+91-22-48913909

+91-22-48913909

Table of Contents

- ماہانہ میوچل فنڈز SIP کے ذریعے سرمایہ کاری کرنا

- میوچل فنڈز میں 10 کروڑ کی سرمایہ کاری کیسے حاصل کی جائے۔

- سرفہرست 10 پرفارمنگ میوچل فنڈز

- میوچل فنڈ ایس آئی پی آن لائن میں کیسے سرمایہ کاری کی جائے؟

Top 10 Funds

- ICICI Prudential Infrastructure Fund

- Nippon India Power and Infra Fund

- IDFC Infrastructure Fund

- ICICI Prudential Dividend Yield Equity Fund

- Franklin India Opportunities Fund

- Franklin Build India Fund

- SBI Healthcare Opportunities Fund

- BOI AXA Manufacturing and Infrastructure Fund

- DSP BlackRock India T.I.G.E.R Fund

- Edelweiss Mid Cap Fund

سرمایہ کاری کرکے 10 کروڑ کیسے حاصل کریں

ماہانہ میوچل فنڈز SIP کے ذریعے سرمایہ کاری کرنا

سرمایہ کاری ایکویٹی میوچل فنڈ اسکیم میں ایک کے ذریعےگھونٹ آپ کے طویل مدتی اہداف کو حاصل کرنے کا بہترین طریقہ ہے۔ اس میں دیگر اثاثوں کی کلاسوں کے مقابلے اعلیٰ منافع کی پیشکش کرنے کی صلاحیت ہے۔ اس سے آپ کو شکست دینے میں بھی مدد مل سکتی ہے۔مہنگائی جو طویل مدتی اہداف کے حصول کے لیے ضروری ہے۔ وہ سازگار ٹیکس سے بھی لطف اندوز ہوتے ہیں۔ اب، طویل مدتیسرمایہ ایک سال سے زیادہ کی سرمایہ کاری پر ٹیکس سے پاک تھا (مالی سال 18-19 کے یونین بجٹ سے یکم فروری سے 1 لاکھ سے زیادہ کے منافع پر 10% ٹیکس لگے گا یعنی اگر کسی کو مالی سال میں 1.1 لاکھ کا طویل عرصہ میں فائدہ ہوتا ہے۔ مدتکیپٹل گینز اسے ٹیکس ادا کرنا ہوگا:1،10،000 - 1,00,000 = 10,000۔ 10% پر 10,000 = 1,000 انچٹیکس).

میوچل فنڈز میں 10 کروڑ کی سرمایہ کاری کیسے حاصل کی جائے۔

ذیل میں مختلف ٹائم فریموں میں 10 کروڑ حاصل کرنے کے طریقے کی مثالیں ہیں۔SIP میں سرمایہ کاری (منظمسرمایہ کاری کا منصوبہ) کابہترین باہمی فنڈز.

