Fincash » Coronavirus- A Guide to Investors » Gold ETF- Investors’ Safe Haven Amid Coronavirus Panic

Table of Contents

Gold ETF- Investors’ Safe Haven Amid Coronavirus Panic

The Coronavirus pandemic has been a matter of serious concern. This is same for both the health and the economic sector in India and the world. As of April 13, 2020, India recorded a total of 9269 cases and 333 deaths. An increased vitality in the stock Market has been an area of concern for both the authorities and investors. However, amid the ongoing panic, investors have found their place of comfort in Gold ETFs.

According to the World Gold Council (WGC) on April 8, 2020, the net asset growth of global gold ETFs crossed $23 billion within the first quarter of 2020. This was the highest quarterly amount in US dollars and the biggest tonnage addition since 2016.

Gold ETFs- the Safe Haven

Investors have taken a liking to invest in gold Exchange Traded Fund (ETFs) amid the outbreak of COVID-19. According to a recent report, investors have infused over Rs. 1600 crores in gold ETFs in 2019-2020. This sudden and huge inflow may be from the fear surrounding the COVID-19 situation.

Investment in gold ETFs saw a rise in January with investors Investing Rs. 202 crores. This was the highest in the last 7 years. Experts mentioned that this may continue to gain momentum in the days to come. The report also stated that the inflows of gold funds (AUM) have increased by 79%. This means it reached Rs. 7949 crores at the end of March 2020 from Rs. 4447 crore in March 2019.

Experts also said that investors looking for liquidity options can bet on gold ETFs. The gold ETF category made Rs. 195 crore in March and the prices have seen similar despite varied geographical locations.

Talk to our investment specialist

AMFI Data

The Association of Mutual Funds in India’s (AMFI) data showed that the investment in Gold ETFs saw net outflows of varied outcomes since 2012.

| Year | Net Outflow (INR Crores) |

|---|---|

| 2012-2013 | Rs. 1,414 |

| 2013-2014 | Rs. 2,293 |

| 2014-2015 | Rs. 1,475 |

| 2015-2016 | Rs. 903 |

| 2016-2017 | Rs. 775 |

| 2017-2018 | Rs. 835 |

| 2018-2019 | Rs. 412 |

| 2019-2020 | Rs. 1,613 |

Status of Gold ETFs Worldwide

A recent report also showed that gold ETFs has received large investments and positive response during the month of March worldwide. The World Gold Council expects to see a continuous rise in demand. Low gold rates are attracting investors’ attention.

Regional inflows in European funds experienced growth by 84 tonnes ($4.4 billion). North American funds added 57 tonners ($3.2 billion).

| Region | Total AUM (bn) | Holdings (Tonnes) | Change (Tonnes) | Flows (US $mn) | Flows (%AUM) |

|---|---|---|---|---|---|

| Europe | 76.7 | 1478.4 | 156.2 | 8520.0 | 11.1% |

| North America | 82.4 | 1589.1 | 148.7 | 7824.0 | 9.5% |

| Asia | 4.7 | 91.0 | 11.8 | 638.3 | 13.5% |

| Other | 2.7 | 51.7 | 6.8 | 357.9 | 13.3% |

| Total | 166.5 | 3210.3 | 325.5 | 17,340.8 | 10.4% |

What is Gold ETF?

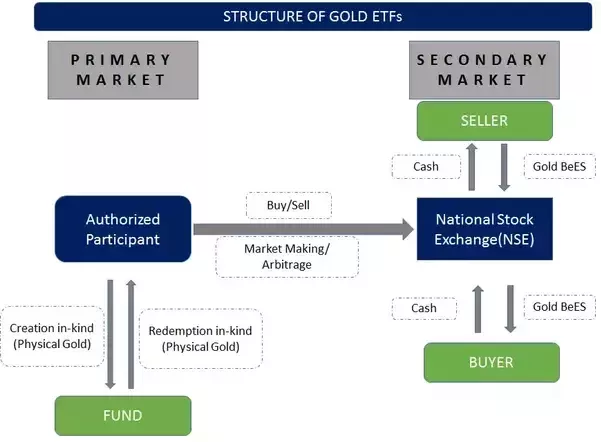

Gold Exchange Traded Funds (ETFs) is a good way of owning paper gold. It’s a cost-effective manner and the investments take place on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Gold remains as the Underlying asset here. One of the major advantages of investing here is price transparency.

If you want to invest in gold ETFs, you should have a Trading Account with \ stockbroker along with a Demat account. You can buy lump sum or invest via Systematic Investment plan (SIP) and make regular monthly investments. This option also allows you to buy 1 gram of gold.

Why Sudden Increase in Investment?

Gold has always been an asset to fall back to in situations of financial Recession. History suggests that it’s a Safe Haven for investment since it can be sold when the prices rise.

The rupee that was trading at Rs. 72 per US dollar in March has increased to an average rate of Rs. 74 to Rs. 76 per US dollar. This shows that the price of USDINR pair will be supporting gold investments.

Best Gold ETFs to Invest 2025 - 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Gold Fund Growth ₹28.1801

↓ -0.06 ₹555 19.2 21.5 33.7 20.8 13.3 18.7 Invesco India Gold Fund Growth ₹27.5392

↑ 0.13 ₹142 18.7 20.8 32.1 20.7 13.8 18.8 Nippon India Gold Savings Fund Growth ₹37.2056

↑ 0.06 ₹2,744 19.1 21.3 33 20.6 13.1 19 SBI Gold Fund Growth ₹28.4095

↑ 0.04 ₹3,582 19.2 21.4 32.6 20.8 13.1 19.6 Kotak Gold Fund Growth ₹37.3695

↓ -0.01 ₹2,835 19 21.5 33 20.4 13.3 18.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25 25 Crore

Conclusion

Gold investments are one of the safest investment options to choose during any pandemic. Its high liquidity value is reliable in times of economic recession. Start your Gold Investment with SIP today.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.