.1 8 7.7 7.17% 10M 10D 10M 10D L&T Money Market Fund Growth ₹26.1591

↑ 0.00 ₹2,536 0.7 2.2 4 7.8 7.5 7% 8M 26D 9M 14D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 May 25

Thus, from the above parameters, it can be said that Systematic Withdrawal Plan has its own benefits. However, investors should have a complete understanding of the scheme in which they are planning to start an SWP. They should check whether such option is required or not. This will help them to achieve their objectives on time.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

It is very helpful for understanding the Systematic withdrawal plan. Systematic withdrawal plan is very useful for raising the fund.