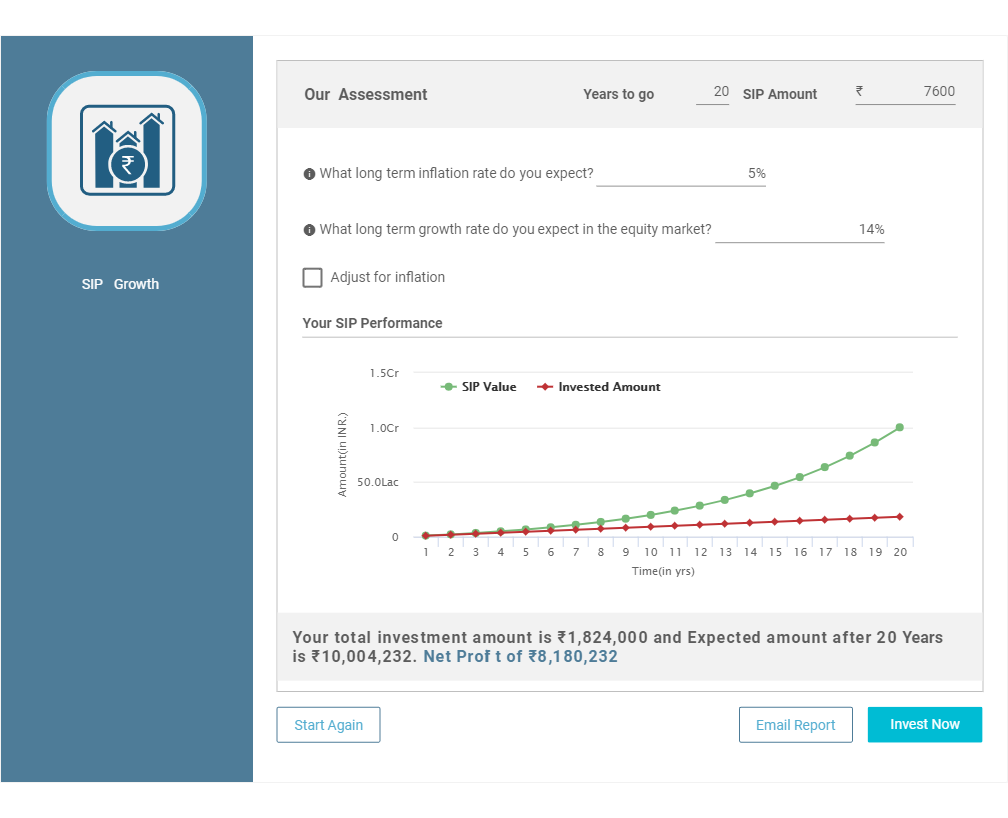

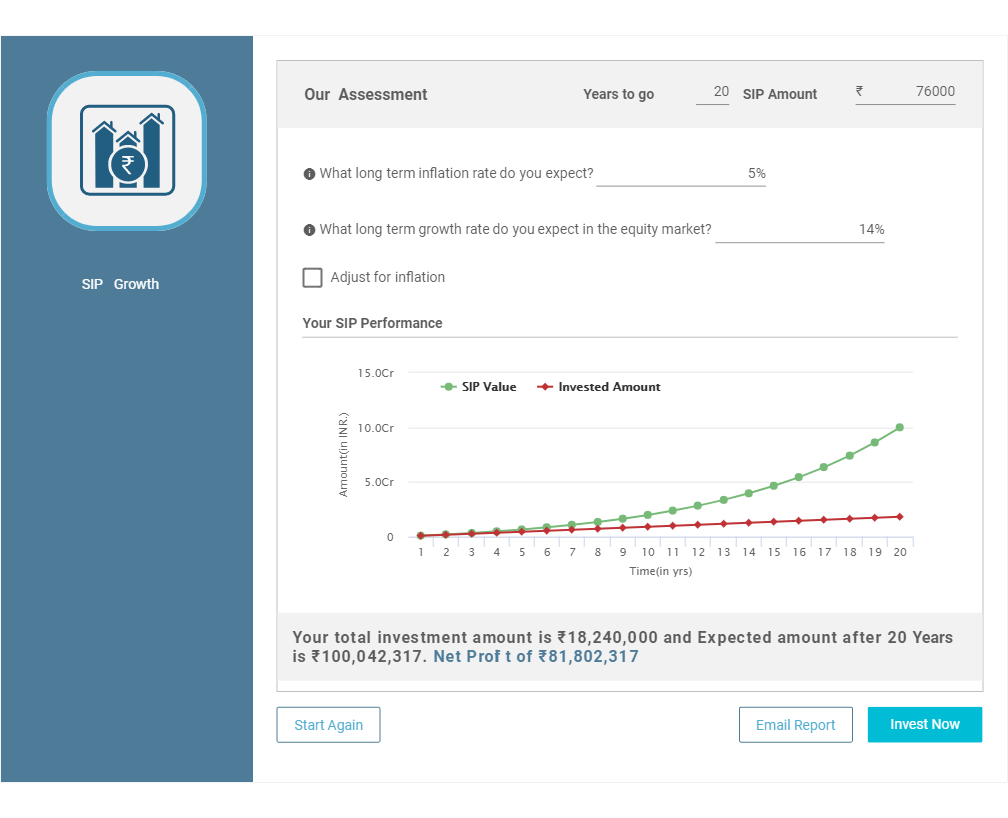

1. 20 سالوں میں 10 کروڑ کیسے حاصل کریں۔

Mutual Funds SIP کے ذریعے روپے کی سرمایہ کاری شروع کریں۔ 76,000 فی مہینہ

اگر آپ روپے بچا سکتے ہیں۔ 76,000 ہر ماہ، فوری طور پر ایک SIP شروع کریں۔ایکویٹی میوچل فنڈز. اگر آپ کو اسکیموں کے انتخاب میں مدد کی ضرورت ہے، تو آپ ہمارے تجویز کردہ ایکویٹی میوچل فنڈ پورٹ فولیوز کو چیک کر سکتے ہیں اور اپنی بنیاد پر ایک پورٹ فولیو چن سکتے ہیں۔خطرے کی بھوک اور SIP کی رقم۔ اگر آپ کا پورٹ فولیوباہمی چندہ 14 فیصد سالانہ ریٹرن پیش کرنے کا انتظام کرتا ہے (جو اس سے کم ہے۔سی اے جی آر 1979 میں آغاز کے بعد سے BSE SENSEX کی طرف سے پیش کردہ)، آپ 20 سالوں میں 10 کروڑ روپے کا کارپس بنانے کے قابل ہو جائیں گے جیسا کہ ذیل میں دکھایا گیا ہے۔

تاریخی ریٹرن پر مبنی کلیدی مفروضے درج ذیل ہیں:

| مفروضے | ڈیٹا |

|---|---|

| اضافے کی شرح | 14% |

| مہنگائی | فیکٹرڈ نہیں |

| سرمایہ کاری کی رقم (pm) | 76,000 |

| وقت کی مدت | 20 سال |

| سرمایہ کاری کی گئی رقم | 1,82,40,000 |

| کل کارپس | 10,00,42,317 |

| نیٹ حاصلات | 8,18,02,317 |

مزید تفصیلات ہمارا استعمال کرتے ہوئے کام کیا جا سکتا ہےگھونٹ کیلکولیٹر نیچے والے بٹن پر کلک کرکے-

