Table of Contents

- What is Tax Planning?

- Types of Corporations

- Tax Planning in India

- Objectives of Tax Planning

- Types of Tax Planning

- What is Corporate Tax?

- Corporate Taxation and Planning in India

- Definition of Corporate

- Corporation Tax AY 2022 – 23

- Corporate Tax Structure

- Dividend Distribution Tax

- Why is Corporate Tax Planning Important?

- Company Tax Planning

- Available Deductions

- Measures for Appropriate Planning

- Good Tax Planning Results from the Following

- Common Mistakes People Make Regarding Income Tax

- Conclusion

Tips for Corporate Tax Planning

Corporate Taxes are a type of tax applied on profits made by enterprises and businesses functioning in the country. The Tax Rate that applies to a company is determined by the size of its profits/taxable Income, as well as considerations including Cost of Goods Sold (COGS), Capital depreciation, and general, selling, and administrative expenditures.

Corporate tax and planning should go hand-in-hand for better cost management. Careful management of such expenses can help save money on business taxes and re duce income loss due to taxation.

The article contains a brief guide on various aspects of corporate Tax Planning.

What is Tax Planning?

Tax planning is an action undertaken by the taxpayers to lower the amount of tax owed to them by maximizing the use of all available allowances, deductions, exclusions, and other legal provisions. It is the examination of a financial position via the lens of taxation.

Tax planning aims to ensure that taxes are as efficient as possible. It also makes sure that all aspects of the Financial plan work together to achieve maximum tax efficiency. For fiscal effectiveness, tax planning is essential.

Types of Corporations

A corporation is a legal entity separate from its stockholders with distinct functions, rights, and responsibilities. Corporations in India are categorized into two types:

Domestic Corporations

A domestic corporation has its administration and control in India and is established under the Indian Companies Acts. If a foreign company's Indian arm is wholly owned and managed within the nation, it is domestic.

Foreign Corporations

A foreign corporation is based outside of India or has its operations managed and controlled outside of the country's borders.

Tax Planning in India

Indian law provides a wide Range of tax-saving alternatives for taxpayers, including a vast number of exclusions and deductions via which you can reduce your overall tax burden.

- Eligible taxpayers can take advantage of the deductions found in Sections 80C through 80U.

- All of these deductions are made against the amount of tax owed.

- Other provisions of the income tax Act of 1961, such as exemptions and tax credits, can help you reduce your tax liabilities.

Objectives of Tax Planning

Here is why proper tax planning is essential:

Minimal Litigation: There is always a conflict between the tax collector and the taxpayer. In such a case, tax payment compliance must be followed and correctly utilized to keep friction minimum.

Productivity: Channelling Taxable Income to Investment plan is one of the essential tax planning goals.

Reduction of Tax Liability: As a taxpayer, you can save the most money on your tax bill by ensuring that your business is appropriately organized and operating following the law.

Healthy Economic Growth: An Economy's growth is primarily determined by the expansion of its citizens. Tax planning forecasts the development of free-flowing white money.

Economic Stability: When a business's tax planning is done correctly, it adds to its stability.

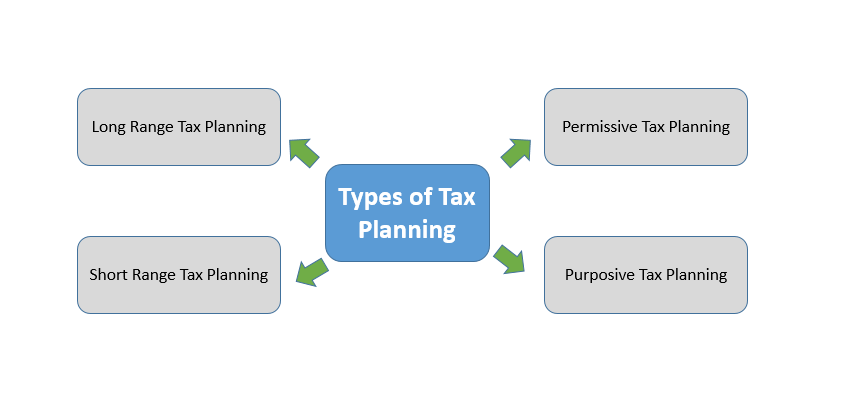

Types of Tax Planning

Tax planning is of three main types, as follows:

- Short-Range and Long-Range Tax Planning: Short-range tax planning is done once a year to achieve specific goals. Long-term tax planning, on the other hand, excludes any quick payment.

