Fincash » Coronavirus- A Guide to Investors » Atmanirbhar Bharat Abhiyan

Table of Contents

Atmanirbhar Bharat Abhiyan

With the coming of the Coronavirus pandemic, the world underwent some major changes. One of the areas that were largely affected was the finance sector. Globally, countries started declaring relief packages for their citizens to help them get through the pandemic with some financial help.

The Government of India introduced the Atmanirbhar Bharat Abhiyan to help the citizens of the country. Atmanirbhar Bharat Abhiyan, self-reliant IndiaScheme, was announced in May 2020 by Union Finance Minister Nirmala Sitharaman in four parts.

Atmanirbhar Bharat Abhiyan Pacakge

The Economic Stimulus relief package was announced to be worth Rs. 20 lakh crores. This package includes the already announced Pradhan Mantri Garib Kalyan Yojana (PMGKY) relief package. This package was worth Rs. 1.70 lakh crore. The package intended to help the poor overcome various difficulties the lockdown would bring to the society.

PM Modi mentioned that the special Atmanirbhar Bharat- self-reliant India’s, economic package’s focus will be on empowering the poor, labourers and migrants from the organised and unorganised sectors.

Alongside, the package will also focus on Land, labour, liquidity and laws. It aims at every sector like the tax-paying middle class and small and medium enterprises. The amount of the package is nearly 10% of India’s Gross Domestic Product (GDP). He further urged the citizens of the country to take a pledge to use more local products and that the Modi government has the interest of the country and the countrymen at the centre.

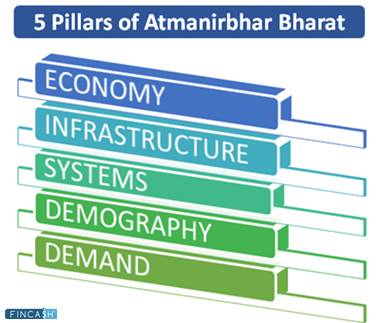

PM Modi further made an important announcement that lockdown 4 will be implemented after May 17 and the details will be shared after suggestions from other states before May 18. PM Modi further said that the five pillars of an Atmanirbhar Bharat were Economy, infrastructure, technology-driven system, demography and demand. This package covers sectors like the MSMEs, middle-class migrants, cottage industries, etc.

FM Nirmala Sithraman also mentioned the importance of the five pillars of India, which are-

- Economy

- Infrastructure

- Demography

- Demand

- Technology-driven system

Atmanirbhar Bharat Abhiyan- Part 1

1. MSMEs

The Finance Minister announced some big reforms for the MSMEs. She also said that the measures taken will enable 45 lakh MSME units to resume business activity and safeguard jobs. The Finance Minister also announced the government’s move of changing the definition of MSMEs as a part of Atma Nirbhar Bharat Abhiyan (self-reliant India) as part of the Economic package.

Revised MSME Definition

The new definition of MSME is that the investment limit will be revised upwards and additional turnover criteria are also being introduced.

Major MSME announcements

The FM mentioned that the definition is being changed in favour of the MSMEs.

A company with an investment of Rs. 1 crore and turnover of Rs. 5 crores, will be under the category of MSME and will get all the benefits entitled to the same.

The new definition will not be differentiating between a Manufacturing company and services sector company, announced FM Nirmala Sitharaman. All the necessary amendments to the current law will be brought about.

Relief for stressed MSMEs

FM Nirmala Sitharaman announced that Rs. 20,000 crore subordinated debt will be provided for stressed MSMEs. It was announced that stressed MSMEs need equity support and 2 lakh MSMEs will be benefited.

The MSMEs under NPA will also be eligible for the same. The Central government will provide an Rs. 4000 crore to CGTMSE. The CGTMSE will then provide a partial credit guarantee support to banks.

FM also announced that the promoters of MSMEs will be provided debt by banks. This will be infused by the promoter as equity in the unit.

Collateral-free Automatic Loans

FM Nirmala Sitharaman announced that Rs. 3 lakh crores Collateral-free automatic loans will be given to businesses including MSMEs. It was announced that borrowers with up to Rs. 25 crores and Rs. 100 crore turnover will be eligible for this scheme.

FM further announced that loans will have a 4-year tenor with a moratorium of 12 months on principal repayment amount and the interest rates will be capped.

