Table of Contents

Quick Steps for Income Tax Online Payment

income tax is one of the major revenue models for the government, which is used for the development of the country. And, therefore, Income tax is obligatory for every salaried person. But, if you think paying income tax is a tedious task, then you probably haven’t been introduced to the online payment system. To make the income tax payment easy, the tax department has gone digital. Follow the below-mentioned steps!

Income Tax Online Payment: Online & Offline

You can pay Taxes in two ways- online and offline mode. If you are looking for a simple, quick & hassle-free process, then paying online is the right option for you.

Steps to Pay Income Tax Online

Follow the following steps:

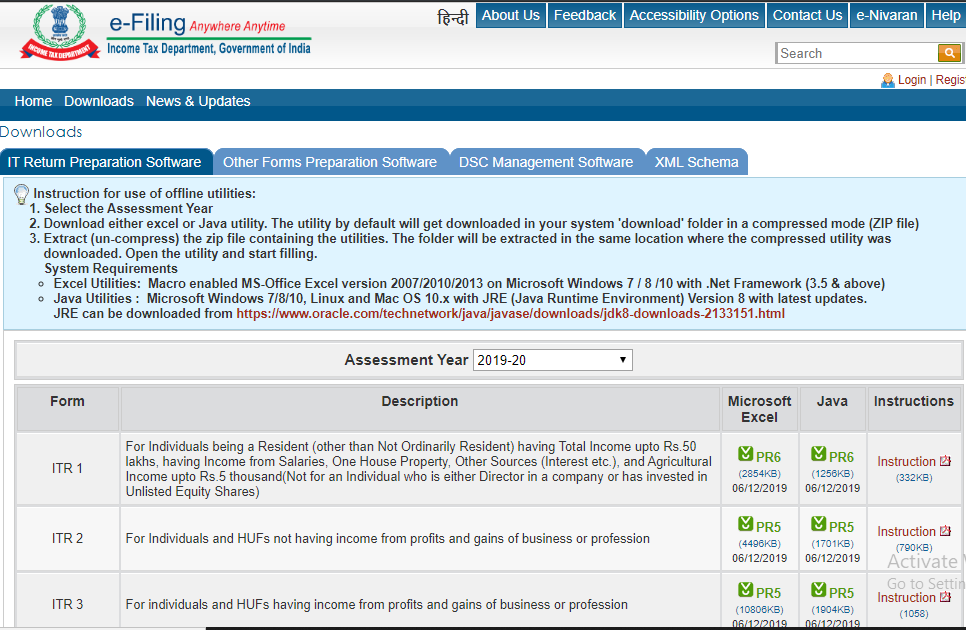

- Step 1 - Visit the official website of the Tax Information

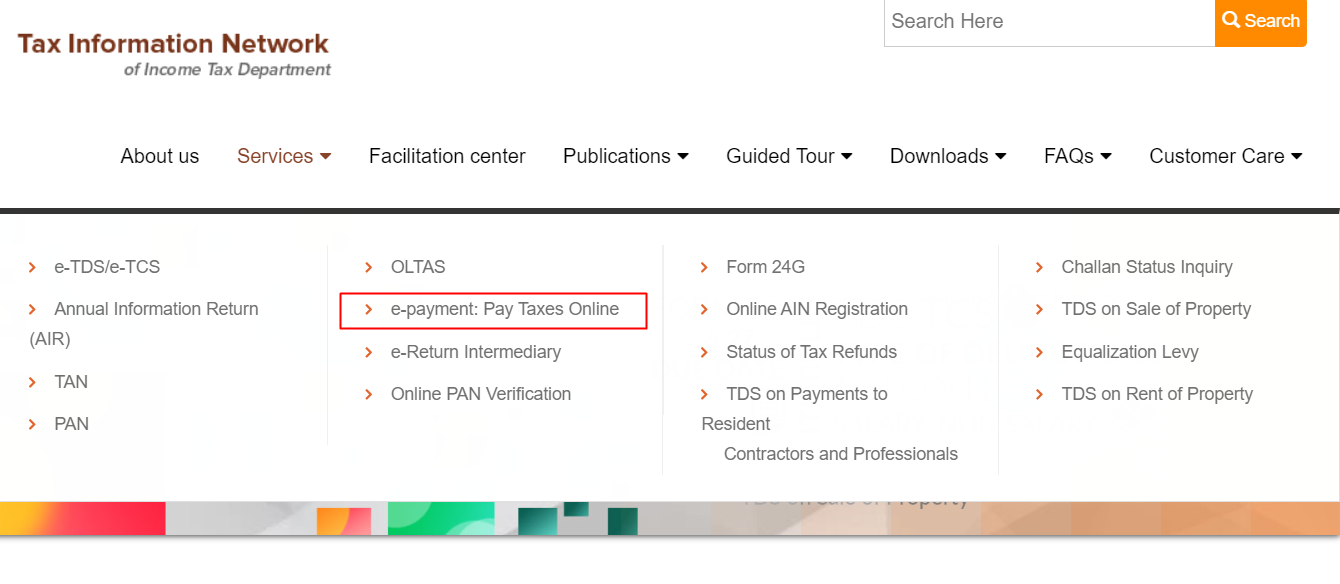

- Step 2- Go on the Service option, in the drop-down, you will find an option of e-payment: Pay Taxes Online.