- Permissive Tax Planning: This type of planning adheres to the tax laws.

- Purposive Tax Planning: This tax planning strategy uses legal loopholes.

Talk to our investment specialist

What is Corporate Tax?

In India, the tax levied can either be direct or indirect. The direct tax is applicable on all types of assessments and, thus, is divided into income and corporate tax. Under the Companies Act of 2013, the registered companies must pay the corporate tax on their profit in a given financial year.

The gain that these businesses make gets taxed at a specific rate that may change as per the government's discretion.

Corporate Taxation and Planning in India

Also known as company tax and corporation tax, corporate taxation in India is levied on foreign and domestic organizations.

Definition of Corporate

A corporation refers to an entity with a separate legal identity from its shareholders and founders. The companies act of 2013 defines every company as an entity incorporated either under this act or some other company laws. These companies' income is assessed and computed differently from the individuals' income computation.

Corporation Tax AY 2022 – 23

Here are the details about the corporate tax rates for various types of companies and added benefits with them:

| Types of Companies | Corporate Tax Rate | Added Benefits |

|---|---|---|

| Companies that do not wish to claim any incentives/ exemptions | 22% + applicable surcharge and cess. 25.17% is the effective rate. | These companies do not have to pay any Alternative Minimum Tax |

| Companies intending to claim incentives/ exemptions | 30% | The alternative minimum tax is reduced from 18.50% to 15% |

| New Manufacturing companies | 15%, reduced from 25% (the earlier level) | These new manufacturing firms should have been incorporated before October 2019 and start their production by March 2023 |

Corporate Tax Structure

Corporate tax is imposed on a company's net profit, which might be derived from rent, Capital Gains, interest, dividends, or the business itself. After the determination of taxable income after deductions, taxation occurs as follows:

Domestic Corporations

- If your gross revenue is less than or equivalent to Rs. 400 crore, you'll get a 25% discount.

- If the gross revenue exceeds Rs. 400 crores, the tax rate is 30%.

- A 7% surcharge is also applied if the income is between Rs. 1 and Rs. 10 crores, and a 10% surcharge is applied if the income exceeds Rs. 10 crores.

- On top of that, a 4% education and health cess are added to the income tax and surcharge.

Foreign Corporations

- Royalties/ fees for technical services received from the government or any Indian company are taxed at a 10% rate.

- In addition, any other sort of income is taxed at 40%.

- Surcharges are 2% for corporations with incomes between Rs.1 crore and Rs.10 crores, and 5% for those above this level.

- On top of that, a 4% surcharge on income tax and the surcharge is levied on health and education expenses.

- Alternatively, if the sums estimated using the rates mentioned above are less than 15% of book profits, corporations can pay a Minimum Alternate Tax of 15%. There is also a 4% health and education cess on top of that and a surcharge at the corresponding rate.

Corporate Tax Rebates

- Several provisions in the income tax law offer deductions and rebates to the companies to calculate their income for the corporate tax. A few key deductions and rebates include:

- Some interest income that the domestic companies receive is Deductible from the calculated profit for corporate tax.

- If a company sets up a new power source or a new infrastructure, those are also subjected to deductions.

- The company can carry the losses incurred for a max of 8 years.

- If a domestic company gets a dividend from another, the deductions are applicable.

- The capital gained from corporate entities is not subject to be taxed.

- In case of a new undertaking or exports, deductions are allowed sometimes.

Dividend Distribution Tax

A dividend refers to the profit distribution to the stakeholders of a company. The Dividend Distribution Tax (DDT) is charged on such profits' distribution. A corporation distributes such profit after the corporate tax deductions, and this is levied on the company's net profit.

Various companies carry Inter-corporate dividend tax planning to ensure better outcomes. The DDT is presently payable in the company's hands at the effective rate of 17.65%. It is to be removed from the financial year 2023. Thus, the current year of assessment is the last one for its applicability.

Why is Corporate Tax Planning Important?

Companies should go for good tax planning before moving on to financial planning to better execute future financial activities. Here are the primary reasons why tax planning is essential:

- Avoiding illegitimacy is the primary motivation for performing business tax planning. The planning enables businesses to adapt to changes in the external environment and leads to better-organized operations.

- Effective corporate tax planning allows businesses to lower their tax bills, benefiting from better Earnings for shareholders or money to reinvest.

