6 Best Share Market Tips for Beginners

A newbie always dreams of making it big in the stock Market. You may dream of becoming the greatest stock market trader by earning big returns and always being successful.

While big returns in the stock market is not always a possibility, certain share market tips and tricks are all you need.

Difference between Share Market and Stock Market

But before we get into understanding the tips, what is share market and a stock market? Share market and the stock market is where shares are issued and traded. The small point of difference in a stock market and share market is that financial instruments like Mutual Funds Bonds are all traded in a stock market. Share market only for the trading of shares.

Best Share Market Tips for Beginners

1. Start with Little

This is probably one of the most important Stock Market Tips in India to follow. You might be tempted to start your trading with more cash in expectations of making more money. However, that is not true in the majority of the situations.In the stock market, it is always recommended that you start small and eventually increase your trading amount after gaining understanding about trade with practical knowledge.

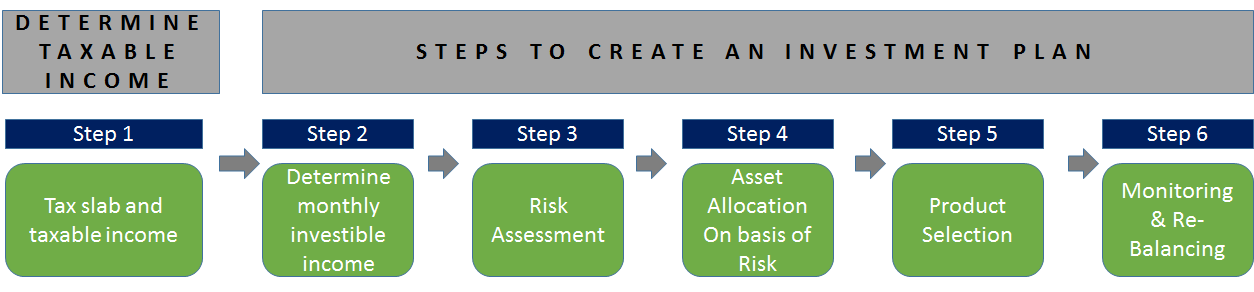

However, it is more important to plan before Investing money into buying shares. Remember these five essential questions and answer them before starting off:

- How do I want to invest in stocks?

- What is my goal for buying a stock?

- What is my budget for buying stocks?

- How much do I know about trading and stocks?

- Am I ready to start investing now?

These questions will help you lay a foundation for your venture as an investor. As a beginner, don’t overspend. Carefully set a budget aside for your trading and never take a loan for trading.

2. Understand Your Options

As a beginner, you might be confused with the number of options available in the market. To help you relax a bit, here is a share market tip for you.

Remember that stocks are based on stock classes, market capitalization, ownership, dividend payment, fundamentals, risk and price trends. Let’s take a brief look at them:

a. Stock based on Market Capitalization

Here are the three types of stocks based on market capitalization:

Large Cap Stocks: These stocks are usually from Blue-chip companies. These companies majorly have a good amount of cash for their disposal. Investors get the benefit of getting higher dividends in comparison to mid-cap and small cap companies.

Mid Cap Stocks: These stocks are from companies with a market capitalization of Rs. 250 crore to Rs. 4000 crore. These companies pay good dividends and also have the potential for growth and stability.

Small-Cap Stocks: These stocks are from companies with a market capitalization up to Rs. 250 crore. They have the potential to grow.

b. Ownership

The three types of stocks are mentioned below:

Preferred and Common Stocks: These stocks offer its investors a fixed amount of dividend every year.

Hybrid Stocks: These stocks are from companies Offering preferred shares with an option of converting them to common stocks. However, this is subject to conditions, at a particular time.

Embedded Derivative Option Stocks: These are stocks that are not available commonly.

c. Dividend Payment

Growth Stocks: The value of these stocks rise with the growth rate which allows investors to get profit from higher returns.

Income Stocks: These stocks indicate that the company will have stable growth and consistent dividends will be available.

Talk to our investment specialist

d. Fundamentals

Overvalued Shares- This refers to share whose prices are more than the base value.

Undervalued Stocks- This is a popular stock among investors as its price is low. Investors believe the price will rise in the future.

e. Risk

Beta Stock: Beta is an indicator of price Volatility of the stock. Higher the beta, the risk of the stock is higher.

Blue Chip Stock: This refers to stocks from companies with a stable income, paying a regular dividend and having low liabilities.

f. Price Trends

Defensive Stocks- These stocks are unaffected by Economic Conditions. These stocks are preferred when market conditions are bad.

Cyclical Stock: These stocks are affected highly by price fluctuations and economic conditions. The automobile Industry falls in the category.

3. Research

As a beginner this is the best Intraday trading tip before you start spending on trading is that you research well. Know about the company you want to invest in. Learn all about is income, dividend payment, historical performance, growth options, management skills, etc. These are key indicators to help you pick and invest in the right stock.

Do not start off without research as a beginner. You may end up making uninformed decisions and let emotions or crowd-based trends take the best of you.

4. Choose Your Investing Method

Taking lessons on advanced stock trading and intraday trading can prove beneficial as it allows you hands-on experience in the trading sector. You can access online material if you have opted for online training classes. Interactive sessions, webinars, etc can come handy anytime you want.

Educating yourself in trading will help you become a knowledgeable trader and having practical experience will help you make the right decisions and earn more profit.

6. Long -term Investment

When you buy and retain stock for a long time you are participating in value purchase and diversification. You can help your wealth grow over a long period of time with quality and quantity. Investing for a long time in shares also lowers your tax rates as compared to short term Investments. You can also escape The possibility of negative returns and expect high returns. Along with this the applicable Taxes, overhead expenses are all extremely less in comparison to short term trading.

FAQs

1. What is Diversification?

Diversification is a technique by which you can reduce the risk involved in the stock market investing. Investments are allocated across various industries, instruments and other categories.

2. What is Dividend?

Dividend refers to the distribution of a company's income to its shareholders.

3. What is paper trading?

Paper trading is a treat that allows you how to purchase and sell without risking real money. Online platforms in software have increased paper trading.

4. What is an IPO?

IPO refers to Initial Public Offering (IPO). it is the process of offering shares of a private company to the public through a stop issuance.

Conclusion

Share market trading is not difficult if you focus on the best shares. Always stay informed and research to adapt to any changes.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.