Table of Contents

Required Yield

Definition of Required Yield

Required yield is the return a bond must offer in order for the investment to be worthwhile. Required yield is set by the Market and it sets the precedent for how current bond issues will be priced.

Details of Required Yield

Required yield is the minimum acceptable return that investors demand as compensation for accepting a given level of risk. It is the yield required by the marketplace to match available expected returns for financial instruments with comparable risk. The yield required for a low-risk bond such as a Treasury security will be lower than the yield required for a high-risk bond such as a junk bond.

Talk to our investment specialist

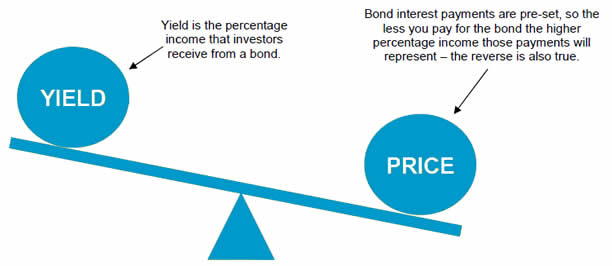

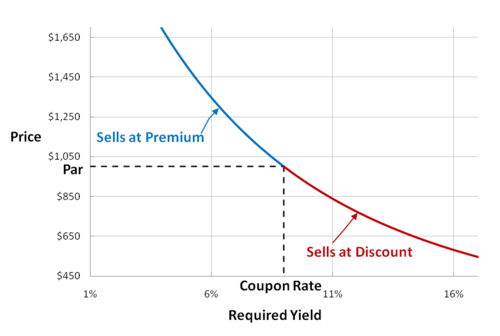

The interest rates on Bonds are set by a consensus of buyers and sellers. How high or low the yield is compared to the set bond interest rate, will determine the price of the bond in the market. For example, if the required yield increases to a rate that is greater than that of the bond's coupon, the bond will be priced at a discount to Par. In this way, the investor acquiring the bond will be compensated for the lower coupon rate in the form of accrued interest. If the bond is not priced at a discount, investors will not purchase the issue because its yield will be lower than that of the market. The opposite occurs when the required yield decreases to a rate that is less than that of the bond's coupon. In this case, investor demand for the higher coupon will drive the bond's price up, making the bond's yield equivalent to market yield.

When calculating the price of a bond, the required yield is used to discount the bond’s cash flows to get the present value. An investor’s required yield is useful for estimating whether or not a bond is a good investment for an investor by comparing it with the yield to maturity (ytm). While the yield to maturity is a measure of what a bond investment will earn over its life if the security is held until it matures, the required yield is the rate of return that a bond issuer must offer to incentivize investors to purchase the bond. The required interest rate on bonds at any given time will greatly affect the YTM of bonds. If market interest rates increase, the yield to maturity of current bonds will be lower than the new issues. Likewise, if prevailing interest rates in the Economy decrease, the YTM on newer issues will be lower than that of outstanding bonds.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.