Table of Contents

Online Share Market — Guide to Make the Most of Trading

An online share Market is a happening place. Every day the graph rises and falls and so do the investors’ investments. The Coronavirus pandemic introduced much panic in the market. However, today, the stock market is witnessing powerful positive changes.

According to the stock news on December 23, 2020, the Sensex, Nifty witnessed two consecutive day rises with investors purchasing stocks across the board. In this article, we will take a look at everything important about the share market.

What is the Share Market?

The share market is where the buying and selling of shares take place. If you buy shares from a company, you have that much unit of ownership in the company. For instance, if you have purchased 20 shares from a company, you automatically become the shareholder in the company. Remember that when you are buying a share, you are Investing cash in the company. With the growth of the company and the market conditions, the price of your share will increase. You can also sell the shares and earn a profit.

Companies also sell their shares to the public to raise Capital for growth and expansion. This process of selling shares is called the Initial Public Offer (IPO).

How to Trade Online?

In today’s digital world, online share market trading is the norm. It makes it much more convenient for investors and traders since the market is just a screen tap away. However, there are certain aspects of online trading you need to consider before taking the leap. The most important question to ask yourself now would be, “How to trade online?”. Well, here is the solution to the question.

9 Major Tips for Share Trading Online

Here are 10 major steps to consider when you want to start trading online. They are mentioned below:

1. Planning

Before you can get into trading in the online share market, do an extensive planning. Experienced investors and financial advisors all warn against a human trait that causes misjudgement when it comes to online trading i.e. emotions.

Emotional decisions are very common among first-time investors. If you are planning to invest for the first time, stay away from making emotional decisions. Start with planning your course of action. Planning would include asking yourself the following questions:

- What type of investment do I want to make?

- How much risk am I willing to take?

- Should I have an exit strategy in place?

You can start planning well once you have answered these questions.

2. Research

Once you are done with planning, get down to research. Never start investing without knowing anything about the market, stocks and other investment protocols. You can start looking at companies and consider their financial standing including their financial reports, earning status, etc.

Once you are comfortable and sure, proceed to pick one or two stocks and invest in them. However, make sure to not enter the online share market with the mindset that profit will always come your way. There might be some losses too, but staying focused and determined will help you go the long way.

3. Educate Yourself

While researching you are also educating yourself along the way. Take an extra step and opt for some good online courses available to help you make the right decisions. Great share market courses online are available for free. If you wish to take this venture forward. There are a number of courses you can take from individual university websites and other educational websites. The National Stock Exchange (NSE) of India also offers certification in Online Essential Technical Analysis Courses.

4. Online Share Trading Apps

Trading applications are in demand today because of the convenience and ease it offers. The online share market live feature helps people to keep up with everything important. It helps in safe investments as you can keep a track on the whereabouts of your money. Secondly, you can invest in stocks that seem right and beneficial to you with available data online. Portfolio management is just a tap away and you can enjoy the ease apps offer to manage them. Moreover, your data is secure and regulated by the exchange authorities and you can access real-time data about your investments through pop-ups and notifications from time to time.

Investors are satisfied with the benefits and working of these apps. These apps also serve as some of the best share market brokers. Some of the top trading apps are as follows:

- Zerodha Kite Mobile App

- NSE Online Trading App

- 5Paisa Mobile Trading App

- IIFL Markets

5. Decide on Right Stock Order

Stock order is commonly known as a trade order. Buying and selling stocks online may seem like a task for the buy button and the sell button on your screen, but it’s much more than that. This is where the concept of ‘slippage’ comes into force. Slippage is the difference between the expected price and the price for which the order is filled. This is important to consider in an online share market when live.

The types of stock orders are mentioned below:

a. Market Order: This refers to a trade order to buy and sell stock at the current price.

b. Limit Order: This refers to an order that allows to buy and sell stock at a specific price set. If there’s a price better than the set price, this trade order allows opting for that.

c. Stop Order: This refers to a trade order that is created to limit and protect an investor’s loss on a position.

d. Stop-Limit Order: This is an order which combines the features of limit and stop order.

6. Cost Behind Trading

One of the most important elements to remind yourself while trading in the online share market is the cost involved in it. Trading and investing can be an extremely rewarding process but also comes with some initial costs behind every transaction to help you move forward.

The three major types of costs you need to consider are:

a. Capital: This refers to the money you hold when buying stocks. The amount does not have to be a large one. You can start small and over time, you will see it growing.

b. Tax: This is another important cost involved in trading. Even if you are not a frequent trader, taxation is involved in the transactions you carry. However, these Taxes also depend on the types of trade and stock you undertake. Service tax is one major tax involved in Indian trading — even online.

c. SEBI Fees: The Securities Exchange Board of India (SEBI), is a legal body that has put up rules and regulations on trading. Their charges need to be considered as well.