Talk to our investment specialist

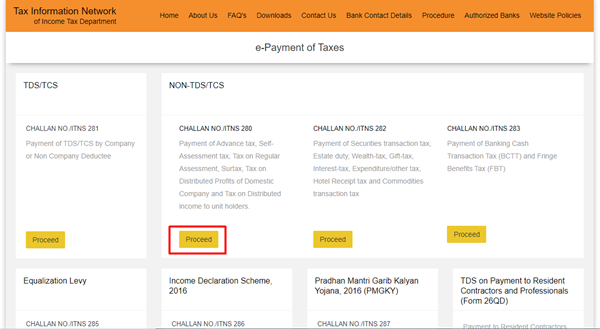

- Step 3- Click, and it will take you the relevant Challan i.e. Challan 280, Challan 281, Challan 2, Challan 283, ITNS 284 or TDS Form 26QB

Step 4- For instance, if you click on the Challan 280, you will have to choose tax applicable year, whether it is 2020 or 2021.

Step 5- Following which you will find an option of the type of payment.

Step 6- In the next step, you have to choose mode of payment i.e.,- either Debit Card or net banking.

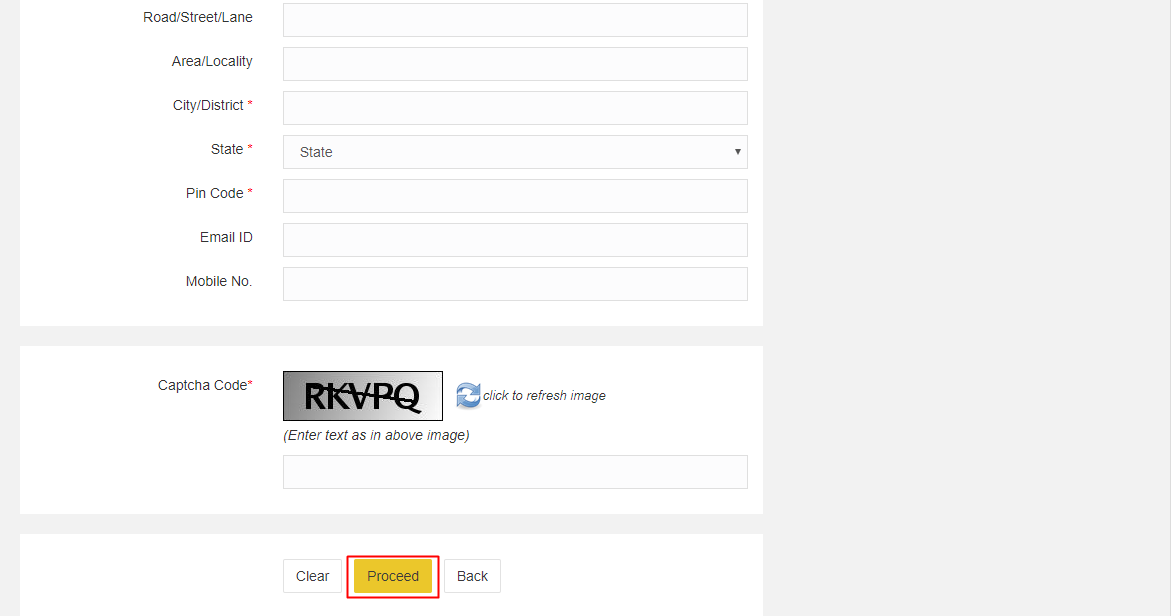

Step 7- Hereafter, you have to fill all the details given, such as - permanent account no, address details, mobile no, etc. After entering all valid information you will be re-directed to the net-banking.

- Step 8- Log-in to the net-banking site with the user id and password. After successful payment, a Challan Receipt will be displayed containing CIN, payment details and the Bank name. The taxpayer should keep the receipt safe to avoid further queries from the income tax department.

The payment may take 10 days to reflect on your Form 26AS after the payment of tax. It will be appeared as ‘Advance Tax’ or ‘Self-Assessment Tax’ based on the type of tax.

Offline Mode of Tax Payment

If you want to opt a physical process of paying taxes or in case you are unable to do the tax deposit online, you can visit your nearest bank and follow the steps:

1) Go to the bank and ask for the Challan 280 form. You have to fill the Challan with relevant details.

2) Submit the Challan 280 to the bank counter along with the amount to be paid as your income tax. In case of a huge amount, submit the cheque. When the payment is done the bank assistant will hand over a receipt, which you have to keep safely for future references.

The payment may take up to 10 days to reflect on someone’s Form 26AS after the payment of tax. It will be appeared as ‘Advance Tax’ or ‘Self-Assessment Tax’ based on the type of tax.

Benefits to Pay Income Tax Online

Paying income tax online is one of the best and easy ways to pay taxes. As it doesn’t require physical effort to move from one counter to another.

- All information you entered remains secure and confidential

- You can keep your Challan receipt copy safe in your device

- By using e-payment options you can easily find your tax status by visiting the website

- Once the bank initiates the payment the receipt will be sent you

- As a track record, your transaction will appear on your bank statement

Conclusion

Income tax is mandatory for every citizen! Ideally, opting for online payments is suggested as it is hassle-free and you can find every record easily.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.