Table of Contents

- What is an Employees Provident Fund?

- EPF Eligibility Criteria

- What is UAN?

- Employee PF Registration and Login

- Benefits of EPF

- How to Check PF Balance?

- Steps for EPF KYC Update

- Process for EPF Withdrawal Online

- Employee PF Claim Form

- 1. Is it possible for an apprentice to join the EPF?

- 2. If an employee is denied PF membership, who should they contact?

- 3. Is it acceptable for a former employee to contribute to the EPF after they have retired?

- 4. Is there any age limit for those employees who wish to join the EPF?

- 5. Being an employee, can I opt-out of the EPF?

- 6. When an employee is paid on a daily or part-time basis, how is the EPF contribution calculated?

- 7. Can an employee join the EPF on their own?

- 8. Is it possible for an employer to minimise their part of the EPF contribution?

- Employee PF Number Check

- Taxation on EPF

- The Bottom Line

- Frequently Asked Questions (FAQs)

- 1. Is it possible for an apprentice to join the EPF?

- 2. If an employee is denied PF membership, who should they contact?

- 3. Is it acceptable for a former employee to contribute to the EPF after they have retired?

- 4. Is there any age limit for those employees who wish to join the EPF?

- 5. Being an employee, can I opt-out of the EPF?

- 6. When an employee is paid on a daily or part-time basis, how is the EPF contribution calculated?

- 7. Can an employee join the EPF on their own?

- 8. Is it possible for an employer to minimise their part of the EPF contribution?

EPF For Employees

Most people invest in attaining three Financial goals in life - to build wealth, to have a regular Income through a pension during retirement, and to ensure the future of our families. While you can buy multiple financial products to fulfil each of these objectives, there is one solution that can assist you with all these purposes, that is - EPF!

Since the Employee Provident Fund (EPF) is a part of everybody’s salary, the majority of Indian citizens contribute towards this avenue. It is also the most popular and secure way of Investing money for financial security over the long term.

The article guides you through the fundamental components of EPF for employees.

What is an Employees Provident Fund?

Employees Provident Fund Organisation (EPFO) manages the Employee Provident Fund (EPF), which is a retirement benefit system. Employees and employers both contribute 12% of their base income and dearness allowance to the EPF plan on a monthly Basis in equal amounts. Employee Pension Scheme receives 8.33% of the employer's contribution. The interest rate on EPF deposits is now 8.50% per annum.

EPF Eligibility Criteria

To receive benefits under this system, here are a few requirements that must be to fulfil:

- Employees must become active members

- Employees of any organisation are eligible as soon as they join the organisation

- A firm must join the EPF plan if it employs more than 20 workers, according to the law Businesses that have less than 20 employees can join the EPF plan voluntarily

- Registration for an EPF account is needed for those salaried individuals who are earning less than Rs.15,000 per month

- Employees earning more than Rs.15,000 can open an EPF account, but they must first receive permission from the Assistant PF Commissioner

- People in Jammu and Kashmir are not benefited from this scheme

What is UAN?

EPFO assigns each member a 12-digit number that they can use to manage their PF accounts. This number is known as the Universal account number (UAN). It enables a person to obtain all Provident Fund (PF) information in one location, regardless of the company for which they work. Employees can simply withdraw and transfer monies with the use of their UAN.

Talk to our investment specialist

Employee PF Registration and Login

EPF registration is usually done by employers. However, it can be done voluntarily by the employee as well. Here is a step-by-step guide to registering under the EPF scheme:

- Visit the EPFO website

- Click on 'Establishment Registration'

- Read the user manual carefully displayed on the screen

- Select the 'Sign Up' button, enter all the relevant information, and then click 'Sign Up'

'Registration For EPFO-ESIC' will be an option

- Before clicking the 'Submit' button, apply for a 'New Registration' and for 'Employees' State insurance Act, 1948' as well as 'Employees' Provident Fund and Miscellaneous Provision Act, 1952', make sure you tick the boxes

- Complete the form and submit it

- Sign the form with the Digital Signature Certificate (DSC) of your employer

- Shram Suvidha will send you a confirmation email once the process is complete

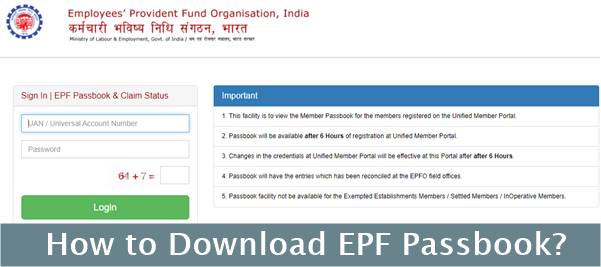

Being an employee, here are the steps you can follow to login into an existing account:

- Visit the EPFO website

- Then, under 'Our Services,' pick 'For Employees'

- Under 'Services,' choose 'Member UAN/Online Service (OCS/OTCP)'

- Along with the CAPTCHA data, enter the UAN and password

- Click 'Sign In'

- Now you can manage your account

Benefits of EPF

Listed down are the benefits of EPF you should be familiar with:

- For Capital appreciation, it gives a set interest rate

- Monthly deductions prevent a large outflow from your paycheque

- It keeps you prepared for other financial situations by allowing you to withdraw money quickly

- If you lose your job, you can take out up to 75% of your savings

- With the EPS scheme, it aids in securing your future retirement

How to Check PF Balance?