Talk to our investment specialist

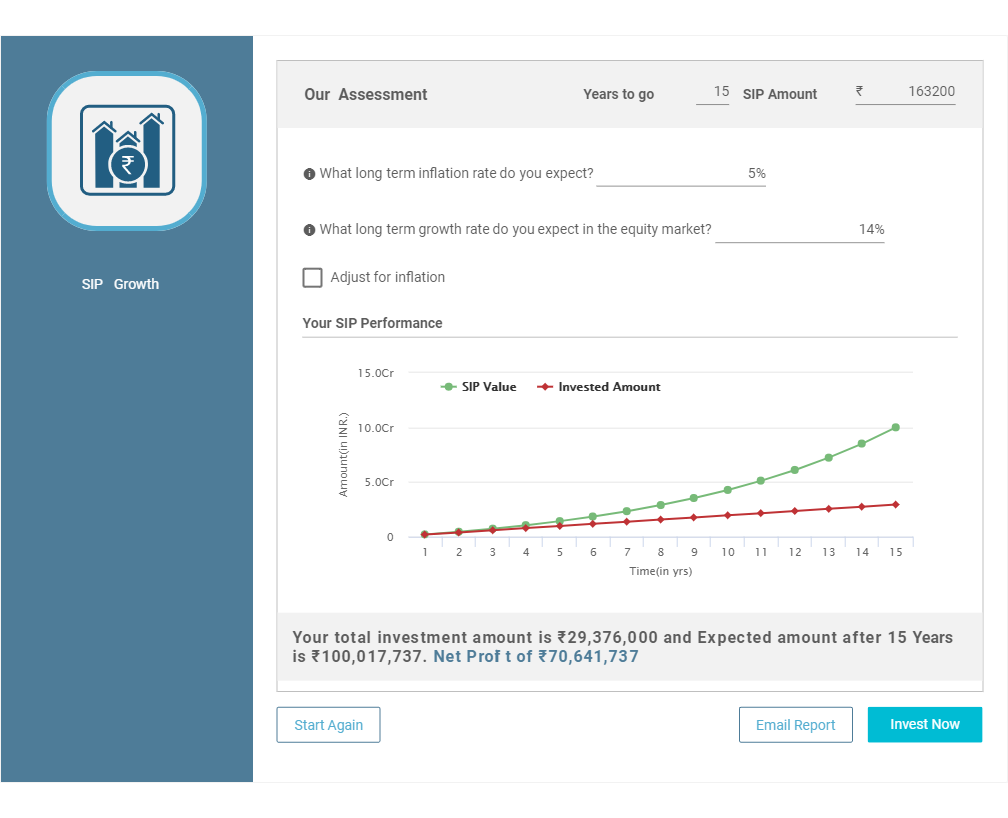

2. 15 سالوں میں 10 کروڑ کیسے حاصل کریں۔

Mutual Funds SIP کے ذریعے روپے کی سرمایہ کاری شروع کریں۔ 1,63,200 فی مہینہ

اگر آپ ہر ماہ 1,63,200 روپے بچا سکتے ہیں تو فوری طور پر ایکویٹی میوچل فنڈز میں ایک SIP شروع کریں۔ اگر آپ کو اسکیموں کے انتخاب میں مدد کی ضرورت ہے تو، آپ ہمارے تجویز کردہ ایکویٹی میوچل فنڈ پورٹ فولیوز کو چیک کر سکتے ہیں اور اپنی خطرے کی بھوک اور SIP رقم کی بنیاد پر ایک پورٹ فولیو منتخب کر سکتے ہیں۔ اگر آپ کا میوچل فنڈز کا پورٹ فولیو 14 فیصد سالانہ ریٹرن پیش کرنے کا انتظام کرتا ہے (جو 1979 میں آغاز سے لے کر اب تک BSE SENSEX کی طرف سے پیش کردہ CAGR سے کم ہے)، تو آپ 15 سالوں میں 10 کروڑ روپے کا کارپس بنا سکیں گے جیسا کہ ذیل میں دکھایا گیا ہے۔ .

تاریخی ریٹرن پر مبنی کلیدی قیاس حسب ذیل ہیں-

| مفروضے | ڈیٹا |

|---|---|

| اضافے کی شرح | 14% |

| مہنگائی | فیکٹرڈ نہیں |

| سرمایہ کاری کی رقم (pm) | 1,63,200 |

| وقت کی مدت | 15 سال |

| سرمایہ کاری کی گئی رقم | 2,93,76,000 |

| کل کارپس | 10,00,17,737 |

| نیٹ حاصلات | 7,06,41,737 |

ذیل کے بٹن پر کلک کر کے ہمارے SIP کیلکولیٹر کا استعمال کرتے ہوئے مزید تفصیلات پر کام کیا جا سکتا ہے۔

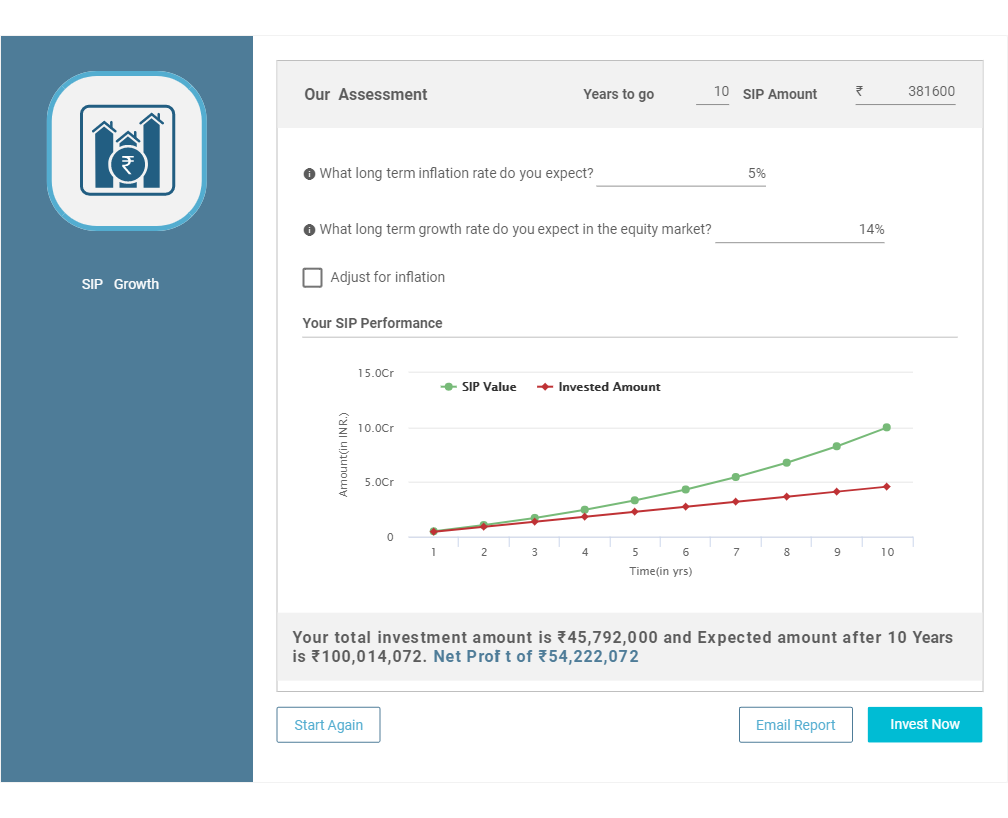

3. 10 سالوں میں 10 کروڑ کیسے حاصل کریں۔

Mutual Funds SIP کے ذریعے روپے کی سرمایہ کاری شروع کریں۔ 3,81,600 فی مہینہ

اگر آپ ہر ماہ 3,81,600 روپے بچا سکتے ہیں تو ایکویٹی میوچل فنڈز میں فوری طور پر ایک SIP شروع کریں۔ اگر آپ کو اسکیموں کے انتخاب میں مدد کی ضرورت ہے تو، آپ ہمارے تجویز کردہ ایکویٹی میوچل فنڈ پورٹ فولیوز کو چیک کر سکتے ہیں اور اپنی خطرے کی بھوک اور SIP رقم کی بنیاد پر ایک پورٹ فولیو منتخب کر سکتے ہیں۔ اگر آپ کا میوچل فنڈز کا پورٹ فولیو 14 فیصد سالانہ ریٹرن پیش کرنے کا انتظام کرتا ہے (جو 1979 میں آغاز سے لے کر اب تک BSE SENSEX کی طرف سے پیش کردہ CAGR سے کم ہے)، تو آپ 10 سالوں میں 10 کروڑ روپے کا کارپس بنانے کے قابل ہو جائیں گے جیسا کہ ذیل میں دکھایا گیا ہے۔ .

