Table of Contents

What is Comprehensive Car Insurance?

If you are looking for a wide coverage policy for your vehicle, then Comprehensive car insurance is an ideal plan for you! Comprehensive insurance is a type of car insurance that provides cover against the third party plus loss or damage occurred to the insured vehicle or to the insured by means of bodily injury.

This scheme also covers damages caused to the vehicle due to thefts, legal liabilities, personal accidents, man-made/natural calamities, etc. Since comprehensive insurance is part of Motor Insurance, it is offered by various car Insurance companies in India.

Comprehensive Car Insurance

A comprehensive policy, as the name suggests, offers overall protection against loss or damage occurred to your car or by your car due to an accident or collision. This scheme is extensive and covers damage to the third party, car, theft and even Personal Accident. It is always advisable to buy comprehensive insurance as it covers the vehicle, insured and third party in a single policy.

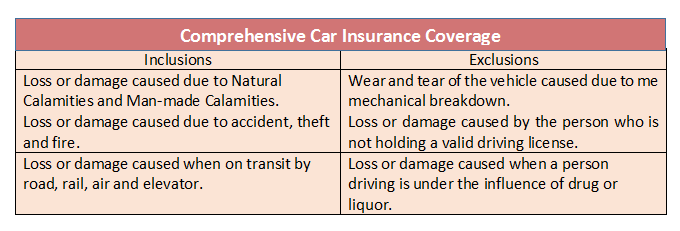

Some of the typical covers offered by this policy are as follows:

- Loss or damage caused due to flood, hurricane, typhoon, earthquake, flood, cyclone, storm, etc.

- Loss or damage caused due to strike, riot and burglary

- Loss or damage caused due to terrorism and Malicious Act

- Loss or damage caused due to accident, fire and theft

- Loss or damage caused when in transit by road, rail, air and elevator

Talk to our investment specialist

This policy also has an option for cover add-ons, wherein customers can add extra cover while buying a policy. Some of the common coverage add-ons are engine protector, zero Depreciation cover, accessories cover, medical expense, etc.

The comprehensive car Insurance Coverage excludes the loss or damage caused due to following reasons-

- Wear and tear of the vehicle caused due to mechanical breakdown

- The vehicle when driven by the person who is not holding a valid driving license

- A person driving when under the influence of drug or liquor

Comprehensive Insurance Vs Third Party Insurance

As per the Motor Vehicles Act of India, third-party car insurance is mandatory for all vehicles running on the road.

Third Party Insurance policy ensures that you would not have to bear any sort of legal liability or expenses arising from an accident that has caused loss or damage to the third person. But, the policy does not provide coverage for any loss or damage caused to the owner’s vehicle or to the insured. Whereas, comprehensive car insurance provides cover against the third party and also cover loss/damage occurred to the insured vehicle or to the insured. This scheme also covers damages caused to the vehicle due to thefts, legal liabilities, personal accidents, man-made/natural calamities, etc.

Comprehensive Car Insurance Companies

Some of the car insurance companies who offer comprehensive car insurance policy are as follows-

1. Tata AIG General Insurance

The comprehensive car insurance offered by TATA AIG provides extensive coverage as compared to a basic third-party four wheeler insurance. It offers protection against third-party liabilities as well as damage due to accidents, loss of the car, natural disasters like floods, earthquakes, cyclones, etc. and man-made disasters.

2. ICICI Lombard General Insurance

The comprehensive car plan by ICICI Lombard offers various benefits and features like personal accident coverage of ₹15 lakh, cover against theft, natural calamities, etc. The plan also offers a network of 4300+ cashless garages takes care of the repair costs.

3. HDFC ERGO General Insurance

The comprehensive car policy offered by HDFC ERGO offers coverage for accidents, fire explosion, theft, calamities, personal accident and third party liability.

4. Reliance General Insurance

A comprehensive car insurance policy covers for losses incurred during an accident. It offers coverage for the damage caused by natural disasters or severe weather, fire, theft, vandalism damage to third party, damage to your vehicle caused by falling objects such as trees and damage or destruction caused to the vehicle in riots.

5. Bharti AXA Insurance

A comprehensive car insurance policy by Bharti AXA covers losses/damages to your car in addition to protecting you against third-party liabilities. The policy offers coverage against weather calamities, mad-made acts, also access to add-on covers.

Conclusion

Since comprehensive car insurance offers a wide coverage, it is always advisable to opt for it. But, if you are confused choosing between third party liability insurance and comprehensive car insurance, you can weigh your buying decision based on the type of vehicle you have, the coverage you would want, the premium you could afford and claims process of the insurance company!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.