Table of Contents

- Tax Planning in India

- Types of Tax Management

- Objectives of Tax Savings

- Corporate Tax Planning

- Role of Tax Consultant

- Tax Software

- FAQs

- 1. Is tax planning important in India?

- 2. Why should I do tax planning?

- 3. What are the three types of tax planning?

- 4. What is the most common mistake people make with tax planning?

- 5. Are tax planning and tax deduction the same thing?

- 6. What is the tax exemption?

- 7. Is tax planning done by individuals or by corporate?

- 8. How can a tax consultant help with tax planning?

- 9. What are the objectives of tax planning?

- 10. Will tax planning help with gratuity?

- 11. Can tax planning help in the long run?

What is Tax Planning?

Tax planning can be defined as the way of analysing, planning and optimising a person's financial situation from a tax saving or tax Efficiency point of view. Tax planning helps you to make the most out of the different tax exemptions and deductions that are available to reduce your tax duty in the financial year.

Tax planning in India is legal and smart way to cut your tax duties. With different tax management options available to the taxpayer, saving tax has become easy. Also, the role of a Tax consultant is very important in tax planning as they advise you in saving tax and suggest you the necessary investments to make.

Tax Planning in India

There are a lot of options for tax saving in India. The income tax Act, 1961 has different sections which provide multiple options for tax saving and tax exemptions. Section 80C to 80U of the Income Tax Act gives all the options for possible tax deductions for the eligible taxpayers. As a taxpayer, you should be aware of the provisions available and make a legit use of those provisions to reduce your tax liabilities.

But while doing so, you should keep in mind that such tax planning is done under the legally defined framework of the Government of India. Tax planning is a legal and smart way to reduce your tax duties. But it is not a channel to avoid tax or evade tax. Tax avoiding or tax evading is illegal and can Land you in a lot of trouble and thus should be avoided. There are enough provisions and opportunities made available by the government to reduce the burden of tax on the taxpayers.

Types of Tax Management

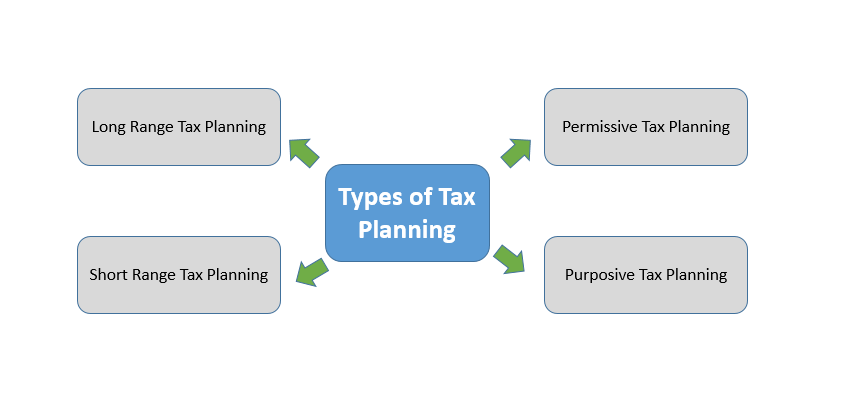

There are four types of tax management or tax planning. They are as follows:

1. Short Range Tax Planning

This type of tax planning is a year to year type of planning with a limited objective or aim. Such planning doesn't have permanent commitment. It means that the planning is thought of and carried out at the end of the financial year to minimise the Taxable Income.

For example, at the end of the financial year, a person finds that their tax duty is too high compared to last year, then they try to cut it down. It can be done in multiple ways with the help of guidelines under Section 80C. In such cases, there is no long-term commitment, yet sizeable tax can be saved.

2. Long Range Tax Planning

In this type of tax planning, a plan is chalked out right at the beginning of a financial year. Such type of planning may not give instant results but they have a positive impact on your tax liabilities in the long run.

For example, a person can transfer the shares or assets possessed by them to their spouse or children who are minor. Even though the money generated from such shares or assets will be clubbed together with the basic income of the person, that money will be treated as the part of the income generated by the spouse or children. The person can then ask for a tax Deduction on that amount.

3. Permissive Tax Planning

Permissive tax planning is a method of reducing your tax duties under the provision of tax laws of the country. It involves taking advantage of the various deductions, concessions and incentives.

Talk to our investment specialist

4. Purpose Tax Planning

In this type, you plan for tax saving with a specific purpose to enjoy the maximum benefits. That can be achieved with proper selection of investments, correct replacement of assets, etc.

Objectives of Tax Savings

- To reduce the tax duty

- Have a stable economic condition

- To make a productive investment

Corporate Tax Planning

Corporate Tax Planning involves minimising the tax liabilities of a registered company. Some of the common ways to do that are by filing deductions for business transport, health insurance of employees, child care, Retirement planning, charitable contribution, etc. The various deductions and exemptions present in the Income Tax Act allow the company to legally reduce their tax duties. Even, while doing this, the companies must keep in mind that they are not evading tax or avoiding it.