تاریخی ریٹرن پر مبنی کلیدی قیاس حسب ذیل ہیں-

| مفروضے | ڈیٹا |

|---|---|

| اضافے کی شرح | 14% |

| مہنگائی | فیکٹرڈ نہیں |

| سرمایہ کاری کی رقم (pm) | 3,81,600 |

| وقت کی مدت | 10 سال |

| سرمایہ کاری کی گئی رقم | 4,57,92,000 |

| کل کارپس | 10,00,14,072 |

| نیٹ حاصلات | 5,42,22,072 |

ذیل کے بٹن پر کلک کر کے ہمارے SIP کیلکولیٹر کا استعمال کرتے ہوئے مزید تفصیلات پر کام کیا جا سکتا ہے۔

سرفہرست 10 پرفارمنگ میوچل فنڈز

*فنڈز کی فہرست پر مبنی ہے۔ To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Nippon India Power and Infra Fund is a Equity - Sectoral fund was launched on 8 May 04. It is a fund with High risk and has given a Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on The investment objective of ICICI Prudential Dividend Yield Equity Fund is to provide medium to long term capital gains and/or dividend distribution by investing in a well diversified portfolio of predominantly equity and equity related instruments, which offer attractive dividend yield ICICI Prudential Dividend Yield Equity Fund is a Equity - Dividend Yield fund was launched on 16 May 14. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Dividend Yield Equity Fund Returns up to 1 year are on The investment objective of Franklin India Opportunities Fund (FIOF) is to generate capital appreciation by capitalizing on the long-term growth opportunities in the Indian economy. Franklin India Opportunities Fund is a Equity - Sectoral fund was launched on 21 Feb 00. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Opportunities Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Franklin Build India Fund is a Equity - Sectoral fund was launched on 4 Sep 09. It is a fund with High risk and has given a Below is the key information for Franklin Build India Fund Returns up to 1 year are on (Erstwhile SBI Pharma Fund) To provide the investors maximum growth opportunity through equity

investments in stocks of growth oriented sectors of the economy. SBI Healthcare Opportunities Fund is a Equity - Sectoral fund was launched on 31 Dec 04. It is a fund with High risk and has given a Below is the key information for SBI Healthcare Opportunities Fund Returns up to 1 year are on The Scheme seeks to generate long term capital appreciation through a portfolio of predominantly equity and equity related securities of companies engaged in manufacturing and infrastructure and related sectors. Further, there can be no assurance that the investment objectives of the scheme will be realized. The Scheme is not providing any assured or guaranteed returns BOI AXA Manufacturing and Infrastructure Fund is a Equity - Sectoral fund was launched on 5 Mar 10. It is a fund with High risk and has given a Below is the key information for BOI AXA Manufacturing and Infrastructure Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. DSP BlackRock India T.I.G.E.R Fund is a Equity - Sectoral fund was launched on 11 Jun 04. It is a fund with High risk and has given a Below is the key information for DSP BlackRock India T.I.G.E.R Fund Returns up to 1 year are on (Erstwhile Edelweiss Mid and Small Cap Fund ) The investment objective is to seek to generate long-term capital appreciation from a portfolio that predominantly invests in equity and equity-related securities of Mid Cap companies.

However, there can be no assurance that the investment objective of the Scheme will be realised. Edelweiss Mid Cap Fund is a Equity - Mid Cap fund was launched on 26 Dec 07. It is a fund with High risk and has given a Below is the key information for Edelweiss Mid Cap Fund Returns up to 1 year are on اثاثے> = 200 کروڑ اور ترتیب دیا گیا5 سالہ CAGR ریٹرن.1. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 15.5% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (25 Feb 25) ₹167.07 ↓ -1.36 (-0.81 %) Net Assets (Cr) ₹7,435 on 31 Jan 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio 0.64 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,385 31 Jan 22 ₹16,659 31 Jan 23 ₹19,888 31 Jan 24 ₹30,973 31 Jan 25 ₹35,717 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 25 Feb 25 Duration Returns 1 Month -5.1% 3 Month -10.8% 6 Month -13.2% 1 Year 2.4% 3 Year 28.3% 5 Year 28.4% 10 Year 15 Year Since launch 15.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 27.4% 2023 44.6% 2022 28.8% 2021 50.1% 2020 3.6% 2019 2.6% 2018 -14% 2017 40.8% 2016 2% 2015 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.67 Yr. Sharmila D’mello 30 Jun 22 2.59 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Industrials 36.99% Basic Materials 18.93% Financial Services 16.99% Utility 10.73% Energy 7.04% Communication Services 1.26% Consumer Cyclical 1.11% Real Estate 0.75% Asset Allocation

Asset Class Value Cash 5.59% Equity 93.78% Debt 0.63% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹615 Cr 1,704,683 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325554% ₹257 Cr 7,710,775 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK4% ₹255 Cr 1,990,000 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹246 Cr 95,657 JM Financial Ltd (Financial Services)

Equity, Since 31 Oct 21 | JMFINANCIL3% ₹231 Cr 17,763,241

↑ 400,000 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹214 Cr 1,740,091 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO3% ₹208 Cr 457,106

↓ -30,684 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹207 Cr 7,547,700 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹202 Cr 1,558,301 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹196 Cr 1,609,486 2. Nippon India Power and Infra Fund

