Table of Contents

Smart Tips for Tax Planning in the New FY 25 - 26

The new FY 25 - 26 has already begun on April 1. The commencement of this new fiscal year is the ideal time to get your Financial goals in order, be it planning your investments, getting your insurance, or keeping track of your monthly expenditures. In all senses, adequate financial planning helps you maintain a stronger portfolio.

On top of that, considering the unexpected scenarios happening in the world, be it an outbreak of a deadly virus or the inception of the war, being prepared for emergencies is always beneficial. So, if you have been struggling with financial planning, this post is for you. Through this article, let's learn how to keep the taxes in check in this new financial year.

Begin your Smart Planning in April

While most people wait until the end, experts recommend that you begin your Tax Planning in April, from the first month of the financial year. To do so, you can work closely with your financial advisor to plan and execute without any delays.

Also, tax planning should be incorporated as a monthly exercise and not just a one-time-a-year thing. If you are a salaried individual, it becomes even easier. You can:

- Begin the rework of your systematic investments into non-tax and tax schemes

- Invest a small amount every month in a tax-saving instrument

- Include ELSS and the NPS in the monthly Financial plan

However, if you are an independent professional or working in a gig industry, you will have to be even more particular regarding tax planning. It is highly important for you to sit with the Accountant and comprehend the difference between tax evasion and tax avoidance. While you can avoid tax up to a certain level, you will still have to make sure you have enough money to pay the tax every quarter. Also, if you are registered for Goods and Services Tax, you must pay that regularly as well.

Why is Advance Planning a Must?

The fundamental benefits of tax planning include reduced tax liability by taking advantage of all available credits and deductions. Here's an overview of why tax planning is so crucial:

1. Making Well-Informed Choices

Tax planning is important because it allows you to make informed judgments rather than rash mistakes that might sabotage your financial goals and eventually become a barrier to long-term wealth building. You can go over the many options accessible to you and choose the one that best meets your needs

2. Efficient Preparations for the End of the Year

Most companies deduct tax in the fourth quarter of the year for salaried employees who fall under the taxable limitations. The tax payable is withheld from the salary before it reaches you. After all, expenditures and deductions get accounted. This is why it's crucial to start planning your taxes as soon as possible. As a result, it is advisable to take advantage of all applicable deductions as soon as possible in order to claim them afterwards

Talk to our investment specialist

Tax-Saving Investment Strategy

The key to saving is to make tax-saving investments, and the right methods can make all the difference. The measures you should take to establish a successful tax-saving strategy are outlined below:

1. Determine your Tax Obligation

Calculate your tax liability based on your yearly earnings forecasts. This will give you a good sense of how much you can claim as a maximum deduction. Divide your entire tax-saving investments into 12 equal payments. Make the payments ahead of time to ease your financial strain at the end of the year.

2. Select the Appropriate Investment Option

Do your current investments allow you to deduct the needed amount? If not, choose an appropriate investment product. If you do not have Life Insurance, you may want to consider purchasing one. You pay a minimal price and receive a lot of coverage by doing so. Moreover, under Section 80C, the premium is tax-free. However, if you are already insured, you can consider Investing in ELSS or PPF. These can help you save money on taxes while building a corpus for future aspirations

3. Choose a Health Care Plan

A health insurance plan protects your cash in the event of a medical emergency. Even if you suddenly have to cover unexpected medical costs, your savings remain untouched. But, when taking a health-care plan, you should be well-versed with the followings:

- Lock-in period of instrument

- Your financial objectives

- risk appetite

- Current tax obligation

- Your income tax slab

This will assist you in making the best tax-saving investments possible.

Best Investment Options

Once your income becomes taxable, tax planning is an important practice to follow. With a sufficient understanding of the tax planning system, you can avoid paying excessive taxes by making appropriate investments to save more and attain all of your aspirational goals.

Here are several tax-saving investment possibilities to consider, depending on your needs:

1. Equity-Linked Tax Savings Scheme (ELSS)

It is one of the finest tax-saving instruments for those who want to invest in short-term plans since it has a three-year lock-in period. Also, with the option of investing as little as Rs. 500, the ELSS this Equity Fund provides strong long-term returns. Apart from the lock-in period, it is not mandatory to continue investing as in the case of pension plans, insurance plans or ULIP

2. New Pension Scheme (NPS)

It is a retirement savings plan that provides monthly income during retirement. Employees in the public and commercial sectors can benefit from it. investor-friendly features, a low-cost structure, and flexibility are all cornerstones of NPS. You can invest a minimum of Rs. 6000 in monthly instalments of at least Rs. 500 or in one lump sum.

3. Infrastructure Bonds

This proves to be an excellent alternative for fixed income groups who are seeking risk-free tax saving instruments. Infrastructure Bonds are issued by companies that fit under the infrastructure category and have been sanctioned by the Indian government. These bonds provide a low rate of interest and certain tax benefits. They allow you to invest up to Rs. 20,000, which can be used as a tax benefit under Section 80C of the IT Act.

