Table of Contents

Step-by-Step Guide to Download ITR Forms Online

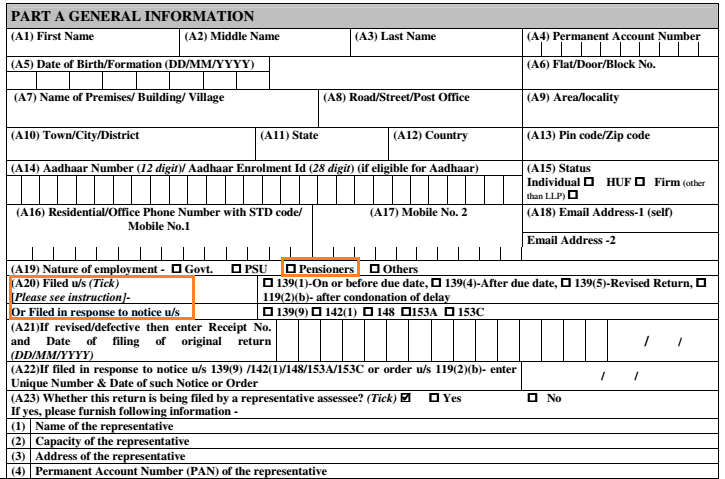

ITR or income tax return is a mandatory form that each taxpayer needs to fill with information about their Income and applicable tax. The ITR form is issued by the income tax department, and it is divided according to the income, property owned, profession, etc. The good thing is that it is now possible to download ITR Form online seamlessly.

Before diving into the process of ITR statement download, let’s figure out the eligibility of ITR.

Who should fill ITR Form

The government has made it obligatory for every taxpayer in India, who falls under any of the given categories, to File ITR forms:

- Gross annual income: 2.5 Lakhs below the age of 60 3 Lakhs between the age of 60 to 80 5 Lakhs above the age of 80

- Has multiple sources of income, including property, Capital, investments in foreign assets, etc.

- Is representing a company or a firm; or

- Needs to file the application for a loan, visa, or claim an income Tax Refund

Different ITR Forms and their Filing Criteria

ITR Forms are categorized differently, and each one of them is filed for a different return. You can visit the website and can download ITR copy for forthcoming references. Below-mentioned is a quick brief regarding who can file which type of ITR form:

ITR 1 Form

The individual should be a resident with total income up to 50 lakhs from salary, property, other sources, and agricultural income up to 5 thousand

IRT 2 Form

The taxpayer without business or profession profit

IRT 3 Form

The taxpayer with business or profession profit

IRT 4 Form

The individual should be a resident with total income up to 50 lakhs from a firm, business, or a profession

IRT 5 Form

People who do not come under HUF, company, and IRT 7

IRT 6 Form

The taxpaying companies with an exemption under section 11.

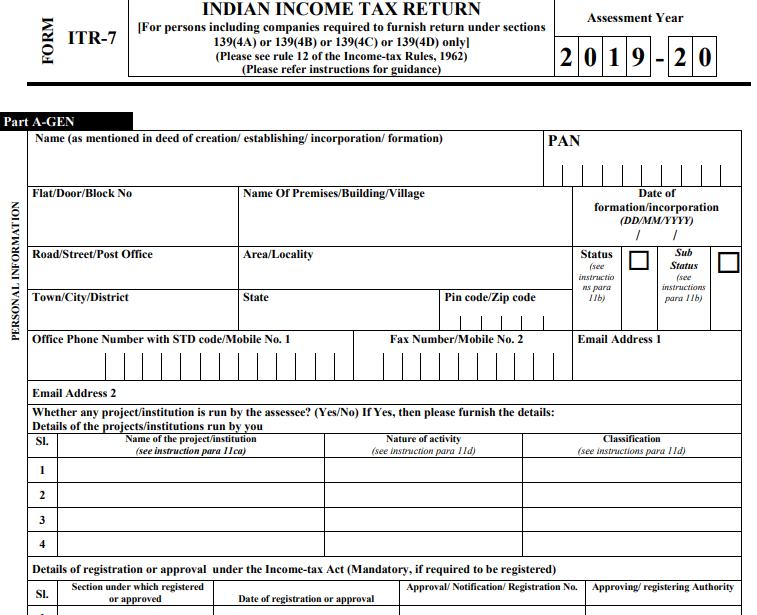

IRT 7 Form

The taxpaying companies under Section 139(4A), (4B), (4C), and (4D)

Talk to our investment specialist

ITR-V

ITR-V or Income Tax Return verification is a process that helps to verify the legitimacy of every e-filing that takes place. It can be done without a digital signature.