CAGR/Annualized return of 17.7% since its launch. Ranked 13 in Sectoral category. Return for 2024 was 26.9% , 2023 was 58% and 2022 was 10.9% . Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (25 Feb 25) ₹294.956 ↓ -1.46 (-0.49 %) Net Assets (Cr) ₹7,001 on 31 Jan 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.05 Sharpe Ratio 0.29 Information Ratio 1.18 Alpha Ratio 3.79 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,728 31 Jan 22 ₹16,044 31 Jan 23 ₹17,651 31 Jan 24 ₹29,963 31 Jan 25 ₹33,188 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 25 Feb 25 Duration Returns 1 Month -8.1% 3 Month -15.9% 6 Month -20.4% 1 Year -3.7% 3 Year 27.3% 5 Year 25.5% 10 Year 15 Year Since launch 17.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 26.9% 2023 58% 2022 10.9% 2021 48.9% 2020 10.8% 2019 -2.9% 2018 -21.1% 2017 61.7% 2016 0.1% 2015 0.3% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 6.7 Yr. Rahul Modi 19 Aug 24 0.45 Yr. Data below for Nippon India Power and Infra Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Industrials 44.95% Utility 15.89% Basic Materials 10.1% Communication Services 7.08% Energy 6.43% Consumer Cyclical 3.98% Real Estate 3.78% Technology 2.94% Health Care 2.45% Financial Services 1.62% Asset Allocation

Asset Class Value Cash 0.77% Equity 99.23% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT8% ₹612 Cr 1,697,001

↓ -302,999 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325556% ₹467 Cr 13,999,999

↑ 999,999 Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE6% ₹431 Cr 3,550,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL6% ₹413 Cr 2,600,000 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Nov 22 | KAYNES5% ₹365 Cr 492,204 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325384% ₹309 Cr 270,000 Carborundum Universal Ltd (Industrials)

Equity, Since 30 Sep 23 | CARBORUNIV3% ₹230 Cr 1,800,000 Siemens Ltd (Industrials)

Equity, Since 31 May 21 | 5005503% ₹229 Cr 350,000 Cyient DLM Ltd (Technology)

Equity, Since 31 Jul 23 | CYIENTDLM3% ₹209 Cr 3,114,722 Brigade Enterprises Ltd (Real Estate)

Equity, Since 31 May 23 | 5329293% ₹199 Cr 1,600,000 3. IDFC Infrastructure Fund

CAGR/Annualized return of 10.9% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (25 Feb 25) ₹42.592 ↓ -0.27 (-0.63 %) Net Assets (Cr) ₹1,641 on 31 Jan 25 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio 0.49 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,449 31 Jan 22 ₹16,786 31 Jan 23 ₹16,915 31 Jan 24 ₹28,172 31 Jan 25 ₹32,572 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 25 Feb 25 Duration Returns 1 Month -8.7% 3 Month -16.3% 6 Month -24.2% 1 Year 0.8% 3 Year 24.1% 5 Year 25.5% 10 Year 15 Year Since launch 10.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 39.3% 2023 50.3% 2022 1.7% 2021 64.8% 2020 6.3% 2019 -5.3% 2018 -25.9% 2017 58.7% 2016 10.7% 2015 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.02 Yr. Ritika Behera 7 Oct 23 1.32 Yr. Gaurav Satra 7 Jun 24 0.65 Yr. Data below for IDFC Infrastructure Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Industrials 58.01% Utility 12.35% Basic Materials 8.64% Technology 4.18% Communication Services 3.82% Financial Services 3.21% Energy 3.07% Consumer Cyclical 2.58% Health Care 1.77% Asset Allocation

Asset Class Value Cash 2.38% Equity 97.62% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹92 Cr 443,385 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA4% ₹68 Cr 4,797,143 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT3% ₹62 Cr 171,447 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹57 Cr 475,362 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE3% ₹55 Cr 452,706 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325383% ₹54 Cr 46,976 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹54 Cr 434,979 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹53 Cr 12,400,122 H.G. Infra Engineering Ltd Ordinary Shares (Industrials)

Equity, Since 28 Feb 18 | HGINFRA3% ₹49 Cr 321,984 Ahluwalia Contracts (India) Ltd (Industrials)

Equity, Since 30 Apr 15 | AHLUCONT3% ₹48 Cr 470,125 4. ICICI Prudential Dividend Yield Equity Fund

CAGR/Annualized return of 15.4% since its launch. Ranked 38 in Dividend Yield category. Return for 2024 was 21% , 2023 was 38.8% and 2022 was 9.2% . ICICI Prudential Dividend Yield Equity Fund

Growth Launch Date 16 May 14 NAV (25 Feb 25) ₹46.82 ↓ -0.12 (-0.26 %) Net Assets (Cr) ₹4,835 on 31 Jan 25 Category Equity - Dividend Yield AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.41 Sharpe Ratio 0.65 Information Ratio 1.45 Alpha Ratio 4.75 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹11,169 31 Jan 22 ₹17,140 31 Jan 23 ₹18,385 31 Jan 24 ₹26,656 31 Jan 25 ₹30,654 Returns for ICICI Prudential Dividend Yield Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 25 Feb 25 Duration Returns 1 Month -2.6% 3 Month -6.8% 6 Month -10% 1 Year 5.2% 3 Year 21.5% 5 Year 25.4% 10 Year 15 Year Since launch 15.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 21% 2023 38.8% 2022 9.2% 2021 47.1% 2020 14.1% 2019 -2.9% 2018 -11.9% 2017 40.7% 2016 9.7% 2015 -5.2% Fund Manager information for ICICI Prudential Dividend Yield Equity Fund

Name Since Tenure Mittul Kalawadia 29 Jan 18 7.01 Yr. Sharmila D’mello 31 Jul 22 2.51 Yr. Data below for ICICI Prudential Dividend Yield Equity Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Financial Services 29.96% Consumer Cyclical 10.06% Energy 9.03% Consumer Defensive 8% Utility 7.35% Health Care 7.02% Industrials 6.57% Basic Materials 5.59% Technology 5% Communication Services 4.73% Real Estate 1.54% Asset Allocation