- Higher shareholder earnings and capital reinvestment are evidence of thriving corporate operations, and they can attract new potential investors, improving the company's financial situation even more.

- The company's financial statements will reflect tax operations, and well-planned corporate tax leads to more healthy-looking financial statements.

Effective business tax planning can only be done by tax specialists who are well-versed with the local tax structure. You can also choose for tax planning using private corporations for better outcomes.

Company Tax Planning

Corporate/ company tax planning is critical in assisting a company's value-added activities and strategic decisions. It aids businesses in reducing their tax burden and running their operations more smoothly and efficiently.

The primary goal of corporate tax planning for troubled corporations is to lower a company's Effective Tax Rate (ETR) to attain tax efficiency and stay competitive in its industry. Effective company tax planning is better for businesses than paying a hefty corporate tax every year.

Available Deductions

Taking notice of deductions, exemptions, and rebates and proper administration and reporting of the organization's expenses can help reduce payable taxes. The following are examples of possible deductions:

- Capital gains can be taxed at a flat rate of 15% or 20%, or they can be tax-exempted under Sections 54G, 54D, 54GA, 54EC, and so on.

- Donations to charitable organizations can be tax-free in the range of 50% to 100% under Section 80G, subject to specific requirements.

- Dividends, in some situations, can be eligible for reimbursement.

- Depreciation deductions under Section 32 allow for a 15% depreciation of the old assets' cost, like machinery, and an added 20% on purchasing new assets in manufacturing or production businesses of any article in power generation, transmission, or distribution.

- Deduction for new employee employment under section 80JJAA.

Measures for Appropriate Planning

Here are a few things you can do to save money on business taxes. These entirely depend on how the company's management plans to save money on taxes.

1. Effective Expense Management

Many firms in the country use unorganized labour, making accurate record-keeping difficult. As a result, detailed records of overhead costs paid are required to claim deductions for labour and production costs.

2. Equity Valuation

While stock prices are often valued at cost, in some circumstances with shorter shelf life, it is also possible to value it at its Net Realizable Value (NRV), which can help avoid overvaluation and restrict taxable capital gains income. Significant variations in the value can lead to fraud. Therefore, this may only be appropriate in exceptional circumstances where the value remains relatively stable.

3. Using Deductions

Deductions can be an effective way to control taxable revenue, and their appropriate management could be crucial for businesses wanting to save money on corporate taxes.

Good Tax Planning Results from the Following

Here are the key aspects that lead to better and efficient tax planning results:

- To receive the tax benefits, all you have to do is invest in qualified securities.

- You need to provide accurate information to the appropriate IT authorities.

- Being well-versed on the proper tax laws as well as judicial rulings on the subject is essential.

- Tax planning entirely within the bounds of the law must be the primary focus.

- Consider business objectives as well as the flexibility to accommodate future changes.

You could be a long-time taxpayer or a first-time payer, but if you did not correctly plan your taxes, you are likely to pay more tax than you should. The income tax provisions appear to be so complicated that the average person avoids dealing with them.

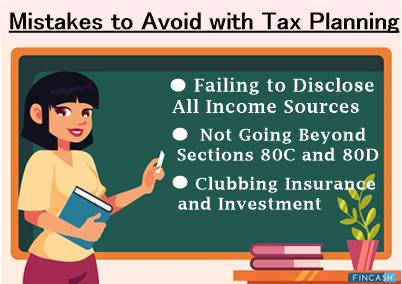

Common Mistakes People Make Regarding Income Tax

Here are some common mistakes that may worsen the situations related to income tax for you:

1. Procrastination

It is the root of all mistakes you'll make as a taxpayer. Instead of making timely investments that lead to optimal tax planning, this will eventually lead to you paying more taxes.

2. Investing in Insurance Products to Save Money on Taxes

Many people receive phone calls from insurance firms as the end of the fiscal year approaches, urging them to purchase a tax-saving insurance policy. This isn't the best course of action.

3. Failure to Take Advantage of all Available Tax-saving Options

Don't be one of those people who think tax planning begins and stops with Section 80C of the Income Tax Act of 1961, which exclusively covers investment instruments for tax savings. Explore more options for tax savings that meet your goals and needs.

Conclusion

A balance must be achieved between the numerous available techniques, like deductions and refunds, and innovative expenditure management to reduce corporate tax.

Understanding the cases in which these tactics are most effective can also help you maximize your company's profits while helping to achieve better income tax and corporate tax planning.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.