If there are more profits for a company, naturally there will be higher tax duties. Thus, it is important for the organisation to have clear tax planning done to minimise the tax. With proper planning, both indirect and direct tax can be cut down at times of Inflation.

A good tax planning is a result of -

- Saving tax legally as per the law.

- Flexible business-minded approach that can incorporate changes in the future.

- Being compliant and informed about the tax laws and court judgments about the same.

- Being transparent in disclosing all the required information to the Income Tax department.

Role of Tax Consultant

Tax consultants are the people who help you in filing your tax returns. They advise you about the steps to be taken in order to reduce your tax duties. Also, they help you in preparing a sound tax plan. Also, as tax consultants are expert in tax laws, they help give out effective tax management strategies in order to cut down the tax payment.

Tax Software

There are many tax software packages available in the Market that help one in tax planning and file Income Tax Returns. These software's are readily available online. Some of the popular tax software are TaxCloudIndia, Zen Income Tax Software, CompuTax, etc.

FAQs

1. Is tax planning important in India?

A: Yes, tax planning is essential in India. As per the Income Tax Act of 1961, under Section 80C and 80U, individual taxpayers can earn tax benefits and tax exemptions. Similarly, corporate taxpayers can opt for better tax management if they invest in employee insurance plans, health benefits, and childcare or make charitable donations. In India, tax benefits are given to both individual taxpayers and corporate if they do adequate tax planning.

2. Why should I do tax planning?

A: If you do tax planning, you can effectively reduce your Income Tax Payable. For example, if you are paying, you pay medical insurance premiums for dependent parents who are above sixty years. You can claim tax benefits under Section 80D of the Income Tax Act of 1961. This can effectively reduce the tax paid by you in the given financial year.

3. What are the three types of tax planning?

A: The three main types of tax planning that you need to do are as follows:

Short-Range tax planning: This is tax planning for a single financial year. You meet your tax commitments for the given financial year. This is usually done at the end of the financial year when you file Taxes.

Long-range tax planning: This you should be done at the beginning of the financial year so that you plan your investment and purchase assets as per your tax planning.

Permissive tax planning: This requires extensive knowledge of the duties and tax laws of the country. It would be best if you managed your taxes to make the best of the laws.

The best of these would be to plan your taxes and evaluate the existing laws, to manage your taxes payable effectively.

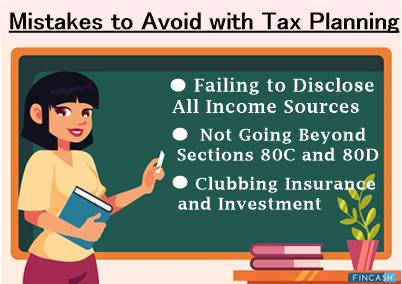

4. What is the most common mistake people make with tax planning?

A: The most common mistake individuals make about tax planning is procrastination. Ideally, tax planning should be made at the beginning of the financial year. Based on tax management and planning, you should purchase assets and make investments. If you do not plan your taxes, you will have to pay more taxes at the end of the year.

5. Are tax planning and tax deduction the same thing?

A: No, tax planning means managing your taxes and investments in such a manner that you can enjoy tax benefits. With the money you earn in a financial year, you are expected to make certain investments to earn tax benefits. These tax benefits are in the form of tax exemptions. In other words, you will not have to pay any tax on the entirely or partially, depending on the rules, on the amount invested.

6. What is the tax exemption?

A: Tax exemption is when a taxpayer can apply for removal or reduction of taxes on compulsory payments. For instance, specially-abled individuals can apply for exemption from payment of road taxes in certain Indian states. Similarly, in India, people below a specific slab are exempted from paying income tax. Tax exemptions apply only to individual sections of the population on whom the exemptions are applicable.

7. Is tax planning done by individuals or by corporate?

A: The tax planning has to be done by individual taxpayers and by corporate houses. Tax planning is done to reduce the taxes payable legally. This is not avoiding payment of taxes, but you are managing your taxes to effectively reduce the amount of money you pay as taxes because you have made investments or purchased assets.

8. How can a tax consultant help with tax planning?

A: A tax consultant will help you evaluate the best methods for managing your taxes. If you find it challenging to understand the tax laws, your consultant will better understand it. Tax consultants are experts in tax management, and they can help you create strategies to reduce the amount of money paid as taxes effectively.

9. What are the objectives of tax planning?

A: The primary objective of tax planning is to reduce the identify methods of reducing the amount of money paid as taxes. However, you can do so only if you make adequate investments and purchase assets. Thus, another reason for doing tax planning is to identify suitable methods for doing investment planning.

10. Will tax planning help with gratuity?

A: Usually, the gratuity that you earn in retirement is exempt from taxation. Hence, if you plan on a gratuity based investment, you can earn a tax exemption up to Rs. 10,00,000 under the Income Tax Act of 1961.

11. Can tax planning help in the long run?

A: Tax planning can help in the long run to identify suitable investment methods and purchase of assets. It can also help you save money on taxes. Moreover, it is a process that the government has incorporated to help individuals and corporate houses save money on taxes.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

good explain