Asset Class Value Cash 3.06% Equity 94.85% Debt 1.77% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK8% ₹394 Cr 2,222,624 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | ICICIBANK8% ₹372 Cr 2,905,184 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 30 Apr 21 | SUNPHARMA7% ₹335 Cr 1,774,051 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jan 22 | MARUTI7% ₹311 Cr 286,610 NTPC Ltd (Utilities)

Equity, Since 31 Oct 16 | 5325556% ₹273 Cr 8,201,022 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 20 | BHARTIARTL4% ₹208 Cr 1,312,548

↑ 250,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Dec 21 | 5003124% ₹194 Cr 8,094,802 Axis Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | 5322154% ₹173 Cr 1,621,099 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Aug 21 | LT3% ₹154 Cr 428,013 Britannia Industries Ltd (Consumer Defensive)

Equity, Since 31 Jul 23 | 5008252% ₹105 Cr 219,613 5. Franklin India Opportunities Fund

CAGR/Annualized return of 13.2% since its launch. Ranked 47 in Sectoral category. Return for 2024 was 37.3% , 2023 was 53.6% and 2022 was -1.9% . Franklin India Opportunities Fund

Growth Launch Date 21 Feb 00 NAV (25 Feb 25) ₹219.887 ↓ -0.09 (-0.04 %) Net Assets (Cr) ₹5,948 on 31 Jan 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.12 Sharpe Ratio 0.94 Information Ratio 1.44 Alpha Ratio 10.74 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹12,591 31 Jan 22 ₹15,887 31 Jan 23 ₹15,681 31 Jan 24 ₹26,031 31 Jan 25 ₹31,795 Returns for Franklin India Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 25 Feb 25 Duration Returns 1 Month -6% 3 Month -10.6% 6 Month -13.2% 1 Year 10.2% 3 Year 25.9% 5 Year 25% 10 Year 15 Year Since launch 13.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 37.3% 2023 53.6% 2022 -1.9% 2021 29.7% 2020 27.3% 2019 5.4% 2018 -10.1% 2017 35.6% 2016 4.2% 2015 2.3% Fund Manager information for Franklin India Opportunities Fund

Name Since Tenure Kiran Sebastian 7 Feb 22 2.99 Yr. R. Janakiraman 1 Apr 13 11.85 Yr. Sandeep Manam 18 Oct 21 3.29 Yr. Data below for Franklin India Opportunities Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Consumer Cyclical 19.42% Health Care 13.81% Financial Services 11.43% Industrials 10.29% Communication Services 10.06% Technology 7.7% Basic Materials 5.08% Consumer Defensive 3.31% Real Estate 2.83% Energy 2.22% Utility 1.96% Asset Allocation

Asset Class Value Cash 10.36% Equity 89.64% Top Securities Holdings / Portfolio

Name Holding Value Quantity Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 24 | BHARTIARTL3% ₹213 Cr 1,342,233 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Aug 23 | 5433203% ₹211 Cr 7,590,491 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 May 24 | M&M3% ₹192 Cr 637,966 HDFC Bank Ltd (Financial Services)

Equity, Since 31 May 24 | HDFCBANK3% ₹188 Cr 1,058,931

↓ -500,163 Info Edge (India) Ltd (Communication Services)

Equity, Since 31 Jul 24 | NAUKRI3% ₹188 Cr 216,138 PB Fintech Ltd (Financial Services)

Equity, Since 30 Nov 21 | 5433903% ₹176 Cr 833,638 Lemon Tree Hotels Ltd (Consumer Cyclical)

Equity, Since 31 Aug 24 | LEMONTREE3% ₹168 Cr 10,951,216 Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Aug 23 | ASTERDM3% ₹157 Cr 3,049,105 APL Apollo Tubes Ltd (Basic Materials)

Equity, Since 31 Oct 24 | APLAPOLLO3% ₹154 Cr 981,985

↑ 448,634 Sudarshan Chemical Industries Ltd (Basic Materials)

Equity, Since 30 Apr 24 | SUDARSCHEM2% ₹149 Cr 1,303,298 6. Franklin Build India Fund

CAGR/Annualized return of 17.5% since its launch. Ranked 4 in Sectoral category. Return for 2024 was 27.8% , 2023 was 51.1% and 2022 was 11.2% . Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (25 Feb 25) ₹121.272 ↓ -0.74 (-0.61 %) Net Assets (Cr) ₹2,659 on 31 Jan 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.13 Sharpe Ratio 0.47 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,683 31 Jan 22 ₹15,739 31 Jan 23 ₹16,876 31 Jan 24 ₹27,633 31 Jan 25 ₹31,246 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 25 Feb 25 Duration Returns 1 Month -6.1% 3 Month -14% 6 Month -16.3% 1 Year 0.2% 3 Year 26% 5 Year 24.8% 10 Year 15 Year Since launch 17.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 27.8% 2023 51.1% 2022 11.2% 2021 45.9% 2020 5.4% 2019 6% 2018 -10.7% 2017 43.3% 2016 8.4% 2015 2.1% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 3.29 Yr. Kiran Sebastian 7 Feb 22 2.99 Yr. Sandeep Manam 18 Oct 21 3.29 Yr. Data below for Franklin Build India Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Industrials 38.96% Financial Services 13.52% Energy 9.34% Utility 8.44% Communication Services 7.08% Basic Materials 6.8% Consumer Cyclical 3.9% Real Estate 3.36% Technology 2.72% Asset Allocation

Asset Class Value Cash 5.88% Equity 94.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹260 Cr 720,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | ICICIBANK6% ₹154 Cr 1,200,000 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | 5325555% ₹131 Cr 3,930,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL4% ₹113 Cr 710,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | 5003124% ₹108 Cr 4,500,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO4% ₹107 Cr 235,000

↑ 102,500 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE4% ₹107 Cr 880,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 28 Feb 21 | 5328984% ₹104 Cr 3,365,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | 5322153% ₹96 Cr 900,000 KEI Industries Ltd (Industrials)

Equity, Since 31 Dec 15 | KEI3% ₹89 Cr 200,000 7. SBI Healthcare Opportunities Fund