It was further announced that 100% credit guarantee cover will be provided to banks and NBFCs on the principal amount and interest rates. This scheme can be availed till 31st October 2020 and there will be no guarantee fee and no fresh collateral.

FM announced that 45 lakh units can resume business activity and safeguard jobs.

Fund of Funds

FM Nirmala Sitharaman announced a big Rs. 50,000 core equity infusion for MSMEs through a fund of funds. An Rs. 10,000 crores corpus will be set up for fund of funds. This will be provided to MSMEs with growth potential and viability. This will encourage MSMEs to get themselves listed on the main board of Stock Exchanges.

Fund of funds will be operated through a mother fund and few daughter funds. The Rs. 50,000 crore funds structure will help leverage at daughter funds level.

MSMEs will now have the opportunity to expand in size and capacity.

Post COVID-19 life for MSMEs

E-Market linkages will be provided across the board to help to make up for the lack of trade activities.

In the next 45 days, all eligible Receivables for MSMEs will be cleared by the government of India and CPSEs.

Talk to our investment specialist

2. EPFs

The Central government has announced various relaxations for employees and employers.

EPF support by the government

The Finance Minister announced that Rs. 2500 crore EPF support will be provided for business and workers for another 3 months. Under the Pradhan Mantri Garib Kalyan Package, 12% employer and 12% employee contribution was made into EPF accounts of eligible establishments. This was provided earlier for March, April and May 2020 salary months. This will now be extended by another 3 months to June, July and August salary months.

The FM also announced that the Central government will take up providing PFs for employees earning less than Rs. 15,000. This move will provide a liquidity relief of Rs. 2500 crore to 3.67 lakh establishments and 72.22 lakh employees.

Reduced EPF contributions

The FM announced that the EPF contribution will be reduced for business and workers for three months. The statutory PF contribution will be reduced to 10% each. It was 12% earlier. This will apply to establishments covered under the EPFO. However, the CPSEs and State PSUs will continue to contribute 12% as an employer contribution. This particular scheme will be applicable for workers not eligible for 24% EPFO support under PM Garib Kalyan package extension.

3. For NBFCs

Non-Banking Financial Companies (NBFC), Housing Finance Companies (HFCs) and Micro-Finance Companies (MFIs) will get a special liquidity scheme of Rs. 30,000 crore. Under this scheme, the investment can be made in primary and secondary investments. The measures taken will be fully guaranteed by the Government of India.

Apart from NBFCs, the government also announced Rs. 45,000 crore liquidity infusion by Partial-Credit Guarantee Scheme.

4. For cash-desperate DISCOMs

Power Finance Corporation and Rural Electrification Corporation to infuse liquidity of Rs. 90,000 crores to DISCOMS against receivables. Loans will be provided against state guarantee for the purpose of discharging liabilities of DISCOMs to a power generation company.

The Digital payment facilities by DISCOMs to consumers, outstanding dues of state government will reduce financial and operational losses

5. Solace to contractors

Extension to all contractors like Railways, Ministry of Road Transport and Highways, Central Public Dept, etc., will be provided by the government for six months. There will be no extension up to six months for government contractors to comply with the contract conditions, construction work, goods and services contract.

6. Real Estate

The Housing and Urban Affairs Ministry will relieve an advisory to state and Union Territories to treat COVID 19 as force majeure and relax timeliness.

The registration and completion date will be extended Suo Moto by six months for all registered projects on or after 25 March 2020 without an individual application.

7. ITR Returns Date Extended

The change in the date for IT filing has extended the new dates are as follows:

- ITR filing extended from July 31 to November 30, 2020.

- Vivaad se Vishwas scheme extended till 31 December 2020

- The assessment date has blocked as on 30 September 2020 and extended to 31 December 2020

- The Assessment date has blocked as on 31 March 2021 and extended to 30 September 2021

8. New TDS Rates

To provide more funds at the disposal of the taxpayers, the rates of the tax Deduction for non-salaried specified payments made to the resident and the new rates for the tax collection source has been reduced by 25%. Payment for the contract, professional fees, interest, dividend, commission, brokerage all will be eligible for the reduced TDS rates. The cut shall be applicable for the remaining part of FY 2019-20 from 14-5-2020 to 31-3-2021. The taken measure will release liquidity of Rs. 50,000 crores.

