Table of Contents

Who Should File ITR 5 Form and How to File it?

Barring the eligibility for individuals and hindu undivided family, ITR 5 is specifically for firms, companies, and other relevant authorities. So, in case you didn’t know much about this form type, the post covers almost every bit of essential information for you. Read on!

What ITR 5 Means?

Out of the seven different types of forms introduced by the income tax Department for the taxpayer citizens, ITR 5 is one form type, specific to a certain section of taxpayers.

Who Can Fill ITR 5 Form?

ITR 5 filling can be done by the following people:

Persons as per section 160 (i) (iii) (iv) of the Income Tax Act

Firms

Local authorities

Limited liability partnership (LLP)

Cooperative/registered society

Association of Persons (AOP)

The artificial juridical person as per section 2 (21) (vi)

Body of Individuals (BOI)

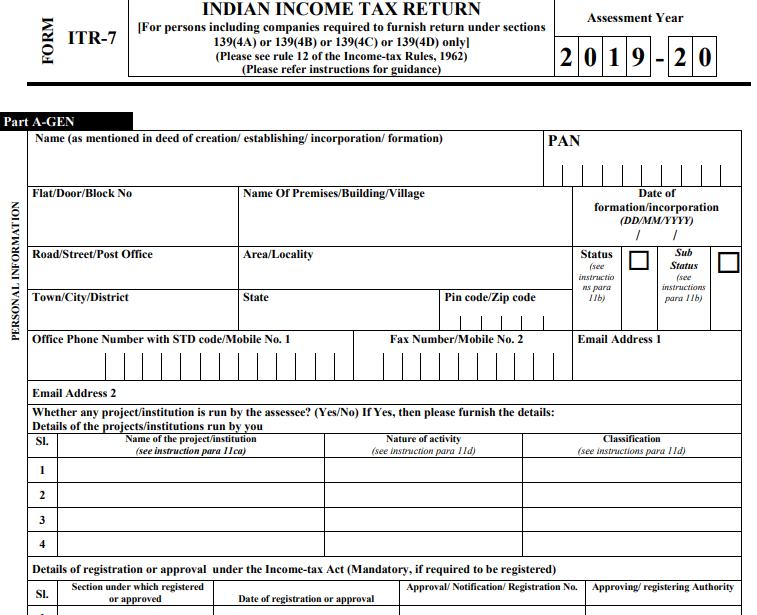

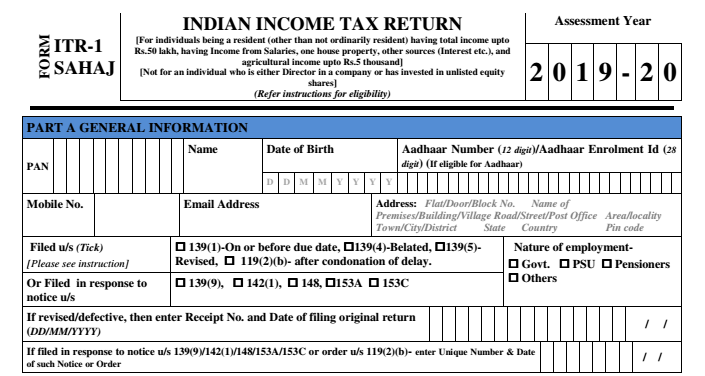

Who Cannot File Income Tax ITR 5?

ITR 5 form cannot be filed by taxpayers who fall under the below category:

- Who file a Tax Return under the Section 139 (4A), 139 (4B), 139 (4C) or 139 (4D)

