Dividend Yield

What is the Dividend Yield?

Dividend Yield is a financial ratio that indicates how much a company pays out in dividends each year relative to its share price. Dividend yield is a stock's dividend as a percentage of the stock price. In other words, it measures how much "bang for your buck" you are getting from dividends. In the absence of any Capital gains, the dividend yield is effectively the Return on Investment for a stock.

The dividend yield is a very important ratio to look out for when analysing shares and the potential returns they could deliver.

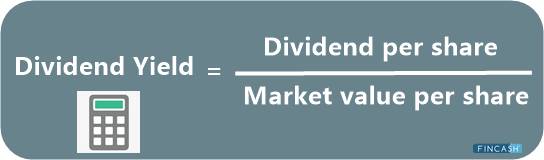

Formula for Dividend Yield

The formula for calculating dividend yield may be represented as follows:

= Annual Dividend Per Share / Price Per Share

Dividend Strategy

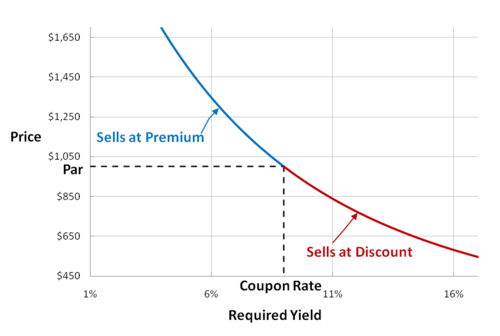

Although dividends can be a great source of return on investment, yields shouldn’t be directly compared to the rates of return on fixed interest or cash products, as the shares always carry the risk of Capital Loss.

Talk to our investment specialist

Whether you are Investing specifically for Income to live off or to grow your initial investment over a long period, it’s ideal to consider both a company’s dividend yield and its potential for capital growth.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.