Fincash » Coronavirus- A Guide to Investors » 20 Lakh Crore For Atmanirbhar Bharat

Table of Contents

20 Lakh Crore for Atmanirbhar Bharat: Know all the Details about the Package

Union Finance Minister Nirmala Sitharaman announced various economic measures at a press conference on 13th May 2020. This came after Prime Minister Narendra Modi’s live announcement of a special economic package worth Rs. 20 lakh crore on 12th May 2020. The comprehensive relief package of Rs. 20 lakh crore is 10% of the Gross Domestic Product (GDP) including the measure announced by the Reserve Bank of India (RBI) earlier.

FM Nirmala Sitharaman addressed various issues the country is facing amid the ongoing COVID-19 pandemic and reassured that the Central government is taking all the necessary measures to help the poor section of the society. The FM also mentioned that the economic relief package is one of the highest packages in the world, which focuses on farmers, small companies, taxpayers, middle class and others primarily involved in the growth of the Economy. She further mentioned that the relief will help restart the economy.

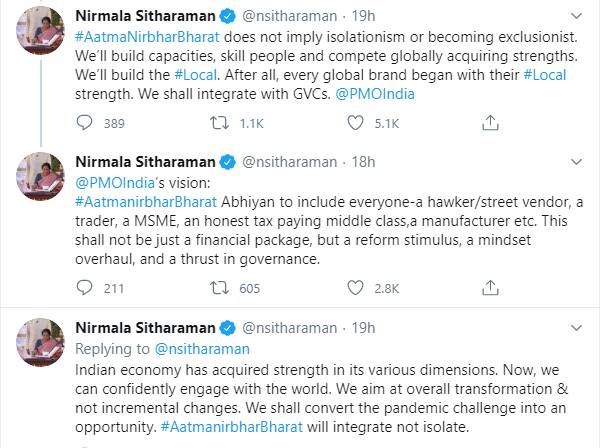

At the end of the press conference, FM clarified a few questions asked by people regarding the Atma Nirbhar Bharat. She stated that it does not imply isolationism or becoming exclusionist. It aims at building capacities, skill people and competes globally acquiring strengths. She further stated that this isn’t a financial package, but a reform stimulus, a mind-set overhaul and thrust in governance.

“The intention is to make local brands and build them to a global level. So there will be integration with global supply chains. Not to make India an isolated entity," the Finance Minister said.

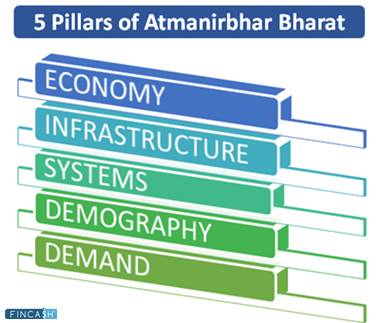

FM Nirmala Sithraman also mentioned the importance of the five pillars of India, which are-

- Economy

- Infrastructure

- Demography

- Demand

- Technology-driven system.

She reinstated that the Government of India has been considerate and sensitive to the growth of the economy.

The Finance Minister stated that the newly established policies regarding the economic package will be announced over the next few days. On 13th May 2020, FM Nirmala Sitharaman announced 16 measures to aid the Indian economy.

16 Measures to Aid Economy

- Six measures directed towards the Micro, Small and Medium-Sized Enterprises (MSMEs)

- Two measures directed towards Employee Provident Funds (EPF)

- Two measures directed towards NBFCs

- Three measures directed towards Tax

- One measure directed toward Discoms

- One measure directed toward Contractors

- One measure directed toward Real Estate

Talk to our investment specialist

MSMEs

The Finance Minister announced some big reforms for the MSMEs. Measures taken will enable 45 lakh MSME units to resume business activity and safeguard jobs.

Revised MSME Definition

Under the new definition of MSME, the investment limit is revised upwards and an addition turnover criteria is also being introduced.

A company with an investment of Rs. 1 crore and turnover up to Rs. 5 crores, will be under the category of MSME. The new definition will not be differentiating between a Manufacturing company and services sector company.

Relief for Stressed MSMEs

FM Nirmala Sitharaman announced that Rs. 20,000 crore subordinated debt will be provided for stressed MSMEs. It was announced that stressed MSMEs need equity support and 2 lakh MSMEs will be benefited.

The MSMEs under NPA will also be eligible for the same. The Central government will provide an Rs. 4000 crore to CGTMSE. The CGTMSE will then provide a partial credit guarantee support to banks.

It is also announced that the promoters of MSMEs will be provided debt by banks. This will be infused by the promoter as equity in the unit.