- An individual

- Hindu undivided funds; or

- A company

Talk to our investment specialist

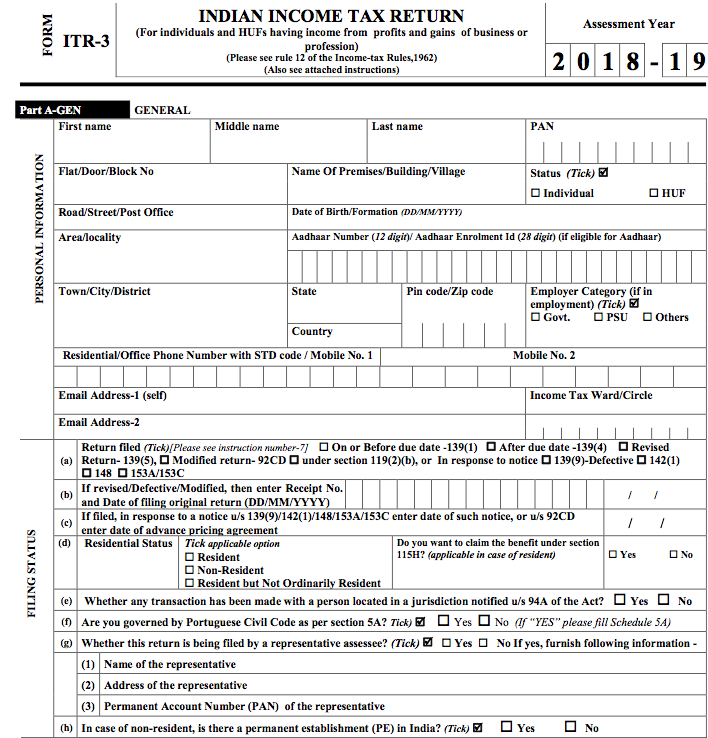

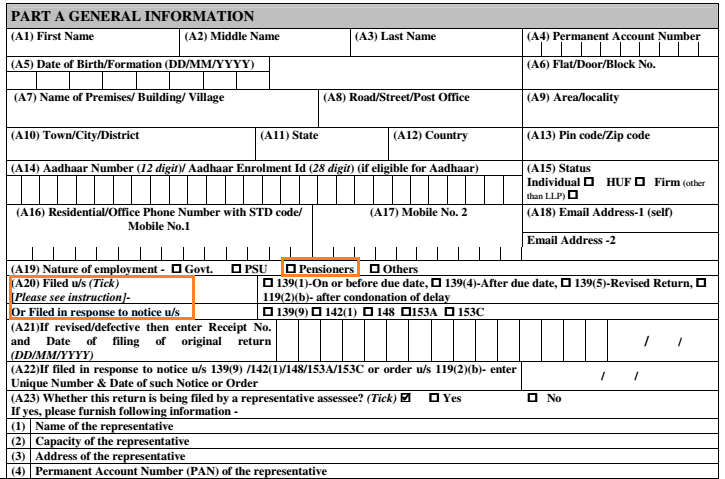

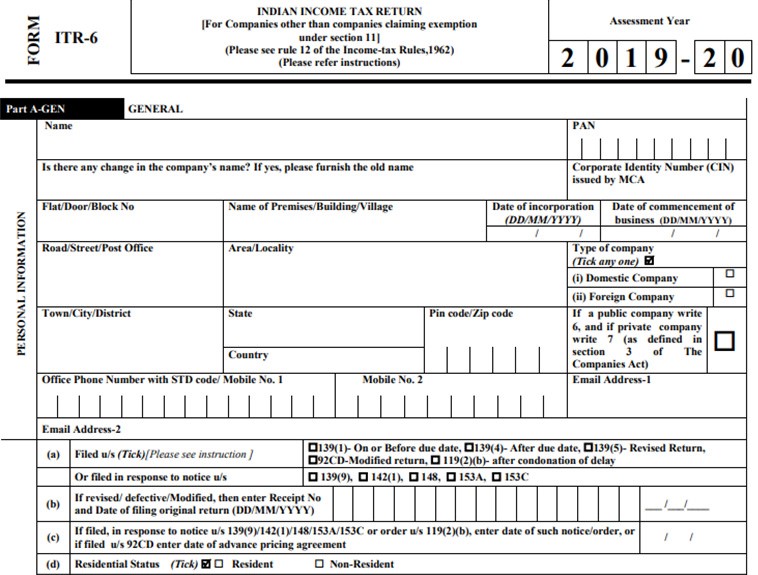

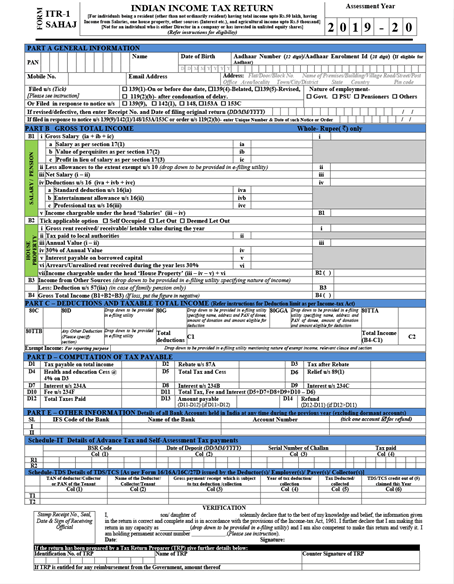

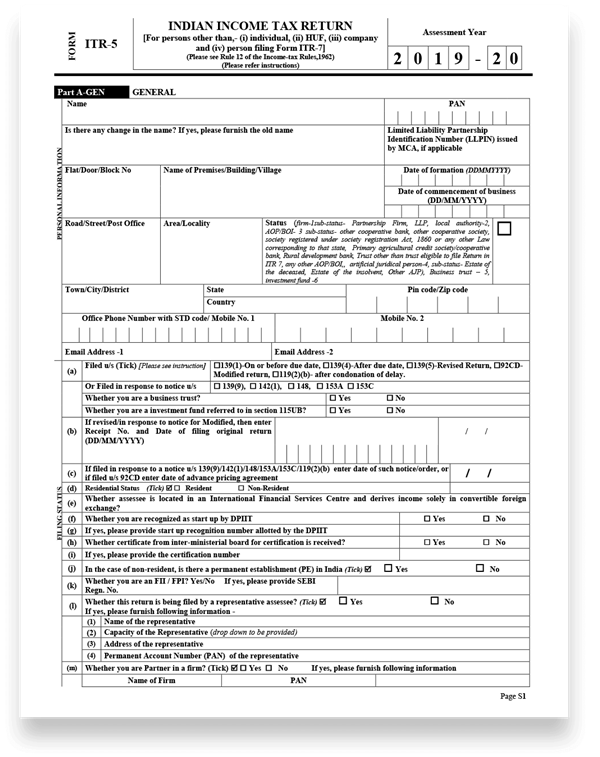

How Does ITR 5 by Income Tax Look Like?

This form has been divided into different parts and schedules, such as:

- Part A: General information

- Part A-BS: Balance Sheet as per the 31st March of the financial year

- Part A-Trading Account for the financial year

- Part A-Manufacturing Account for the financial year

- Part A- P&L: Profit and Loss for that financial year

- Part A-QD: Quantitative details

- Part A-OI: Other information

Along with these parts, you can find almost 31 schedules in this form.

Schedule-HP: Computation of income under Income from house property head

Schedule-DPM: Computation of depreciation of plant and machinery according to the Income Tax Act

Schedule-BP: Income details under the head profit and gains from business or profession

Schedule DOA: Depreciation details on other assets under the Income Tax Act

Schedule DEP: Depreciation summary on all the assets under the Income-tax Act

Schedule DCG: Computation of deemed Capital gains on the sale of depreciable assets

Schedule ESR: Deduction under section 35

Schedule-CG: Income details under the head Capital Gains

Schedule-OS: Income details under the head income from other sources

Schedule-CYLA: Income details after set off of current year’s losses

Schedule-BFLA: Income details after set off of the unabsorbed loss brought forward from earlier years

Schedule- CFL: statement regarding losses to be carried forward to future years

Schedule –UD: Unabsorbed Depreciation

Schedule ICDS: Effect of income details revelation standards on profit

Schedule- 10AA: Details of deduction under section 10AA

Schedule- 80G: Donation details entitled for deduction under Section 80G

Schedule- 80GGA: Donation details for scientific research or rural development