Talk to our investment specialist

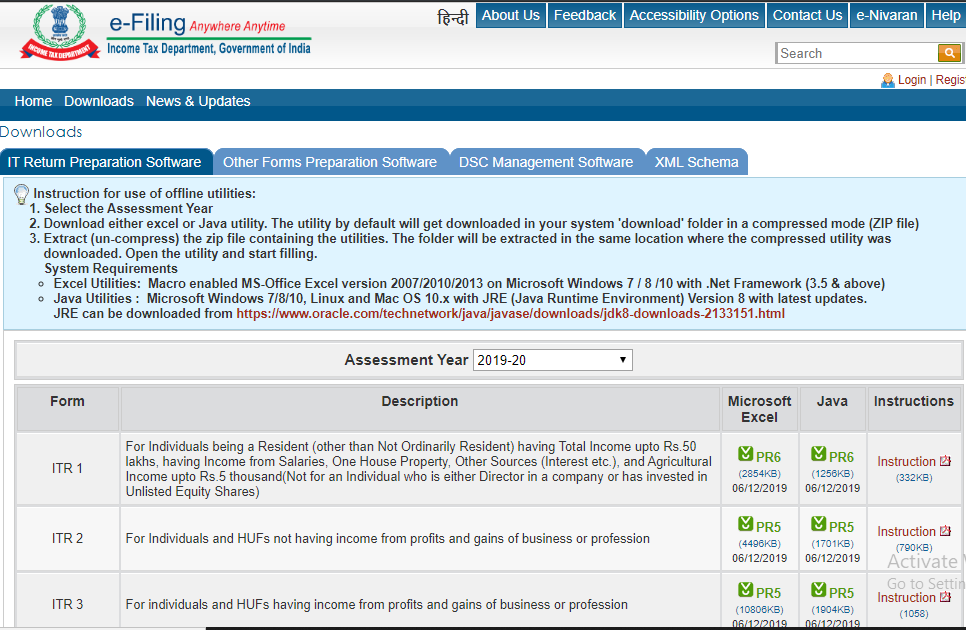

7. Trading Softwares

Trading software is preferred among investors today since it provides transparency and avoids middleman bias. With Trading platforms and software, time-sensitive stocks can be easily tracked and trade can be carried out instantly. The charges for using such types of software are low compared to the offline method of trading.

8. Buying on Margin

One of the many facilities you can benefit from the online share market is also buying on margin. This means you can borrow money to purchase securities. You will have to pay a percentage of the value of the asset and borrow the remaining amount from a Bank or broker.

9. Long-Term Investment

This is probably the most important aspect to consider when it comes to investing. Investing for long-term is important to gain increased returns. Investing experts like Warren Buffet, etc support long-term investment.

4 Things to Avoid in Online Stock Market Trading

- Herd Behaviour Stock and Investment experts warn against this behaviour in the online share market. This is because human decisions are vastly influenced by emotions. Her behaviour is when individuals make decisions with a group rather than individually. In other words, when you make your investment choices based on the choices of the majority, you are participating in her behaviour.

It’s always wise to avoid this kind of decision making when it comes to investment. Remember, even a group is made up of other individuals with their own biases and choices. Their inclination may not be yours. That’s why plan and research well before investing.

2. Short-term Goals

You have already read why it is important to have long-term investments. Let’s also talk about why short-term goals usually lead to losses. Short-term goals can lead to short-term investments which often end up in low Income or losses. They also carry high risk and are highly sensitive to market Volatility.

3. Value Traps

Well, this is something you should not skip through. Value traps could be quite dangerous for you as an investor. A value trap refers to the situation where a stock or investment seems to be inexpensive. This could be because it has been trading at low valuation metrics. These types of stocks are usually the ones that attract naïve investors because it may seem that the stock did well historically.

The danger becomes real when you purchase the stock and the value continues falling further and you go through terrible losses.

4. Short Selling

Well, short selling doesn’t necessarily need to be avoided, but it is only advisable to those who are truly practical experts in trading and stocks. If you are a beginner or even an intermediate, avoid short selling as it can cause huge losses. Short selling is an investment strategy where a trader speculates a decline in the stock or security price.

FAQs

1. What is a Bull Market?

A bull market is a term used to describe the condition in the stock market when prices are rising or are expected to rise.

2. What is a Bear Market?

A Bear Market is a term used to describe the condition in the stock market where prices are constantly falling.

3. What’s the difference between Buy-Side and Sell-Side Analysts?

The buy-side and Sell-Side analysts play important roles in the financial markets.

a. Buy-Side Analysts: A buy-side analyst deals with being right about anything regarding the market. In other words, they often avoid the negative side and try portraying the positive side.

b. Sell-Side Analysts: Sell-side analysts provide an unbiased view based on the research of company securities. They regularly research firms and provide an unbiased report to their clients.

4. What are Stock Rights?

Companies issue stock rights to help shareholders preserve their share of ownership in the company. The company issues a single right for each share of stock.

5. What is a Capital Market?

A capital market is a place where long-term investments are bought by companies, individuals and stockbrokers. This market deals with both stocks and Bonds.

Conclusion

If you are looking to commit to trading in the online share market, make sure to do your research well and plan your investment. Avoid making decisions as per the majority and don’t opt for advanced investing techniques if you are a beginner.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.