Table of Contents

A Guide to Generate Rent Receipt Online and Avail HRA Benefits

What is Rent Receipt?

It is a Receipt that you get from your Landlord for paying your rent. It’s just like a receipt from a shop, which is a proof of purchase. Many people think that a cheque or credit card statement is enough for a rent receipt proof. However, this isn't the right method. A rent receipt from your landlord is a must to avail HRA benefits.

Why do you need Rent Receipts?

If an employee wants to claim income tax benefit on House Rent Allowance (HRA) then an individual has to provide the proof of rent payment to the employer. On the Basis of the rent receipt, the Indian Government provides deductions and allowances to the employee.

Tax Benefit of Monthly Rent paid

If you are a salaried person and you live in a rented house, here is an opportunity for you to claim House Rent Allowance. You can avail HRA Exemption under section 10 (13A) of the Income Tax Act. People those who are self-employed, they can avail HRA under section 80GG. Calculate your HRA exempted amount by following the below-mentioned steps:

- HRA received from your employer

- The rent you pay - 10% of sum basic salary & dearness allowance

- In case you reside in a metro city than 50% of your basic salary and dearness allowance. Another option 40% of your basic salary & dearness allowance.

The lowest of these 3 components are the part of your exemptions in Income tax Calculation. Your final Tax Liability will be calculated on the exempted HRA amount.

Talk to our investment specialist

Important Factors of a Valid Rent Receipt

As said earlier, the salaried person has to give a rent receipt to the company as proof of rental expenses t. A rent receipt is provided by the landlord when he receives rent from the tenant. If you submit the rent receipt as the evidence you can save tax. The total amount is reduced from your gross Taxable Income.

A rent receipt is only valid if the receipt has the following components:

- Tenant name

- Landlord name

- House address

- Rent paid

- Rental period

- Signature of landlord

Other than this, if your annual rent exceeds Rs. 1,00,000 in a year then you have to submit the PAN details of the landlord. A revenue stamp may also be required if the amount exceeding Rs.5,000.

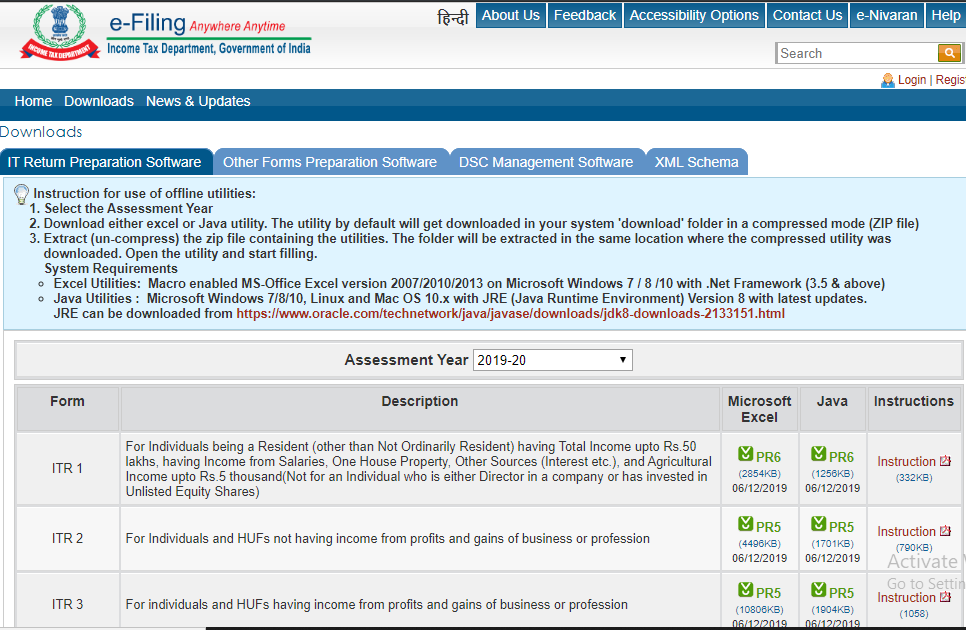

How to Generate a Rent Receipt Online?

There are many online sites that help you to generate rent receipts. All you have to do is fill the relevant details asked on the page and create generate a receipt. You will get a rent receipt PDF on email and also you can take a print of it.

Important Points to Remember for Rent Receipt

Before submitting a rent receipt and claiming a tax Deduction you need to keep these following points in the mind:

An individual must have a valid rental agreement- the agreement should contain all pertinent information, including monthly rent, time period of the agreement and any utility bills.

In case, it is a shared accommodation, then you must have all the details mentioned in the agreement, which includes- the number of tenants, how rent and utility bills are to be divided.

Online payment is the better option to pay rent because you can keep track of your transaction in a seamless manner.

An individual should ask for a rent receipt from the landlord. It is important to share rent receipts with the employer to claim HRA exemption for monthly rent paid above Rs. 3,000.

In case, if the rent payment exceeds Rs. 1 lakh annually then it is obligatory for the employee to provide the PAN of the landlord to your employer in order to avail the full benefit of HRA exemption.

If the PAN of the landlord is not available, then the landlord needs to give a declaration. This must be confirmed with the landlord before taking a house on rent. Along with the declaration, you need to acquire Form 60 duly filled by the landlord. All these documents need to be submitted to the employer to claim HRA.

Some situation occurs where an employee pays higher payment different from what is mentioned in the rental agreement. In this case, the tax exemption is calculated on the basis of the rent receipt shared by the employee.

Conclusion

Rent receipts play an important role in tax deductions. Always make sure to generate a rent receipt, as it will help you claim House Rent Allowance.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.