Schedule- RA: Donation details regarding research associations etc.

Schedule- 80IA: Details of deduction under section 80IA

Schedule- 80IB: Details of deduction under section 80IB

Schedule- 80IC/ 80-IE: Details of deduction under section 80IC/ 80-IE

Schedule 80P: Deductions under section 80P

Schedule-VIA: Deduction statement under Chapter VIA

Schedule –AMT: Details of Alternate Minimum Tax payable under section 115JC

Schedule AMTC: Details of tax credit under section 115JD

Schedule-SI: income statement which is chargeable to tax at special rates

Schedule IF: Information pertaining to associated partnership firms

Schedule-EI: Income statement not included in total income (exempt incomes)

Schedule PTI: Details of pass-through income from business trust or investment fund as per section 115UA, 115UB

Schedule ESI: Income details from outside India and tax relief

Schedule TR: Detailed Summary of tax relief claimed for Taxes paid outside India

Schedule FA: Information regarding Foreign Assets and Income from any source outside India

Schedule GST: Information of turnover/gross Receipt reported for GST

Part B – TI: Total income details

Part B – TTI: Details of Tax Liability on total income

Tax Payments

- Details of payment of advance-tax and tax on self-assessment tax

- Details of tax deducted at source on income other than salary (16A, 16B, 16C)

- Details of collected at source

How to File ITR Form 5?

So, basically, the only method to file this form is online. You can choose any of the below-mentioned ways:

By filing electronic returns under digital signature; or

By electronically communicating the return and submitting the verification of the return

Wrapping Up

Filing the ITR 5 form is a task that would not even take five minutes out of your schedule as it doesn’t require enough documents, courtesy to its annexure-less type. So, if you think this is the right form for you, go ahead with it.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.