CAGR/Annualized return of 15.3% since its launch. Ranked 34 in Sectoral category. Return for 2024 was 42.2% , 2023 was 38.2% and 2022 was -6% . SBI Healthcare Opportunities Fund

Growth Launch Date 31 Dec 04 NAV (25 Feb 25) ₹391.737 ↑ 2.29 (0.59 %) Net Assets (Cr) ₹3,522 on 31 Jan 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 2.09 Sharpe Ratio 1.36 Information Ratio 0.67 Alpha Ratio 4.66 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-15 Days (0.5%),15 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹15,535 31 Jan 22 ₹17,594 31 Jan 23 ₹17,709 31 Jan 24 ₹26,160 31 Jan 25 ₹33,176 Returns for SBI Healthcare Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 25 Feb 25 Duration Returns 1 Month -5.2% 3 Month -7.5% 6 Month -1.7% 1 Year 12.2% 3 Year 22.8% 5 Year 24.7% 10 Year 15 Year Since launch 15.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 42.2% 2023 38.2% 2022 -6% 2021 20.1% 2020 65.8% 2019 -0.5% 2018 -9.9% 2017 2.1% 2016 -14% 2015 27.1% Fund Manager information for SBI Healthcare Opportunities Fund

Name Since Tenure Tanmaya Desai 1 Jun 11 13.68 Yr. Pradeep Kesavan 31 Dec 23 1.09 Yr. Data below for SBI Healthcare Opportunities Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Health Care 90.04% Basic Materials 6.53% Asset Allocation

Asset Class Value Cash 3.35% Equity 96.57% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Dec 17 | SUNPHARMA13% ₹472 Cr 2,500,000 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 21 | MAXHEALTH6% ₹226 Cr 2,000,000 Divi's Laboratories Ltd (Healthcare)

Equity, Since 31 Mar 12 | DIVISLAB6% ₹220 Cr 360,000 Cipla Ltd (Healthcare)

Equity, Since 31 Aug 16 | 5000876% ₹214 Cr 1,400,000

↑ 120,000 Lupin Ltd (Healthcare)

Equity, Since 31 Aug 23 | 5002575% ₹188 Cr 800,000 Lonza Group Ltd ADR (Healthcare)

Equity, Since 31 Jan 24 | LZAGY4% ₹151 Cr 300,000 Mankind Pharma Ltd (Healthcare)

Equity, Since 30 Apr 23 | MANKIND4% ₹151 Cr 523,016

↑ 123,016 Poly Medicure Ltd (Healthcare)

Equity, Since 31 Aug 24 | POLYMED4% ₹131 Cr 500,000 Krishna Institute of Medical Sciences Ltd (Healthcare)

Equity, Since 30 Nov 22 | 5433083% ₹126 Cr 2,100,000

↓ -100,000 Jupiter Life Line Hospitals Ltd (Healthcare)

Equity, Since 31 Aug 23 | JLHL3% ₹125 Cr 800,000

↓ -32,871 8. BOI AXA Manufacturing and Infrastructure Fund

CAGR/Annualized return of 11% since its launch. Return for 2024 was 25.7% , 2023 was 44.7% and 2022 was 3.3% . BOI AXA Manufacturing and Infrastructure Fund

Growth Launch Date 5 Mar 10 NAV (25 Feb 25) ₹47.7 ↓ -0.31 (-0.65 %) Net Assets (Cr) ₹524 on 31 Jan 25 Category Equity - Sectoral AMC BOI AXA Investment Mngrs Private Ltd Rating Risk High Expense Ratio 2.57 Sharpe Ratio 0.5 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹12,210 31 Jan 22 ₹18,356 31 Jan 23 ₹18,974 31 Jan 24 ₹29,005 31 Jan 25 ₹33,073 Returns for BOI AXA Manufacturing and Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 25 Feb 25 Duration Returns 1 Month -7.7% 3 Month -14.7% 6 Month -19.3% 1 Year 0.8% 3 Year 20.8% 5 Year 24.7% 10 Year 15 Year Since launch 11% Historical performance (Yearly) on absolute basis

Year Returns 2024 25.7% 2023 44.7% 2022 3.3% 2021 52.5% 2020 28.1% 2019 2.5% 2018 -22.8% 2017 56% 2016 1% 2015 0.3% Fund Manager information for BOI AXA Manufacturing and Infrastructure Fund

Name Since Tenure Nitin Gosar 27 Sep 22 2.35 Yr. Data below for BOI AXA Manufacturing and Infrastructure Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Industrials 28.83% Basic Materials 21.97% Consumer Cyclical 12.11% Utility 6.41% Health Care 5.61% Energy 5.16% Communication Services 4.47% Technology 4.11% Consumer Defensive 3.88% Real Estate 3% Asset Allocation

Asset Class Value Cash 4.46% Equity 95.54% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 10 | LT7% ₹35 Cr 97,169

↑ 21,367 NTPC Ltd (Utilities)

Equity, Since 31 May 21 | 5325555% ₹26 Cr 773,906 Vedanta Ltd (Basic Materials)

Equity, Since 31 Mar 24 | 5002954% ₹22 Cr 487,680

↑ 10,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 20 | RELIANCE3% ₹18 Cr 150,806 Manorama Industries Ltd (Consumer Defensive)

Equity, Since 31 May 24 | 5419743% ₹15 Cr 137,935 Swan Energy Ltd (Industrials)

Equity, Since 31 Dec 23 | SWANENERGY2% ₹13 Cr 178,821

↑ 19,195 Indus Towers Ltd Ordinary Shares (Communication Services)

Equity, Since 31 Jan 24 | 5348162% ₹13 Cr 375,411 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 31 Jul 23 | ERIS2% ₹12 Cr 84,903 Sterling and Wilson Renewable Energy Ltd (Technology)

Equity, Since 31 Mar 24 | SWSOLAR2% ₹11 Cr 244,992 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Dec 22 | BHARTIARTL2% ₹11 Cr 70,260

