Table of Contents

- What is MahaGst?

- Features of Registering on the MahaGST Portal

- Services on MahaGst Portal

- Tax Forms for MahaGst

- MahaGst Registration Process Guide

- How to Login into MahaGst Portal?

- How to Reset your Password on MahaGst Portal?

- How to Make e-Payments through MahaGst Portal?

- What is the GST Amnesty Scheme for Maharashtra 2022?

- The Bottom Line

- Frequently Asked Questions (FAQs)

- 1. How do I submit a service request through the MahaGST website?

- 2. What is the support desk number for the MahaGst portal?

- 3. What should one do if they are unable to access or get the activation link for the MahaGst profile?

- 4. How do I file returns, either monthly or quarterly?

- 5. In Maharashtra, who is responsible for paying professional tax?

Know Everything About MahaGst

The Indian government has been working towards simplifying the tax collection procedure for years altogether now. Amidst this effort, one of the latest advances has been the introduction of the Goods and Service Tax (GST). GST is a destination-based consumption tax that is unified throughout India, meaning there is no cascading effect.

Lately, the government of Maharashtra launched an all-inclusive MahaGst portal that caters to an extensive Range of GST requirements, be it applying for the GST number or claiming a refund. This article provides information on Maharashtra's GST, including a brief description of the MahaGst online registration and the MahaGst login process. To learn more, keep reading.

What is MahaGst?

MahaGst is a new online GST filing and payment portal launched by the Government of Maharashtra. This portal is designed to streamline the process of filing GST Returns and making payments for businesses in the state. The portal is integrated with the existing GSTN portal and allows businesses to track their GST filings and payments.

Features of Registering on the MahaGST Portal

There are several useful features of the MahaGST Portal, such as:

- It is a one-stop destination for all your GST-related needs. You can use the portal to register for GST, file your GST returns, make payments, track your GST refunds, and more

- The portal is designed to be user-friendly and simple to use

- It is available in both English, Hindi and Marathi

- You can also use the portal to access helpful resources such as GST rules and regulations, GST rates, GST forms, and more

- Registering on the MahaGST portal is quick and easy

Services on MahaGst Portal

From filing Taxes to applying for GST benefits, the MahaGst Portal has you covered. Plus, the MahaGst Portal is completely free to use. The services offered are as follows:

E-services

- Login for VAT and Allied Acts

- RTO Login

- Profile for Registered Dealers

GST E-services

- GST Registration

- GST Payments

- GST Return Filing

- Know your GST Taxpayer

- GST Rate Search

- Tracking GSTIN

- GST Verification

- GST Dealer Services

- GST Rules and Regulations

E-Payment

- e-Payment Returns

- e-Payment – Assessment Order

- Return/Order Dues

- PTEC OTPT Payment

- Amnesty-Installment Payment

- PT/Old Acts Payment History

Other Acts Registrations

- New Dealer Registration

- RC Download

- URD Profile Creation

Talk to our investment specialist

Tax Forms for MahaGst

There is a range of forms available for different taxpayers, but you only need to complete the form in the category you fall in. Under GST Rule 80, there are four distinct annual return types, which are as follows:

| Category | Form |

|---|---|

| Taxpayers under a normal scheme | GSTR-9 |

| Taxpayers covered by the composition scheme | GSTR-9A |

| E-commerce operator | GSTR-9B |

| Taxpayer/business entity (over 200 cr in revenue) | GSTR-9C |

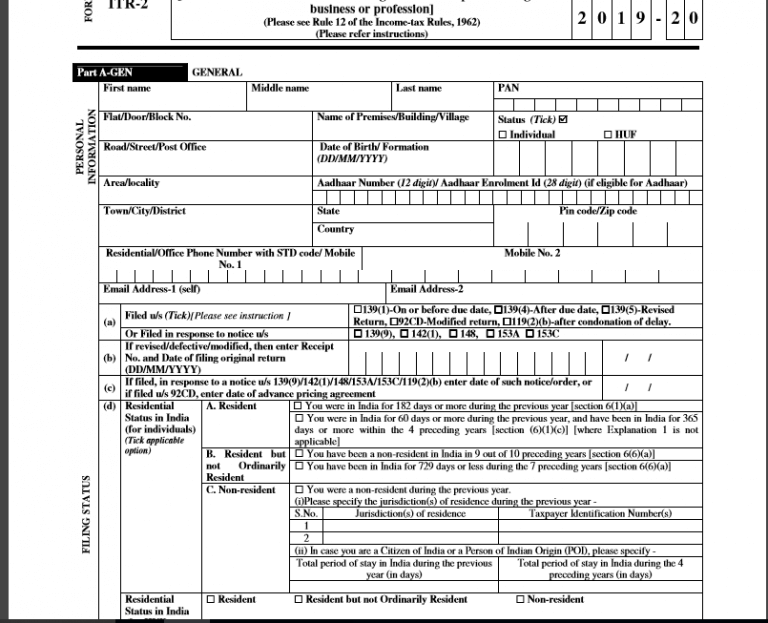

MahaGst Registration Process Guide

The MahaGST registration process is a simple and straightforward process. Follow the below-mentioned steps to register:

- Visit the MahaGST website and click the 'Skip to main content' option available at the top of the page

- A menu will appear on the page. Put your cursor on the 'Other Acts Registration' option and choose the 'New Dealer Registration' option

- You'll be prompted to a new page where you will have to click on the 'New Registration Under Various Acts' option

- A new page will open up where you can find the entire process flow listed along with Instructions and required documents to complete the registration

- Once you've gone through the listed instructions, click 'Next' available at the end of the page

- To continue, select 'New Dealer' and click 'Next'

- Fill in your PAN/TAN details along with the captcha code to continue the registration procedure

- By completing the registration form on the website, you will receive a user ID and password after registering. With these credentials, you can log in to the MahaGST portal and begin the process of filing your GST returns

How to Login into MahaGst Portal?

To login into the MahaGST portal, follow the steps outlined below:

- Visit the MahaGST website

- Scroll down and put your cursor on 'Login for e-services' and click 'Login for VAT and Allied Acts'

- A new page will open where you will have to add your username and password and click 'Log on'

How to Reset your Password on MahaGst Portal?

To reset your password on the Maha GST portal, you will need to follow the steps below:

- Visit the MahaGST website

- Scroll down and put your cursor on 'Login for e-services' and click 'Login for VAT and Allied Acts'

- A new page will open where you will have to add your username and password and click 'Log on'

- Enter your user ID and click on the 'Forgot Password' link

- A new tab will open where you will have to add your user ID, security question and its answer

- Once done, click Submit

- A link to reset your password will be received in the email

- Click on the link and enter your new password

- Confirm your new password and click on the 'Submit' button

- After submitting, you'll be redirected to the login page, where you can enter your new password to login into the MahaGst portal

How to Make e-Payments through MahaGst Portal?

Making your MahaGst payment is quite easy and straightforward. Follow the listed steps to make e-payments:

- Visit the MahaGST website

- Scroll down and put your cursor on the 'e-Payments' tile.

- Select the required payment option from the given list

- e-Payment – Returns

- Return/Order Dues

- e-Payment – Assessment Order

- PTEC OTPT Payment

- PTRC Payment

- Amnesty-Installment Payment

- PT/Old Acts Payment History

- Follow the instructions as you'll be prompted on the next page

What is the GST Amnesty Scheme for Maharashtra 2022?

The Maharashtra government recently announced a new GST Amnesty Scheme for businesses in the state. Under the scheme, businesses can declare and pay any outstanding GST dues without interest or penalty. This is a one-time opportunity for businesses to get their GST affairs in order and avoid any interest or penalty charges. The scheme was open for three months, from April 1, 2022, to June 30, 2022. Businesses were able to avail scheme by filing a declaration form with the Maharashtra GST department

The Bottom Line

The GST portal has been a big help to taxpayers in digitizing the complex process of registration, return filing, getting refunds and cancelling registration. Now the entire process is online and can be done with just a few clicks. Moreover, the Maharashtra State Government has also announced an Amnesty Scheme to settle disputes related to the pre-GST era and make the transition to GST smoother and more efficient for taxpayers.

Frequently Asked Questions (FAQs)

1. How do I submit a service request through the MahaGST website?

A: Log on to the MahaGST portal and choose the "May I Help You?" tile to submit a service request. Select "Service Request'' and enter your information.

2. What is the support desk number for the MahaGst portal?

A: The toll-free number is 1800 225 900. You can also visit the "About Us" section of the website and select "Contact us."

3. What should one do if they are unable to access or get the activation link for the MahaGst profile?

A: If the original link is down, click the URL that was supplied to your email. It'll make your MahaGst profile active.

4. How do I file returns, either monthly or quarterly?

A: Businesses having a maximum annual revenue of Rs. 5 crores will be required to file monthly returns, while those with a turnover of more than Rs. 5 crores will have to file quarterly returns. Annual returns will be filed by all businesses.

5. In Maharashtra, who is responsible for paying professional tax?

A: All persons who engage partly or actively in any kind of trade, employment, profession or callings or come under any class referred to in Column 2 of Schedule I of the professional tax Act should pay professional tax.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.