To check the PF balance, there are four different ways:

- Through the EPFO Portal

You can check the balance by simply logging into the official website with UAN and checking the passbook

- Through Umang App

It allows you to check your EPF Passbook by logging into the member section with your UAN and registered mobile phone

- Through Missed Call Service

By giving a missed call from your EPF-registered mobile number to 011-22901406, you can check the balance.

- Through SMS

By sending EPFOHO UAN ENG to 7738299899 and adjusting the final three characters to the language you want the information in, you can check the PF balance.

Steps for EPF KYC Update

Employees must link their EPF account to their Aadhaar and other documents, according to the government. EPFO has made it simple for anyone to update their KYC information using the online portal.

Jotted down below are some steps to be taken for EPF KYC update:

- Visit the EPF website

- Sign in with UAN and password

- Go to the 'Manage' area and choose KYC from the dropdown menu

- Update information such as PAN number, Aadhar, Bank papers, and so on

- Save it, and it will appear as Pending KYC as long as the other end verifies it

Process for EPF Withdrawal Online

EPF can be withdrawn in two ways - either partially or fully. When a person retires or is jobless for more than two months, they are entitled to withdraw completely. Partially withdrawing from the EPF is permitted under certain conditions.

You need to fill out the EPF withdrawal form online to request a withdrawal. You can only use the online withdrawal claim option if your Aadhaar is linked to your UAN.

To fill out the EPF withdrawal form and claim online, follow the procedure below:

- Sign in to the UAN Member Portal

- Select 'Claim (Form-31, 19 & 10C)' from the dropdown menu under the 'Online Services' option in the top navigation bar

- Enter your bank account's last four numbers and click 'Verify’

- Click 'Yes' to sign the undertaking certificate and continue

- Then click 'Proceed for Online Claim'

- To withdraw funds online, choose 'PF Advance (Form 31)'

- Next select 'Purpose for which advance is necessary,' the amount required, and the employee's address

- To submit your application, check the certification box

- Submit required scanned documents

- After your employer approves your withdrawal request, the funds will be removed from your EPF account and transferred into the bank account you specified

Employee PF Claim Form

For easy disbursement of money, it is crucial to apply for an appropriate claim form. There are different types of EPF claim forms depending on the kind of claim.

Listed down are the types:

- Form 10C- It is filled at the time of withdrawal benefit from Employees pension scheme 95

- Form 10D - It is to be filled for pension claims

- Form 13 - Transferring PF/pension funds across accounts

- Form 14 - To use the PF account to fund a Life Insurance policy

- Form 19 - This form must be filled at the time of final settlement of PF account

- Form 20 - This form is used to claim PF following the death of a member by a lawful Heir/nominee

- Form 31 - In order to obtain advance/temporary withdrawals under the Employees' Provident Scheme '52

- Form 51F - This form must be filled by the lawful heir/nominee of a member who wishes to claim an assurance benefit under the Employees' Deposit Linked Insurance Act of 1976

Employee PF Number Check

It is crucial to know your PF number to monitor details and transactions taking place. Here are a few ways through which you can check the PF number:

- PF number can be found on the payslip. Aside from the figure, the salary slip includes a thorough breakdown of the PF allocation for the month

- Consult an HR department if the payslip does not include the PF number or if the firm issues annual slips

- By using UAN, one can get the details of a PF account

If none of the given options work, visit the nearest EPFO office grievance cell. Submit KYC details along with grievance redressal form. After the scrutiny, one can get the details of their account.

Taxation on EPF

Until the year 2020, EPF deposits and interest were tax-free. However, the government declared in Budget 2021 that if a financial year's EPF and Voluntary Provident Fund (VPF) deposits exceed Rs. 2.5 lakhs, the income generated on the contributions will be taxed. If the employer fails to contribute to the EPF account, the interest component will be excluded up to a maximum deposit of Rs. 5 lakhs in the financial year in question.

The Bottom Line

With the outbreak of the COVID pandemic, EPFO has allowed its members to take money out of their EPF account twice to cover expenses. A non-refundable withdrawal of up to 75% of their EPF balance, or three months of their basic Earnings and dearness allowance, whichever is smaller, is accessible to members. You can take the remaining 25% of the money if you are unemployed for two consecutive months.

EPFO also plans to fulfil these withdrawal claims within three days and has set up an auto-claim settlement procedure for members who have completed their KYC in every way.

Frequently Asked Questions (FAQs)

1. Is it possible for an apprentice to join the EPF?

A: No, an apprentice cannot join the EPF; however, after they cease to be an apprentice and get a valid, full-time job, they must enlist in the EPF.

2. If an employee is denied PF membership, who should they contact?

A: If the employer fails to give the PF membership, the former can contact the PF office's Regional Provident Fund Commissioner.

3. Is it acceptable for a former employee to contribute to the EPF after they have retired?

A: Employees who have left their jobs are not entitled to contribute to the EPF.

4. Is there any age limit for those employees who wish to join the EPF?

A: No, there is no age limit for employees who want to join the Provident Fund. However, if an employee has reached the age of 58, they are no longer eligible to join the Provident Fund.

5. Being an employee, can I opt-out of the EPF?

A: No, a qualified member cannot refuse to participate in the EPF.

6. When an employee is paid on a daily or part-time basis, how is the EPF contribution calculated?

A: The amount of the contribution is determined by the wage paid in a calendar month.

7. Can an employee join the EPF on their own?

A: No, an employee cannot join the EPF on their own. Employees need to be part of an organisation that is covered by the EPF and MF Act of 1952.

8. Is it possible for an employer to minimise their part of the EPF contribution?

A: No, employers cannot minimise their EPF contributions. It is considered a criminal offence.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.