What are Alternate Investment Funds?

Stocks, Bonds, and cash are some traditional investment options for investors. But, if you want a new way to make investments, Alternate Investment Funds can be the right choice. The rate of return is higher when compared to conventional options.

At the same time, Investing in AIF involves a high risk. Especially high Net worth investors choose AIF to get a massive amount as a return. So, let us know about AIF and top alternate Investment Funds in India.

Understanding the Basic Concept of AIF

AIF is different from debt securities, stocks, and other conventional investments. If you want to diversify your investment Portfolio, you can invest in AIF. Most commonly, foreign and national HNIs who own massive Capital prefer AIF for investment. OCIs, NRIs, and PIOs also can invest in this fund. But they have to fulfil the eligibility criteria to make an investment successfully.

Before investing in AIF, you should know about SEBI (Alternate Investment Funds) regulations in 2012. According to the latest rules, venture capital should distribute 75% (or higher) of the asset to unlisted equity shares and equity-related instruments. You can invest in SME-listed companies; the minimum amount to be invested is INR 25 lakhs. However, this minimum investment rule is not for those who want to invest in social venture funds.

Talk to our investment specialist

Who is Referred to as AIF’s Sponsor?

A sponsor is the individual who has set up the AIF. For instance, a promoter acts as the sponsor if it is a company. Again, the sponsor for a Limited Liability Partnership is a designated partner. Some regulations also align the interests of the investors and the sponsor. The sponsor will receive a continuing interest (but not as a fee waiver). In the case of Category I/II AIF, the sponsor contributes INR 5 Crores or 2.5% of the total amount. But, for AIF Category III, it is 10% or INR 10 crores.

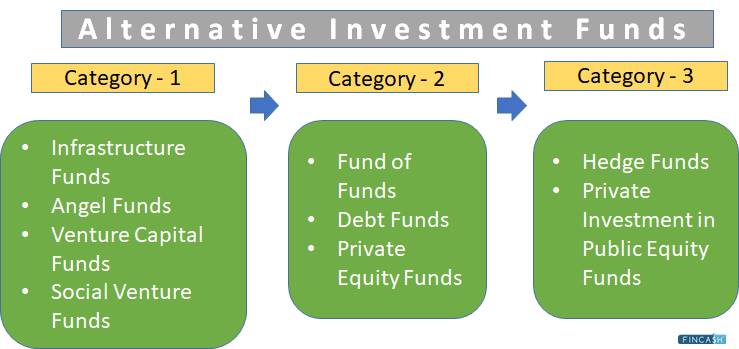

Various Categories of AIF

Before investing in AIF, you should be aware of the alternate investment funds categories.

AIF Category 1

AIFS under this Category involve investment in various funds. With the growth of economies, the government promotes these AIF investments.

SME funds

Another option is to invest in SMEs that assist different companies, including publicly listed startups. These companies need funding for business growth. The annual return for investors is over 8%. You can grow your portfolio by investing in SME funds.

Infrastructure funds

Infrastructure is the main investment option you should consider. Some common infrastructural assets comprise the renewable Energy Sector (like wind, thermal, and hydro energy). This sector grows rapidly; thus, investing in the Industry can gain higher returns. Furthermore, the government offers different tax rebates and incentives for renewable energy. So, investors can grab a significant profit if they choose infrastructure funds.

Angel funds

You can become angel investors by investing in startups. In due course, you will receive higher returns with the growth of companies. SEBI regulates Angel Funds and has imposed some investment-related restrictions.

VC funds

VC or Venture Capital Funds also let you gain higher returns. However, these funds also involve some risks. Startups need to make investments during the initial stage and depend on funding to expand their businesses. In Category-1 AIF investment, Venture Capital Funds involve investing in various startups depending on the development status and size.

AIF Category 2

AIFs under this Category are different from Category 1 funds because companies have taken debts only for regular operational activities. Under Category 2, you can find some investment options like-

Private equity funds

By investing in Private Equity Funds, you can obtain ownership stakes in well-known private organizations. Most investors who have chosen these funds received higher returns.

Funds of funds

Also known as FoFs, these funds involve direct investments in other AIFs. You will have a diversified portfolio that includes various assets. There is a chance of high profitability, and the risk is also low.

Debt of funds

You can invest in unlisted companies’ debt securities, as these businesses have significant growth potential. So, you can invest in Debentures, bonds and some other securities. You will earn from them consistently.

AIF Category 3

If you are searching for short-term investment opportunities, AIF Category-3 is the right choice. Although there is a higher risk, your investment in structured products will produce lucrative returns. Category 3 presents you with multiple investment options-

Private investment in public equity funds

Publicly listed corporations let you invest in equity shares. They are primarily large or medium-sized companies and have different revenue streams.

Hedge funds

Investors who like to invest in equity markets can choose hedge fund. Higher risks and higher returns are the characteristics of these funds.

AIF Taxation Rules in India

If you think of investing in AIF, it is important to know about taxation. Taxation is not applicable for AIFs under the first two categories. But, when you start earning from your investment, the tax amount will be based on the current tax slab. In case you have invested in equity shares, your tax on Capital Gain is 10% to 15%. In the case of Category 3, you will be taxed at a maximum 42.7% marginal rate. You should calculate your Earnings by considering Deduction.

Which are the Best AIFs in India?