Collateral-free Automatic Loans

FM Nirmala Sitharaman announced that Rs. 3 lakh crores Collateral-free automatic loans will be given to businesses including MSMEs. The borrowers with up to Rs. 25 crores and Rs. 100 crore turnover will be eligible for this scheme.

Moreover, loans will have a 4-year tenor with a moratorium of 12 months on principal repayment amount and the interest rates will be capped. It was further announced that 100% credit guarantee cover will be provided to banks and NBFCs on the principal amount and interest rates.

This scheme can be availed till 31st October 2020 and there will be no guarantee fee and no fresh collateral. It is announced that 45 lakh units can resume business activity and safeguard jobs.

Fund of Funds

FM announced a big Rs. 50,000 core equity infusion for MSMEs through fund of funds. A Rs. 10,000 crores will be set up for fund of funds. This will be provided to MSMEs with growth potential and viability. This will encourage MSMEs to get themselves listed on the main board of Stock Exchanges.

Fund of funds will be operated through a mother fund and few daughter funds. The Rs. 50,000 crore fund structure will help leverage at daughter funds level.

MSMEs will now have the opportunity to expand in size and capacity.

Post COVID-19 life for MSMEs

E-Market linkages will be provided across the board to help to make up for the lack of trade activities. In the next 45 days, all eligible Receivables for MSMEs will be cleared by the government of India and CPSEs.

EPFs

The Central government has announced various relaxations for employees and employers.

EPF Support by the Government

The Finance Minister announced that Rs. 2500 crore EPF support will be provided for business and workers for another three months. Under the Pradhan Mantri Garib Kalyan Package, 12% employer and 12% employee contribution was made into EPF accounts of eligible establishments. This was provided earlier for March, April and May 2020 salary months. This will now be extended by another three months to June, July and August.

The FM also announced that the Central government will provide PFs for employees earning up to Rs. 15,000. This will provide a liquidity relief of Rs. 2500 crore to 3.67 lakh establishments and 72.22 lakh employees.

Reduced EPF contributions

The EPF contribution will be reduced for business and workers for three months. The statutory PF contribution will be reduced to 10% each. It was 12% earlier. This will apply to establishments covered under the EPFO. However, the CPSEs and State PSUs will continue to contribute 12% as an employer contribution. This particular scheme will be applicable for workers not eligible for 24% EPF support under PM Garib Kalyan package extension.

NBFCs, HFCs, MFIs

Non-Banking Financial Companies (NBFC), Housing Finance Companies (HFCs) and Micro Finance Companies (MFIs) will get a special liquidity scheme of Rs. 30,000 crore. Under this scheme, the investment can be made in primary and secondary investments. The measures taken will be fully guaranteed by the Government of India.

Apart from NBFC’s, the government also announced Rs. 45,000 crore liquidity infusion by Partial-Credit Guarantee Scheme.

DISCOMs

Power Finance Corporation and Rural Electrification Corporation to infuse liquidity of Rs. 90,000 crores to DISCOMS against receivables. Loans will be provided against the state guarantee for the purpose of discharging liabilities of DISCOMs to a power generation company.

The Digital payment facilities by DISCOMs to consumers, outstanding dues of state government will reduce financial and operational losses.

Solace to Contractors

Extension to all contractors like from the Railways, Ministry of Road Transport and Highways, Central Public Dept, etc., will be provided by the government for six months. There will be no extension up to six months for government contractors to comply with the contract conditions, construction work, goods and services contract.

Real Estate

The housing and Urban Affairs Ministry will relieve an advisory to state and Union Territories to treat COVID 19 as force majeure and relax timeliness. The registration and completion date will be extended Suo Moto by six months for all registered projects on or after 25 March 2020 without an individual application.

ITR Returns Date Extended

Income Tax Return filing has been extended. The new dates are as follows:

- ITR filing extended from July 31 to November 30, 2020

- Vivaad se Vishwas scheme extended till 31 December 2020

- The assessment date has blocked as on 30 September 2020, and extended to 31 December 2020

- The Assessment date has blocked as on 31 March 2021, and extended to 30 September 2021

New TDS Rates

To provide more funds at the disposal of the taxpayers, the rates of the tax Deduction for non-salaried specified payments made to the resident and the new rates for the tax collection source have been reduced by 25%.

Payment for the contract, professional fees, interest, dividend, commission, brokerage will be eligible for the reduced TDS rates. The cut for FY 2019-20 will be applicable from 14th May 2020 to 31st March 2021. The taken measure will release liquidity of Rs. 50,000 crores.

Conclusion

The Government of India has taken an effective measure to aid the country’s economy during COVID 19. These measures will create a balance in various sectors, and help us to fight against the harsh market phase.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.