↑ 42,631 9. DSP BlackRock India T.I.G.E.R Fund

CAGR/Annualized return of 17.2% since its launch. Ranked 12 in Sectoral category. Return for 2024 was 32.4% , 2023 was 49% and 2022 was 13.9% . DSP BlackRock India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (25 Feb 25) ₹268.106 ↓ -1.45 (-0.54 %) Net Assets (Cr) ₹5,003 on 31 Jan 25 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.24 Sharpe Ratio 0.43 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,312 31 Jan 22 ₹15,497 31 Jan 23 ₹17,340 31 Jan 24 ₹27,320 31 Jan 25 ₹31,163 Returns for DSP BlackRock India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 25 Feb 25 Duration Returns 1 Month -7.7% 3 Month -16.9% 6 Month -21.1% 1 Year 1.5% 3 Year 25.5% 5 Year 24.5% 10 Year 15 Year Since launch 17.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 32.4% 2023 49% 2022 13.9% 2021 51.6% 2020 2.7% 2019 6.7% 2018 -17.2% 2017 47% 2016 4.1% 2015 0.7% Fund Manager information for DSP BlackRock India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 14.63 Yr. Data below for DSP BlackRock India T.I.G.E.R Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Industrials 43.51% Basic Materials 15.98% Consumer Cyclical 8.86% Utility 6.5% Energy 5.52% Financial Services 4.7% Technology 3.54% Communication Services 3.23% Consumer Defensive 1.54% Health Care 1.45% Real Estate 1.24% Asset Allocation

Asset Class Value Cash 3.94% Equity 96.06% Top Securities Holdings / Portfolio

Name Holding Value Quantity NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | 5325555% ₹269 Cr 8,078,568 Siemens Ltd (Industrials)

Equity, Since 30 Nov 18 | 5005504% ₹241 Cr 369,482 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT4% ₹213 Cr 591,385 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL3% ₹172 Cr 1,080,606 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 22 | KPIL3% ₹163 Cr 1,253,711 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG3% ₹154 Cr 1,502,475 Polycab India Ltd (Industrials)

Equity, Since 31 Jan 21 | POLYCAB3% ₹148 Cr 204,150 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA2% ₹128 Cr 3,321,453 Avalon Technologies Ltd (Technology)

Equity, Since 30 Sep 24 | AVALON2% ₹127 Cr 1,316,308 KEC International Ltd (Industrials)

Equity, Since 30 Sep 22 | 5327142% ₹111 Cr 924,629 10. Edelweiss Mid Cap Fund

CAGR/Annualized return of 13.3% since its launch. Ranked 22 in Mid Cap category. Return for 2024 was 38.9% , 2023 was 38.4% and 2022 was 2.4% . Edelweiss Mid Cap Fund

Growth Launch Date 26 Dec 07 NAV (25 Feb 25) ₹85.485 ↓ -0.28 (-0.33 %) Net Assets (Cr) ₹8,268 on 31 Jan 25 Category Equity - Mid Cap AMC Edelweiss Asset Management Limited Rating ☆☆☆ Risk High Expense Ratio 1.86 Sharpe Ratio 0.87 Information Ratio 0.3 Alpha Ratio 8.97 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹12,069 31 Jan 22 ₹17,509 31 Jan 23 ₹17,851 31 Jan 24 ₹26,385 31 Jan 25 ₹32,169 Returns for Edelweiss Mid Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 25 Feb 25 Duration Returns 1 Month -7.8% 3 Month -13.4% 6 Month -12.6% 1 Year 10.3% 3 Year 21.9% 5 Year 24.3% 10 Year 15 Year Since launch 13.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 38.9% 2023 38.4% 2022 2.4% 2021 50.3% 2020 26.4% 2019 5.2% 2018 -15.7% 2017 52.3% 2016 2.5% 2015 9.4% Fund Manager information for Edelweiss Mid Cap Fund

Name Since Tenure Dhruv Bhatia 14 Oct 24 0.3 Yr. Trideep Bhattacharya 1 Oct 21 3.34 Yr. Raj Koradia 1 Aug 24 0.5 Yr. Data below for Edelweiss Mid Cap Fund as on 31 Jan 25

Equity Sector Allocation

Sector Value Financial Services 19.6% Industrials 16.97% Consumer Cyclical 15.76% Technology 13.43% Health Care 11.37% Basic Materials 7.19% Real Estate 4.12% Consumer Defensive 3.9% Communication Services 1.8% Utility 1.39% Energy 1.34% Asset Allocation

Asset Class Value Cash 3.12% Equity 96.88% Top Securities Holdings / Portfolio

Name Holding Value Quantity Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Jan 20 | DIXON4% ₹378 Cr 210,748 Persistent Systems Ltd (Technology)

Equity, Since 31 Mar 21 | PERSISTENT4% ₹369 Cr 571,854 Lupin Ltd (Healthcare)

Equity, Since 31 Jul 24 | 5002573% ₹262 Cr 1,112,780 PB Fintech Ltd (Financial Services)

Equity, Since 29 Feb 24 | 5433903% ₹253 Cr 1,202,006 Coforge Ltd (Technology)

Equity, Since 30 Jun 23 | COFORGE3% ₹252 Cr 260,696

↑ 20,998 Indian Hotels Co Ltd (Consumer Cyclical)

Equity, Since 30 Sep 23 | 5008503% ₹220 Cr 2,505,184 The Federal Bank Ltd (Financial Services)

Equity, Since 31 Dec 18 | FEDERALBNK2% ₹200 Cr 9,993,757 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 31 May 24 | 5000932% ₹185 Cr 2,546,699 Solar Industries India Ltd (Basic Materials)

Equity, Since 30 Sep 12 | SOLARINDS2% ₹184 Cr 188,023 BSE Ltd (Financial Services)

Equity, Since 31 Mar 24 | BSE2% ₹172 Cr 322,121

میوچل فنڈ ایس آئی پی آن لائن میں کیسے سرمایہ کاری کی جائے؟

Fincash.com پر لائف ٹائم کے لیے مفت انویسٹمنٹ اکاؤنٹ کھولیں۔

اپنی رجسٹریشن اور KYC کا عمل مکمل کریں۔

دستاویزات اپ لوڈ کریں (PAN، آدھار، وغیرہ)۔اور، آپ سرمایہ کاری کے لیے تیار ہیں!

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