Atmanirbhar Bharat Abhiyan- Part 2

1. Food Grains

The government declared to spend Rs. 3500 crore to provide free food grains for migrant workers without ration cards for two months post the date of the announcement. This was an extension of the PMGKY.

2. Credit Facilities

Under this, street vendors will be able to get credit through an Rs. 5000 crore scheme. This will offer Rs. 10,000 loans for the purpose of initial working Capital.

The government also declared plans to enrol 2.5 crore farmers with other fish workers and livestock farmers and also provide them with Rs. 2 lakh worth concessional credit. NABARD will also provide additional refinance support worth Rs. 30,000 crore for crop loans to rural banks.

3. Rental Housing

Under this, a scheme to build rental housing complexes through PPP mode. This would be launched under the existing Pradhan Mantri Awas Yojana (PMAY) scheme.

Public and private agencies will be incentivised in order to build rental housing on the government and private land. Existing government housing will be changed into rental units. The lower middle class will also be able to get credit under the PMAY by an extension till March 2021.

4. Subvention

Under this, the small businesses who have availed loans under the Mudra-Shishu scheme will receive 2% interest subvention relief for next year.

5. Ration Card Scheme

Under this scheme, by August 2020, a ration card scheme will be launched which will allow 67 crore NFSA beneficiaries in 23 states of the country. They can use their ration cards to shop at any ration shop throughout the country.

Atmanirbhar Bharat Abhiyan- Part 3

This part is focused on farmers and their impact on consumers nationwide. It deals with agricultural marketing reforms.

1. Trade

The government plans to bring out a central law which will allow barrier-free inter-state trade of farm commodities and e-trading. Farmers can also sell their produce at good prices. This will help them come out of the current mandi system.

2. Contract Farming

There will be a legal framework to oversee contract farming. Farmers will be able to get assured sale prices and quantities before the crop is sown. Private players can also invest in inputs and technology in the agricultural sector.

3. Deregulating Agricultural Produce

The sale of six types of agricultural produce like cereals, oilseeds, pulses, potatoes, onions, edible oils will be deregulated by the government. This will be done by amending the Essential Commodities Act, 1955.

There will be no imposition of stock limits on these commodities. However, there will be an exception in the case of national calamity or famine or if there is an out of the ordinary surge in prices. These stock limits will not be applicable to processors and exporters.

4. Agricultural Infrastructure

The government will provide an investment of Rs. 1.5 lakh crores in order to build farm-gate infrastructure. It will also be used to support the fish workers, livestock farmers, vegetable growers, beekeepers, etc logistics need.

Atmanirbhar Bharat Abhiyan- Part 4

The fourth and the final part of the scheme focuses on defence, aviation, power, mineral, atomic and space.

1. Defence

It aims at encouraging the production of defence weaponry within the country. A provision for a separate budget is made for the same. The Foreign Direct Investment (FDI) limit for the purpose of defence manufacturing under the automatic route to be raised from 49% to 74%. Ordnance Factory Boards (OFB) will now be corporatised. They will be listed in the stock market which will improve their Efficiency and Accountability.

2. Space

Private players will be encouraged to get involved in space-related happenings. A space sector will be created for the private players to use the ISRO facilities and also participate in projects on space travel and planet exploration.

Remote-sensing data will be made available to entrepreneurs in the field of technology as the government plans to ease the geo-spatial data policy.

3. Minerals

The government plans to remove the monopoly on coal. Commercial mining will be allowed based on revenue sharing.

The private sector will be allowed to bid for 50 coal blocks where they will be allowed to undertake exploration activities.

4. Aviation

Six more airports will be put up for auction on the private and public partnership model. Private investment will be invited to additional 12 airports. Airspace restrictions will be eased with certain measures to be put in place. Rationalising of the maintenance, repair and operations (MRO) will make India an MRO hub.

5. Atomic

Medical isotopes will be produced with research reactors in PPP mode.

6. Power

A new tariff policy will be announced which will help power departments/utilities and distributions companies to be privatised.

Conclusion

Atmanirbhar Bharat Abhiyan has the vision to see India grow as a self-reliant country. Citizens joining hands together and encouraging local businesses can help lead the way.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Super good