India has more than 800 SEBI-registered AIF funds, and it is challenging to choose the best one. Still, you can go through the list of AIF in India to make the right choice.

Ampersand Capital

With highly skilled fund managers, Ampersand Capital tries to make optimal use of private investors’ investments. It targets companies that have a soundtrack of long-term earning opportunities. The investment horizon covers 4 to 5 years, and Ampersand Capital is best as a close-ended AIF in India.

Girik Capital

It is another close-ended AIF, and the Average Return in a year is around 44.25%. The SEBI-registered fund has gained popularity due to its investment management. It is a Category 3 AIF, which promotes long-term investments. Investors have found steady returns from their investments in Girik Capital.

TCG Advisory

TCG Advisory implements a distinctive investment approach focusing mainly on SMF. Like other funds, the investment horizon can be up to 5 years. There is a fund manager who is efficient at managing funds.

Roha Asset Manager

It is a close-ended Category 3 AIF with a single strategy. The returns from this fund are high. You can choose this fund if you desire a long-term investment and multiply your wealth.

Abakkas Asset Manager

With Growth Fund opportunities, Abakkas enables you to invest in mid-cap ad large-cap assets. The founder plays a vital role in fund management.

But how will you decide on the right AIF? You have to focus on some factors, including-

- AIF Category- As AIF is of different types, you have to check the Category before choosing one. Every Category has distinctive advantages.

- IAF strategy- It makes a difference in how much it returns from your investment.

- Total returns- The AIF in India has to reveal its Efficiency, and based on this data, you can create a long-term plan.

- Periodic returns - How much return does the AIF guarantee in a month or in 3 months? You should check this detail before selecting alternate investment funds in India.

- Fund manager’s experience- The number of fund managers and their experience enables you to understand whether the fund is managed efficiently.

Consider these above factors when you are searching for AIF in India.

Why Should you Invest in AIF?

Investing in AIF benefits you in several ways-

- Diversify your portfolio - Portfolio diversification is the main advantage of AIF investments. The stock Market’s performance does not affect your AIF’s performance. You can make your investment portfolio stronger by investing in AIF. Market fluctuations will not have a significant effect on the AIF.

- Low Volatility - Most AIFs are less volatile when compared to stocks and other investment options. If you want to increase the stability of your portfolio, you can choose AIF.

- Better and higher returns - Many investors prefer AIF due to the potential to get significant returns.

- Earn passive income - If you have invested in AIF, it becomes a passive source of Income.

Eligibility Criteria for Investing in AIF

Potential investors who think of investing in AIFs should fulfil some criteria.

- Your investment amount should be at least INR 1 crore. But, fund managers, employers, and directors may start investments only with INR 25 Lakh

- The minimum lock-in period for your AIF investment is three years

- Every investment includes not more than 1000 investments. In the case of angel funds, the number of investors is only 49

- You can be an NRI or Indian citizen to invest in SEBI AIF

- The sponsor or manager should reveal the AIF investment to investors

- As an applicant, a trust Deed needs to be provided if you are a registered trust

What are the Steps for AIF Registration?

If you want to know how to invest in AIF, it is essential to understand the AIF registration process:

- You should fill out Form A and send an application to SEBI along with relevant documents. Make sure that the form is stamped and duly signed before submission

- You will get a rejection or acceptance message when SEBI receives your application. It takes 21 days to have the response

- Before sending your application, you must check the criteria set by SEBI. It will accelerate the registration process, and you can avoid potential issues

- Another important step is to write a cover letter, which is one of the attachments, along with the application. The letter needs to mention whether you are currently SEBI registered and involved in activities undertaken by Alternate Investment Funds. Besides, you have to clearly state if you want to apply to register a new AIF

- In case you want to involve an authorized signatory, you should submit an authorization letter (created by trustees or directors)

- To make the registration process successful, you have to fill out an online application form based on the SEBI guidelines. You should also submit a Bank draft (INR 1,00,000/-) as your application charge, and this draft needs to be in favour of SEBI

- SEBI will grant the registration certificate after ensuring that you have complied with its guidelines and regulations. After reviewing your application and documents, SEBI will inform you about its decision by sending a message

Getting Familiar with Post-Registration Rules

After registering with SEBI, you should ensure that you have complied with its rules. If any details related to the AIF are to be modified, you should inform SEBI without any delay. A custodian plays a role in safeguarding the securities for every AIF if the corpus is higher than Rs 500 crore. The custodial also should undergo registration under SEBI. A certified auditor should audit the account books of the AIF every year. Besides, AIF sponsors have a fiduciary duty to investors. So, they should inform whether there is any dispute regarding interests. AIF must check any guidelines or circulars provided by SEBI.

The Grievance Redressal Process

If you have any grievances or complaints about the registered AIF, you can raise them with SEBI. SEBI Complaint Redress System is an online portal for grievance redressal. So, you can use the portal and lodge your complaint against the fund for violating norms. AIF or its sponsors will implement the arbitration process to resolve disputes. The concerned parties may also mutually arrive at a decision to ensure a settlement.

Conclusion

AIFs are the best option for those who desire higher investment returns. But they should be ready to accept the risks associated with these investments. The brief discussion on AIF will guide you to invest in funds strategically. Besides, you need to check the AIF regulations before sending an application to SEBI. Smart AIF investors always do market research and set parameters before making investments. It helps them gain long-term profitability from AIF in India.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.