4. Sukanya Samridhi Yojana

For parents who desire to save for their daughter, the Sukanya Samriddhi Yojana is one of the most efficient tax-saving mechanisms. With a minimum investment of Rs. 1000, the scheme can be opened for girls under the age of 10. Every quarter, the government announces the interest rate. The interest rate is higher than that of a PPF, and it is also tax-free under the current tax structure, up to a limit of Rs. 1.5 lakh. The best component is that the Sukanya Samriddhi Yojana account is formed in the female child's name, and the maturity income can be used for her marriage and education.

5. Health Insurance

It is one of the best tax-saving mechanisms. Tax deductions are available on health insurance premiums up to Rs. 25,000. The limit has been raised from Rs. 20,000 to Rs. 30,000 for senior citizens. You can get a deduction of up to Rs. 35,000 if you get health insurance for yourself and your parents. The lump-sum payment paid in the event of disability (as a result of an accident) is not taxed. Hence, it involves maximum tax savings, low cost of investment, and minimum risk with substantial returns.

6. Life Insurance

As per the new budget 2022, under section 80C of the Income Tax Act, life insurance plans can provide a tax advantage of up to Rs. 1.5 lakhs. In addition, in the event of the insured's death, the lump sum paid to the recipient as a death benefit is not taxable under section 10 (10D).

7. Public Provident Fund (PPF)

PPF is a long-term savings plan that includes a 15-year lock-in period and can be extended to 5-year levels. The new budget has raised the yearly investment limit from Rs. 1 lakh to Rs 1.5 lakhs. PPF investments qualify for a tax deduction of up to Rs 1.5 lakhs per year under Section 80C.

Accordingly, the PPF interest rate 2022-23 would earn 7.10% in the first quarter. Tax deduction benefits of up to Rs. 1.5 lakhs can be claimed by investing in Tax saving fixed deposits.

8. Unit Linked Insurance Plans (ULIPs)

It is a long-term investment option that helps you save money on taxes. ULIPs protect your investment by providing insurance. Your premium is invested in the debt and stock markets, providing you with tax-free income. If you spend 10–12 years on ULIPs, you can anticipate good profits from this. It is a tax-advantaged investment product that lets you switch between equity and debt.

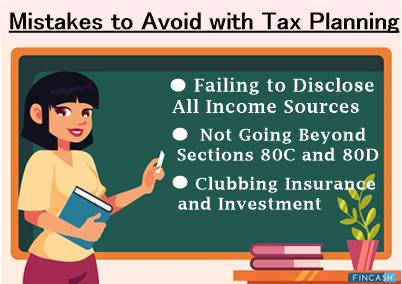

Mistakes to Avoid with Tax Planning

With tax planning, there are plenty of mistakes you might end up committing. To help you out avoid them, here are a few mistakes you should be wary of:

Failing to Disclose All Income Sources

Generally, you may end up getting into the habit of exempting the incomes and transactions that don’t come under the taxable category. Some of them may include interest on Savings Account and interest on fixed deposits.

If you fail to disclose all of the credible income sources when filing returns, it will be considered a concealment act of income and can cause trouble later.

Not Going Beyond Sections 80C and 80D

One of the significant mistakes that most people make is not expanding their horizons beyond sections 80C and 80D of the Income Tax Act. Some other elements that you can include when planning taxes comprise medical expenses of a disabled dependent, interest paid on loan, donations to charity, house rent allowance, etc.

There are varying transactions liable for tax returns. However, you might fail to integrate them because of no or little knowledge. Thus, it is critical to have an understanding of the transactions for which you are filing returns.

Clubbing Insurance and Investment

Avoid clubbing your tax-saving and insurance investments and keep them separate. Traditional life insurance instruments that combine debt and Term Insurance investment generate not-so-adequate returns and are lower than PPF and other small savings schemes. They also have long tenures.

Thus, make sure you are considering all of the essential points and clarifying tax implications on the income earned from these investments before moving ahead. It would be best if you select the mixture of tax-saving investments that suit your needs the best.

Options to Maximise from your Investments

Simply having a tax-saving strategy isn't enough if you want to keep last-minute stress at bay. Put your strategy into action as soon as possible. This can help you save a lot of money and time. Here is how you can maximise your investments:

- Begin tax planning as soon as feasible

- Gather all of your income and investment documentation ahead of time

- Before claiming any deductions, organise your investment portfolio

- If you foresee an increment in your pay, increase your investments. A rise in income would result in a tax increase. Increase your investment to combat it

- To avoid TDS on interest, submit forms 15G and 15H

The Bottom Line

The early quarter in the financial year is a good time to start investing. As a result, you'll have plenty of time to properly plan your tax-saving investments, ensuring that you reach your financial objectives. As you've learned about tax-saving instruments for 2025 and beyond, it's time to put what you've learned into action and invest in one of them to keep your hard-earned money from being drained at tax time. However, keep in mind that you should manage your savings not merely for tax benefits but also a more secure financial future.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.