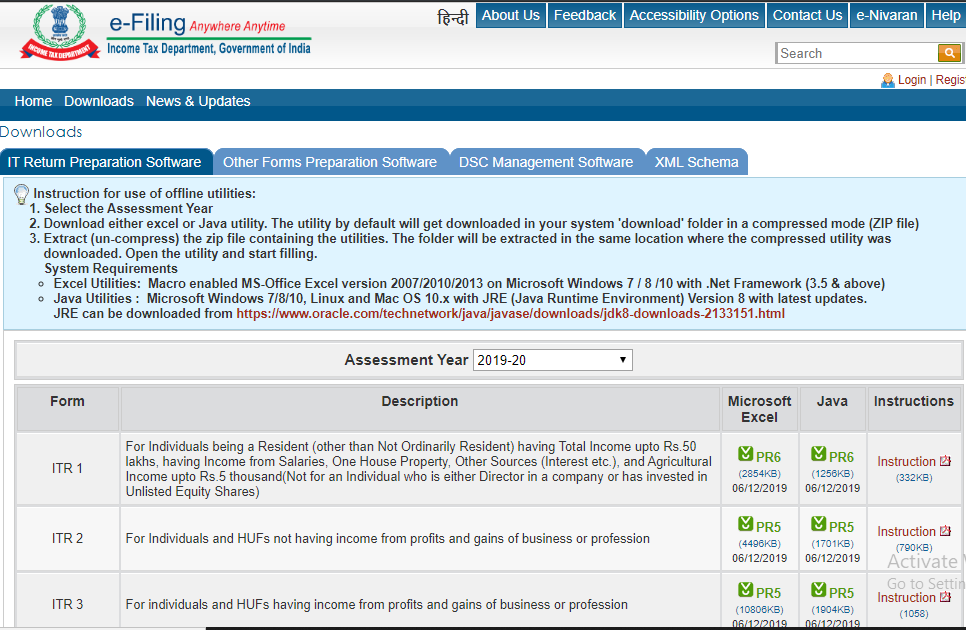

Here, you can access Incometaxindiaefiling downloads online easily from your home or office.

Steps to Download ITR-V

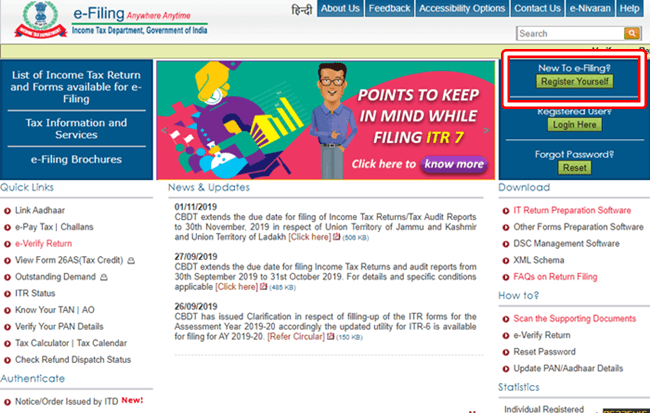

Step 1: Visit the Income Tax India website and login into your account

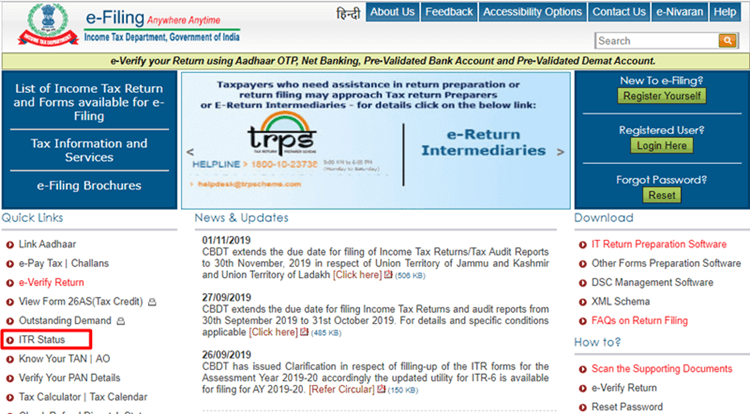

Step 2: Once your dashboard opens, click View Returns/Forms option to view the e-filed Tax Return

Step 3: Then, click on the acknowledgement number to download ITR online

Step 4: Now, choose ITR-V/Acknowledgement to start ITR acknowledgement download

Step 5: Once the download is done, the file would require a password, i.e., the user’s PAN number in the lower case along with the DOB

Step 6: The final procedure is to print, sign, and post the document to CPC Bangalore. This needs to be done under 120 days from e-filing

Conclusion

Due to the advent of technology, it has become extremely easy to download ITR forms online. Not just the download process; however, you also have an option to file your Income Tax Returns from the convenience of your house.

Further, the seamless navigation and user-friendliness of the website have made sure that you don’t come across any hassles while doing so. Now that you understand the procedure of downloading the forms, e-filing them would not be a tough task anymore.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.